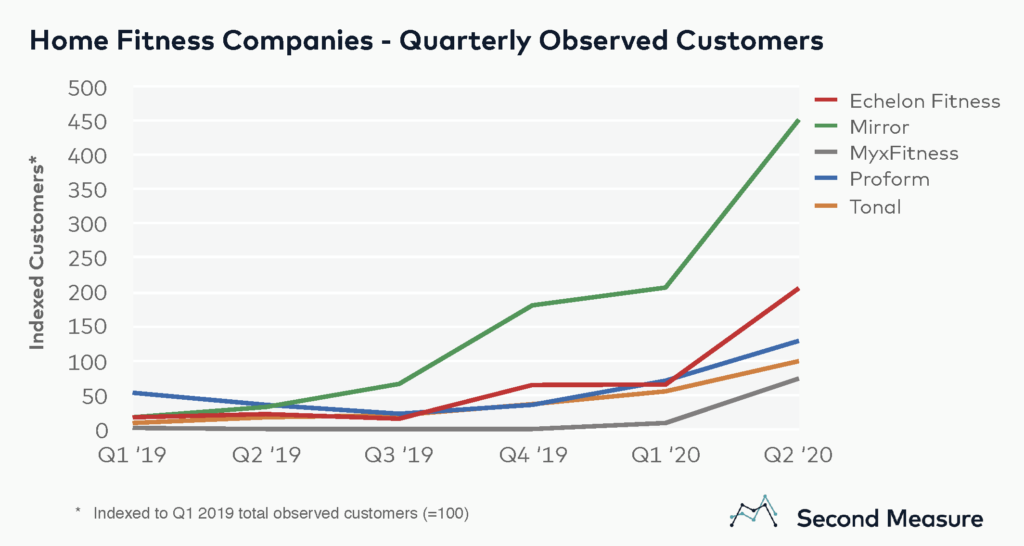

The home fitness industry is growing rapidly, with several companies now offering interactive fitness hardware with subscription access to classes, private training, or workouts. High-tech at-home workouts have been increasing in popularity, and among select private companies in this space, recent growth has been impressive. Our data indicates that Q2 2020 saw nearly 780 percent more consumers purchasing versus Q2 2019. Not all of this growth is due to the pandemic. The trend appeared to take off in Q4 2019 when growth was up 180 percent year-over-year.

The fashion retailer Lululemon (LULU) has taken notice and recently announced its acquisition of Mirror, an emerging leader in this space. Relative to its private competitors, Mirror added more customers in Q2 and, most recently, was up approximately 13X year-over-year.

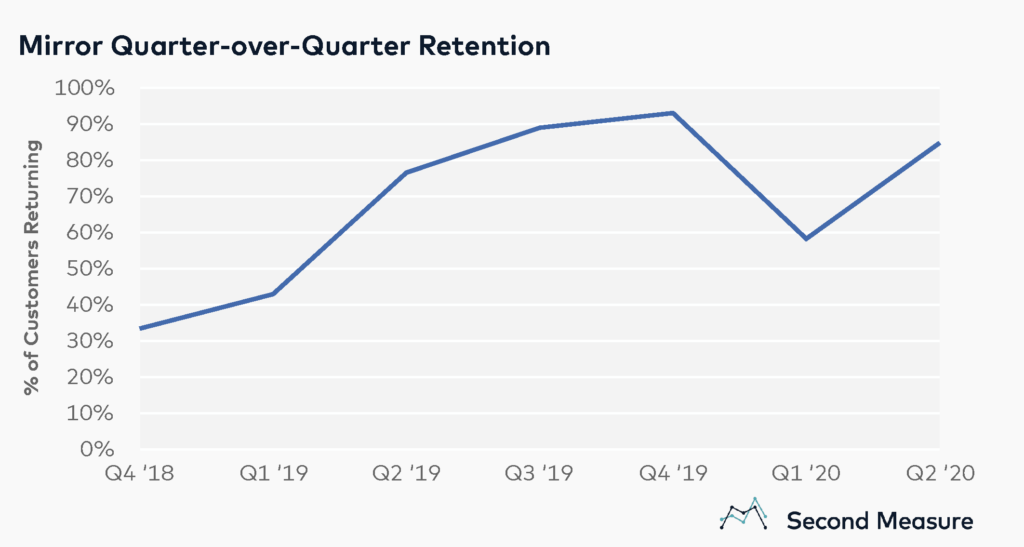

Strong retention reflects well on Mirror

At least one reason for Mirror’s success is its ability to retain consumers. In the past year, quarter-over-quarter retention has been as high as 93 percent, meaning that almost all of the consumers who purchased in Q3 2019 purchased again in Q4 2019. After purchasing its fitness hardware, Mirror customers generally pay a monthly subscription fee to access content on the device. Due to promotions during the 2019 holiday season, it is likely that Q1 2020 retention is artificially deflated because the monthly subscription fee was waived for an initial period.

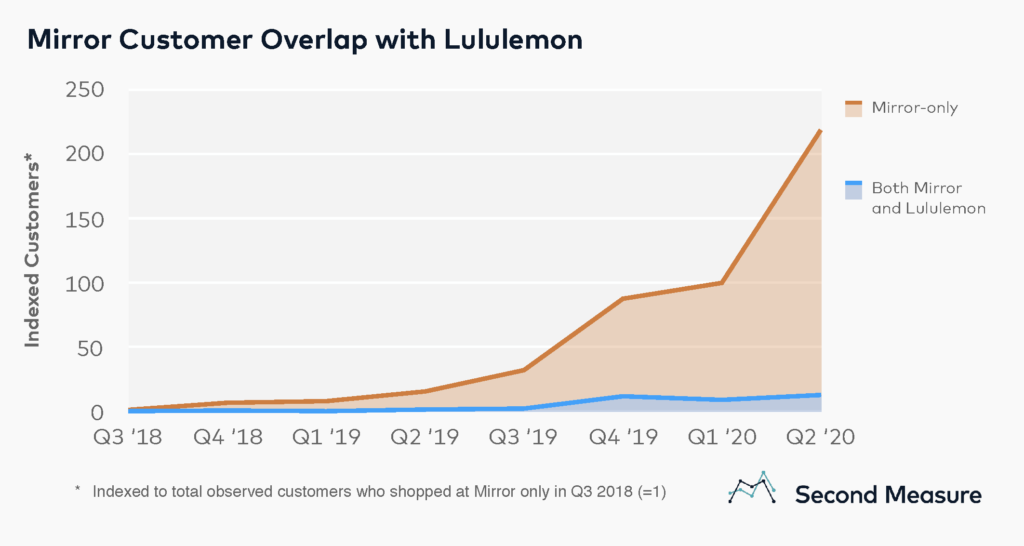

Did LULU re-acquire its own customers?

Although Mirror may be a strong standalone business, LULU likely saw potential to reach Mirror customers, as well. But are these consumers already LULU customers? We examined the cross-shopping behavior of Mirror customers to see what fraction also transacted with Lululemon in the same time period. In Q2 2020, only 6 percent of Mirror customers also purchased from LULU. Even during the holiday season—the period when most consumers shop at LULU—a mere 16 percent of Mirror customers also purchased from LULU.

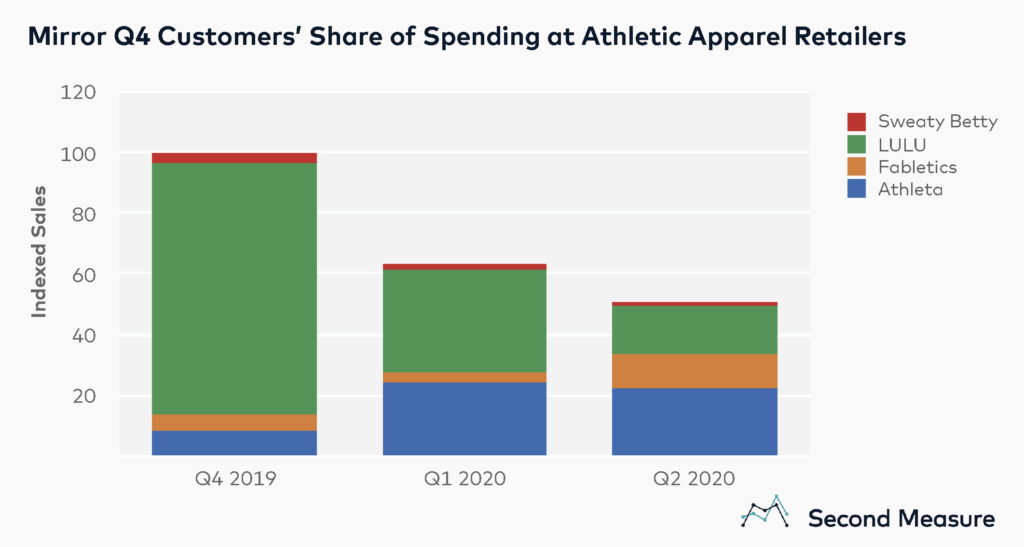

At which athletic apparel companies are Mirror customers shopping?

Further analysis reveals how Q4 2019 Mirror customers spent their dollars at Lululemon and other similar fashion retailers. During the holiday season, Mirror customers spent more of their money at Lululemon than at other major athletic apparel retailers. This may be surprising given the small percentage of Mirror customers shopping there, but is consistent with what our data indicates about overall market share.

We followed Mirror Q4 customers over time and observed their spending during Q1 and Q2 of 2020. Overall, their spending at these retailers dropped 37 percent quarter-over-quarter in Q1 and a further 20 percent QoQ in Q2. The main reason for the overall decline is that consumers are spending relatively less at LULU in 2020. Other companies, like Athleta, have actually seen their sales increase among Mirror Q4 ‘19 shoppers. In fact, relative market share has shifted to such an extent that during Q2 ‘20, LULU lost its position as the market leader among this set of Mirror customers. With the acquisition, LULU has gained an interesting channel to re-engage this set of consumers and potentially win back market share.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.