It’s over. The UK’s aviation dream was broken this morning when U2 883 departed from London Gatwick for Glasgow at 07:00; the first of some eleven scheduled flights from the airport today. The same day last year 435 scheduled services departed from the airport; we still have a long way to go in that recovery.

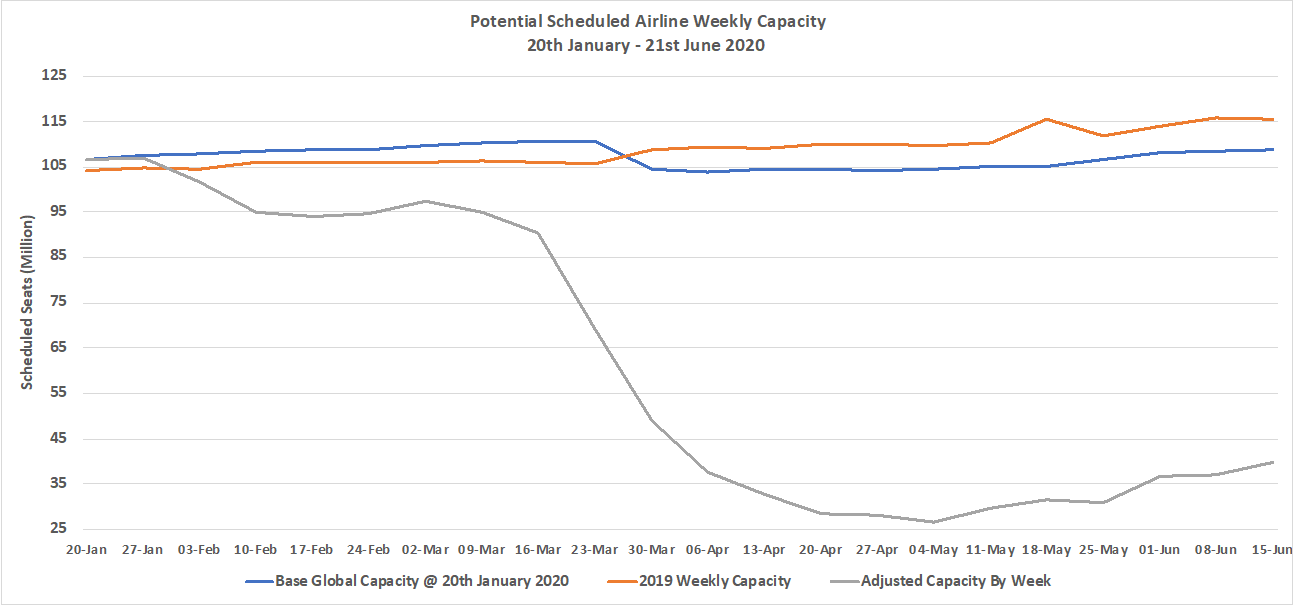

Global capacity has increased by a solid 7% week on week as the chart below illustrates; at just under 40 million seats a week we are a mere 75 million seats below the same point last year. A quick headline assessment would suggest that if 80% of those seats had been filled then around 60 million flights would have been taken; assume an average yield of US$200 per passenger and it is around a US$1.2 Billion revenue hit this week. Scary numbers and of course reflected in the latest IATA forecast published last week.

Chart 1 – Scheduled Airline Capacity by Week Compared to Schedules Filed on 20th January 2020 & Previous Year

Source: OAG

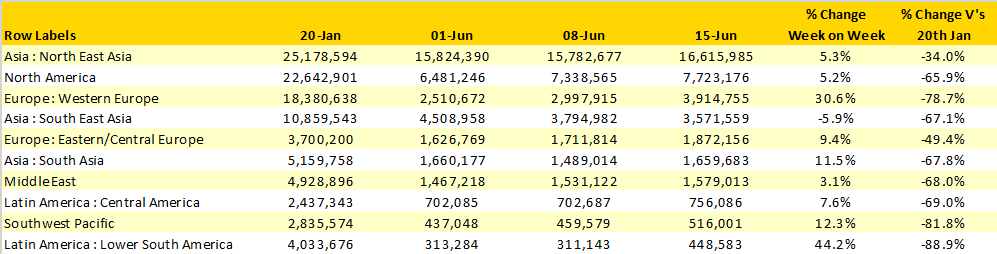

The return of Premier League football this week seems to have resulted in more than one million additional seats week on week in Western Europe with the United Kingdom leading the way with an 88% increase in capacity. Despite the quarantine ban in the United Kingdom an additional 213,00 additional international seats are available for those desperate for a 14-day staycation or perhaps heeding the advice of Michael O’Leary and learning golf whilst carrying their mobile phone with them.

Nine of the top ten regional markets reported week on week capacity growth with a further one million seats added back to North East Asia where total capacity is now just 34% below the January pre Covid-19 levels as the domestic market sizes underpin those volumes. The reopening of services in the Philippines has added over 100,000 extra weekly seats to the South East Asian market but further capacity cuts by Lion Air and Batik Air that are now reflected in the data base result in a 6% decline in weekly capacity.

Table 1 – Scheduled Airline Capacity by Region

Source: OAG

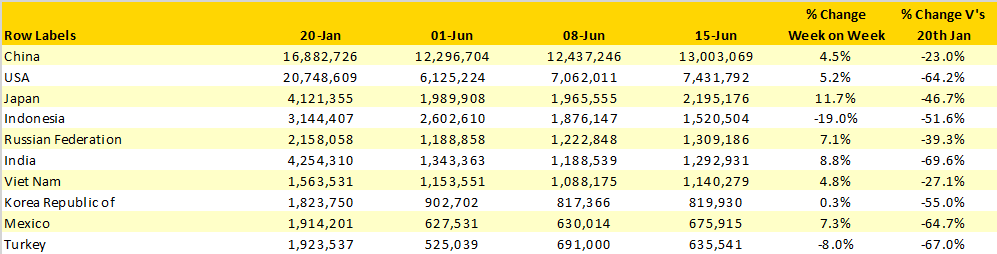

The top ten country markets remain unchanged this week with only Turkey and Mexico swapping places; the 8% reduction in weekly capacity in Turkey reflecting the real challenges of recovering out of COVID-19 and match supply to what demand there currently is in the market. Japan and India both report strong week on week capacity growth but as we will see later, the levels of cancellations in both markets are much higher than normal as last minute operational/commercial adjustments are being made by many airlines.

Table 2- Scheduled Capacity, Top 10 Country Markets

Source: OAG

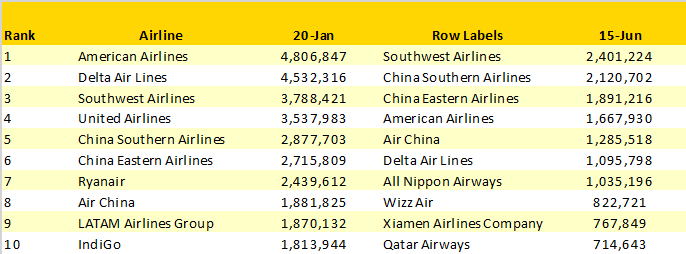

The addition of a further 178,000 seats from Southwest Airlines allows them to both retain their number one position and pull slightly further away from China Southern and China Eastern who both added more capacity to their networks. Although just in the top ten airlines, Qatar Airways are now operating 73% of their pre Covid-19 capacity and for an airline with no domestic market and subsequent reliance on international access the continued uncertainty around lockdowns, bubbles, corridors and quarantines would seemingly make this a high-risk strategy towards recovery.

Rather than repeat the same table as last week the table below compares the top ten airline ranking in January against this week’s position highlighting both the absolute scale of capacity change and the continued non-appearance of some larger carriers. Sadly, it’s hard to imagine LATAM returning any time soon to the top ten given their Chapter 11 filing but United Airlines (currently in 11th place) Ryanair (115th place) and Indigo (16th position) will all return at some point in the next few months.

Table 3- Scheduled Capacity, Top 10 Airlines

Source: OAG

Last minute schedule changes and cancellations are inevitable in a market recovering from such a dramatic decline in capacity and especially in those markets where capacity is relatively close to pre Covid-19 levels and where high frequency domestic services have been the backbone of that recovery. However, some markets are performing better than others; in Japan current cancellation rates are running at around 29% which for a market with regular winners in the OAG on Time Performance awards is very high, whilst in Turkey last week domestic cancellations were near normal operating levels.

With over 70 million fewer seats than this week last year it’s a bit of an understatement to say that there remains a long way to go! The market really is in a state of churn; the OAG data published on the 25th May indicated some 68.5 million seats would be operated this week; dramatic changes from airlines adjusting schedules brought that back to 39.9 million, a 28.6 million (-42%) adjustment. Looking forward, this week’s data reports some 80 million seats in the first full week of July highlighting the scale of capacity cuts we can expect in the next few weeks; breaking 45 million seats by that point will be quite something.

Yes, a capacity recovery is underway, demand continues to lag, and the summer season looks extremely fragile with uncertainty damaging consumer confidence in booking anything more than a short-haul flight. And while it has been nice to sleep without the early morning departures to Palma, Rome and Glasgow acting as a wakeup call it would be great to hear a bit more noise in the next few weeks!

To learn more about the data behind this article and what OAG has to offer, visit https://www.oag.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.