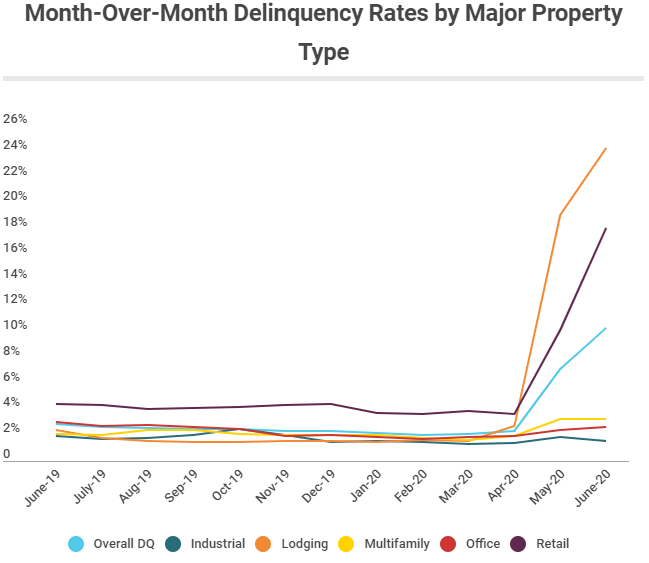

At one point in June, it appeared that a new all-time high for CMBS delinquencies would be reached. However, when the final numbers were posted, the 2012 high remains the peak for the time being.

Trepp’s CMBS Delinquency Rate in June is 10.32%, a jump of 317 basis points over the May number. About 5% of that number represents loans in the 30 days delinquent bucket while another 3.2% are now 60 days delinquent.

The numbers could be headed still higher in July. That’s because 4.1% of loans by balance missed the June payment but remained less than 30 days delinquent. That percentage of loans in or beyond grace period (the A/B loans as we refer to them) has fallen from 8.1% in April and 7.6% in May.

So perhaps we have reached terminal delinquency velocity – meaning most of the borrowers that felt the need for debt service relief have requested it. (Put another way, if a borrower didn’t need relief in April, May, or June there is a good chance the borrower won’t be needing it – although maturity defaults could still be an issue.) If that is the case, the expectation would be that the increases in the delinquency rate going forward should be smaller than what we saw in May and June.

Some other overall statistics:

The percentage of loans with the special servicer grew from 6.07% in June to 8.28% in May. According to June servicer data, 20.5% of all lodging loans were in special servicing, up from 16.2% in May. In addition, 14.3% of retail loans are with the special servicer, up from 9.3% in May. The percentage of loans on servicer watchlist in June was 20.9%.

To learn more about the data behind this article and what Trepp has to offer, visit www.trepp.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.