Fourth quarter is quickly approaching—meaning holiday advertising is gearing up. But this year’s final advertising push will be far from normal.

We’re already seeing the release of the first ads fusing Christmas and the ongoing pandemic. Frito Lays leaned into pandemic-driven cultural changes with its Christmas spoof celebrating NFL kickoff. While the ad is not promoting Christmas presents quite yet, it does reflect how magical certain events will feel when they do return to ‘normal.’

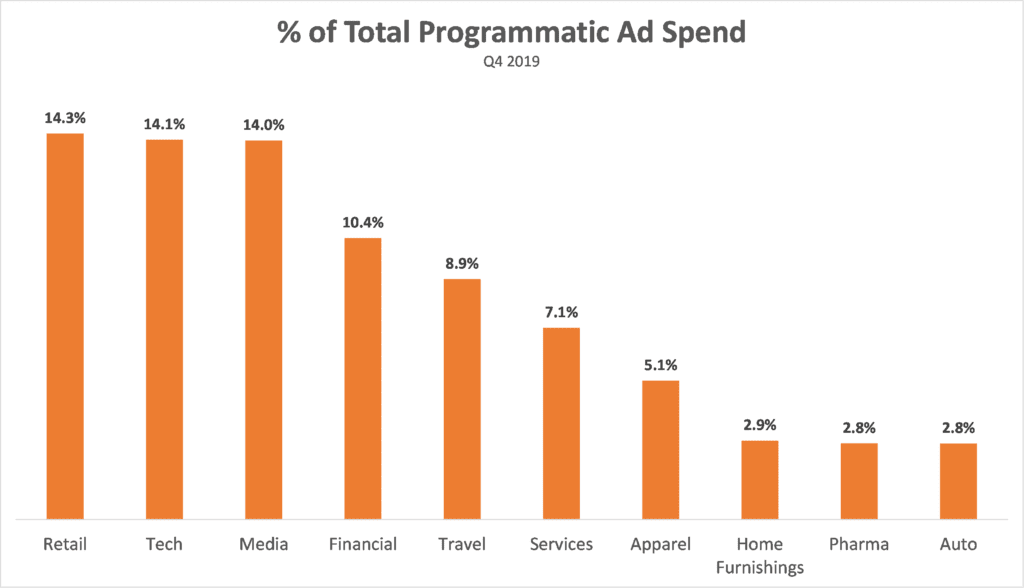

This is just a hint of what might be coming in months to come. Before jumping into what holiday ad buying could look like this year, let’s take a look at what programmatic buying looked like in Q4 2019.

MediaRadar Insights: Programmatic in a pandemic-guided Q4

While the U.S. is technically in a pandemic-induced recession, the National Bureau of Economic Research noted that this is “a downturn with different characteristics and dynamics than prior recessions” and one that might “[turn] out to be briefer than earlier contractions.”

The stock market is breaking records, unemployment rates remain high, and an additional government stimulus deal is stalled. The economy is in a confusing state—so it may be difficult to predict exactly how advertisers and buyers will behave this holiday season.

Last year in Q4, the largest programmatic advertising categories were Retail, Tech, Media, Financial and Travel.

Travel

Travel is a big part of the holiday season—but people may not be visiting distant family members or going on special vacations amid the pandemic. For this reason, it seems unlikely that travel companies will spend much on advertising this year. Though people may travel to destinations within a drivable distance, they’re not likely to travel on planes at typical levels.

According to Zeta Global, 58% of consumers are not planning this holiday season, up from 49% last year. This means 31 million fewer travelers will be leaving their neighborhoods. “People are generally scared to fly and also have economic uncertainty, especially because unemployment benefits are running out,” explained CEO David A. Steinberg.

Retail

Retail is a category that feels more like a toss up. Sales could be lower than last year due to the struggling economy—or they can do well due to the cancellation of summer vacations and eating out at restaurants.

For example, Target had a blowout quarter in Q2 that drove profits up 80%. Between stimulus checks and a lack of entertainment and traveling, consumer spending was directed to shopping.

“In the pandemic, we’re not going to restaurants, we’re not going to movies,” explained Target CEO Brian Cornell. “Those traditional summer trips have been canceled. We’re not on planes. We’re not spending dollars on lodging, so many of those dollars have been redirected into retail.”

Retail programmatic spending was down 9% YoY between April and July, but we will see if brands change their strategies as holidays approach.

Top Programmatic Advertisers

Last year, the top programmatic advertisers included Amazon, Berkshire Hathaway (mostly Geico), Best Buy, Disney, Netflix, Verizon, and Target. Together, these buyers made up 8% of all programmatic spend in Q4.

As Amazon, Best Buy, Disney, Netflix and Target were essential for consumers during COVID for their retail and entertainment needs, it is unlikely that these top brands will pull back programmatic spending this year.

Looking Forward

Overall, Q4 is the biggest quarter of the year for programmatic buyers. 28.4% of all 2019’s programmatic dollars were spent during Q4.

Though this has been a difficult year, there is little reason to think that this would decrease significantly. Programmatic has proved resilient during the pandemic despite an initial strain on ad tech companies.

Programmatic is currently up about 11% YoY — and three out of the top five top programmatic spending categories increased their programmatic buying between April and July. There are still plenty of unknowns, so as we enter Q4, we will continue to share our analysis here.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.