Commercial real estate markets are often referred to as roller coasters as the relatively fixed supply of investment grade stock forces prices higher during the good times and lower when that demand ebbs, sometimes very quickly. One market that illustrates the highs and lows of real estate investment in recent times is Hong Kong.

For many decades Hong Kong has been one of the key financial markets in Asia, long known as a trading hub with a vibrant lifestyle. The handover of Hong Kong by the U.K. in 1997 heralded the start of the one country, two systems within China. China’s acceptance into the World Trade Organization in 2001 transformed Hong Kong as the gateway into China and provided a route for Chinese capital into global property markets. Momentum gradually built during the 2010s as economic growth rebounded, and China’s global influence increased.

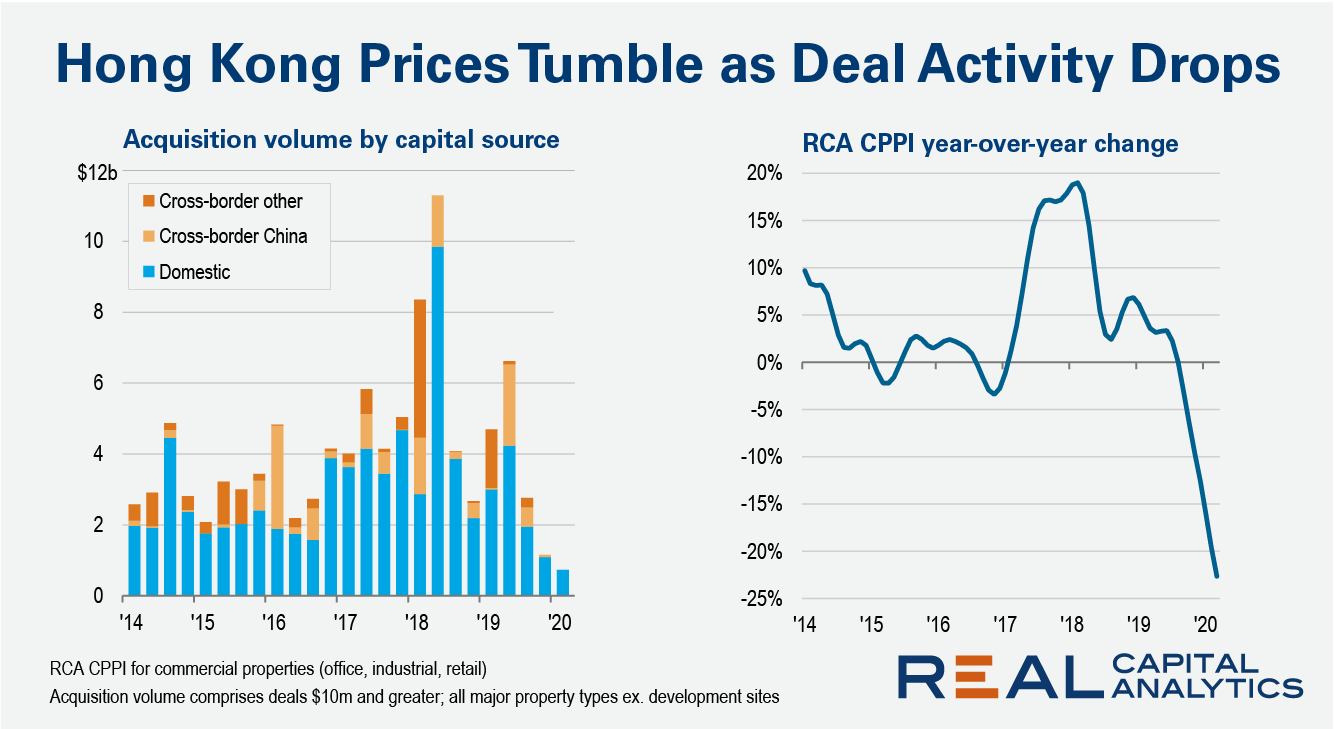

One of the factors that makes Hong Kong such a volatile market is its geography, as new supply (particularly in the CBD) is hard to come by. In 2016-17 a modest uptick in the demand for investment grade property was enough to induce the steepest rise in pricing of all global cities covered by the RCA CPPI. The culmination of this trend was the sale of The Center office tower for almost $7 billion in May 2018, pushing the annual volume to a record $26 billion.

In hindsight, this surge was ultimately unsustainable, as the high pricing in 2018 caused many investors to search elsewhere for better returns. Volumes and price growth had already settled at more muted levels before pro-democracy protests broke out in mid-2019. The political unrest was quickly compounded by the Covid-19 outbreak, which together brought the investment market to an almost complete standstill in the first quarter of 2020.

This market pause has coincided with an equally dramatic price decline, with the commercial property prices falling 23% from the peak a year ago, according to the latest RCA CPPI data. Hong Kong’s future is as yet uncertain, as the protests have picked up where Covid-19 left off earlier this month. But its journey up to this point is a unique case study of how prolonged inactivity can take its toll on commercial real estate pricing, and provides us with a stern warning for other global cities currently at the peak of their roller coaster ride.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.