Amidst the COVID-19 pandemic, many lenders are reportedly tightening credit by raising the minimum FICO score requirement or increasing down payment requirements to 20%.[1] The credit tightening is driven by a familiar credit market phenomenon known as flight to quality – in time of economic crisis and market uncertainty, investors tend to become more risk averse and will reduce exposures to higher risk loans or loan products.

Borrower’s debt-to-income ratio (DTI), FICO score, and loan-to-value ratio (LTV) are commonly used to gauge housing credit availability. And tighter credit standards mean borrowers on the riskier end of the spectrum (borrowers with higher DTI, lower FICO, or higher loan LTV) get limited access to credit.

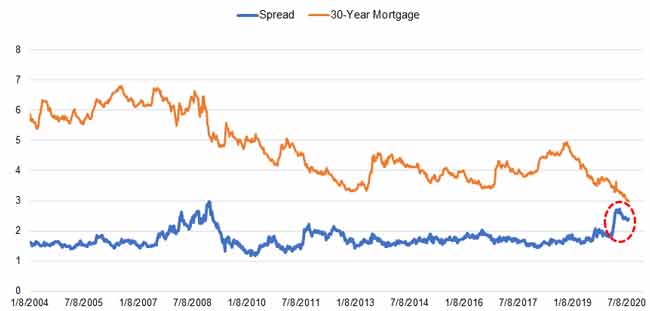

Investor flight to quality amid rising risk in the mortgage market is becoming more apparent with the widening yield between the mortgage rate and treasury yield (Figure 1).

While interest rates drop in response to COVID-19, the spread between the 30-year mortgage and 10-year treasury has moved in an opposite direction, rising sharply to levels unseen since the Great Recession. This can be seen as a reflection of investor’s demand for higher yield in return for the potential risk exposure. The spread peaked in the week of April 23 reaching 2.72%, and has since stayed above 2.4% as recent as the week of July 30.

Figure 1

Source: Freddie Mac Average 30-Year Fixed Rate; St. Louis Federal Reserve Bank FRED Database

Loans to borrowers with high DTI likely to become limited

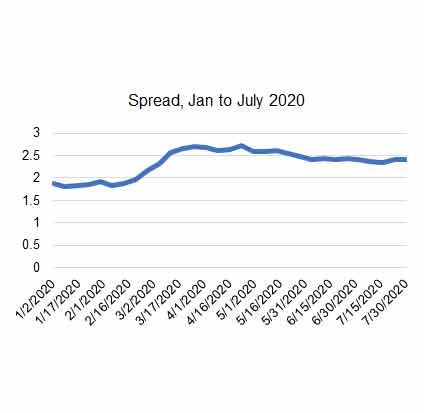

One area of mortgage credit availability that has likely taken a fair share from tightened underwriting is loans to borrowers with high DTI. Like loans to borrowers with low FICO score or loans with high LTV, high-DTI loans generally have higher nonpayment or default risk during the life of these loans. When a hefty portion of borrower income is tied up with the monthly mortgage payment, unexpected changes to circumstances can quickly change a borrower’s ability to maintain the mortgage. In addition, high-DTI borrowers tend to have lower median credit scores (Figure 2), and a lower credit score is generally associated with greater nonpayment or default risk.[2]

Figure 2

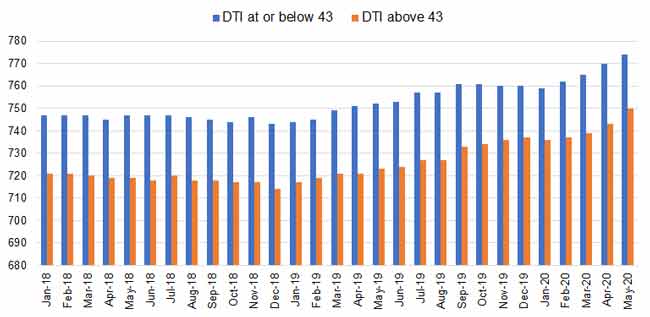

High-DTI loans down in the conventional loan market

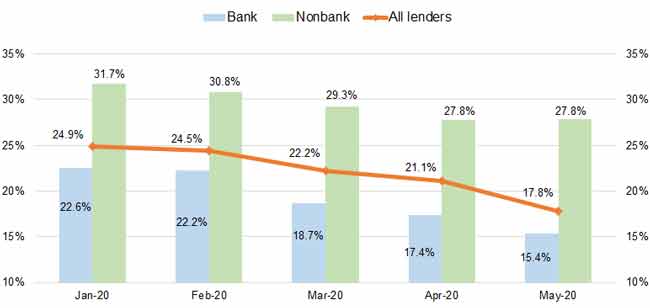

The latest loan-level origination data shows exactly that (Figure 3), where the share of high-DTI originations as a percentage of total first-lien, fixed-rate purchase-loan originations began to drop quickly in March. Overall, high-DTI lending in the conventional loan market declined from 24.9% in January to 17.8% by May.

Moreover, high-DTI lending from bank lenders is down 7%, from 22.6% in January to 15.4% in May. For nonbank lenders, the decrease in high-DTI lending is relatively modest, declining only 4% since January – from 31.7% to 27.8% in May.

Figure 3

Federally insured high-DTI loans are only down slightly

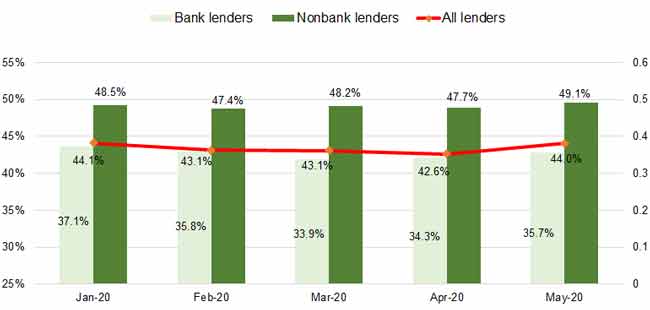

Despite the fact that neither the GSEs nor FHA has substantially changed underwriting guidelines due to COVID-19, the tightening of high-DTI lending has disproportionately affected borrowers in the conventional loan market. As shown in Figure 4, the overall share of federally insured loans to high-DTI borrowers has not changed much between January to May, fluctuating slightly around 43%.

When broken down by bank and nonbank lenders, the data also shows relatively insignificant changes, especially by nonbank lenders. Nonbank lenders are known to carry the lion’s share in loans to high-DTI borrowers in the FHA and other federally insured loan market, contributing to 70-80% of the loan volume in the data analyzed here.

Figure 4

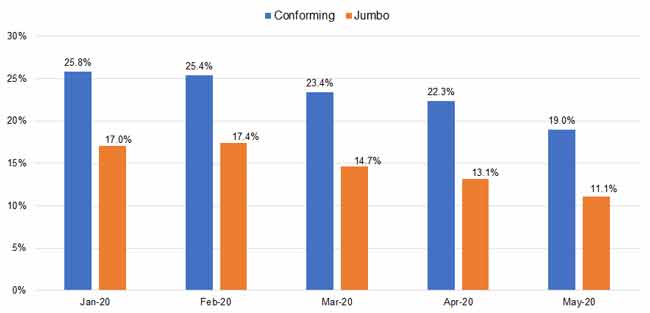

Tightening across jumbo and conforming loans

Within the conventional loan market, high-DTI loan tightening is not just limited to the jumbo loans which have reportedly tightened credit amid the crisis and liquidity drying up in the private securitization market (Figure 5). The credit tightening appears across the board: high-DTI loans in the jumbo market is down from 17% in January to 11% in May, and the conforming market has seen a similar decline from 25.8% to 19% in the same time frame.

Figure 5

With millions of American workers remaining sidelined by COVID-19 and millions of home mortgages under the payment forbearance plan, mortgage market investors will likely remain cautious about the potential risk exposure. Conceivably, until the economic strengthens and the end of the pandemic is in sight, credit availability for riskier mortgage loans will remain constrained by the current state of the economy.

© 2020 CoreLogic, Inc. All rights reserved.

For a more comprehensive review of the distribution of high-DTI loans by different loan types, loan purposes, lender types, or by secondary-market securitizers, read our previous post on high-DTI loans here.

[1] See, for example, Inside Mortgage Finance: In a Major Credit Tightening Move, JPMorgan Chase Caps Warehouse Credit, https://www.insidemortgagefinance.com/articles/217722-in-a-major-credit-tightening-move-jpmorgan-chase-caps-warehouse-credit?v=preview.

Pittsburgh Post-Gazette: Mortgage standards get tougher as banks face greater risks, https://www.post-gazette.com/business/money/2020/05/05/mortgage-banks-credit-score-loan-borrowers-home-lenders-COVID-19-down-payments/stories/202005010026

[2] When further separating conventional and federally insured loans, high-DTI borrowers of conventional loans tend to have much lower FICO score than borrowers with a DTI at or below 43, averaging 15 points lower. However, the FICO scores of high-DTI borrowers of federally insured loans are similar to those with a DTI at or below 43.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.