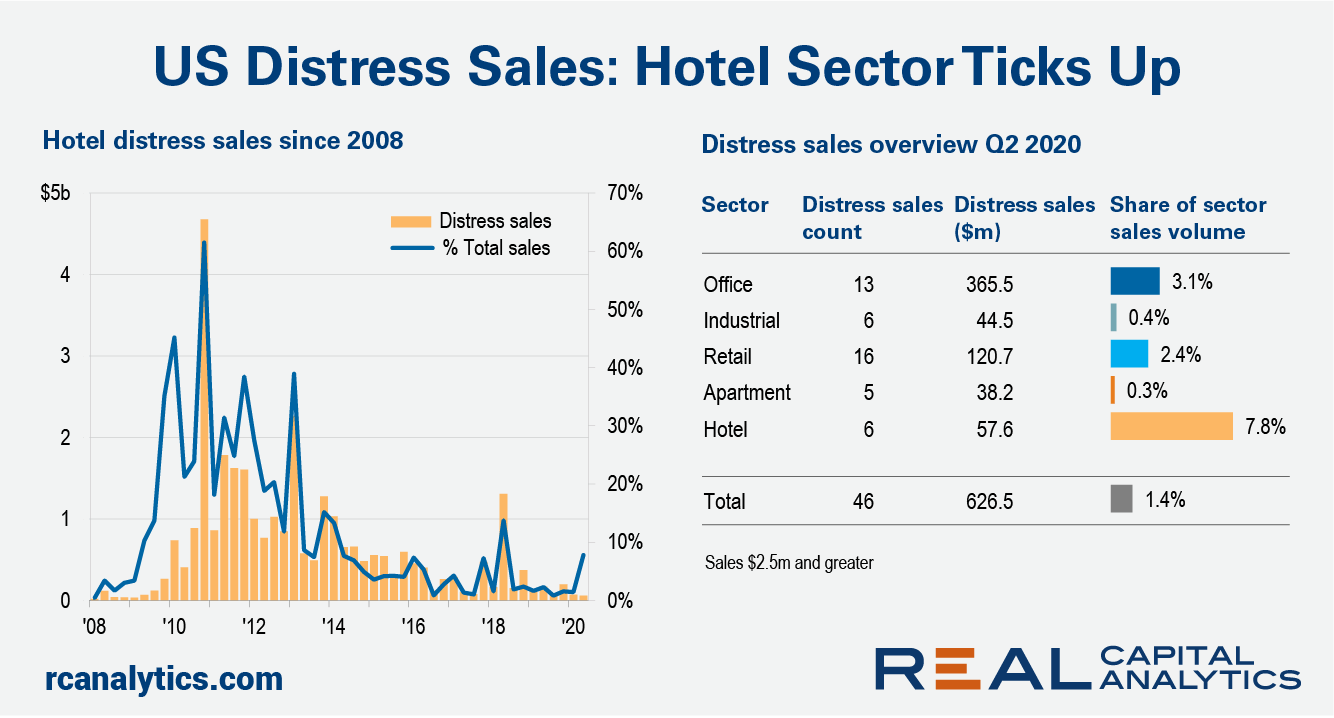

Rising distressed sales of commercial properties can be the push that topples commercial property prices, but with the exception of the hotel sector, such activity is still a small portion of the U.S. market.

The economic calamity from the Covid-19 crisis has changed investor perceptions of prices with few still willing to step up to the high pricing set before the upheaval. Owners do not want to take a loss, buyers do not want to take a risk, and in combination deal volume has collapsed and not prices.

If and when owners are forced to take a loss through distressed sales, prices will adjust down enough for buyers to step up to the risks in investing today. So far however, few investors are being forced to sell in distressed situations.

The hotel sector is one exception to this lack of distressed activity. In the second quarter, distressed sales represented 7.8% of all hotel sales. This figure is up from levels 2% and lower back in 2019, but is still a far cry from the highs following the Global Financial Crisis when distressed sales touched more than 60% of all hotel transactions. The RCA CPPI for the hotel sector fell 4.4% YOY in July, a steeper pace of decline than seen earlier in 2020.

The office sector is the next highest for distressed activity as a portion of total sales. Coming close behind is the retail sector. Again though, these distressed deals are a small share of total activity relative to that seen in the Global Financial Crisis and are not yet at a high enough level to start that chain reaction of significant declines in property prices.

Part of the challenge here is that commercial property sales of any kind have been a struggle in 2020. Aside from the gap between owners and potential buyers on pricing expectations, the Covid-19 crisis has complicated the marketing and bidding process for commercial properties. As travel restrictions ease and the picture on the economic fallout from Covid-19 becomes clearer, more owners may be forced to sell and prices for other property sectors could follow the path set by hotels.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.