U.S. commercial real estate transaction activity during the coronavirus-blighted second quarter was far from the worst on record. However, the magnitude of the drop from the first quarter was unprecedented.

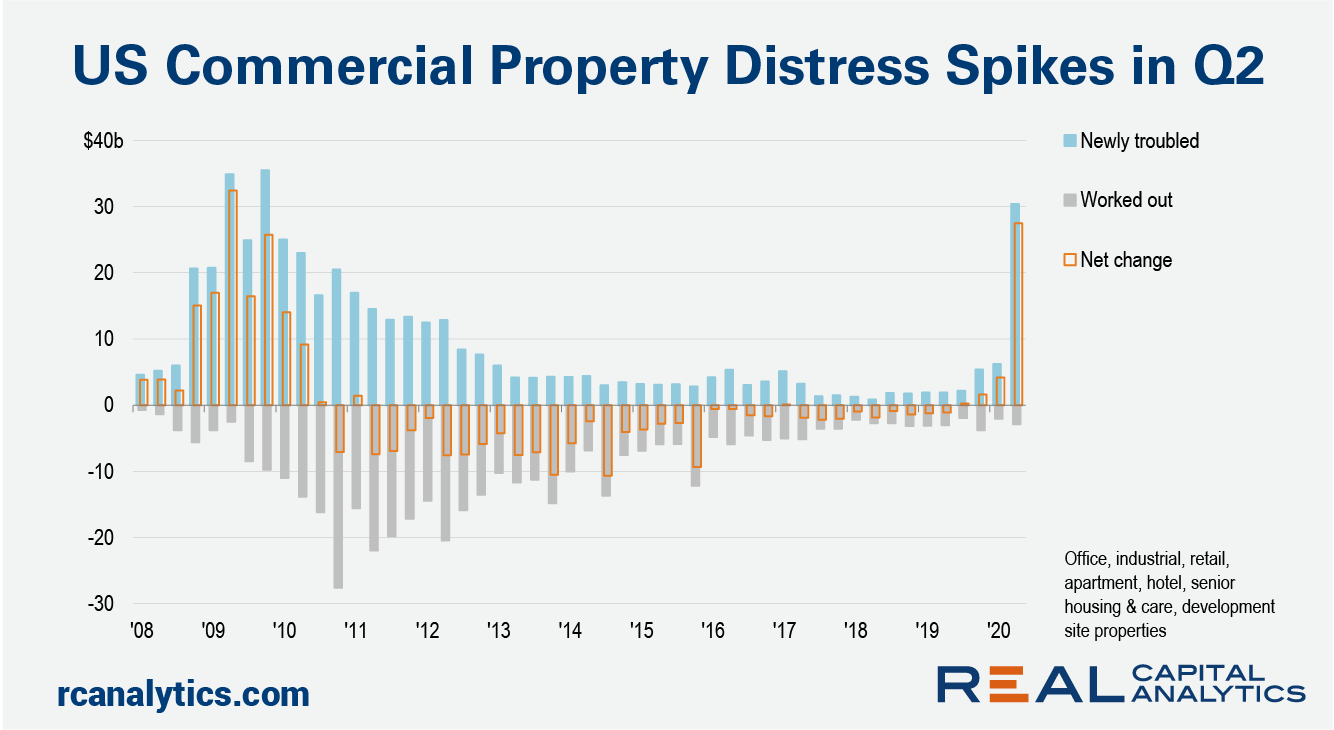

Evidence of distress is mounting, according to Real Capital Analytics data, though it’s clear that the pain from the Covid-19 crisis has not been experienced equally across all the property types.

At more than $30 billion, the quarter’s inflow of distress rivals that of the average quarter in 2009. The vast majority of the distress that appeared was related to retail and hotel properties. Together, retail and hotel assets accounted for over 90% of all distress during the second quarter. Industrial has been relatively unscathed, representing less than 1% of all new distress.

The level of potentially distressed assets stands at over three times that of outright distress, having leapt since March. Potential distress is more evenly distributed across the property types. Apartment assets accounted for more than 20% of potential distress in the quarter, while offices represented about 15%.

Despite the availability of dry powder, investors stuck to the sidelines in the second quarter, with deal volume totaling about one third of the level seen in the same quarter a year ago, preliminary RCA data shows.

The pause in transaction activity is in part due to potential buyers’ unwillingness to overpay. We are still in what we term the “shock & triage” phase of the cycle and likely will be for some time. It will not be until we start seeing forced sales and transaction volumes start to pick up that we will enter the “price discovery” phase. Until price discovery happens, investors will be wary.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.