With Walmart and Target among some of the brands announcing that they won’t be opening this Thanksgiving, a lot of attention is going to focus on Black Friday’s ability to make up the difference.

So, is Black Friday still as critical as we think? And how might traffic patterns change if more retailers close on the day before?

Black Friday 2019 Reinforced the Value

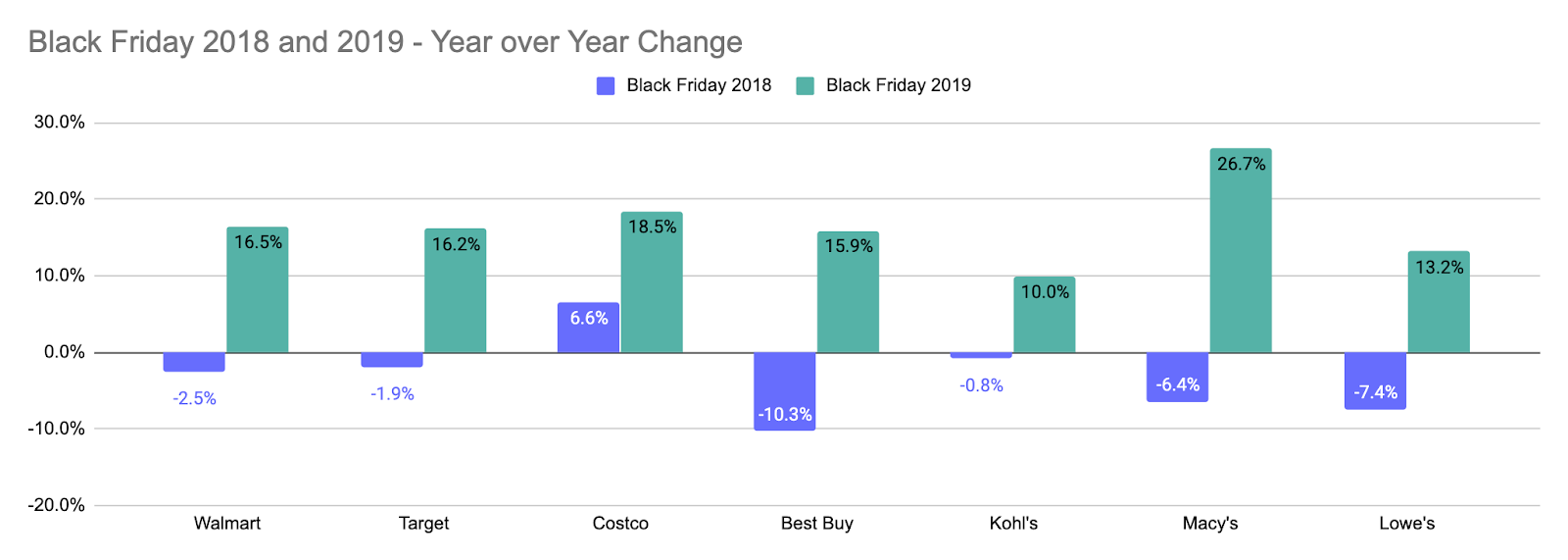

Looking at several top brands, it’s clear that Black Friday 2019 drove a bounceback for some of retail’s top brands. Some of this certainly centered around Black Friday 2019 appearing later in the month, and thus shrinking the overall holiday shopping period while creating urgency. Yet, it also speaks to the day’s unique ability to drive traffic. For all of the brands analyzed, Black Friday was one of the top-performing days annually each year from 2017 to 2019.

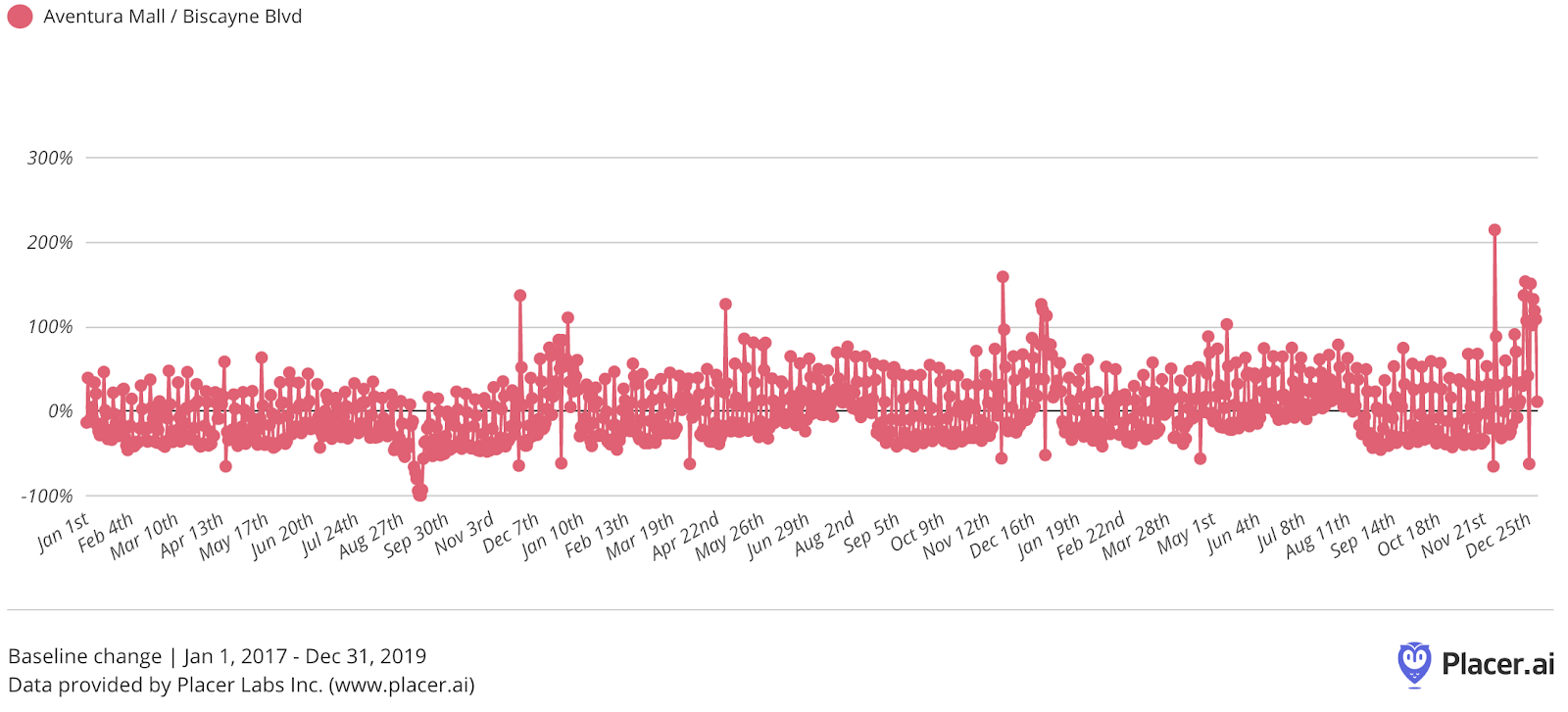

And Black Friday clearly ranked as among the most important days for top shopping centers as well. For Aventura Mall in Florida, Black Friday was the highest day for overall visits in 2017, 2018, and 2019.

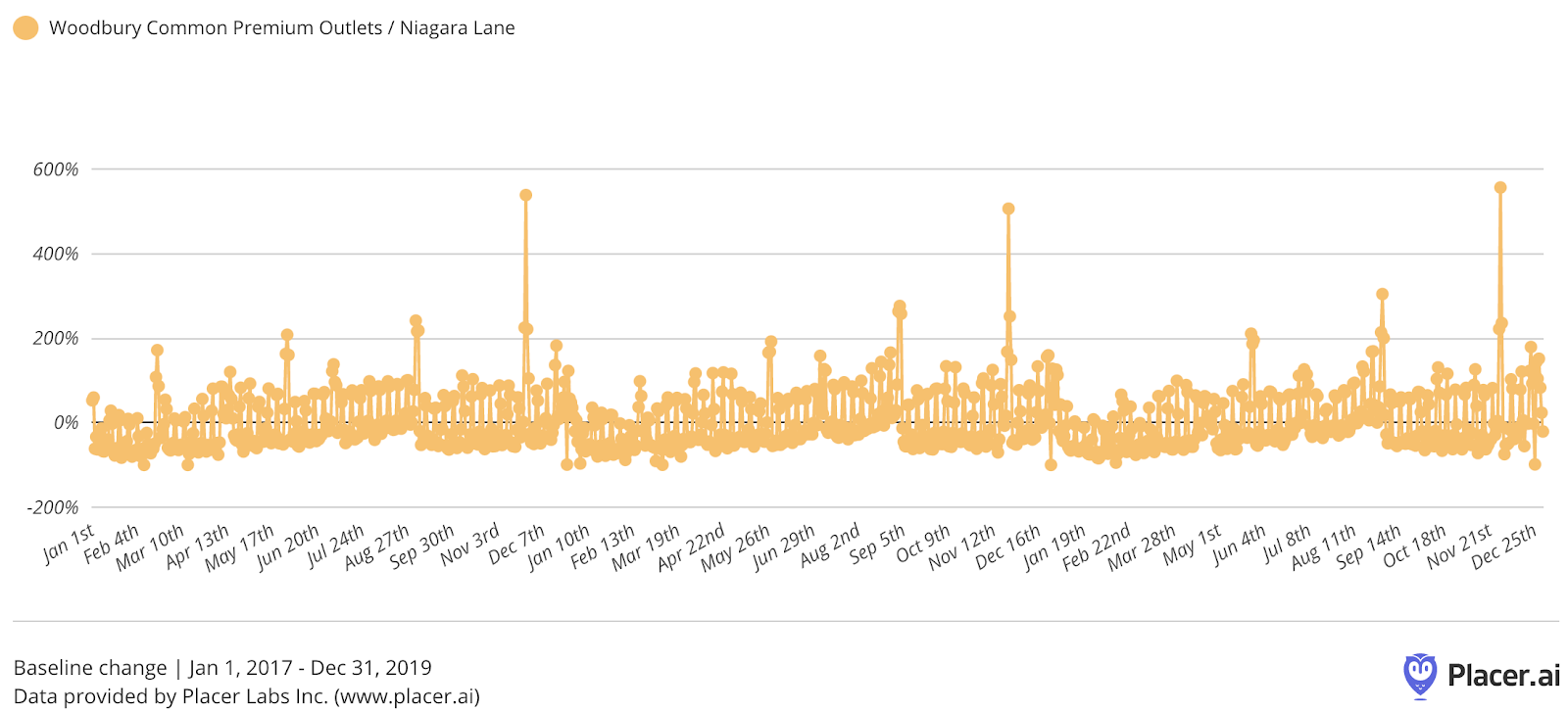

And the same held true for Woodbury Common in NY, one of the top outdoor centers in the country. Black Friday was by far biggest day for visits in 2017, 2018, and 2019.

Disaster Without the Full Black Friday Period?

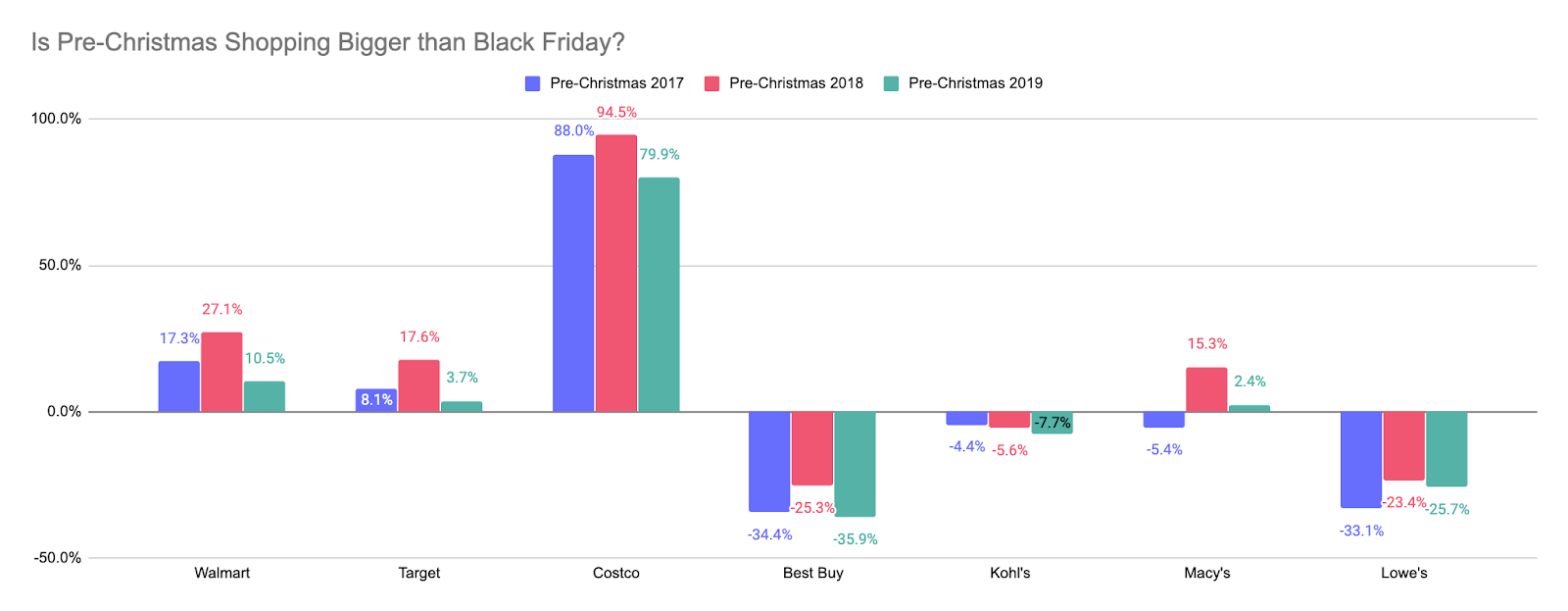

However, not all brands are as impacted by Black Friday and the late November holiday surge. For example, while six of Best Buy’s top ten days from 2017 through 2019 were in late November, only three of Target’s were and only two of Walmart’s. And comparing the three most trafficked days in December, December 21st through 23rd, to the annual period that includes Thanksgiving, Black Friday, and the Saturday immediately after, the late December period is more substantial for many brands.

And the difference looks to center around the types of products on offer. Food oriented brands like Costco see a dramatically more significant period pre-Christmas, while brands oriented towards classic Black Friday shopping like Best Buy, Lowe’s, or Kohl’s see a shift towards Black Friday. Interestingly, Target and Walmart, two of the brands forsaking Thanksgiving in 2020, consistently see more traffic pre-Christmas.

And even the shopping centers analyzed are less dependent on Thanksgiving, with the day bringing in significant visits in some cases and very low levels in others.

The Result?

Losing Thanksgiving matters, because the day does drive a lot of visits to retailers across the country. But, it should not be too overstated especially for Walmart and Target, the two biggest names to announce they won’t be opening that Thursday. Both brands see more traffic in the three day period pre-Christmas than they do in the three day period on Black Friday weekend. Additionally, both are already taking active steps to use the closure to drive traffic during other days.

So will a lack of Thanksgiving visits hurt some brands? Probably. Do many have strong channels to compensate? Yes. But it could put Black Friday numbers into even greater focus in 2020.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.