Hard seltzer is one juxtaposition after another—and that’s what’s driving its overall success.

For starters, while hard seltzer is generally categorized within the flavored malt beverage (FMB) category and the broader beer category, a majority of U.S. hard seltzer buyers (60%) and 70% of legal age Millennial drinkers—a core demographic for hard seltzer—consider hard seltzer as its own category. Fewer than 10% think of it as a ‘type’ of beer.

By successfully carving out its own identity, hard seltzer poses a threat to traditional FMB and core beer options, and even the broader alcohol category, largely because overall alcohol budgets and tolerances are finite. In comparing March and April 2020 with the same two months in 2019, hard seltzer buyers decreased their share of spending on beer and wine, with beer losing 5.6 share points and wine losing 4 share points among this consumer group, while spirits were relatively unaffected. Seventy-five percent of hard seltzer drinkers, however, also buy beer, and many of the beer brand extensions we’re seeing (Bud Light Seltzer, Corona Seltzer, etc.) reflect a potential opportunity for cross pollination, as well as a potential risk to the mainstream beer brand.

No matter the branding strategy, the phenomenal growth of hard seltzers affords opportunities not to be missed. While brand name extensions from mainstream beer manufacturers represent a little less than 20% of the hard seltzer market as of June 2020, hard seltzers with brand names not affiliated with beer still command the lion’s share of the category; White Claw and Truly led the pack, with supplier owners (Mark Anthony Brands and Boston Beer) that elected to go to market with their own identities that were separate from their beer (Sam Adams) and flavored malt beverage (Mike’s Hard) brands. Combined, they maintained a combined market share of just over 75% as of the week ended June 13, 2020.

The explosion of the hard seltzer segment has caught the attention of many companies eager to grab a piece of the rapidly expanding pie. At the beginning of 2018, just 10 hard seltzer brands were on the market. That number rose to 26 brands by the beginning of 2019, and more than 65 brands are now fighting for consumers’ attention and purchase—with about half using a unique brand name, and the other half pivoting off an existing beer brand name.

PANDEMIC PURCHASING AND SEASONALITY PROPEL HARD SELTZER

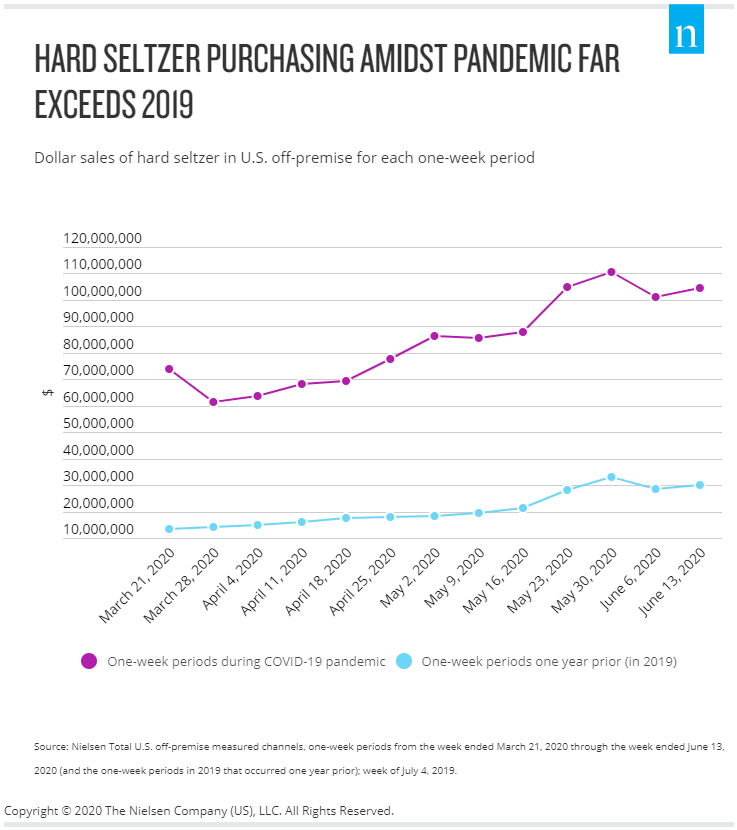

Since hitting the market, hard seltzer has proven to be an unstoppable force. It’s also proven to be the most resilient segment within the entire alcoholic beverage industry, which has felt the sting of sudden bar, restaurant and on-premise tasting room closings amid the COVID-19 pandemic. Retail sales, however, haven’t missed a beat, particularly as consumers quarantined to avoid risk of exposure to COVID-19. Since the week ending March 21, 2020, each week’s dollar sales of hard seltzer within the U.S. off-premise market has exceeded the week of July 4, 2019, which was previously the highest individual week of sales. Moreover, the week ending June 13, 2020 represented the fourth consecutive week during which hard seltzer drove more than $100 million in retail off-premise dollar sales, and the 10th consecutive week during which annual retail hard seltzer dollar sales increased by at least $50 million.

Before this year, hard seltzer sales had fluctuated to some degree due to seasonality. And while there will continue to be seasonality, hard seltzer has proven to be a powerhouse outside of summer. During the 15-week period ended June 13, 2020, hard seltzer off-premise sales within U.S. retail quadrupled on a year-over-year basis, an increase of $900 million. Total hard seltzer sales for the 52-week period ended June 13, 2020 were $2.7 billion, and dollar share of total beer/FMB/cider has now exceeded 10% for four consecutive weeks (more than double the 4.4% share it held as of the 52-week period ending Feb. 29, 2020). Given this trajectory, we think it’s possible that hard seltzer’s share could reach 15% before the end of the summer.

A BLENDING AND BLURRING OF OPTIONS, BRANDS AND CATEGORIES

The popularity of hard seltzer and the companion sales growth has given an array of manufacturers from across the alcohol industry ample motivation to continue pushing the envelope—with new hard offerings and blends. Consumers now have choices that include traditional hard seltzers, cider seltzers, wine seltzers, spritzers, spirit type seltzers and more—and these products are resonating. Hard seltzer-correlated ready-to-drink cocktails drove $120 million in U.S. off-premise sales in the 52-week period ending June 13, 2020, while growing at a 127% rate compared with the previous year. And while wine seltzers and spritzers totaled just $44.6 million in dollar sales in the 52-week period ended June 13, 2020, their pandemic period year-over-year growth of 61.7% far exceeds the 12.1% pre-pandemic growth.

Additional choice poses both opportunity and challenge. Shelf space is limited at retail outlets, and many consumers will become selective in their purchases amid rising unemployment. Manufacturers launching new hard seltzer products cannot expect to automatically succeed just because they have ‘hard seltzer’ on the packaging. Success can be fostered through a number of tactics, including a compelling value proposition—e.g., price point, flavors and branding—and an activation plan to articulate and drive awareness to these specific differentiators.

To win and maintain consumer interest, new and old entrants alike need to capitalize on new buyers of hard seltzer. And that pool of consumers is big and driving significant growth for hard seltzer as a whole. In the month of April alone, one million households in the U.S. bought hard seltzer for the first time, and almost twice as many households bought hard seltzer in April than in an average month before April.

Hard seltzer gained traction because of its correlation with health and wellness, convenience and an intriguing variety of flavors—and now, consumers can’t get enough. That growth has opened the doors to an even broader array of new and bolder flavor options accompanying the base liquid, and it’s allowing manufacturers to expand the limits of what ‘hard seltzer’ means.

THE ‘BEYOND-COVID-19’ OUTLOOK IS STRONG

Looking ahead to a new normal, hard seltzer will remain relatively insulated from broader shifts in consumer behavior and regulation.

The gradual re-opening of the U.S. on-premise space—where Nielsen CGA measurement shows that hard seltzer dollar sales were already up nearly 500% from 2018 to 2019—provides another avenue for the growing number of hard seltzer brands to build on at-home consumption. And with its foundation as a canned beverage enjoyed outside the home, hard seltzer is more resilient than other alcoholic beverages in the face of any subsequent on-premise disruptions brought on by COVID-19 or otherwise.

No matter how you frame it, hard seltzer has the most sustainable growth trajectory across the U.S. alcohol landscape. With new launch after new launch, manufacturers with hard seltzer products already on the market may lose market share but continue growing their sales, as the hard seltzer train shows no signs of slowing.

METHODOLOGY

To learn more about the data behind this article and what Nielsen has to offer, visit https://www.nielsen.com/us/en/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.