U.S. sales involving large office buildings had been on the decline throughout the economic expansion. As more small buildings sell, other measures of market health such as the dollar volume of deal activity can reveal a different meaning. A $100 billion market where half of the volume was concentrated in the purchase of expensive office towers is qualitatively distinct from a more broad-based market driven by the sale of a multitude of small buildings.

It is unclear, however, how this size measure will evolve into the early parts of the economic recovery (when it happens), but potential changes in views on quality will determine what sells.

Some aspects of commercial real estate investment correlate nicely with economic conditions. At other times, unique events drive activity. The size of what sells in the office market has aspects of each. Some of the decline in recent years is due to the nature of the deals that happened at the height of the housing boom. Other parts of the decline were driven by the best assets being picked over early in the economic recovery.

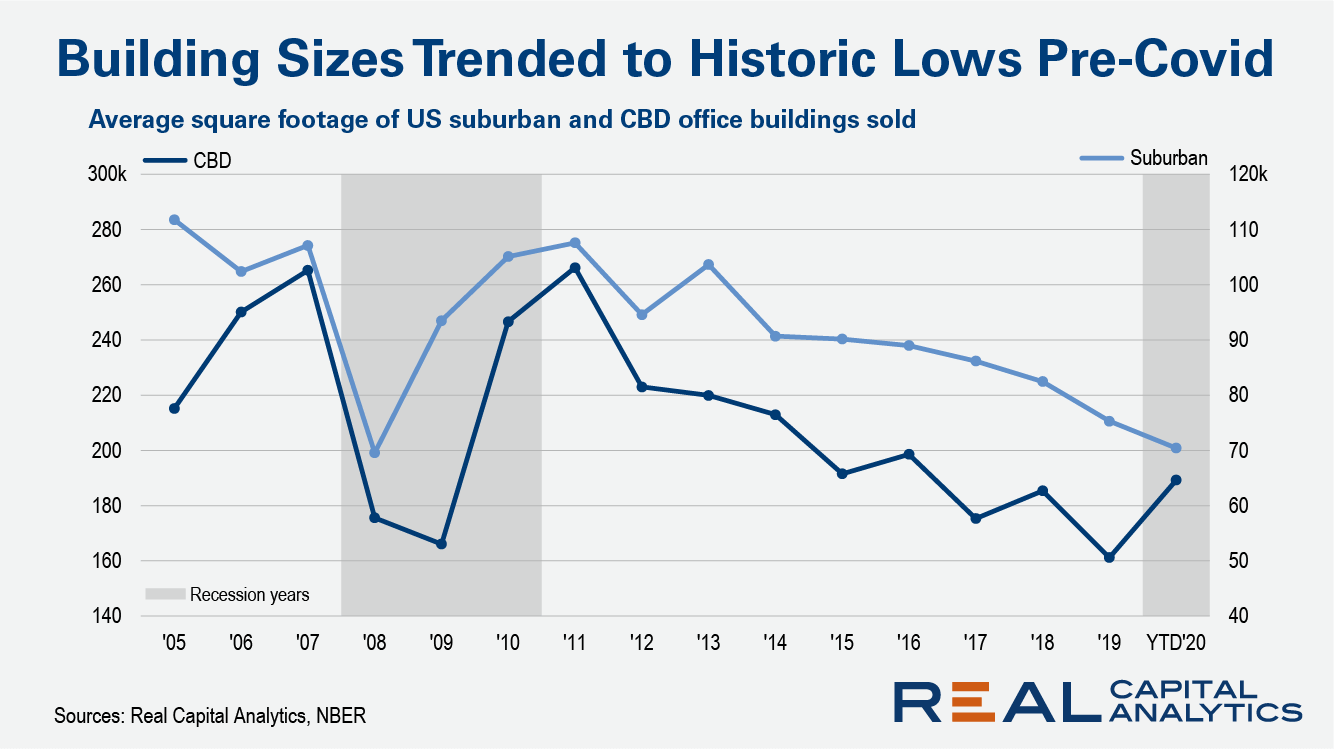

Before Covid-19 hit, the average size of office buildings that were selling was trending to a low point over the last 15 years. In 2019, CBD office assets that sold averaged 161,000 square feet while suburban assets averaged 75,000 square feet. These lows were similar to the levels seen in 2008 in the middle of a recession. The U.S. economy was still growing nicely in 2019, however.

The falling size of what sold in both CBD and suburban locations throughout the economic expansion is in part a story of shifts in views on quality. Early in the cycle, investors were still cautious and only stepping into transactions involving assets where perceived risks were lower. Size and quality often go hand in hand, as it pays to build bigger in areas where land is more valuable, and tenant demand is greater. Deals involving the largest properties with the highest quality were seen early in 2011 and 2012 and investors faced more difficulty acquiring high quality assets later in the cycle.

The availability of large assets changed throughout the economic expansion as well because of one-time events in the market. The take-private transaction involving the Equity Office Properties REIT (EOP) in 2007 has rippled through the market with spikes in the size of what sold in later years. This REIT owned many of the largest and highest quality office assets in the U.S. and after Blackstone flipped pieces of the REIT on to other investors, those flips then echoed through to a spike in the sale of large assets in 2010 and 2011. (Many of those initial flips were deals done at LTVs that provided no margin for error as the economy faltered.)

There was no equivalent to the EOP transaction in the last five years for the office market. Without one big portfolio moving into the system, we are unlikely to see a spike in the size of what sells comparable to that seen in 2010 and 2011. There is a bigger issue, though, with respect to potential changes in how investors assess quality.

Investors are likely to be cautious once we move through the Covid-19 economic downturn. There is always an initial period of investor caution following an economic downturn and the term “flight to quality” will be bandied about once again. In periods of economic recovery in the past, this flight to quality has tended towards larger assets as location issues often led to a high correlation of size and quality. There is an open question as to whether these location issues will still determine quality moving forward.

If the future is like the past and investors view quality in much the same terms as in the past, a flight to quality could well raise the size of what sells during the economic recovery. In a return to the status quo ante, large assets would be valued by investors as a sign of quality as tenants try to bring all their workers in one location in a suburban business node or a CBD location.

However, if the pain of Covid-19 changes the view of the benefits of centrality and there is more dispersion in workforces and more of a focus on satellite locations in secondary markets, the average size of what sells could continue down to new lows. If views of quality shift to these smaller, more dispersed assets, jumping to high dollar levels of annual office sector sales activity will not happen as easily or quickly as before, with many more deals required to hit the average levels of activity seen in the past.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.