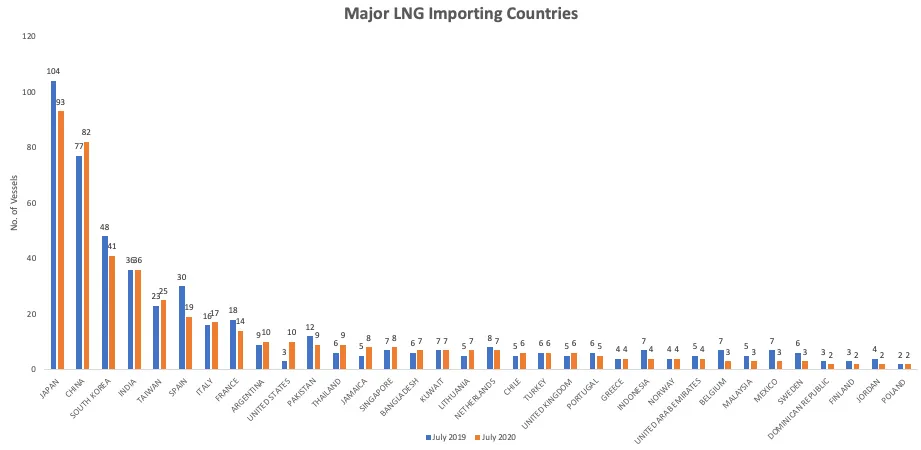

Global exports of liquefied natural gas in July totaled approximately 28.7 million tons on board 474 vessels, much lower than July 2019’s pace of 31.7 million tons, with a reduction of loading from the US & Pacific regions. Approximately 27.6 million tons arrived on 471 vessels at import terminals in July, compared to 30.8 million tons in July 2019.

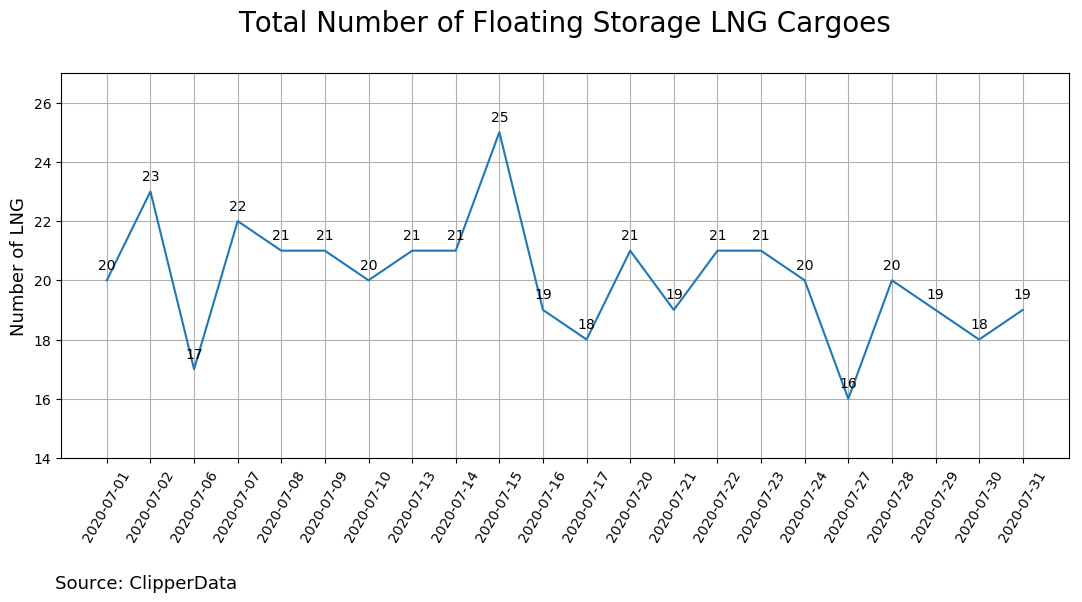

The number of floating LNG cargoes remained steady for most of the month, with the highest number of vessels occurring on July 15 at 25.

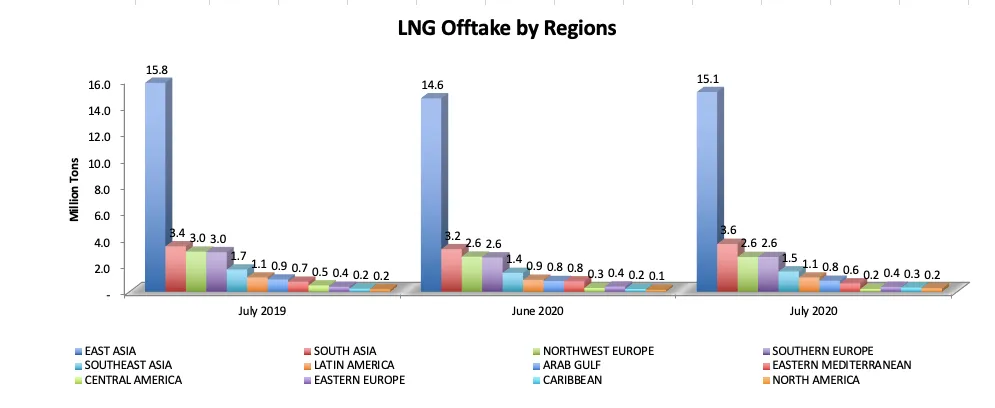

East Asia took in 15.1 million tons of LNG in July 2020, lower than the 15.8 million tons taken in during July 2019. For South Asia, the 3.6 million tons imported in July represented a 5 percent increase from year-ago levels.

Chinese LNG imports remained strong with 5.1 million tons received on 77 vessels in July 2020, higher than July 2019 imports of 4.7 million tons, while Japanese imports slide from 6.4 million tons in July 2019 to 5.6 million tons in July 2020.

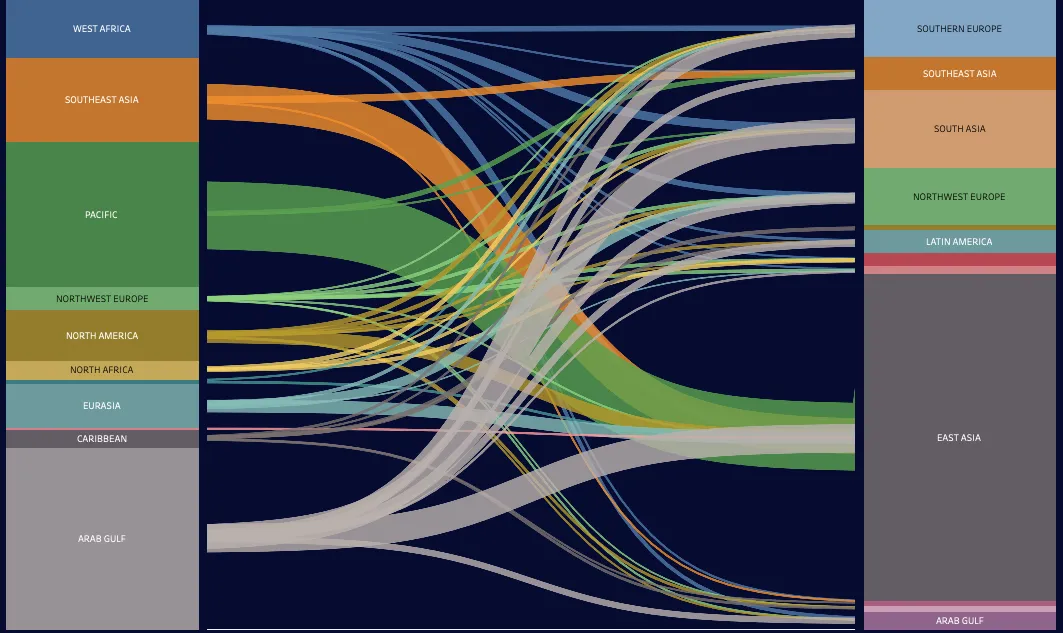

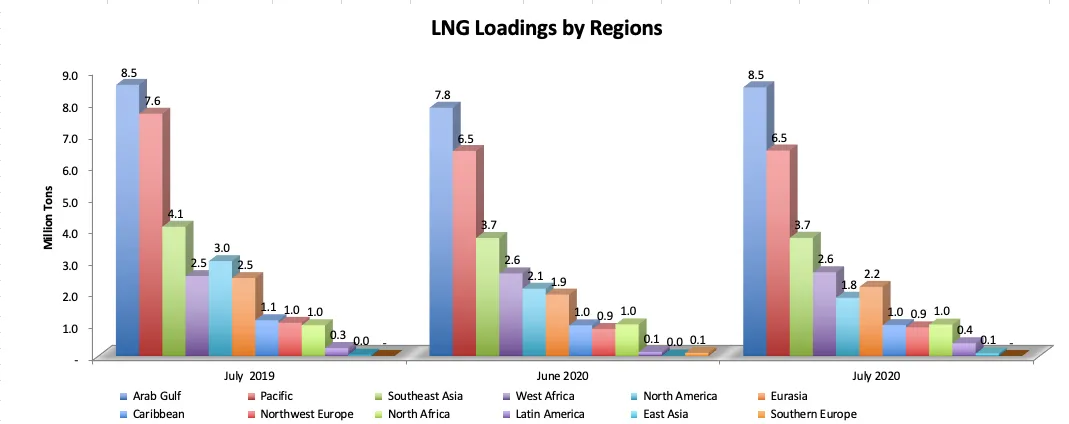

The Asia-Pacific region exported about 6.5 million tons of LNG in July, approximately 0.9 million tons less than in July 2019 and on par with June 2020 levels – primarily due to lower loadings from the Gorgon LNG and Prelude FLNG facilities. Exports from the Arab Gulf came in at 8.5 million tons, higher than June’s total of 7.8 million tons.

North America exports in June continued to be subdued with a 39% drop on a year-on-year basis to 1.8 million tons, and approximately 0.3 million tons lower than in the month prior. Northern Russia loaded 1.4 million tons in July, up by 0.1 million tons from June 2020 and 0.1 million tons lower than the volume loaded in July 2019.

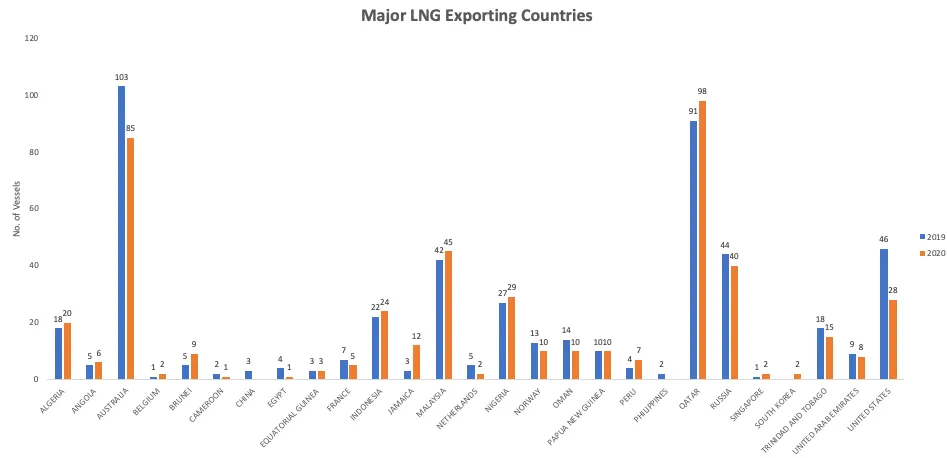

LNG exports were lower last month from Australia, United States & Norway, while exports from the Arab Gulf & West Africa remained normal.

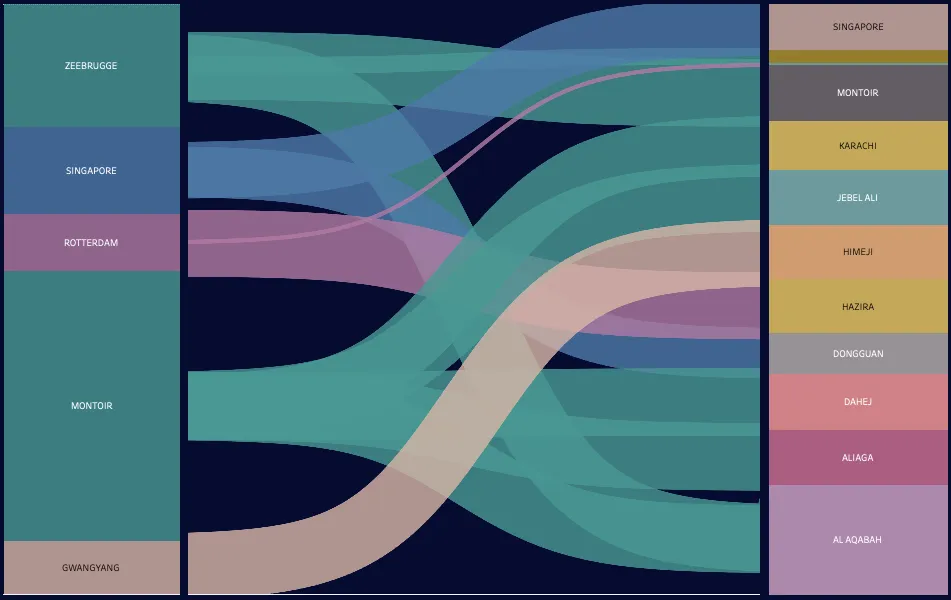

The European reloading arbitrage window for NE Asia remained closed throughout July 2020, with 11 out of 15 reloaded cargoes leaving from European terminals. European reloads discharged in SW Europe, the Mediterranean & South Asia.

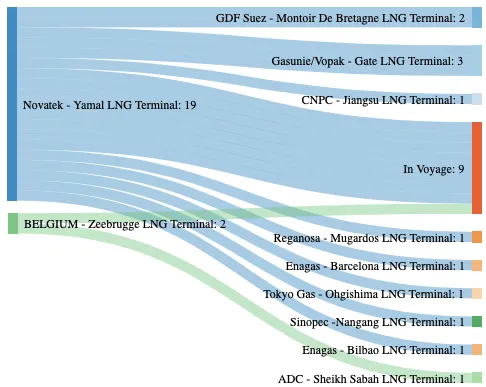

During July 2020, 19 vessels left from the Yamal LNG project in Northern Russia, with three vessels each arriving at the Netherlands and Spain, two in France and China, and one in Japan. Eight vessels are in still on the water.

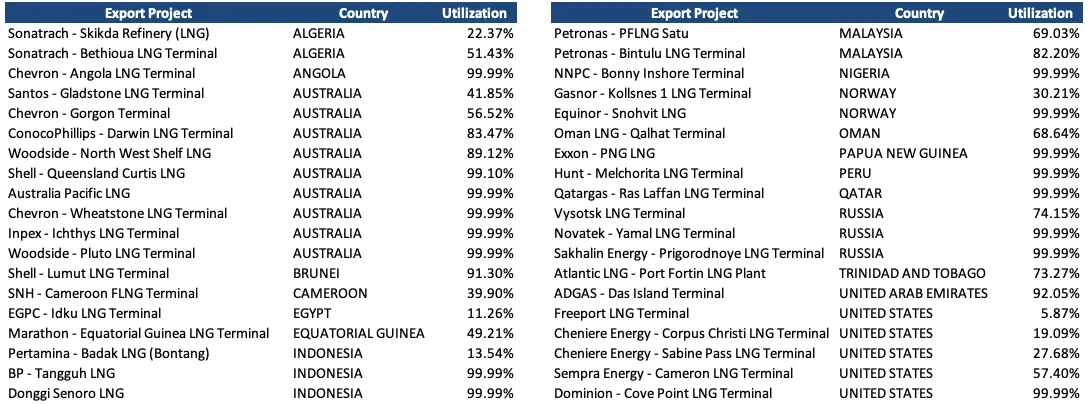

LNG export terminal utilization based upon ClipperData shipping tracking is listed below:

To learn more about the data behind this article and what ClipperData has to offer, visit https://clipperdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.