It’s a powerful indication of the insanity plaguing the headlines these days that a global pandemic that has, so far, claimed over 100,000 lives in the U.S., put at least 40 million people out of work, driven unemployment to depression-era levels, decimated tens of thousands of businesses, and fundamentally transformed the world we live in could rightly drop from the front-pages.

The events that took place here in Minneapolis over the past week and subsequently spread throughout the country have added an unimaginable level of sadness, pain, and rage to what already stands as one of the most horrible, challenging periods in our lifetime. It seems impossible to know where or how to wade into the situation, and I have no presumption of being able to add to the incredibly powerful messages that have been articulated by so many over the past 7 days.

But as a human being, a member of a wide range of different communities, and a CEO of a Minneapolis-based business, there’s no way I can begin our monthly non-farm payroll forecast without first making a few points.

First, we could not possibly express more thoroughly the horror, grief, outrage, and sadness elicited by the murder of George Floyd last Monday. Without question, we support the prosecution of the officers involved to the fullest extent of the law – both for their actions and their failure to act to uphold their duty of care. Their actions are just one more horrific page in the seemingly endless tragedy that is the persistent, structural racism that exists in our community, in our institutions, and in our country.

Secondly, we stand with the peaceful protestors in demanding the obliteration of racial injustice everywhere. Equally as vehemently, we condemn the actions of those that have compounded the injustice by fostering chaos and destruction in our community and throughout the country.

And lastly, as we wrote earlier this week on our site:

It is imperative that companies of all sizes make clear where they stand in the movement to combat systemic racism. Statements are powerful in illuminating your stance, but actions speak far louder. If you’re looking for ways that your company can get involved, there is an ever growing list from which to choose. If you live in an area where demonstrations are being held, look for organizations that support those on the front lines and that help impacted communities address immediate needs and rebuild. Share your efforts with employees and offer ways for them to participate on an individual level. Fund drives or collecting needed supplies allow teams to rally behind the cause. Some Minneapolis companies are even offering employees vacation time to volunteer for city cleanup efforts.

We cannot simply let this moment pass us by. It is more important than ever that companies actively advocate for our fellow humans and use our platforms to make the world a more just place. We are in a position to stand up, speak out and move things forward in the right direction, but only if we all use our voices.

One of the more brutal aspects of the pandemic is the extent to which it has disproportionately ravaged minority and low-income communities and intensified the spotlight on racial injustice and economic inequality. It’s impossible to know what the trajectory of events will look like in the coming weeks and months, but it’s quite certain that while the long-term arc will bend towards recovery, justice, and human dignity, things in the short-term are likely to remain grim. And to no one’s surprise, this Friday’s jobs report will be horrific.

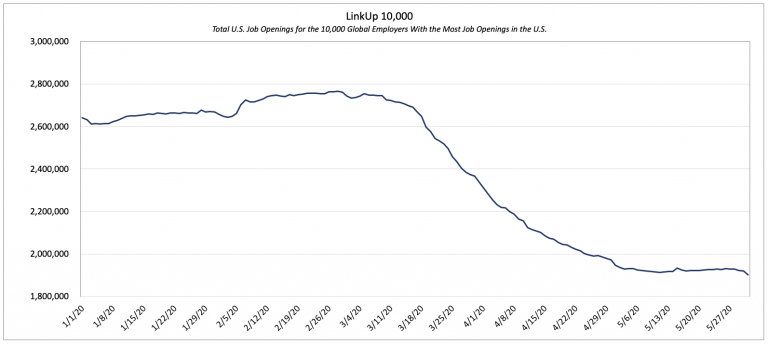

As we’ve highlighted seemingly continuously over the past few months, labor demand fell off a cliff beginning in mid-March. Between March 16th and the end of April, job openings on company websites fell roughly 30% as highlighted in the chart of the LinkUp 10,000 Index below. The LinkUp 10,000 measures the total number of job openings in the U.S. from the 10,000 global employers with the most U.S. job openings.

Relative to the 2020 peak in February, The LinkUp 10,000 has dropped closer to 35%.

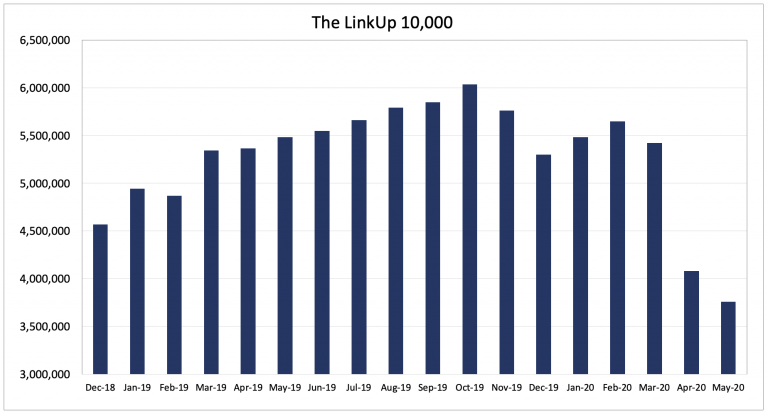

Looking at our raw data, total job openings have dropped 31% since February and new and removed job listings are down 38% and 29% respectively.

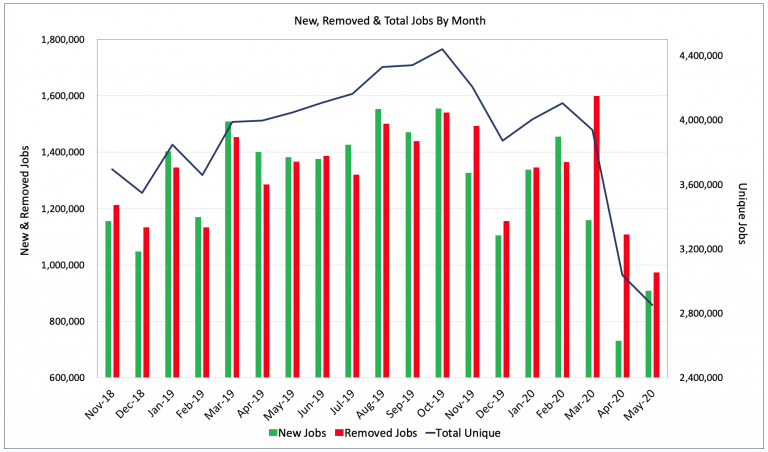

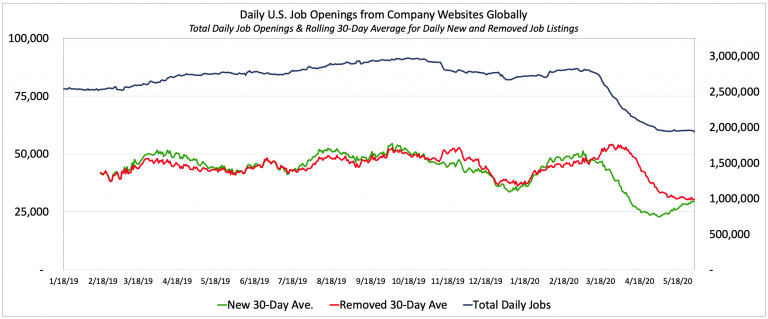

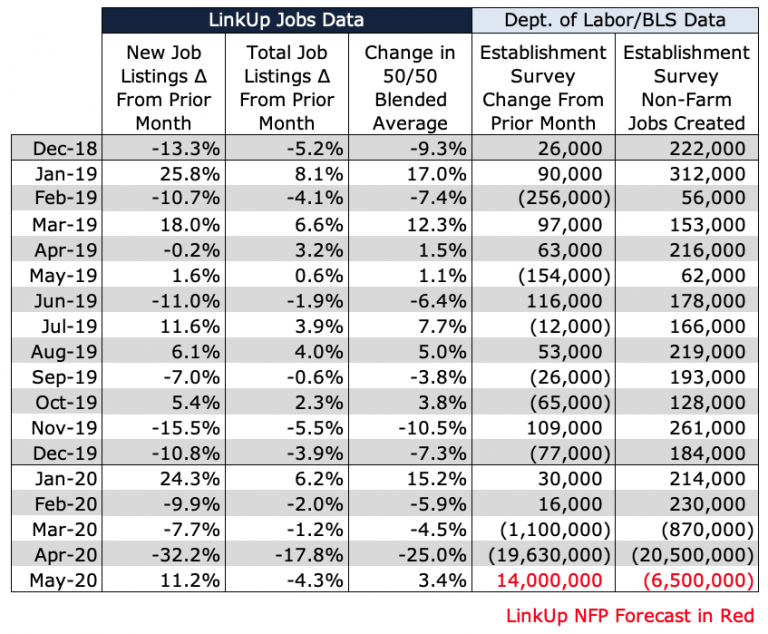

But as the chart above shows, new job openings jumped sharply in May, rising 24% from the prior month. Looking at the same data on a daily basis with a 30-day rolling average of new and removed jobs shows the same upward trend beginning in early May. Of note, as well, is the unprecedented extent to which new and removed jobs diverged precisely on March 16th.

In the normal course of events as the job markets ebbs and flows through regular business cycles, companies and employers posts new openings, fill jobs with new hires, and then take those openings off their corporate career portal. There may be slight divergences depending on whether the economy is expanding or contracting and/or if there are above-average imbalances between labor demand and supply, but for the most part, new and removed jobs track closely with one another, reflecting the normal churn in the job market as they work in tandem.

In March, however, new jobs were removed at significantly elevated levels not because companies were filling openings but because they no longer intended to fill the positions. In fact, thousands of companies in our dataset removed every single opening on their company website in one fell swoop.

At the same time, most companies either severely curtailed posting new job openings or stopped posting them altogether. While a handful of sectors such as grocery stores, general merchandisers, delivery companies, food companies, and certain online retailers, for example, ramped up hiring, some quite aggressively, in fact, the vast majority of employers across the economy slowed or stopped their hiring efforts.

And while it’s obvious, it was the combination of much higher-than-average jobs removed and much lower-than-average new jobs posted that combined to create the 30% drop in labor demand between mid-March and the end of April.

In mid-April, however, the decline in new job postings slowed down and started to actually increase by the end of the month. At the same time, the rate of decline in jobs removed also slowed towards the end of April. The result of those two phenomena was the convergence, once again, of new and removed jobs, albeit at a far lower level than pre-COVID-19.

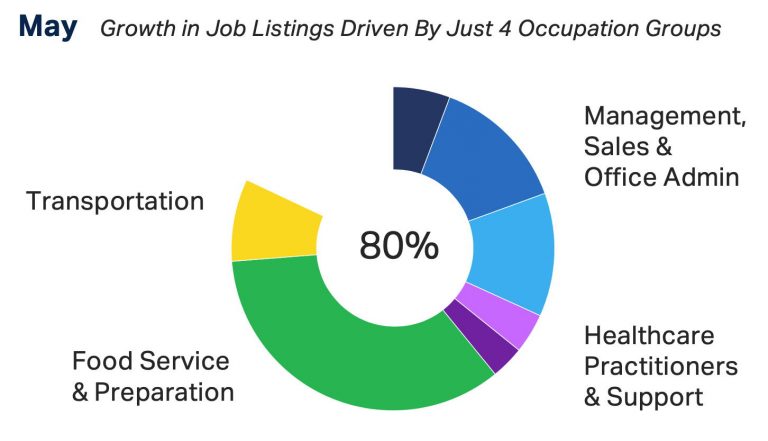

Drilling into where in the economy, exactly, that growth in new job postings has been occurring, it is interesting to note that roughly 80% of the growth in new job postings can be accounted for by 4 occupation groups – General Business, Healthcare, Food Service, and Transportation.

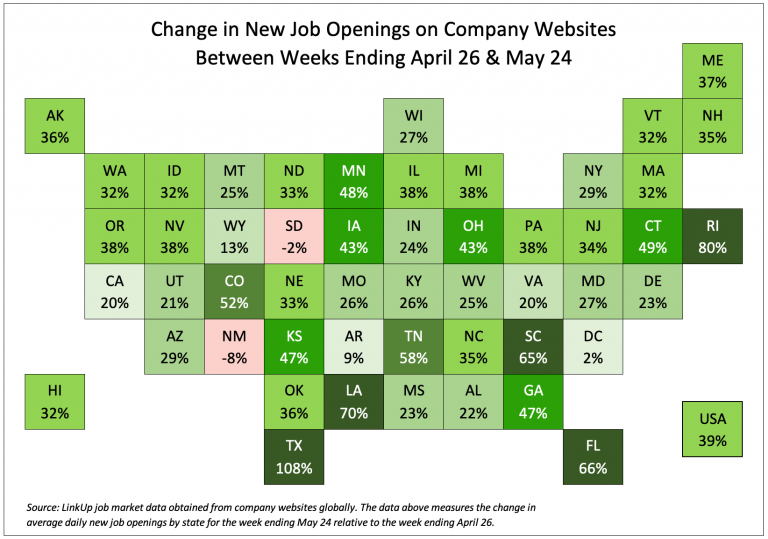

Equally as noteworthy is where geographically those increases were taking place. As we highlighted in a blog post on the 26th, the increase in new jobs started in the end of April and continued through the week ending May 24th. Through that period, new job listings had risen nearly 40% from the end of April with gains seen essentially throughout the country.

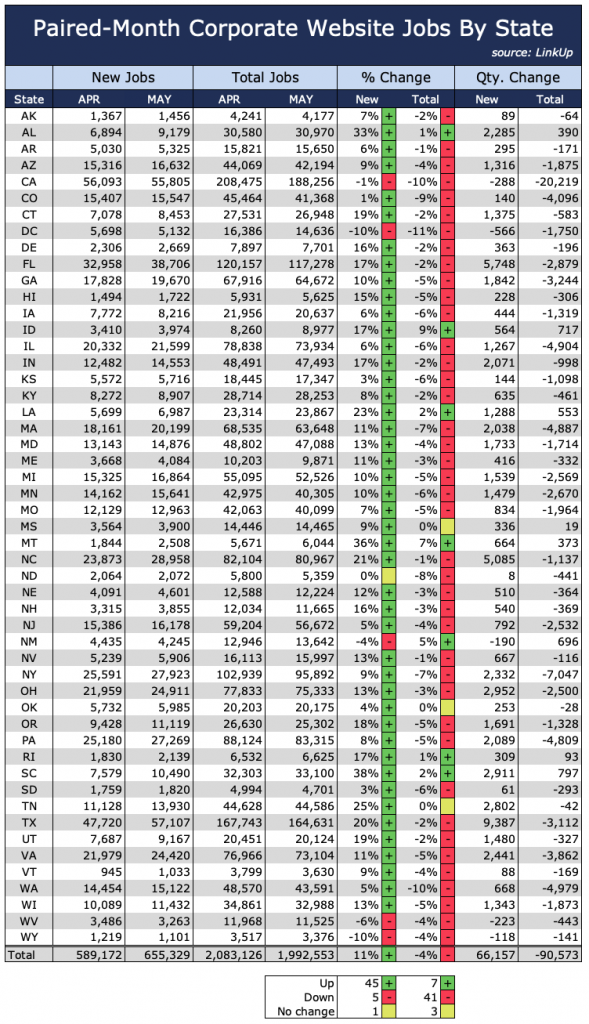

Our paired month data which measures job openings for a common set of companies that were hiring in both April and May shows similar patterns with new job openings up 11% from the prior month while total job openings were down slightly from April.

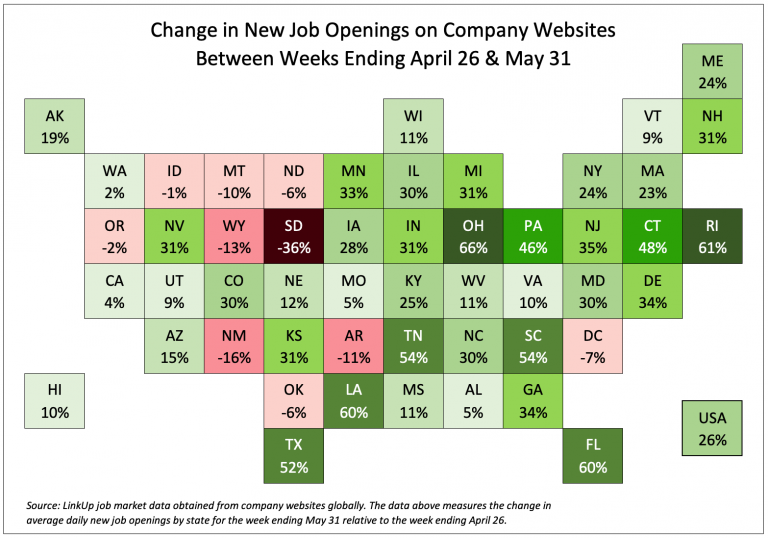

In the week ended May 31st, however, new job openings across the U.S. declined 10% from the prior week and only a handful of states saw increases (PA, OH, IN, DE, NJ, MD). With the decline, sharp ones in many states (WA, OR, ID, MT, SD, ND, OK, TX), the state-by-state change in labor demand since the end of April now has a far higher degree of variability than it did just a week ago.

Despite the fact that the worst of the devastation to labor demand is likely behind us, there is no doubt whatsoever that bouncing along the bottom of this trough is going to be both jarring and protracted. The cycle of opening local economies and accelerating infection rates followed by re-instituting lockdowns to flatten the curve will likely go on until a vaccine is discovered and fully deployed or the virus runs its course. Even worse but not unimaginable in the dystopian world we live in these days, it’s possible that some number of states don’t return to lockdown mode as infection rates accelerate and deaths rise, but simply let things play out the way they will.

In all imaginable scenarios, given the current administration, every state will be forced to chart its own path and the human and economic toll will be be even more catastrophic than it’s already been. And that’s just the short and medium-term time horizon – we can only speculate at this point what the permanent demand destruction will be from the pandemic and the corresponding implications that that demand destruction will have for the nation, the economy, unemployment, public policy, and society as a whole.

As it relates to the economy broadly and the job market in particular, it is likely that things will play out at a very local level, much the way the pandemic itself is playing out. As a NYT article today entitled “Is America’s Pandemic Waning or Raging? Yes” states:

The dizzying volatility from city to city and state to state could continue indefinitely, with vastly different policy implications for individual places and no single, unified course in sight.

Some states are seeing vast improvements. But as the pandemic progresses, parts of the country may eventually need to reimpose restrictions, Dr. Tom Inglesby, the director of the Center for Health Security at Johns Hopkins University, said.

“The country is divided in terms of its overall trajectory,” Dr. Inglesby said. “This virus is persistent. It hasn’t changed.”

The same could be said for the trajectory of the labor market and the title of the article could just as easily be “Is The Job Market Beginning to Recover or Still Deteriorating? Yes.” The crisis gripping the country is accelerating the widening of so many gaps in the country based on race, income, education, age, geography, and politics. As it relates to employers, the widening gaps are increasingly a function of geography, industry, size, innovation, and market. Absent a massive, intelligent response from government, the separation between winners and losers will continue to grow. And as polarized and bifurcated as our reality is these days, it’s only going to get worse as the pandemic and accompanying economic distress are unevenly distributed throughout the country.

And on that cheery note, our forecast for the May jobs report is a loss of ‘only’ 6.5 million jobs – how depressing that our forecast could conceivably be regarded as hopeful given the consensus estimates of a net loss of ~8 million jobs.

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.