With COVID-19 disrupting businesses throughout the nation, there is reasonable concern regarding the impact of the pandemic on construction trends. Every quarter, CoreLogic publishes the Quarterly Construction Insights report, which digs into critical pieces of the construction economy in the U.S. and Canada, such as changes in material and labor costs, permits for new construction, and construction employment. Here are some of our key findings for Q2 2020:

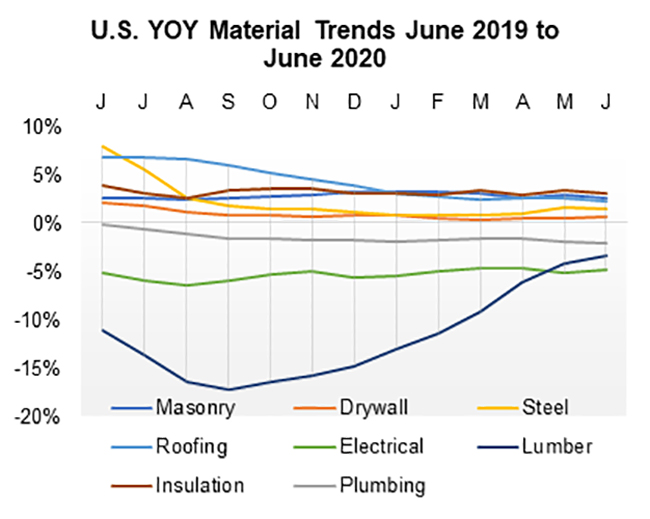

There were no drastic changes in aggregate material costs in the U.S. and Canada

There was no indication of drastic cost changes for aggregates of common construction materials in the U.S. after the start of the pandemic. Overall, costs in Q2 slightly increased 0.4% from last quarter. Rising costs were most notable in the West and Northeast states.

Figure 1 U.S. YOY Material Trends June 2019 to June 2020

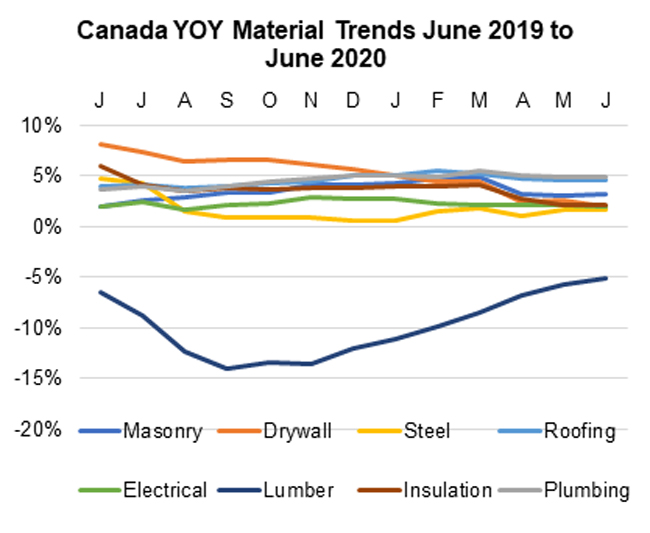

In Canada, costs were more notably affected by the pandemic than in the U.S. as can be seen in the dip of YOY costs in March 2020. Overall, costs in Q2 slightly increased 0.9% from last quarter. Rising costs were most notable in Western Canada and Atlantic Canada.

Figure 2 Canada YOY Material Trends June 2019 to June 2020

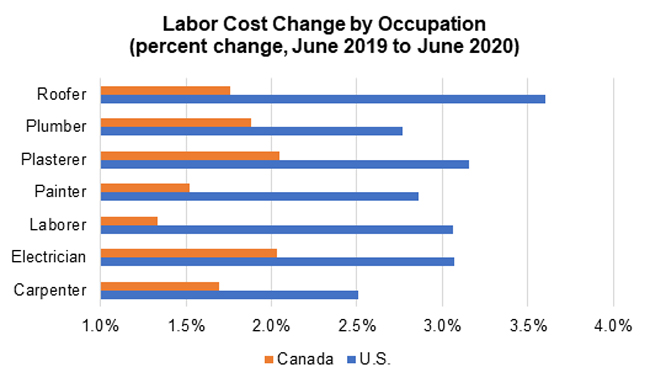

Labor costs are growing faster in the U.S. than in Canada

From June 2019 to June 2020, overall labor costs in the United States grew by 3%, while in Canada they only grew by 1.8%. Labor costs in the U.S. grew the most for roofers while labor costs in Canada grew the most for plasterers.

Figure 3 Labor Cost Change by Occupation (percent change, June 2019 to June 2020)

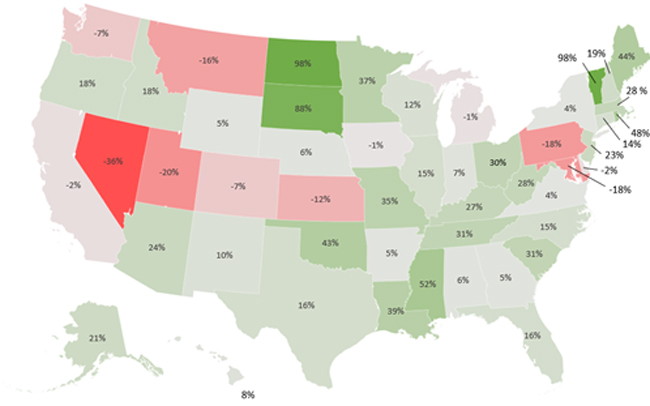

U.S. permit authorizations for new construction in June made a comeback after declining in April

U.S. permits authorizations in June bounced back at 12% total growth. While three- or four-unit permits declined by 17%, all other unit types increased. On a regional basis, the West saw a decline of 2% while the Midwest and South increased by 18% and the Northeast has increased by 9%.

Figure 4 U.S. Permit Authorizations

Construction employment plummeted in June with a 4.5% decline YOY

Construction employment totaled 7,167,000 in June, down 407,000 from March. Employment in construction was down by 330,000 jobs over the past 12 months, a 4.5% decline. Overall, annual construction employment declined in 34 states and D.C (Source: U.S. Bureau of Labor Statistics).

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.