Anybody trying to implement a successful investment strategy using the distress playbook from the Global Financial Crisis (GFC) is going to be disappointed. There will be opportunities for sure as the U.S. distress cycle progresses to the work-out stage, but the big chunk of problematic loans this time were not originated for the CMBS market. Trying to source distressed deals out of special servicers will overlook most of the opportunities.

Investors have a tendency to try to fight the last war in every economic downturn, a trait I observed in the last cycle. At that time my argument was that all the investors hoping for a repeat of the RTC in the aftermath of the GFC were going to be disappointed given the differences in the nature of the space market in those last two recessions. That tendency to fight the last war is evident today as well, with some investors misreading the nature of the debt market in this downturn versus the last.

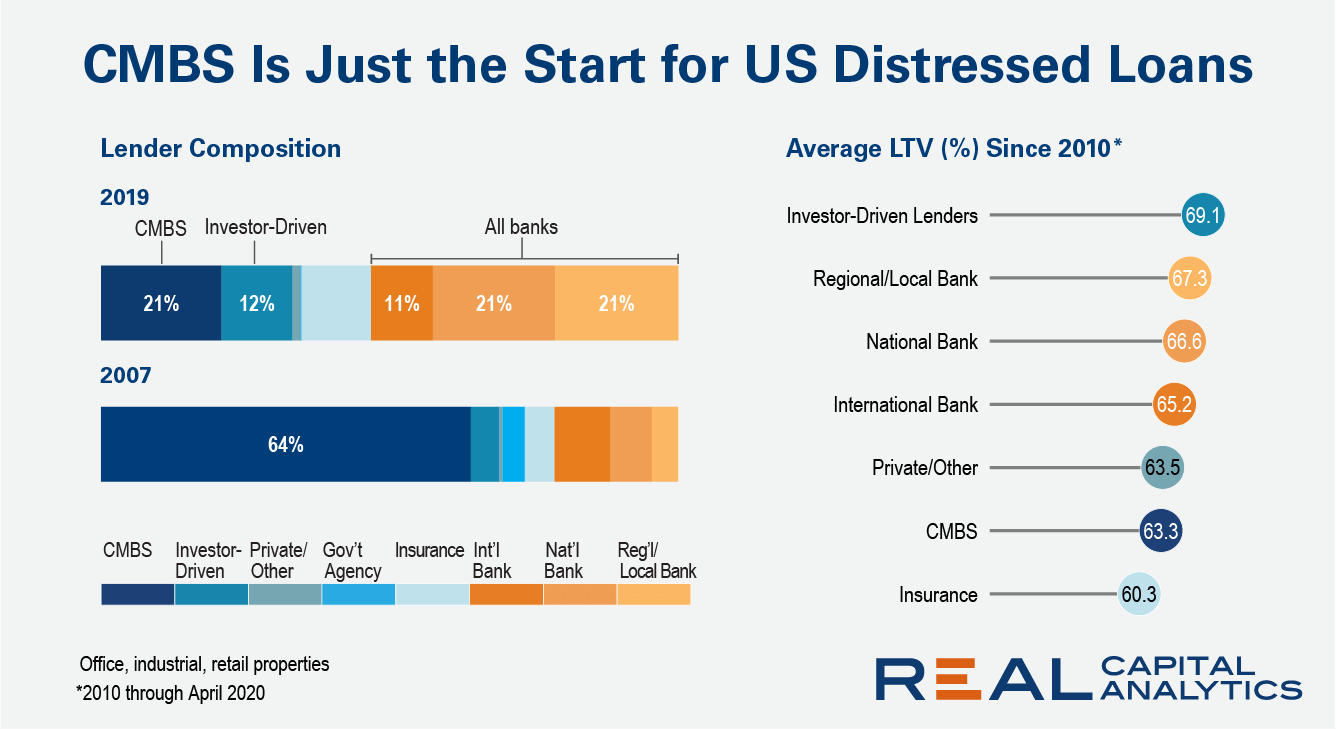

Tremendous distress opportunities were found in the last downturn by looking at CMBS loans on the watchlist and working with special servicers to get ahead of the opportunities before others. Investors will undoubtedly find opportunities via the same route this time, but there simply will not be as much deal flow. The issue is that CMBS was not where the risky lending was happening in this most recent cycle.

The CMBS market has not been the primary originator of commercial mortgage debt in this cycle. Banks of all scale have captured a larger share of all commercial mortgage activity than the CMBS market. (This analysis looks at office, industrial and retail properties.) These bank lenders were also more aggressive at origination, with higher LTVs than CMBS lenders. However, the aggressiveness of bank lending is tame compared to what some of the investor-driven lenders (a grouping that includes debt funds) were doing with their leveraged lending platforms.

There is tremendous transparency around CMBS in this cycle and Real Capital Analytics has seen a surge of many tens of billions of dollars of these loans move over to special servicing in May. This jump in troubled loans has been seen coming from what was a smaller portion of the market over the last decade. Additionally, these troubled loans are surging for what were low LTVs compared to the rest of the market.

Just as most of an iceberg is below the surface and hidden from view, so too are many of the troubled loans today. Building relationships to pick up opportunities out of special servicing will certainly be useful, but relationships with the banks and debt funds will provide access to more distress opportunities during this downturn.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.