With the Covid-19 outbreak, ad spend is on the decline. But how can your business make the most out of the crisis?

Before we mention how the coronavirus pandemic impacts online ad spend, keep in mind the changing consumer behavior. We are seeing an unprecedented increase in people staying indoors.

This means people are spending a significant share of their lives online. And we will most likely see this behavior remain for a considerable amount of time when the pandemic ends.

Some observed ongoing trends:

So, how can brands reconcile these trends and make sound decisions on their ad spend?

Coronavirus was initially compared to the 2008 financial crisis, but as time went on, we saw more and more associations with the Great Depression of the 1930s. As the crisis has worsened, it looks like we will face the greatest recession in the world’s economy since that time.

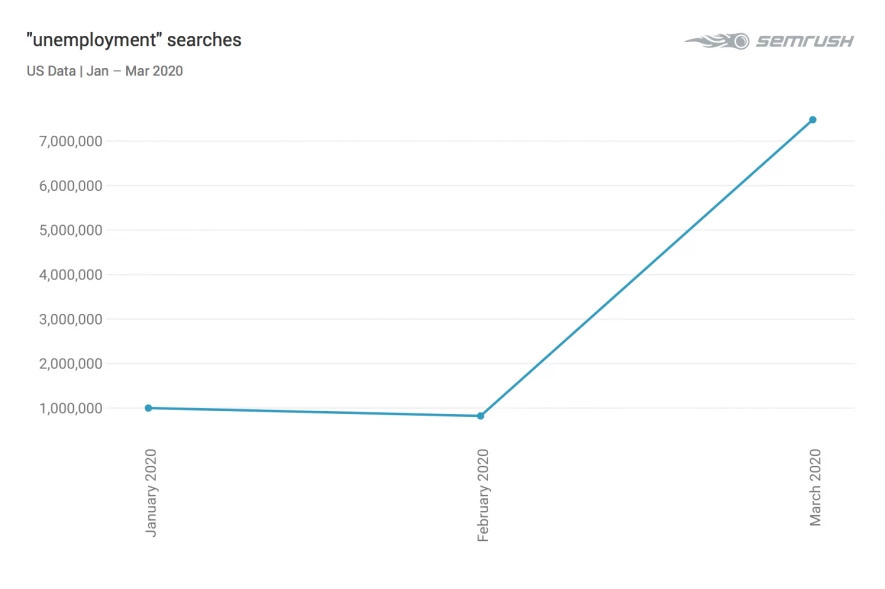

With worldwide unemployment figures hitting a record high, almost no country is exempt from this trend. The US is seeing an unprecedented number of people filing for unemployment.

And this, of course, negatively impacts buyers’ confidence and consumer spending, even for those less affected by the coronavirus crisis.

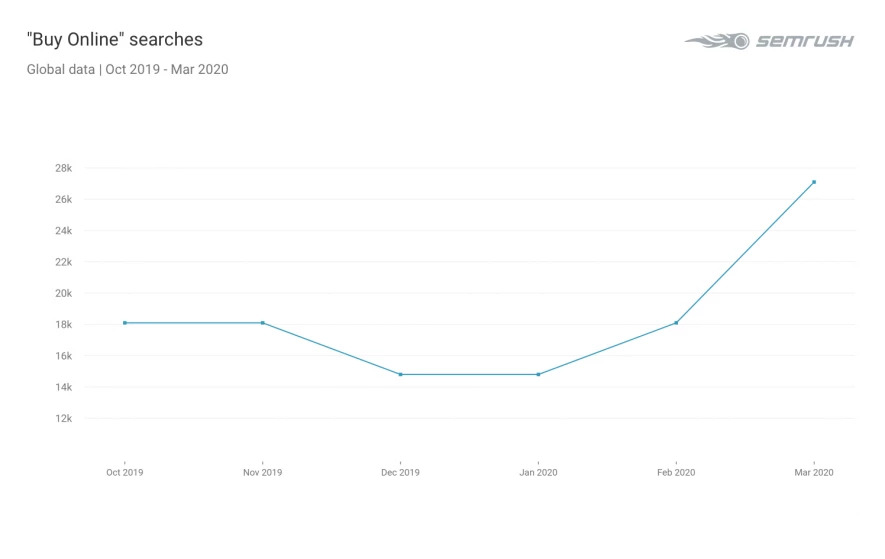

However, according to SEMrush data, the “buy online” keyword skyrocketed in March globally for up to 27K+ searches per month. So, it seems that users are ready to spend online and do some online shopping, while the real shopping experience is still far away.

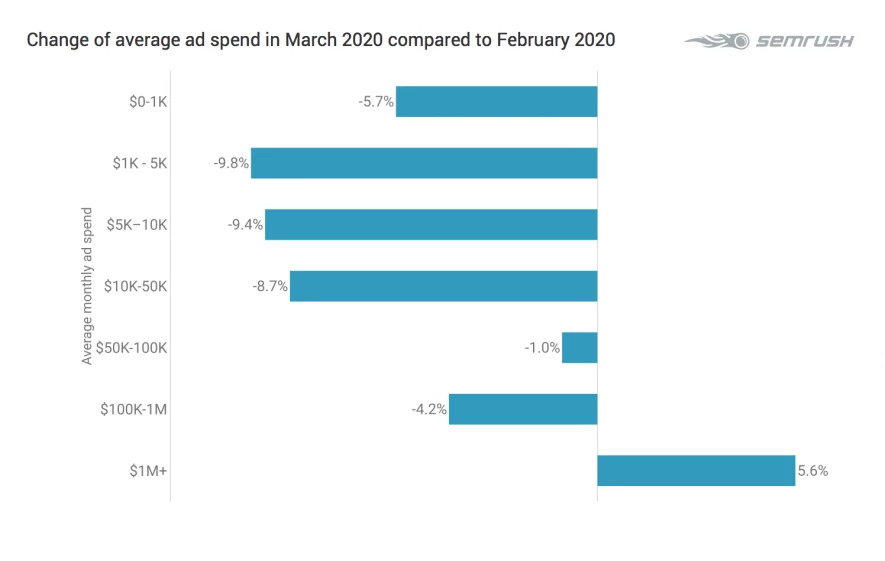

By and large, the ad spend has dropped dramatically. And this is true for both large and small brands — from your local brick-and-mortar grocery to multinationals.

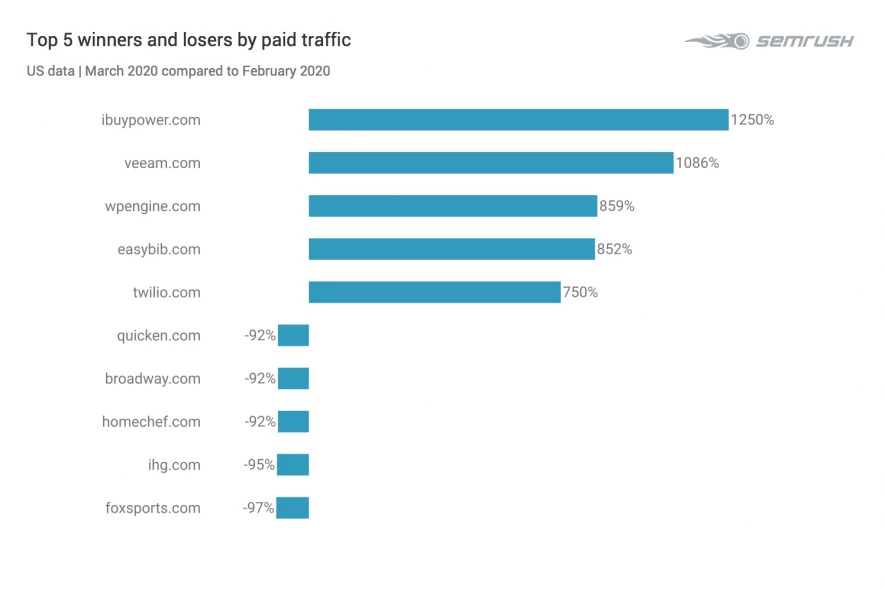

Digging deeper into SEMrush data, when we compare February 2020 to March 2020 stats, we see a huge shift in digital ad spend.

The biggest drop in ad spend is on the side of smaller-scale advertisers, while the only increase is seen across those with ad expenditure exceeding $1 million.

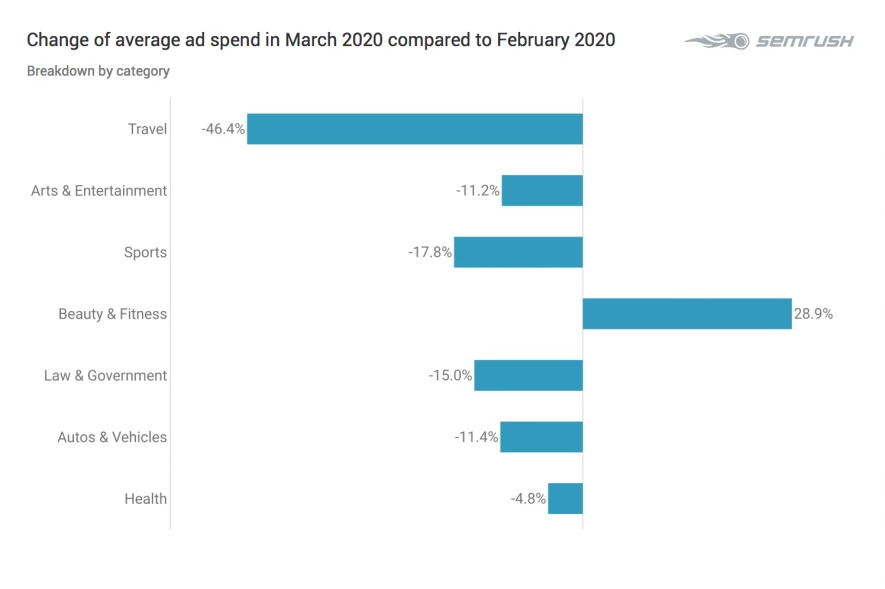

When we look at the industry breakdown, we can spot a similar pattern as above:

The only two industries that continued and even increased their ad spend are Beauty and Fitness.

These industries have already been under stress to compete with their online counterparts, even in the pre-COVID-19 era. So they seem to be best suited to quickly adapt to the changing environment and find growth opportunities.

Moreover, many brick and mortar beauty and fitness businesses expect some short-term flow of customers once the lockdown is over. And they have been offering discounts, selling gift certificates, and offering spots on their waitlists that are expected to get filled up shortly after the restriction measures are eased.

The general audience is now turning to digital news, gaming, and streaming. Italian YouTube, for instance, is seeing a 49,04% increase in its traffic according to SEMrush Traffic Analytics data, while Google’s 2020 total net revenue is now projected to decrease by $28.6 billion.

The catch: With low consumer confidence and shrinking purchasing power, brands can still consider investing in online advertising.

With the declining ad spend, the costs of advertising are also down.

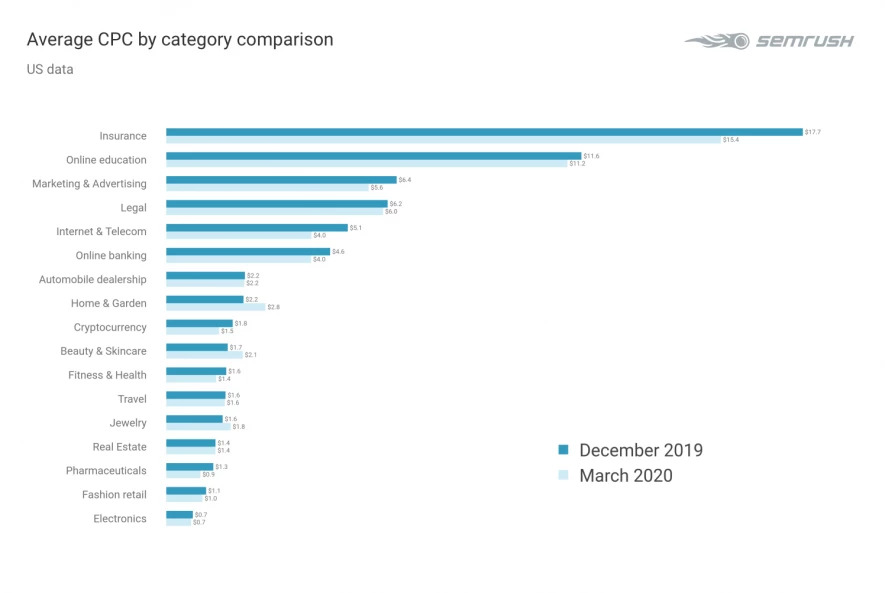

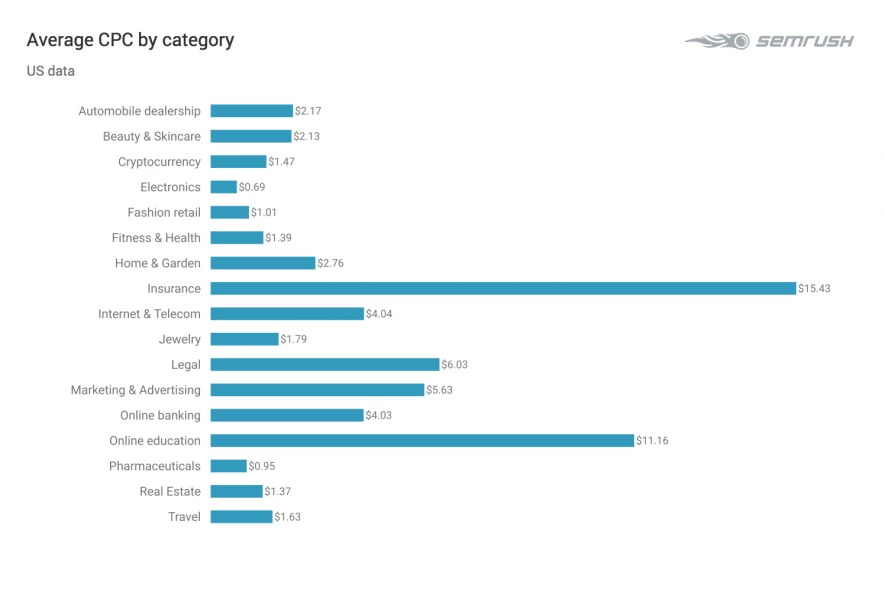

As we can see from SEMrush’s CPC Map, most industries are witnessing a drop in the average CPC. So, right now, you can attract more users per dollar than in pre-COVID-19 times.

The only exceptions are Beauty & Skincare, Jewelry, and Home & Garden industries, as people’s demand for these items is growing.

However, the trends we saw before remain consistent; insurance and online education are still the most expensive industries to advertise in. And it is not surprising to see only an insignificant drop in their pricing per keyword — both insurance and online education are on the rise.

Only you know the best approach to ad spend within your marketing efforts. But, in a nutshell, it comes down to a choice between reaching more users per dollar or saving money for better days ahead.

When making your marketing and advertising decisions, keep in mind both the short-term and the long-term market perspectives:

The key idea of marketing and advertising in the new coronavirus and post-COVID-19 era is to adapt to the new customer. So, keep things digital and map out how your target audience’s lifestyle is changing.

Locate them at the right place and at the right time, and if you are willing to allocate some ad budget, you can now reach them at an unprecedented cost.

Your messaging might also need to change along with customer behavior. You can advertise new deals, offer customer-friendly loans for your services, or just shift your entire marketing message to meet the altered customer demand.

With all this constant new flow of data, we also want to hear how your business or marketing team is navigating through the crisis. Let us know in the comments below how your approach to online advertising has changed or will change in the upcoming days, weeks, and even months!

To learn more about the data behind this article and what SEMrush has to offer, visit https://www.semrush.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.