McDonald’s leads competition in online spend on breakfast items via third party delivery services, with 166% more customer spending than Dunkin’ Donuts.

Key Takeaways

In early March, claims that “2020 is the year of the breakfast wars,” made headlines. When Quick Service Restaurant (QSR) Wendy’s added breakfast items to their menu to cash in on morning meals, category leader McDonald’s in turn offered a promotion of free breakfast sandwiches. With the recent challenge of COVID-19 impeding traditional dine-in restaurant sales, the competition between QSRs has only further intensified.

As buyers became stuck at home under shelter-in-place and quarantine orders around the nation, a question emerged of how the QSR breakfast wars have been affected in recent months. Edison Trends has been at the forefront of reporting how COVID-19 is shifting e-commerce trends nationwide. To determine how QSR breakfast item sales have performed online in recent months, Edison Trends analyzed over 53,000 transactions made for pickup and delivery via third party services DoorDash, Uber Eats, and Grubhub.

How has online spend on QSRs’ overall breakfast items changed during COVID-19?

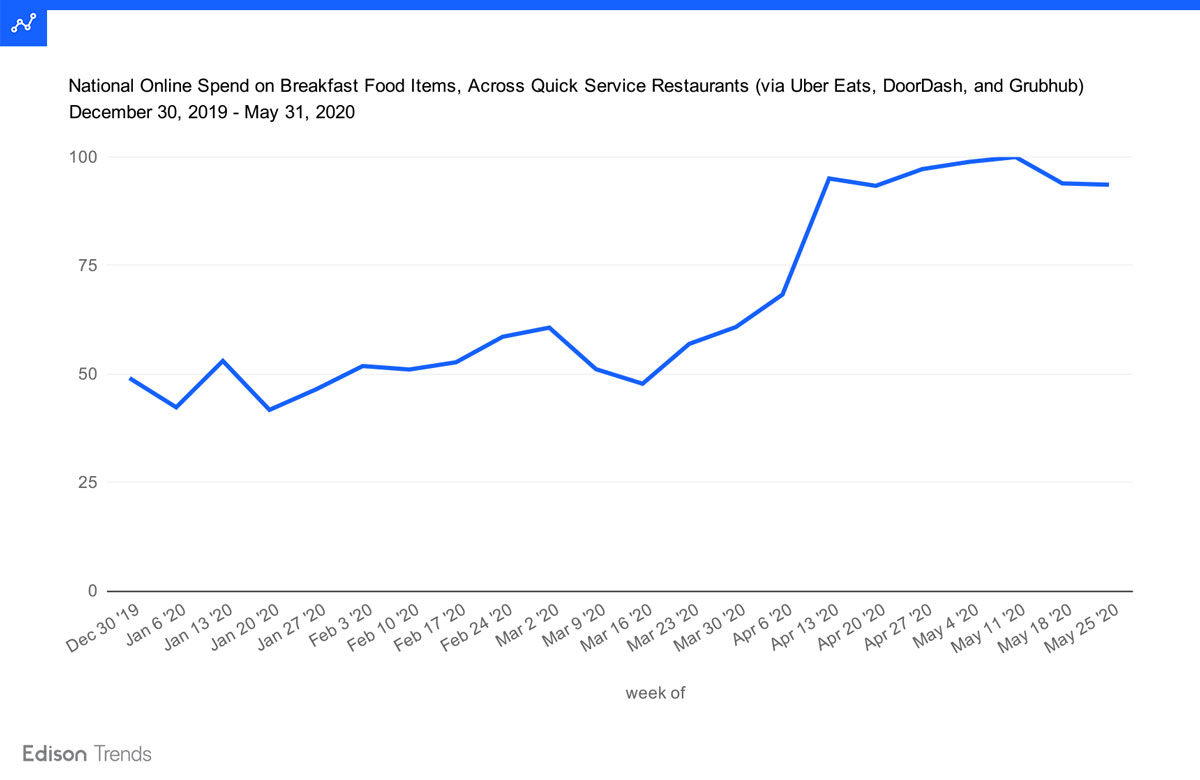

Figure 1a: Chart shows estimated national online spend on breakfast food items across quick service restaurants from December 30, 2019 - May 31, 2020 by week, according to Edison Trends. Note: The week/vendor with the highest spend was set to 100, and other values were scaled accordingly. This analysis was performed on over 13,000 transactions from Uber Eats, DoorDash (including Caviar), and Grubhub (including Seamless, Eat24, Yelp, Order Up, and Tapingo). The analysis includes all food items listed in the “breakfast” section of these restaurants’ restaurants’ offerings on third party services and orders for both pickup and delivery.

Spending on all breakfast items from top QSR restaurants through food delivery services reached a new plateau the week of April 13, after a month of solid growth; between the week of March 16 and that of April 13, spending grew 99%. As of the week of May 25, it has fallen just 2% since the start of the plateau.

Figure 1b: Chart shows estimated national online spend on breakfast food items by quick service restaurants McDonald’s, Dunkin’ Donuts, Starbucks, Wendy’s, Jack in the Box, Burger King, and Taco Bell from December 30, 2019 - May 31, 2020 by week, according to Edison Trends. Note: The week/vendor with the highest spend was set to 100, and other values were scaled accordingly. This analysis was performed on over 13,000 transactions from Uber Eats, DoorDash (including Caviar), and Grubhub (including Seamless, Eat24, Yelp, Order Up, and Tapingo). The analysis includes all food items listed in the “breakfast” section of these restaurants’ restaurants’ offerings on third party services and orders for both pickup and delivery.

Comparing Quick Service Restaurant sales through third party services Uber Eats, DoorDash, and Grubhub shows that McDonald’s holds a significant lead over competitors in online spend on breakfast food items, with 166% more customer spending on breakfast foods than Dunkin’ Donuts, which took second the week of May 25. Starbucks was third, followed by Wendy’s and Jack in the Box, then Burger King and Taco Bell.

Worth noting is that in late March, McDonald’s temporarily pulled its all-day breakfast menu and pared down its offerings to include only its most popular menu items to keep U.S. operations nimble amid the economic pressure of the coronavirus.

To learn more about the data behind this article and what Edison Trends has to offer, visit https://trends.edison.tech/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.