Cross-border institutional purchases have been one of the most resilient sources of capital in Asia Pacific in the first half of 2020, a surprising trend given that the practical advantages that domestic groups have during the Covid-19 pandemic. The volume of acquisitions by cross-border investors fell by 14% year-over-year, as compared with declines of around a half for listed and private entities.

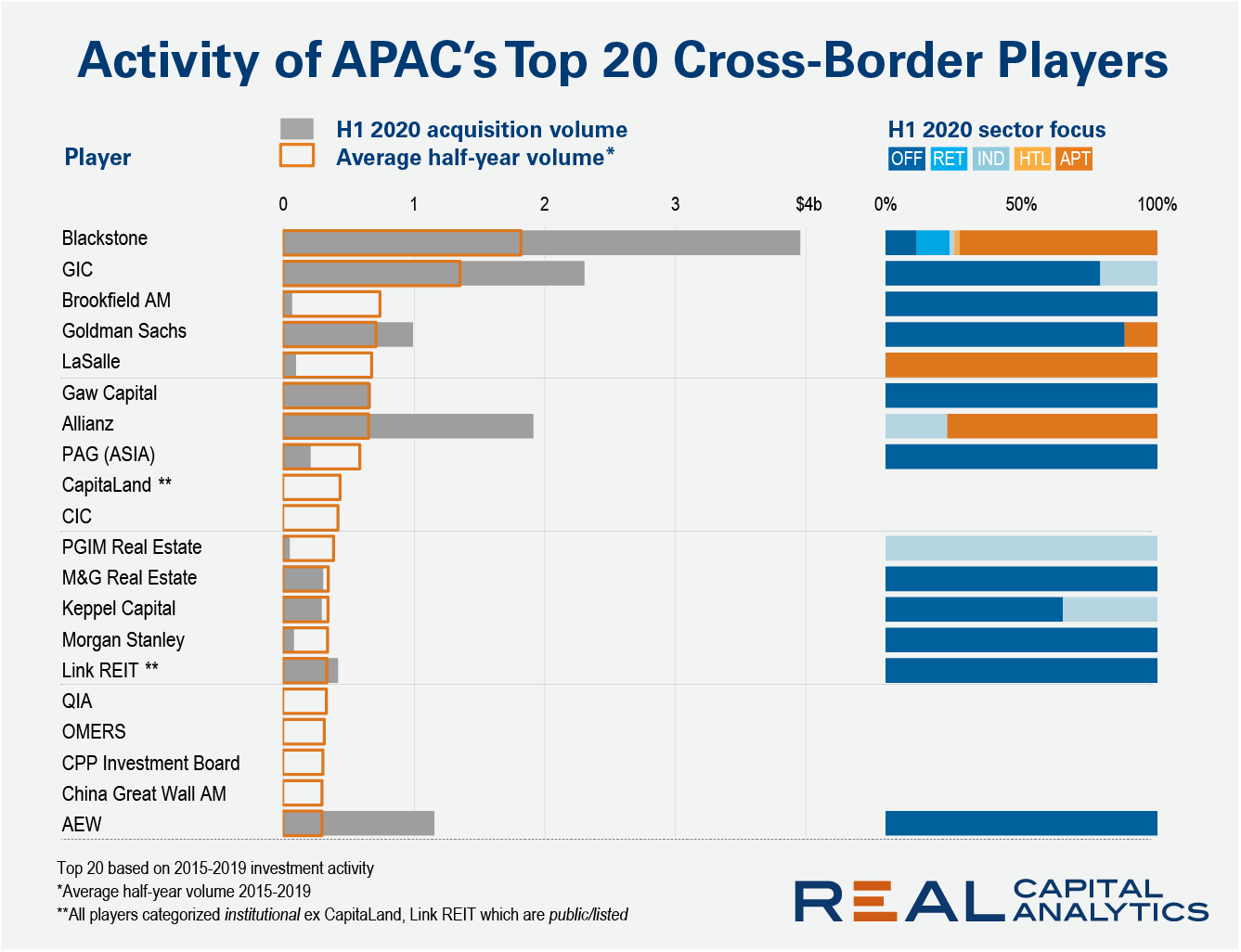

The chart below shows the H1 2020 activity of top 20 cross border-players in Asia Pacific, ranked by their volume invested over the past five years before the pandemic struck. Blackstone retained the #1 spot for the first half of 2020, having sat at the top for three of the past four years. However, GIC looks poised to overtake it in the second half of 2020 with some large deals in the pipeline, including purchases of a Beijing office tower (together with AEW), and logistics facilities and data centers across China and Japan.

Together with the other active players this year, Blackstone and GIC have more than compensated for the absence of some other firms. The active buyers were behind 21% of overall activity in H1 2020, up from an average of 13% during 2015-19. As a result, big institutional money is having an outsized influence on how deal activity – and, by extension, pricing – evolves through this downturn.

While the spotlight has mainly been focused on which players have been buying, potential sellers may be equally interested in who hasn’t yet spent. Canadian players such as Brookfield and CPP Investment Board, as well as state-controlled entities CIC, QIA and China Great Wall, have all been much more reticent this year. Meanwhile, Gaw Capital, PAG, and LaSalle are examples of institutions that have notched a couple of deals so far in 2020, but may still be hungry for more having recently completed significant levels of fundraising.

The divergence in sector trends has been accentuated with each additional month that the pandemic drags on, and this is fully reflected in cross-border institutional preferences as well. Industrial and multifamily properties have featured heavily, while offices still appear to be in play despite an increased prevalence and acceptance of remote working arrangements. Only Blackstone has fully diversified its allocations so far this year, with the other players appearing to avoid the beleaguered retail and hotel sectors.

This apparent aversion to retail and hotel assets stands in contrast to 2019, when over half of these investors made acquisitions in the retail sector, with a third also picking up hotel assets. Their absence this year may reflect the fact that a long-awaited repricing has yet to materialize in these sectors, which may in turn be due to the high levels of tenant support provided by the governments of the major real estate economies. The re-entry of these institutional investors in the coming months could well be one of the first signals that pricing is on the move, particularly as government support is set to expire gradually in the second half of 2020.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.