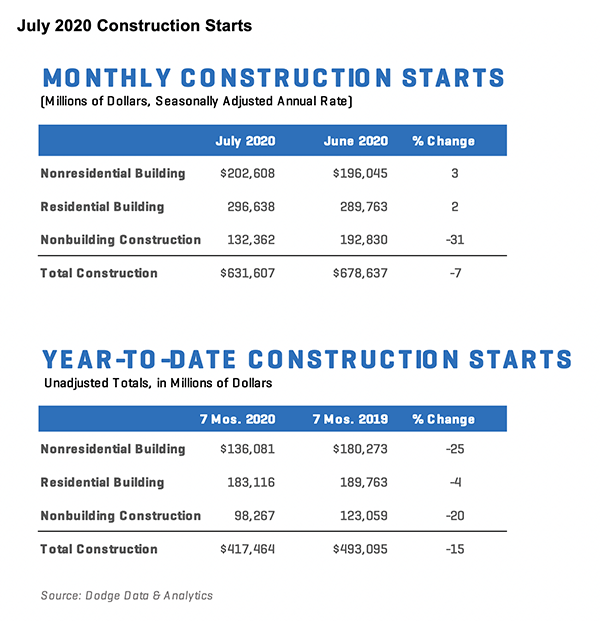

Total construction starts fell 7% in July to a seasonally adjusted annual rate of $631.6 billion. The decline was due to a significant pullback in the nonbuilding segment, which fell 31% from June to July. Nonresidential building starts rose 3% while residential building starts increased 2%.

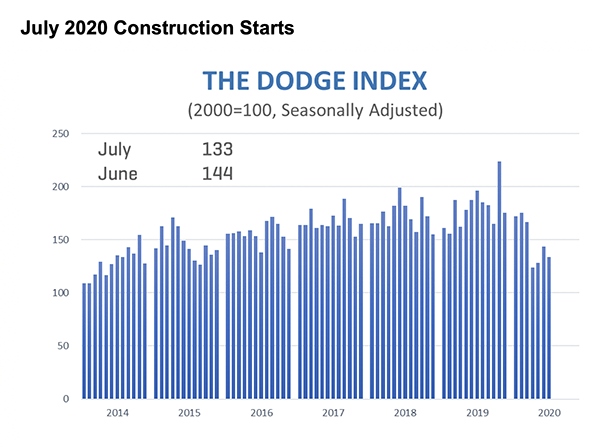

Year-to-date through seven months, starts were 15% down from the same period in 2019. Nonresidential starts plummeted 25%, nonbuilding starts dropped 20%, and residential starts slipped 4%. For the 12 months ending July 2020, total construction starts fell a more modest 5% from the same period a year earlier. Nonresidential building starts were 11% lower, while residential building starts rose 1%. Nonbuilding starts fell in between, with a 7% drop over the 12 months ending July 2020. In July, the Dodge Index fell 7% to 134 (2000=100) from the 144 reading in June. Compared to a year ago, the Dodge Index was down 32%.

“The July decline in construction starts should not be interpreted as a setback on the sector’s road to recovery,” stated Richard Branch Chief Economist for Dodge Data & Analytics. “The gains in the nonresidential and residential sectors mirror the general overall improvements in the economy. The drop in public works could represent a settling back in activity following a solid spring in which some projects broke ground earlier than expected to take advantage of the fewer cars on the road during the COVID-19 shutdown in March and April. While the recovery progresses, the Congressional impasse preventing the extension of enhanced unemployment insurance benefits and small business loans included in earlier fiscal support packages casts a pallor over the future trajectory for growth. Furthermore, the gain in nonresidential building starts was entirely due to strength in the Northeast and West regions, with starts in the South Atlantic and South Central regions down sharply during the month. While one month doesn’t constitute a trend, the potential risk to construction from the rising number of COVID cases in these regions is significant.”

Nonbuilding construction fell 31% in July to a seasonally adjusted annual rate of $132.4 billion. All categories within nonbuilding dropped during July. Utilities/gas plants fell 58% following a very large gain in June. Starts in environmental public works and the miscellaneous nonbuilding sector each lost 27%, while highways and bridges dropped 25%.

The largest nonbuilding project to break ground in July was the $1.0 billion Whistler Natural Gas Pipeline, which stretches 450 miles from Waha TX to Agua Dulce TX. Also starting during the month were the $421 million widening of Interstate 26 from Little Mountain SC to Irmo TX and the $301 million interchange improvements along State Highway 12 near Dallas TX.

Through the first seven months of the year, total nonbuilding starts were down 20% compared to the same time period in 2019. Starts in the highway and bridge category gained 4%, while the environmental public works category dipped 24% and the miscellaneous nonbuilding sector was 30% lower. On a year-to-date basis, starts in the electric power/gas plant category were down 46%. On a 12-month rolling sum basis, total nonbuilding starts were down 7% compared to the 12 months ending July 2020. Starts in the street and bridge category were down 2%, while in the electric power/gas plant category starts fell 3%. Environmental public works starts declined 13% and starts in miscellaneous public works dropped 16%.

Nonresidential building starts increased 3% in July to a seasonally adjusted annual rate of $202.6 billion. Commercial starts gained 13% led by gains in hotels, warehouses, and office buildings. Institutional starts rose 2% due to an increase in education activity, while manufacturing starts lost 52% during the month.

The largest nonresidential building project to break ground in July was the $400 million Mickey Leland International Terminal at George Bust Intercontinental Airport in Houston. Also starting were the $377 million Hyatt Regency Hotel at the Salt Lake Convention Center in Salt Lake City UT and a $337 million renovation of a terminal building at Los Angeles International Airport.

Year-to-date, total nonresidential building starts were 25% lower in the first seven months of 2020. Institutional building starts were down 16%, while commercial starts were 32% lower and manufacturing starts were down 52% on a year-to-date basis. For the 12 months ending July 2020, total nonresidential building starts dropped 11% from the 12 months ending in July 2019. Commercial starts were 12% lower, while institutional starts were down 10%. Manufacturing starts dropped 4% on a 12-month rolling basis.

Residential building starts rose 2% in July to a seasonally adjusted annual rate of $296.6 billion. Multifamily starts increased 11%, while single family starts declined by less than one percent. The largest multifamily structure to break ground in July was the $500 million 101 Lincoln Ave mixed-use project in the Bronx NY. Also starting was the $275 million Figueroa Centre mixed-use complex in Los Angeles CA and the $200 million first phase of the Society Orlando Apartments in Orlando FL.

Through the first seven months of 2020, residential construction starts were down 4% versus the same time period in 2019. Single family starts were 2% higher, while multifamily starts were down 17% year-to-date. For the 12 months ending in July, total residential starts were 1% higher than a year earlier. Single family starts were up 4%, while multifamily starts were down 7%.

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.