Time moves differently during a Pandemic. The news is constant, cramming what would have been a week’s worth of content into a single day. But at the same time, here we are in August. Time both crawls and runs in the era of COVID.

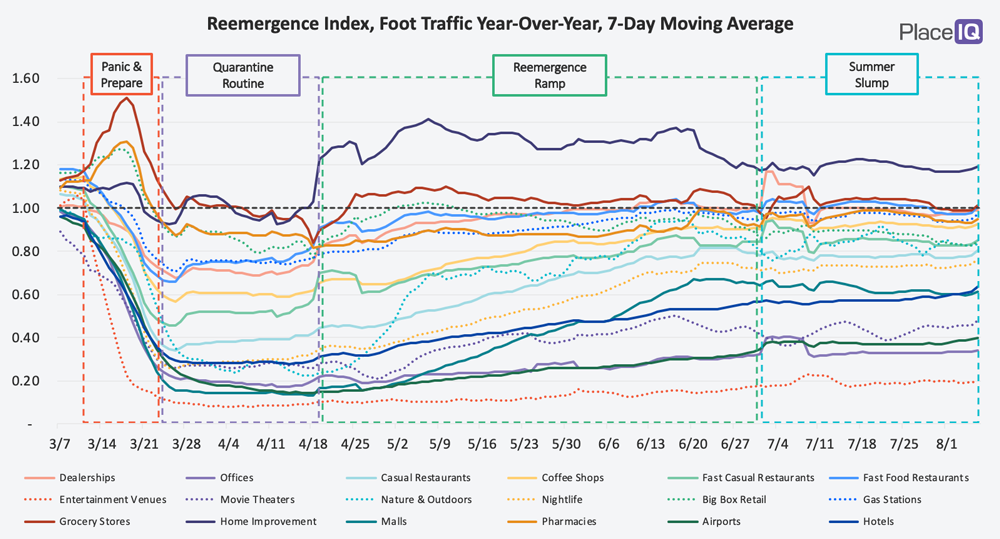

Reviewing this week’s foot traffic category indices, we were similarly struck by how long the Summer Slump has persisted. Here we are, in August, still in the thick of sustained, flat traffic:

The Summer Slump is now our second longest phase, right behind the Reemergence Ramp. And given we’re only now cresting the curve in many recent virus hot spots, we expect the duration of the Summer Slump to match the Ramp soon enough. Looking back, it may have been optimistic to name a phase after a single season. But let’s knock on wood and do our best to set ourselves up for progress before Autumn.

This week we’ll be taking a closer look at dining. Working together with our partners at LoopMe, we conducted a survey to better understand the motivations shaping foot traffic in the restaurant sector.

New Considerations and the Persistence of Pizza

Viewing the world through the lens of mobile movement data allows us to observe shifts in behavior in real time. As we’ve dug into dining these past few weeks we’ve seen some significant changes, including the absence of breakfast traffic due to a lack of commutes and fast casual restaurants adapting their businesses to subsist almost entirely on take-out.

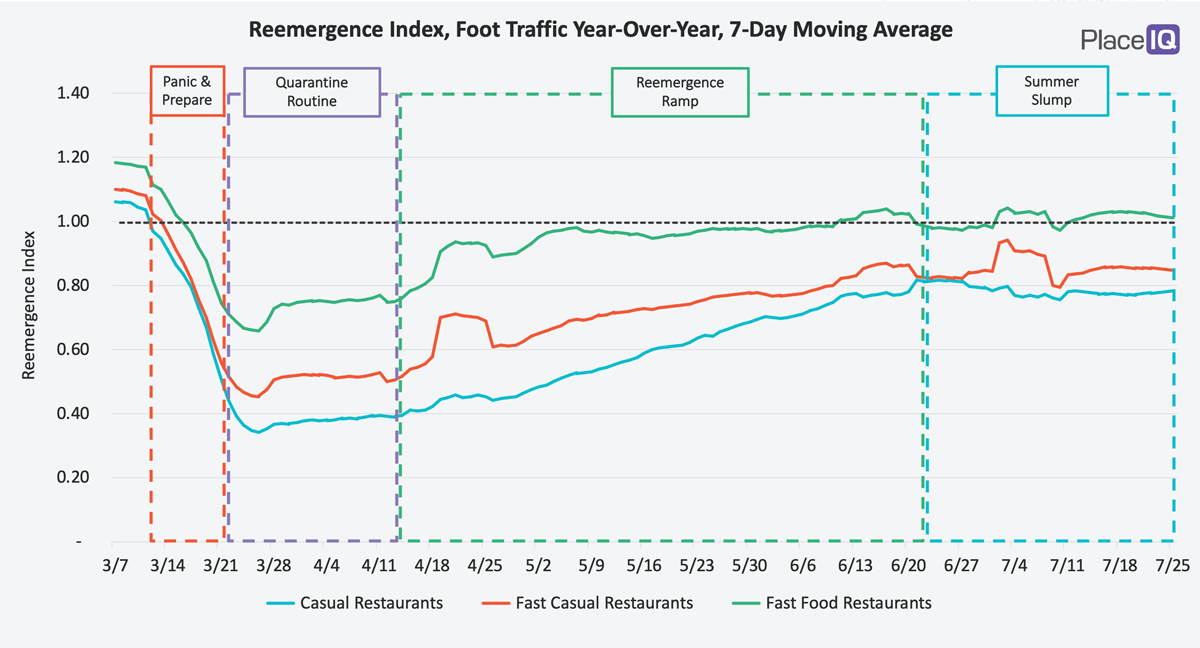

But some observations require us to go beyond the foot traffic data we have on hand. For example, take the relative strength of fast food restaurants over the last 3 months:

Fast food was the first business to break out (aside from the Quarantine Routine core of grocery stores, big box retailers, and pharmacies) as we began to venture outside. Anecdotal evidence and conversations with industry leaders supported our belief that fast food was thriving (relatively) because their existing low-touch infrastructure (the drive-through) made them the perceived safest option available to bored and weary customers looking for an excuse to leave the house and a break from doing dishes.

But what we couldn’t know for sure was how important perceived safety is to fast food customers. Were customers visiting fast food restaurants because they seemed the most safe or because they were the only open option in town?

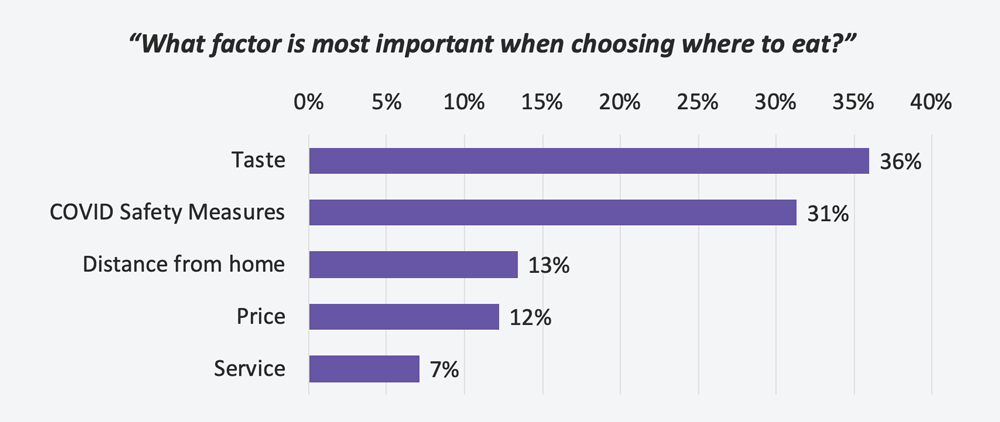

Recently, we worked with LoopMe to survey a couple thousand people to find out. The results were quite stark: restaurant safety measures are now the 2nd most cited factor, behind taste, when choosing where to eat:

Nearly a third of all respondents said COVID safety measures were the most important factor when choosing where to eat. Practically overnight, a new requirement has been forced onto an entire industry. But like anything else, every challenge is an opportunity: those restaurants who can check this box will reliably win.

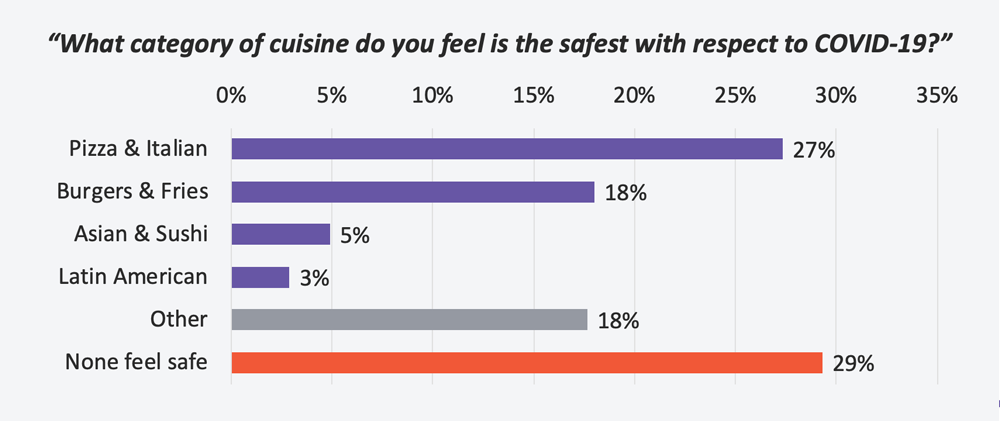

To see this in action, we probed further and asked, “what category of cuisine do you feel is the safest with respect to COVID-19?”

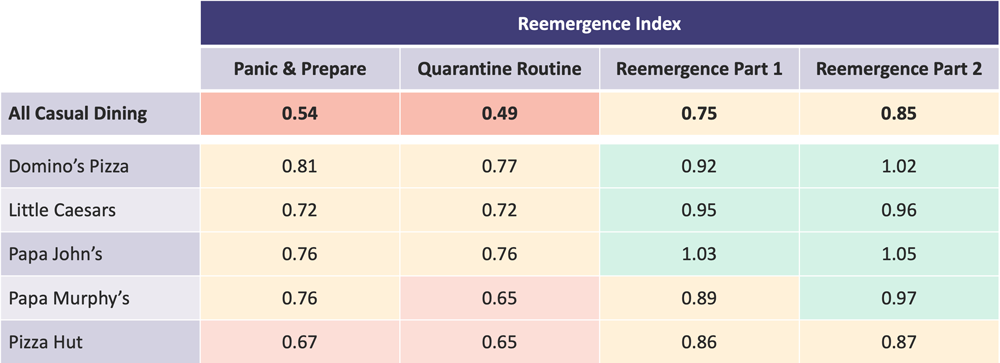

More than a quarter of the time, pizza is cited as the safest cuisine among the options above. If perceived safety was truly driving fast food’s resurgence, we’d expect to see a similar resilience among pizza restaurants. Which we clearly do:

Pizza chains (specifically Domino’s, Little Caesars, Papa John’s, Papa Murphy’s, and Pizza Hut) fell less and recovered much quicker than the rest of the restaurant industry. By the first half of the Reemergence Ramp, 3 out of the 5 tracked vendors were nearly normal compared to 2019.

Safety concerns are determining winners and losers in the restaurant industry. Here we can see these concerns supporting pizza traffic. And remember: last week we saw these concerns undercut casual dining’s gains as new virus hotspots emerged.

Smart businesses have already adjusted to protect their employees and customers. But in the data above, we can see that they should also be actively marketing the steps they’ve taken. Safety is a key consideration, especially when you take into account “none feel safe” was the option chosen by 29% of respondents. This aligns with another fact we learned: 27% of respondents have yet to dine out, take out, or receive delivery since this all started. Safety is already a top concern for those actively dining out, and likely the primary concern for over a quarter of customers who so far remain on the sideline.

To learn more about the data behind this article and what PlaceIQ has to offer, visit https://www.placeiq.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.