Brent crude prices have more than doubled since the lows of late April, and while part of that is a reflection of the demand-driven recovery we’ve seen on a global basis, it is also the result of global oil producers throttling back on exports.

While this recent discipline is to be commended, let us not forget what got us into this mess. Amid an oil price war, Saudi Arabia, Russia, UAE and others opened the spigots in April, pushing an unprecedented amount of crude onto the global market.

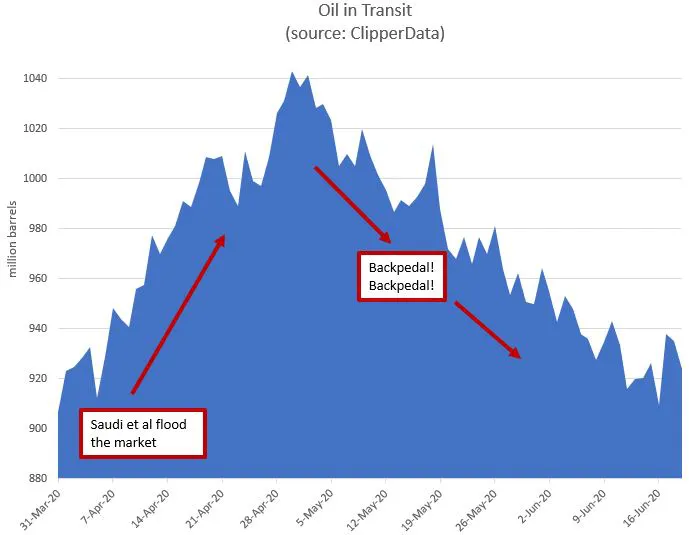

This meant that oil in transit on a daily basis rose well above a billion barrels in late April. As oil in transit peaked, prices troughed. Then began the backpedal:

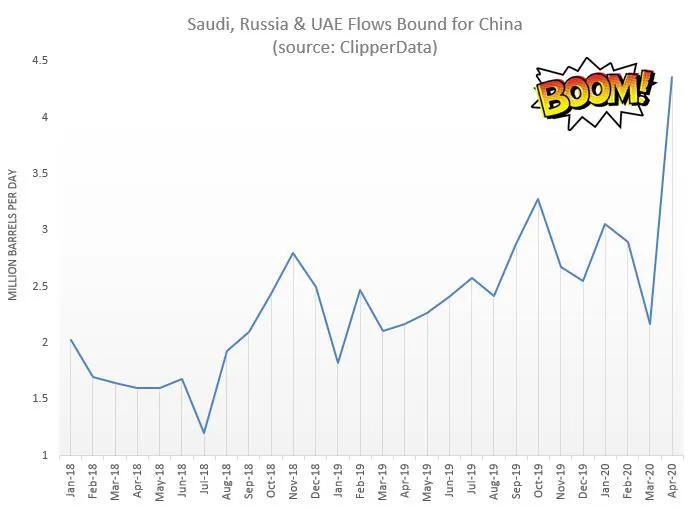

The oil price war encouraged China to back up the truck and fill its boots, resulting in record imports in May – and due to their ongoing voracious appetite, record volumes of crude floating storage this month.

But just as Tyrone Davis sang: what goes up (must come down). A combination of oil prices in the teens and the demand shock of the coronavirus was enough to bring an abrupt end to the oil price war, and subsequently a reversal in oil in transit.

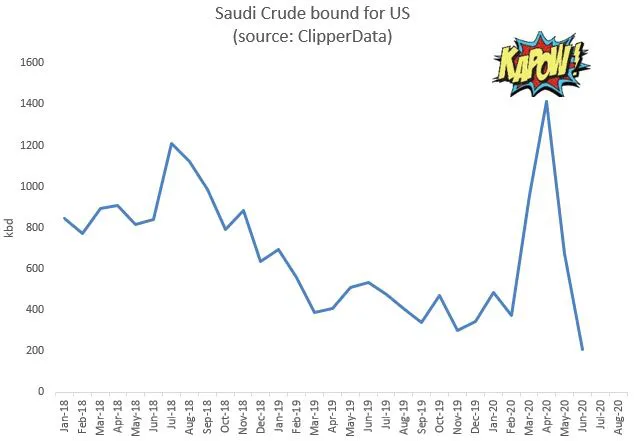

Such a ramp up in Saudi exports in April meant that there were many destinations that benefited from cheap Saudi oil, not just China. This is reflected in flows bound for the US in April (Kapow indeed).

US oil exports held up much better than expected last month, in part due to US refiners importing dirt cheap Saudi crude and exporting domestic Mars crude at a higher price. But back to Tyrone Davis, and what goes up, must come down: Saudi crude to the US is singing from the same song-sheet.

To learn more about the data behind this article and what ClipperData has to offer, visit https://clipperdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.