The United States faces a possible foreclosure surge over the coming months that could more than double the number of households threatened with eviction for not paying their mortgages – an offshoot of the worldwide Coronavirus pandemic that has cast a shadow over the nation’s eight-year housing market boom.

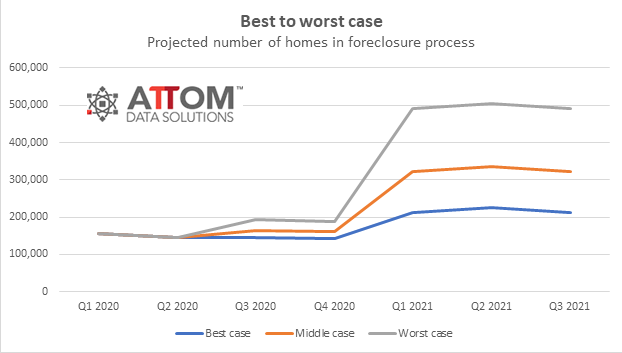

Amid projections that high unemployment connected to the pandemic will worsen, an analysis by ATTOM Data Solutions shows that anywhere from about 225,000 to 500,000 homeowners across the country could face possible foreclosure throughout the rest of 2021 because of delinquent loan payments.

In the most likely scenario, the number of cases somewhere in the foreclosure process would shoot up more than 100 percent, from the current level of about 145,000 to roughly 336,000 in the second quarter of 2021.

Should foreclosures spike, the analysis projects that the increase will likely hit hardest at the high-end of the market, concentrated in the West, which currently has the smallest levels of foreclosures in the nation. States projected to see the biggest jumps in foreclosure activity include California, Colorado and Massachusetts. All have median home prices topping $300,000.

Projections in the analysis range from best- to middle- to worst-case scenarios based on unemployment forecasts, different numbers of households that can withstand a job loss and various percentages of delinquent loans that lenders pursue in court.

A foreclosure surge would add another element of uncertainty to a housing market already looking at trouble in the form of prices leveling off after eight years of almost unceasing increases. Data collected by ATTOM in May showed home values flat or beginning to drop in about half the country, with the biggest impact in the West.

The ominous projections are far from a guarantee and, even if they come true, envision less severe damage than what happened during the foreclosure wave that hit during and after the Great Recession of the late 2000s.

The current potential surge could get delayed or tempered if Congress continues a moratorium on most residential foreclosures or subsidizes homeowners who have fallen behind on their mortgages. The moratorium, which affects federally insured home loans, is set to expire August 31, 2020 and Congress is locked over how much more support the government should provide to financially stressed households. A $2.2 trillion package of aid to businesses, unemployed workers and others largely runs out at the end of July.

Even if the worst predictions pan out, the impact would be milder than when 600,000 to 950,000 homes faced possible foreclosure from 2008 through late 2011.

Still, if the foreclosure ban ends on schedule without major aid to struggling homeowners, the analysis projects that at least 225,000 properties next Spring will sit somewhere between initial foreclosure notice and final resale by lenders that have taken over properties. The number rises to 505,000 in the worst-case scenario developed in the analysis.

The mid-level, or more likely outlook, projects that foreclosure activity will hit 336,000 homes in the second quarter of 2021, with numbers increasing in almost all 50 states and at least doubling in 34.

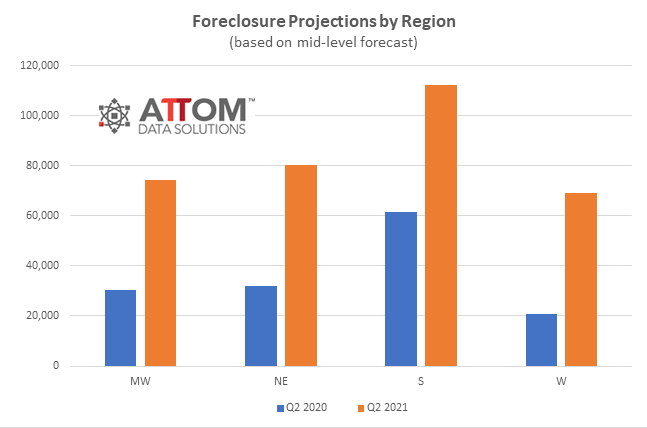

By region, the mid-level forecast shows foreclosure filings shooting up more than three-fold in the West and by more than double in the Northeast and Midwest from the second quarter of 2020 to the second quarter of 2021. They would increase about 80 percent in the South.

Topping the list of states with the biggest projected percentage increase are 14 states where filings would at least triple. They include Colorado, where the number would spike from 1,107 to 5,103, or 361 percent, Massachusetts, where it would rise from 2,512 to 11,228, or 347 percent, and California, where it would jump from 10,566 to 39,793, or 277 percent. Foreclosure filings would rise 288 percent in Michigan from 3,284 to 12,740 and 287 percent in Minnesota, from 1,056 to 4,091.

States likely to escape with the least damage in a mid-range scenario include Kentucky, which would see its count stay at 1,358, Maryland, where the number would go up 48 percent, from 5,034 to 7,455, and New Mexico, where it would rise 49 percent, from 1,129 to 1,685. The tally would increase 52 percent in Oklahoma, from 1,941 to 2,945, and 65 percent in Florida, from 19,034 to 31,494.

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.