ALN is conducting an ongoing survey of more than 60,000 conventional properties around the United States in effort to understand to what extent on-time full rent payments are being made and what measures properties are taking to work with their residents during this challenging and unprecedented period.

Our preliminary look at May data will focus on Texas and all numbers are derived from the responses of conventional properties with at least 50 units.

An average of 83% of residents paid their rent on time in May across the Texas properties surveyed by ALN. This is a slight improvement from 81% in April. For the most part the major Texas markets performed more similarly than in April. Once again, the highest average rate of on-time payments was in Austin, at 89%.

Responding properties in the Dallas – Fort Worth and San Antonio areas reported an average of 86% of residents making payments on-time. In Houston, the average stands at 77%. In terms of change from last month, Austin, DFW and Houston are close to their April numbers while San Antonio improved from 78% in April.

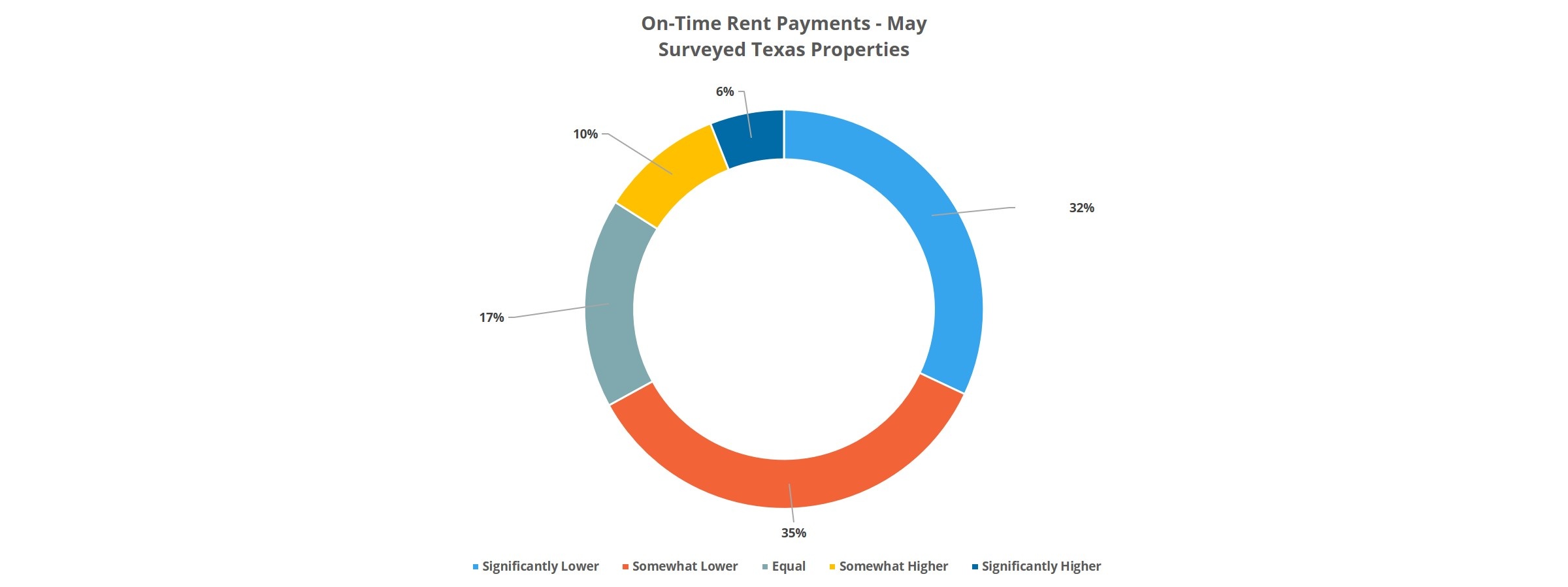

ALN asked properties to indicate whether on-time April rent collections were equal, somewhat lower or significantly lower than in March. 32% of respondents answered that May rent collections were equal to March, 35% answered that payments were somewhat lower and 17% said payments were significantly lower. Interestingly, 10% of responding properties indicated May rent collections were somewhat better than in March and 6% said collections were significantly higher.

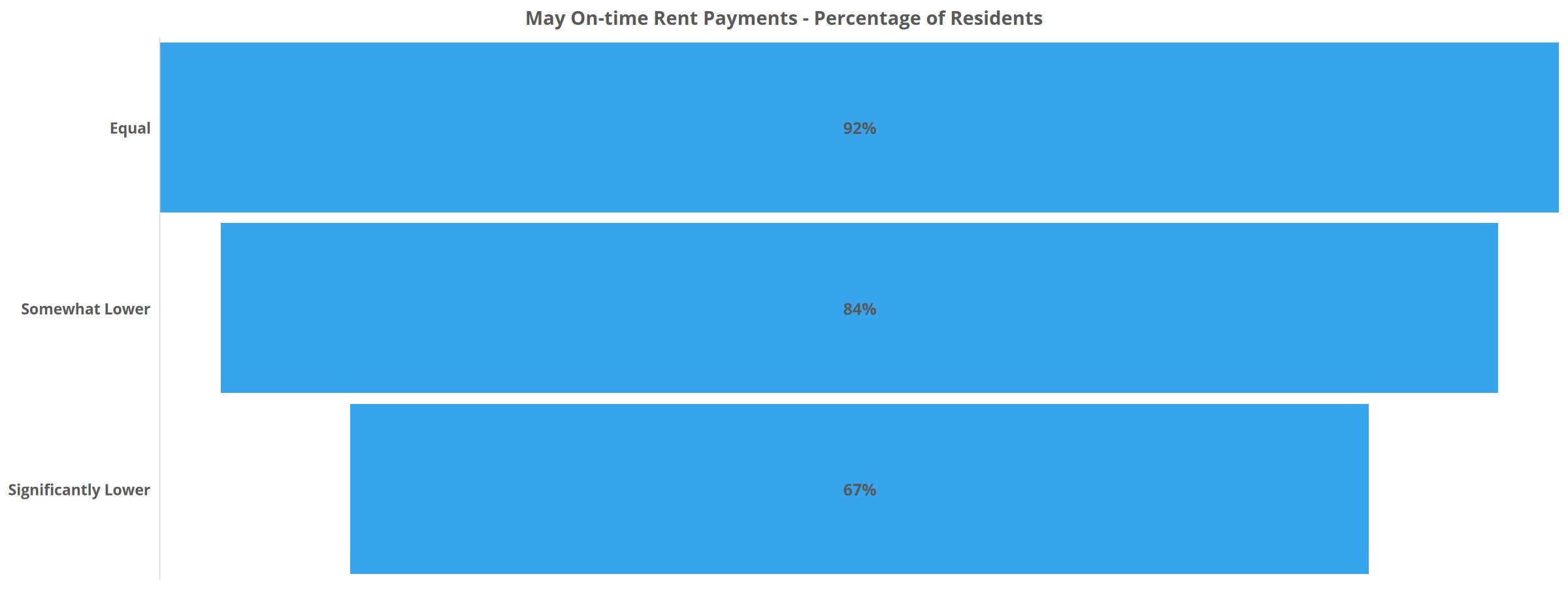

For properties that indicated on-time May rent payments were equal to those in March, 92% of residents paid May rent on time. In properties that indicated rent collections were somewhat lower in May than in March, an average of 84% of residents paid rent on time in April. For properties that saw a significant reduction in May payments, an average of 67% of residents paid rent on time.

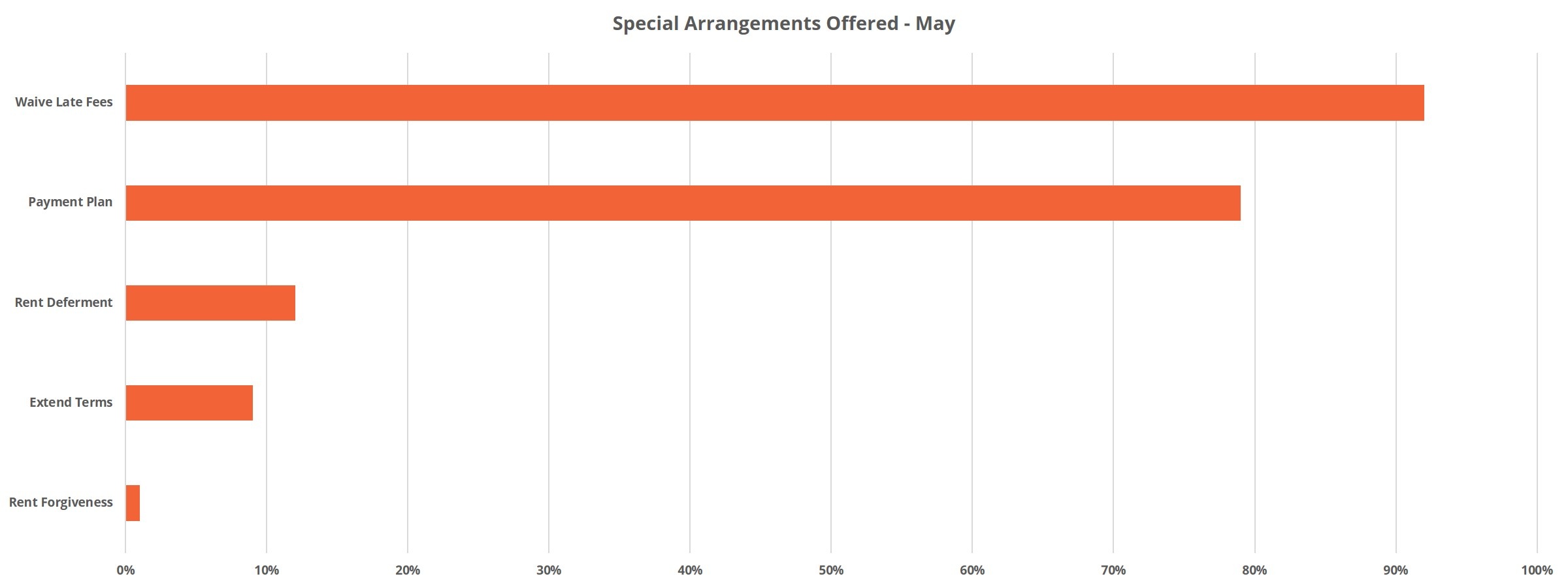

The most common measure taken by properties of those options included in the survey was to waive late fees. 92% of responding properties waived late fees for residents in May, up marginally from April. Payment plans continue to be another common option being offered to residents with 79% of responding properties indicating payment plans were a tool being used.

There were also some less common steps taken by properties across Texas. 12% of respondents indicated they were offering rent deferments of some kind and 9% of properties extended the term of some leases. Only 1% of properties offered a rent forgiveness option to residents. Lastly, 11% of properties did not extend any of the above special arrangements to residents, up from 4% in April.

While a small minority of properties offered special arrangement of some kind to all residents, most respondents indicated arrangements were offered more selectively.

Austin continues to perform best with rent collections, followed closely by DFW and San Antonio. The Houston area continues to lag behind but has been no worse off in May than in April. In April almost one-quarter of surveyed conventional Texas properties reported a significant decrease in on-time rent payments compared to March. For May payments that figure is down to 17%. Almost half of responding properties indicated May collections were equal to, or greater than, pre-COVID levels.

The most commonly reported measures being undertaken by properties to assist residents continue to be the waiving of late fees and the development of payment plans. Overall, 89% of responding properties indicated they were offering some sort of special arrangement to residents.

ALN asked properties if common areas such as pools, playgrounds, leasing centers and club rooms were open, restricted or closed. The only common area for which at least 5% of responding properties indicated no closures or restrictions for May was the leasing center – at 9%.

To learn more about the data behind this article and what ALN Apartment Data has to offer, visit https://alndata.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.