Manufacturing executives are reimagining how to conduct business in a world where COVID-19 impacts the health of employees and supply chains.

Different industries have been affected to varying degrees: Commercial aerospace companies experienced great losses as commercial flights weren’t taking off and factory production slowed down, while other industries, such as defense markets, carried on rather unharmed.

How are manufacturers transitioning into the ‘next normal’ and how is that impacting advertising spend?

Manufacturing is looking ‘better than expected’

In May, manufacturing was one of the first industries to start reopening.

There were many unresolved issues surrounding employees, supply chains, and bringing back operations. Some companies felt that their markets would be destroyed without outside assistance.

Some experienced more bumps than others. For example, it only took two days before a reopened Ford factory reclosed its doors.

Now, the tone is lifting. More than half of manufacturers reported that business was ‘better than expected’ in June. The ISM Manufacturing index backs those sentiments up. The index recorded a 52.6 reading last month, after economists had predicted a 49.5.

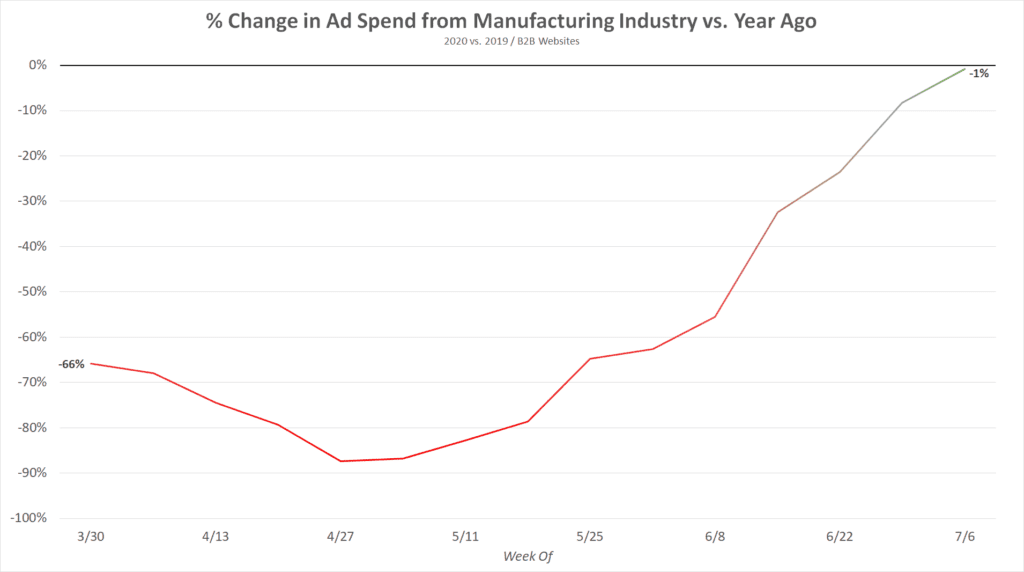

The advertising data reflects this positive performance.

By the beginning of July, manufacturing ad spend across B2B websites returned to levels consistent with last year. During the week starting July 6th, over fourty different manufacturing companies were running digital ad campaigns on B2B websites.

Potential Risks to Manufacturing

Despite performing ‘better than expected,’ business leaders say that the pandemic has exposed a flaw in U.S. manufacturing—supply chains are too dependent on foreign companies. In a recent study from Fictiv, 83% of respondents said COVID-19 has “been an extreme test of their supply chain.”

While it will not be easy, Nikki Haley and Bill Simon argue that it is possible to bring manufacturing jobs back to the U.S. and is already being done.

For example, in June, U.S. factory output increased more than it has in seventy four-years and there have been overall increases in production for two straight months. This growth was largely driven by motor vehicle production. However, auto factories are now seeing more infections among employees and employees are missing work.

The new surge in coronavirus cases is a threat to the gains factories made in May and June. Until a vaccine or treatment is created, it will continue to be a challenge for businesses that require on-site employees to build products at full-capacity.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.