The economic repercussions brought on by the pandemic caused some industries to soar this year, while others experienced major losses.

Using MediaRadar data, we dive into the ad spending of various consumer industries in a two-part series.

First, we will analyze the industries that slashed their ad spending, and have yet to recover. Next week, we will share the categories that significantly increased ad spending.

Let’s jump in.

MediaRadar Insights

Unfortunately, the pandemic negatively impacted many consumer industries—resulting in substantial advertising cuts that have yet to rebound.

Live Events

Since the beginning of April, ad spend for live events, like comedy shows, plays, and concerts, is down 94% YoY. At this current moment, there is no sign of recovery.

Unfortunately, these types of events can’t fully return until there is a vaccine. For example, Broadway League President Charlotte St. Martin explained that the Broadway financial model simply isn’t possible with social distancing.

“Our financial model is so [dependent upon] attendance and revenue. In order to socially distance, we would have to completely break the Broadway model,” she said. “That would mean lower wages, lower rent at theaters, lower fees from designers and specialists.” Plus, ticket prices would need to be lower, and there would be a limited audience.

While events will come back, they aren’t realistic from a financial or safety perspective yet.

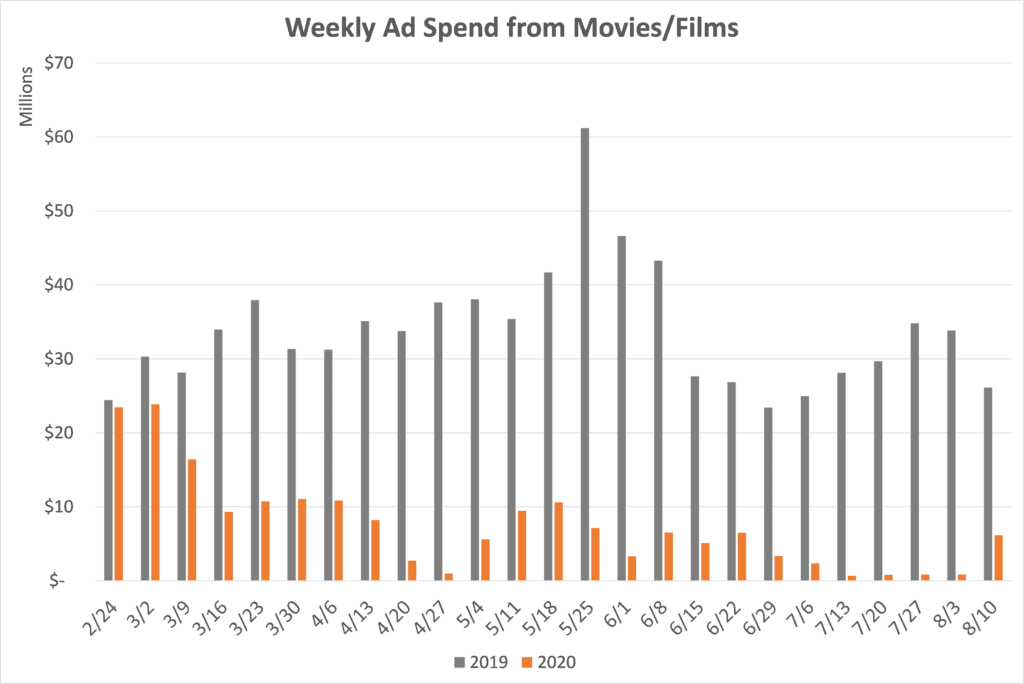

Movies and Films

Since the beginning of March, ad spend dedicated to promoting film releases dropped 80% YoY—a loss of over $650M in ad spending.

OTT launches like Trolls World Tour and Hamilton kept some money coming in from this category. However, the gap remains large.

Mulan is coming to Disney+ for streaming, but viewers will have to pay extra to view the new release. This represents a significant change for the film industry and will result in additional ad dollars.

Luxury Fashion

Luxury fashion saw steep declines in advertising over the last several months. Watch advertising spend, for example, saw a decrease of 59% YoY since March began. Unfortunately, this category is still on the decline. Similar stories are seen across formalwear, purses, footwear, and luxury fashion brands.

Prior to COVID-19, fashion leaders weren’t hopeful about 2020—but attitudes became more pessimistic once the pandemic began. The luxury apparel and accessory market is expected to lose 35-39% of revenue in 2020 YoY. To put this in perspective, the investment firm Bernstein predicted that the first half of 2020 is “likely going to be the worst in the history of the modern luxury goods industry.”

LVMH is navigating this reality. The company reported that its overall profits were down 84% YoY in the first half of the year. “We cut costs by about 30 percent in the second quarter but we do not want to cut too deeply so as to be ready for the recovery when it inevitably comes,” said aid chief financial officer Jean Jacques Guiony to Financial Times.

Part of those cuts were advertising—and across the luxury industry, there is little sign of recovery.

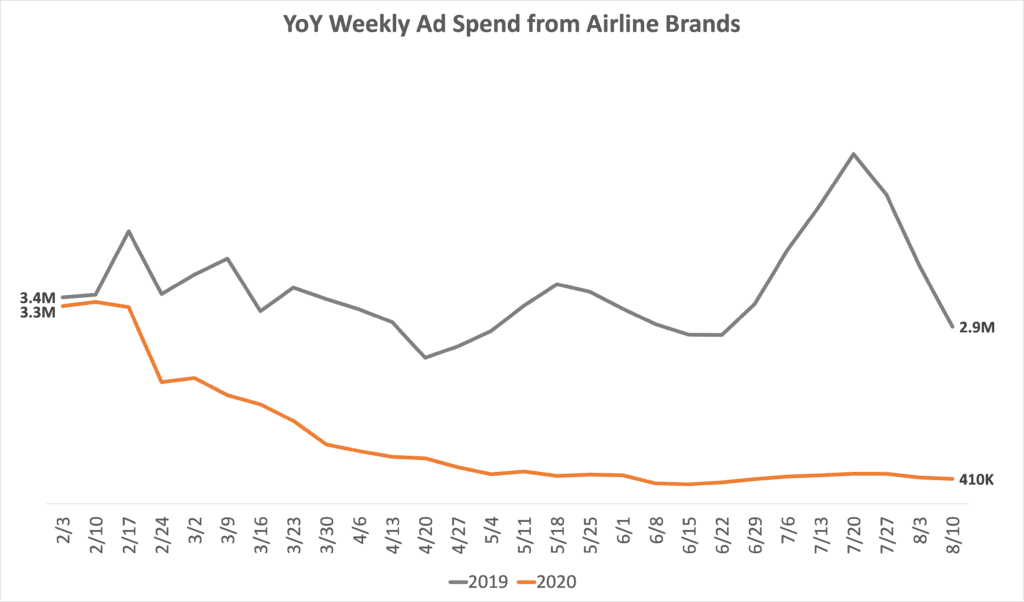

Airlines

(Note: This data excludes Southwest Airlines. In recent weeks, the company has been running a large campaign that skews the data.)

When it comes to airline advertising spend, the differences between 2019 and 2020 are staggering. In 2019, airlines spent at least $1 million per week, every week. Fast forward to 2020: since mid-March, spend levels have not hit $1M in a single week.

Airlines continue to struggle and may cut thousands of jobs. American Airlines announced it will lay off forty thousand employees in the coming months pending government aid, while air travel remains 70% lower than where it was last year.

Performance Foods (energy bars, protein powder, etc.)

Since the beginning of March, ad spending from this category fell 51% YoY, with no signs of improvement.

According to Bernstein, sales of performance nutrition foods were down 20% in March and April. Bernstein predicted that sales would rebound quickly. While sales may return, our data shows that advertising has not.

Foot Care Products

During the pandemic, consumers are walking less. Fitbit data shows step counts from Americans were down 12% in the early days of the pandemic, with metropolitan areas seeing even worse declines.

This is unfortunate news for foot care brands. Fashion footwear, in particular, saw significant losses. Sales were down 48% YoY in Q2.

In response to decreased demand for new footwear, foot care brands adjusted their marketing levels. Year-to-date, ad spend from this category is down 73% YoY.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.