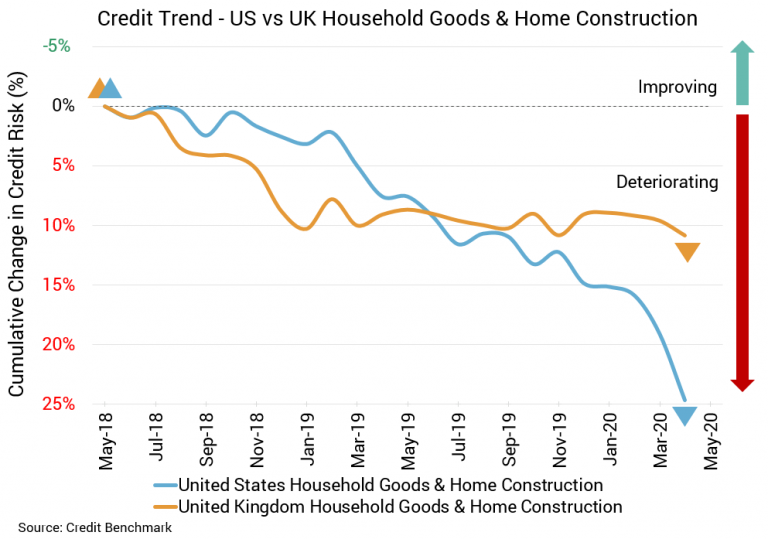

A myriad of problems are confronting the US housing market — far fewer homes are being built and new construction planning processes are diminishing. The rate of home sales is also falling. While there is some evidence emerging that things are beginning to look up, credit problems persist for this sector.

Default Risk Up Almost 16% in Last Year

US Household Goods and Home Construction Firms

Credit difficulties for the US housing sector are becoming more conspicuous. The deterioration in credit quality has been speeding up, with month-over-month declines of 5% and 8% over the last two months. Year-over-year, credit quality has deteriorated by 15.9%. Average probability of default for this sector continues to move up quickly, rising to 57.6 basis points with the most recent update. It was 55 basis points in the prior month and 53.5 basis points two months earlier. At the same point last year, average probability of default was 49.7 basis points. Around 80% of the firms in the sector have a CBC rating of bbb or lower with the most recent update. Over the last 12 months, the overall CBC rating for this aggregate has remained bb+.

UK Household Goods and Home Construction Firms

As described in last month’s update, credit quality for the UK housing sector has been in a holding pattern over the last year, getting worse slowly over the short-term but still flat over the long-term. The month-over-month decline was a mere 1% and the year-over-year decline was about 2%. Average probability of default is 53.4 basis points, which compares to 52.8 basis points the prior month. At the same point last year, average probability of default was 52.6 basis points. About 82% of the firms in the sector have a CBC rating of bbb or lower. The overall CBC rating for the sector over the last 12 months has stayed at bb+.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.