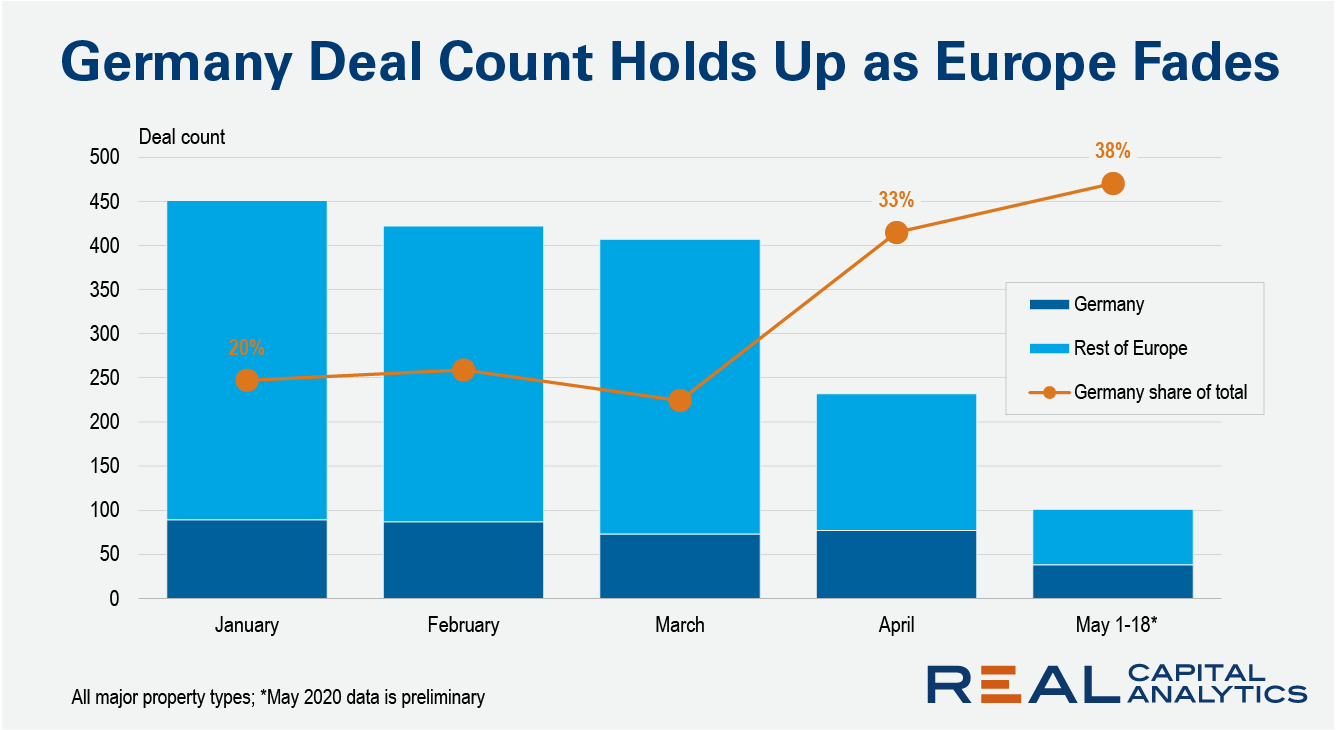

The count of commercial property deals in Europe has dropped sharply due to the impact of the Covid-19 crisis. So far, Real Capital Analytics has recorded some 230 deals for April, which is around one-third of the April 2019 figure.

However, the impact of the outbreak is unevenly distributed. RCA data shows that in Germany, where the authorities seem to have managed the viral outbreak better than other large nations, the real estate market has held up better than anywhere else. April’s transaction count is down just 24% in comparison with April 2019.

Domestic players were behind a larger share of deals in Germany in April, though overseas investors still accounted for one-quarter of the transaction count. For instance, Swedish pension fund AP3 acquired an office property in Wiesbaden, close to Frankfurt, for €64 million ($69 million). Among domestic players, Hahn Gruppe acquired the Eppendorf retail centre in Hamburg on behalf of an institutional investor for €103 million. The same buyer also acquired two more grocery-anchored retail properties from Patrizia.

Why might activity in Europe’s biggest commercial property market be bearing up better than its counterparts? The effectiveness of the medical response will likely be a factor and the country has also started to ease restrictions sooner than other large countries, with shops, bars and restaurants now open again (but still subject to social distancing and other rules).

Second, the country can afford the huge volume of public money that has been promised to try and keep Europe’s largest economy afloat. Germany’s budget surplus has averaged 1.3% of GDP over the last five years and the fiscal support mechanisms put in place at the start of the crisis were the most generous in the world. Strong public finances may be an incentive for investors keep buying at a time when most governments are running up record deficits.

Third, the domestic buyer base is large, sophisticated and well capitalized. Current travel restrictions clearly penalize cross-border investors and those with a local presence and a close knowledge of the markets will be more able to do deals than those at a distance. Cross-border deal volumes have fallen very sharply since the start of April, to the detriment of markets such as Warsaw, which has been dominated by cross-border capital and where just four deals have completed since April 1.

As Europe emerges in piecemeal fashion from the lockdown it is becoming clear that the real estate recovery will not be uniform.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.