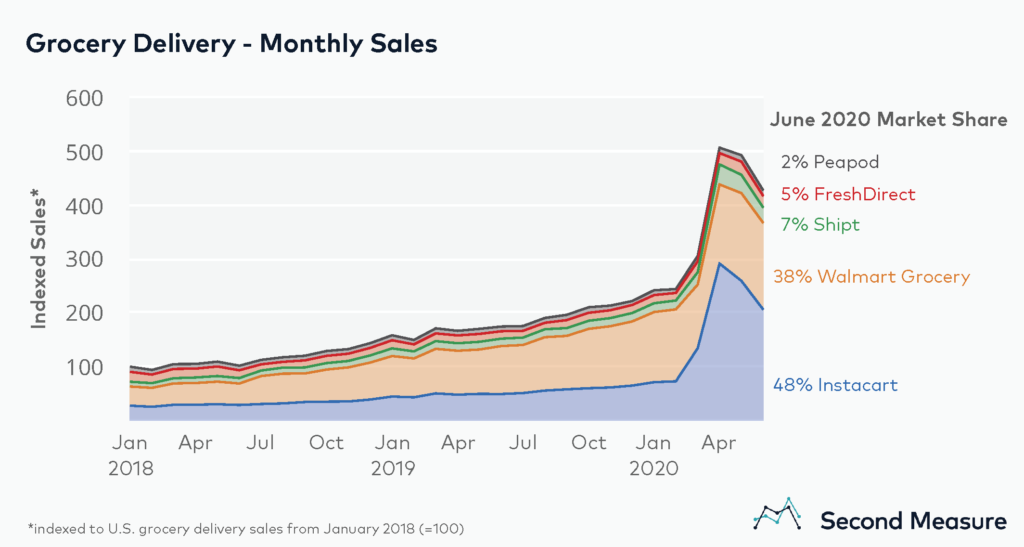

Even staple categories like grocery are facing upheaval as COVID-19 continues to impact U.S. consumer spending. While grocers themselves have seen some shifts in spending behavior, the largest change has taken place among delivery services, which saw sales increase 146 percent year-over-year.

Grocery delivery, previously thought of as a costly convenience, has become an essential offering during the pandemic, as services deliver food to customers who may be self-quarantining, high-risk, or simply attempting to limit their exposure to public places. Industry sales peaked in April, more than doubling pre-pandemic levels, and have remained elevated in subsequent months.

Prior to the pandemic, Walmart Grocery (which includes grocery pickup orders) led market share among top delivery services, with share of sales consistently over 50 percent. Since March, however, Instacart has emerged as the industry leader, eclipsing Walmart Grocery, and capturing 48 percent market share in June.

Consumers spending more on groceries during the pandemic

Across the grocery industry, year-over-year spending is growing. Sales were up 11 percent in the second quarter, and shoppers are spending more on groceries than ever before. Quarterly spending averaged $387 per consumer, a 31 percent increase over the prior year.

It’s not just stress eating driving up grocery sales. In the first quarter of 2020, average sales per customer rose 12 percent year-over-year as a wave of panic buying swept the U.S. and the pandemic began to dominate headlines in late February. In the second quarter, Americans have continued buying more groceries than before, potentially due in part to displaced spend from restaurants, which have been hit hard by COVID-19, especially dine-in.

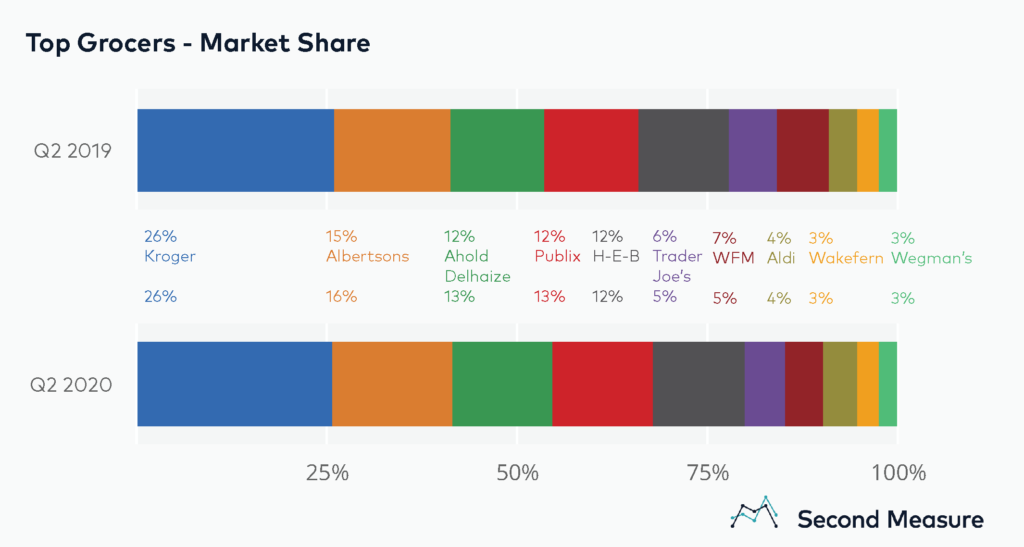

Among top grocers, market share is relatively stable

From the deli counter to the checkout line, the impact of COVID-19 has rippled through the grocery shopping experience. But when it comes to market share, top grocers have seen little shift. Second quarter market share shifted less than 2 percentage points year-over-year among top grocers. Albertsons has even managed to IPO in the midst of the pandemic.

Only two grocers saw their share of sales fall year-over-year: Trader Joe’s and Whole Foods Market. Trader Joe’s—which fell from 6 percent to 5 percent share of sales—may have become a less desirable shop during the pandemic for reasons related to its typically smaller store footprints. Smaller stores face lower occupancy limits, while tighter aisles increase the challenge of social distancing. Furthermore, stores with a limited selection of goods may be passed over in favor of larger stores that can act as a one-stop shop for groceries, reducing a shopper’s overall exposure to public places.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.