The latest developments in international relations between Australia and China could result in a case of “what goes around comes around”, as Australia’s recent finger-wagging could return to haunt it.

Australia hopped onto the world stage when it demanded an investigation into China for the spread of the coronavirus, which has crippled the global economy and resulted in hundreds of thousands of deaths. More than just a foreign statement, the Aussies’ actions have led to a domino effect of worldwide critical rhetoric of the Asian giant.

In response, China has stabbed an economic estocada into its close neighbor by imposing tariffs on Australian barley, suspending its beef imports from major plants, and warning its citizens against traveling to the country. Despite this tough stance, LNG and iron ore flows remain stable – highlighting an economic decoupling is a tougher task than one may assume:

Tensions have ratcheted up in recent days, as hackers reportedly linked to China have stolen data from an Australian defense contractor – a move which could be the catalyst of a further breakdown in relations between the two countries.

A breakdown in trade would prove painful for both: The Asian giant accounts for nearly 40% of all Australian trade with its top 10 trade partners – which totaled some 214 billion Australian dollars in 2018. Additionally, about 41% of Australian exports in 2018 went to China, making Beijing its top economic partner and underscoring their interconnectedness.

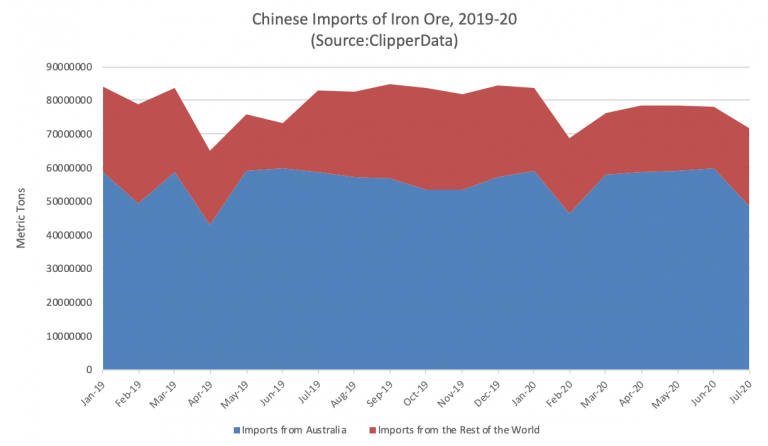

Australia is China’s main supplier of iron ore, a key commodity in Chinese manufacturing, accounting for 69% of total iron ore imports into China last year. Through the first half of this year, the import pace of Australian iron ore has averaged close to 57,000,000 metric tons per month. So far in July, Chinese imports of Australian iron ore are slightly below normal levels but could yet finish the month strongly.

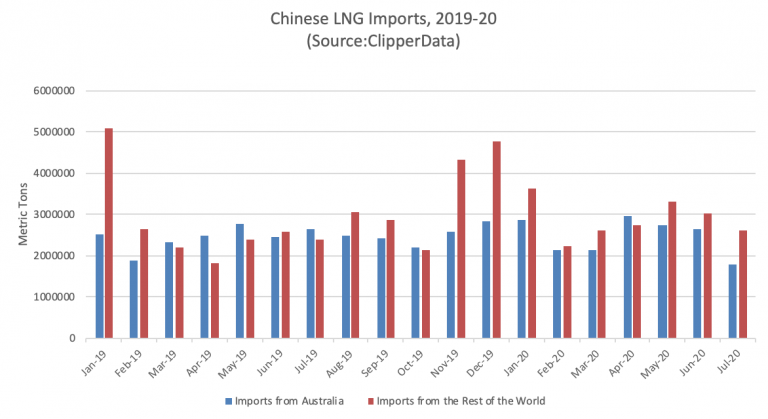

In terms of LNG, Australia accounts for almost a half of all Chinese LNG imports (as highlighted in the chart below). Despite deteriorating relations, a steady flow of LNG has continued between the two in recent months.

Iron ore and LNG flows between the two countries illustrate the conflict has not yet devolved to commodity disruptions. If it were though, it would likely hurt Australia more, as they would likely struggle to find new markets. In an oversupplied LNG market, China has plenty of alternative sources, while a weak global economy means steel demand is also on the wane. Given this backdrop, Australia should be careful what they throw at China, as it may boomerang back to hurt them.

To learn more about the data behind this article and what ClipperData has to offer, visit https://clipperdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.