Earnings Insights Q2 2020: ZI, VRM, HFG, ANGI, LYFT

Now that most US megacorps have reported their earnings for 2Q, we turn our attention and focus to two of this year’s hottest IPOs and one of the most interesting European companies that are reporting earnings this week.

While we often focus on American companies, given their market size, our data goes far beyond the borders of the North American continent, and earnings season is a great time to take a look at our friends across the pond.

This week, we’re focusing on ZoomInfo, Vroom, HelloFresh, ANGI Homeservices, and Lyft. All the data mentioned below is desktop data.

ZoomInfo

ZoomInfo, one of this year’s hottest IPOs, continues to show strong digital growth.

- Worldwide visits to ZoomInfo.com grew 26.5% YOY in 2Q. The month of June was the first month ever in which Zoominfo.com crossed 5 million visits.

- The number of MUVs to login.zoominfo.com is growing even faster than visits to the website. For the month of June, MUVs increased by 49.1% YOY.

- ZoomInfo’s traffic distribution in 2Q was dominated by its top 5 markets: the US (76.6% of traffic), India (5.16%), the UK (4.71%), Canada (4.12%), and the Philippines (1.29%).

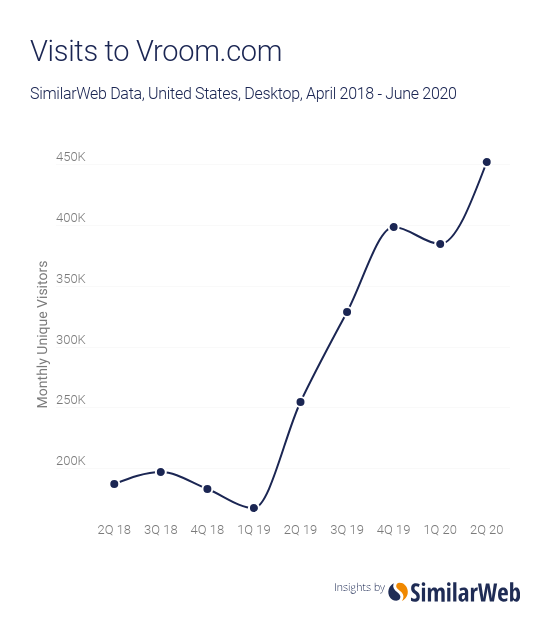

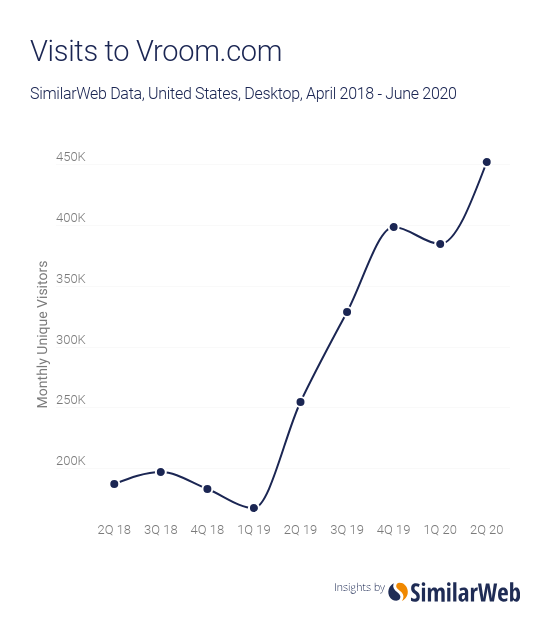

Vroom

Vroom’s growth in 2Q is evident throughout the funnel; from visits to its homepage to visits to its members’ area.

- US visits to Vroom.com grew 77.6% YOY in 2Q, as a weaker April (16.2% YOY growth) was made up for by an explosive month of June (169.6% YOY growth in visits).

- 74.5% of the visits to Vroom.com included a visit to Vroom.com/catalog, where users can search for cars to purchase, indicating that roughly three-quarters of the websites visitors are potential car buyers.

- Throughout the quarter, about 6% of the visits to Vroom.com included a visit to a URL which includes the string /my-account/, another strong indication of intent. The proportion of visits which included a /my-account/ URL was larger in June, as 7.2% of visits included a /my-account/ URL string, despite the higher volume of visits. This indicates that Vroom is successfully moving prospects down the funnel.

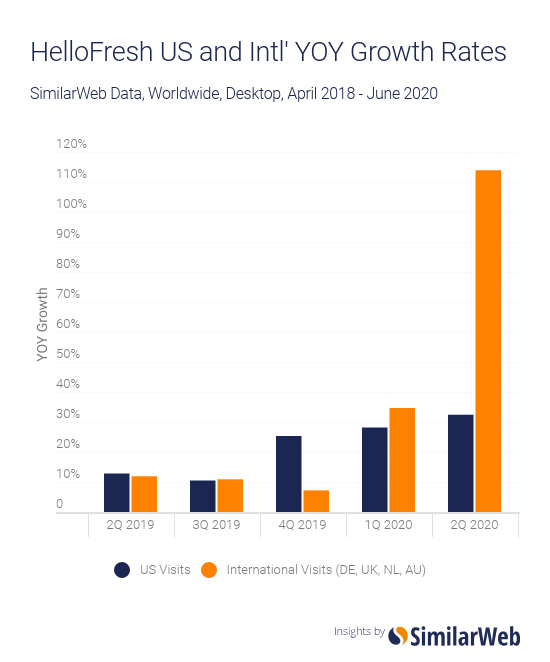

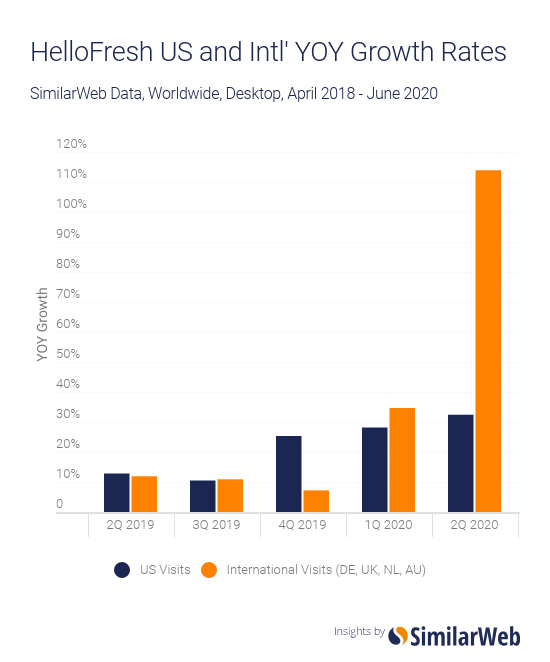

HelloFresh

HelloFresh, the European meal kit service has enjoyed particularly strong international growth in 2Q, all while shifting from paid user acquisition to organic user acquisition.

- US Visits to hellofresh.com rose 32.4% YOY in 2Q, marking its strongest quarter of growth in the past 5 quarters.

- Visits to HelloFresh’s top 4 international websites (Germany, United Kingdom, Netherlands, and Australia) increased 113.9% YOY in 2Q, a growth rate three times as strong as the strongest growth rate in the past 5 quarters.

- In 2Q 2019, HelloFresh’s traffic mix was 15.3% and 5.9% referrals. These figures dropped to 5.5% and 1.7% respectively, while the share of direct traffic and organic search traffic rose from 42.9% and 20.4% to 55.1% and 26.3% respectively. HelloFresh isn’t just growing; it’s growing organically.

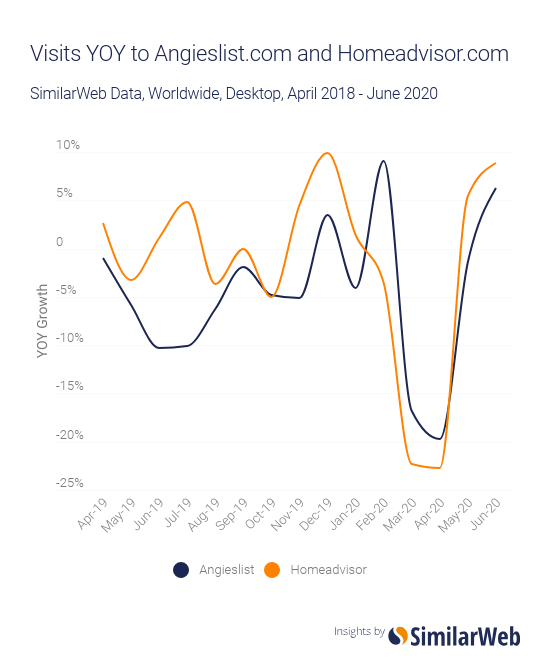

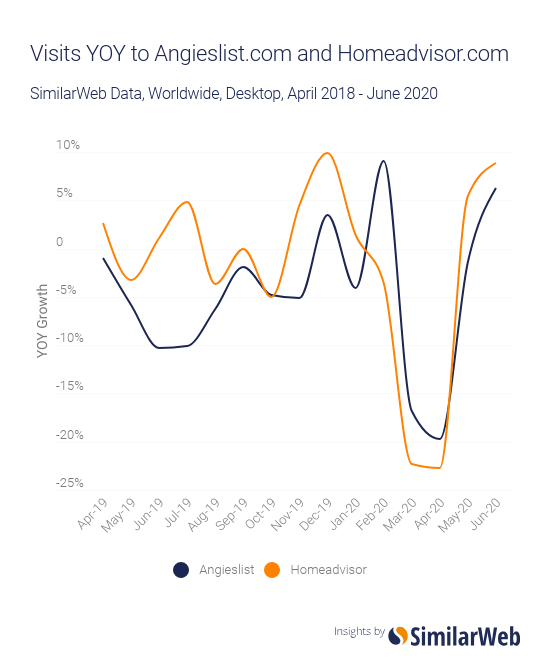

Angie’s List

Despite 2Q’s status as the strongest quarter for the home improvement industry, ANGI Homeservices’ online properties (Angie’s List and Home Advisor) struggled in 2Q due to a weak month of April.

- Worldwide visits to angieslist.com and homeadvisor.com, the group’s two biggest online properties, were down 4.9% and 2.7% YOY respectively in 2Q. However, both websites grew YOY in June, by 6.2 and 8.8%, respectively.

- Monthly Unique Visitors (MUVs) to PRO.Homeadvisor.com, where professionals sign up to the platform, is down 8.8% YOY in 2Q, signaling weaker supply in addition to a drop in demand

- MUVs to member.angieslist.com logged a 29.7% decline YOY in 2Q. However, in June, MUVs were down only 13.9%, indicating that demand did pick up throughout the quarter.

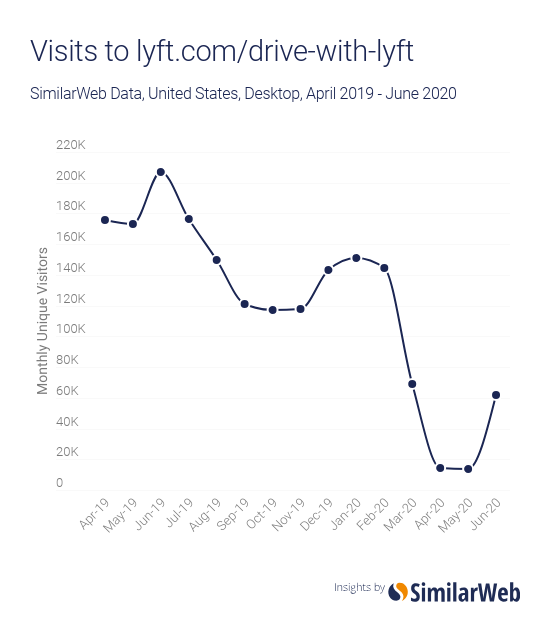

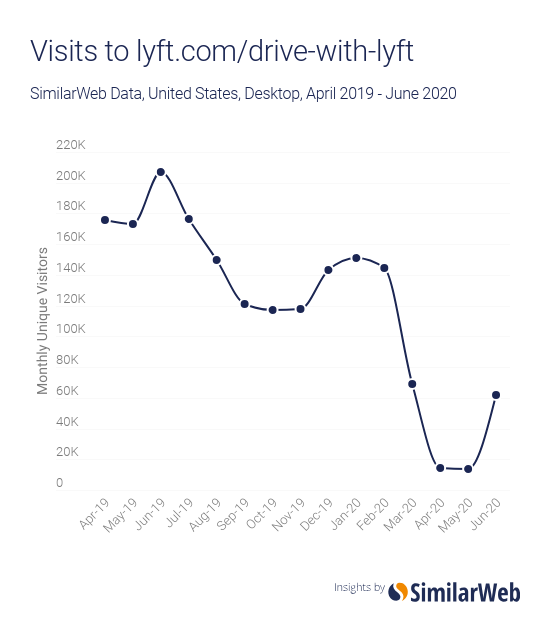

Lyft

Activity on Lyft’s websites has ground to a halt in 2Q, as the pandemic disrupted our usual transportation habits.

- Worldwide visits to account.lyft.com fell 74.6% YOY in 2Q and 66.7% QOQ, as less riding activity is manifested in fewer visits to the account management and sign-in subdomain.

- New driver sign-ups have also slowed down considerably, with US visits to URLs including /drive-with-lyft/ dropped 83.8% YOY in 2Q and 75.3% QOQ.

- US visits to lyftbusiness.com, the company’s website for corporate customers, fared a bit better than its other online properties, falling only 42.4% YOY in 2Q

.

.

To learn more about the data behind this article and what

Similarweb has to offer,

visit https://www.similarweb.com/.

.

.