News of the planned sale of a Beijing data center campus for half a billion dollars may have come as a surprise to some. However, the deal — which, if it closes, would be the largest industrial deal in the Asia Pacific region in 2020 — is just one of a bundle of pending data center transactions in the region.

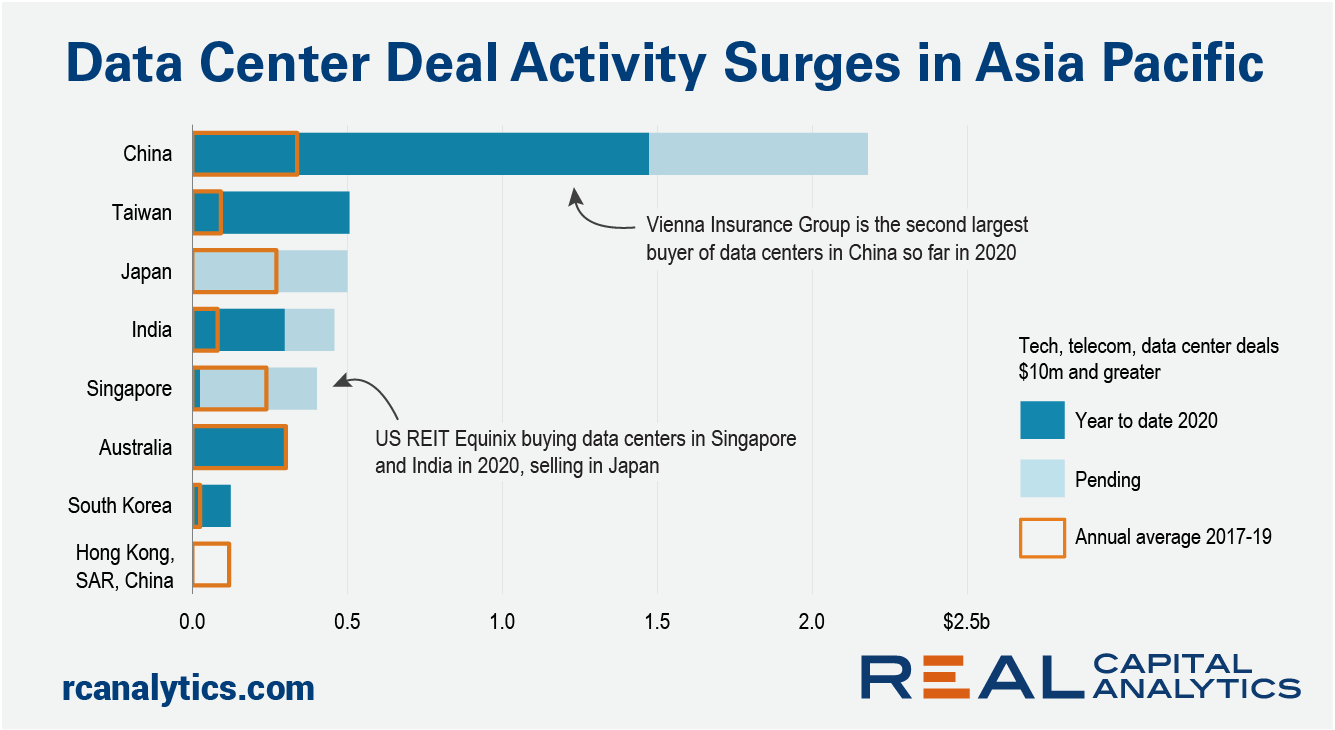

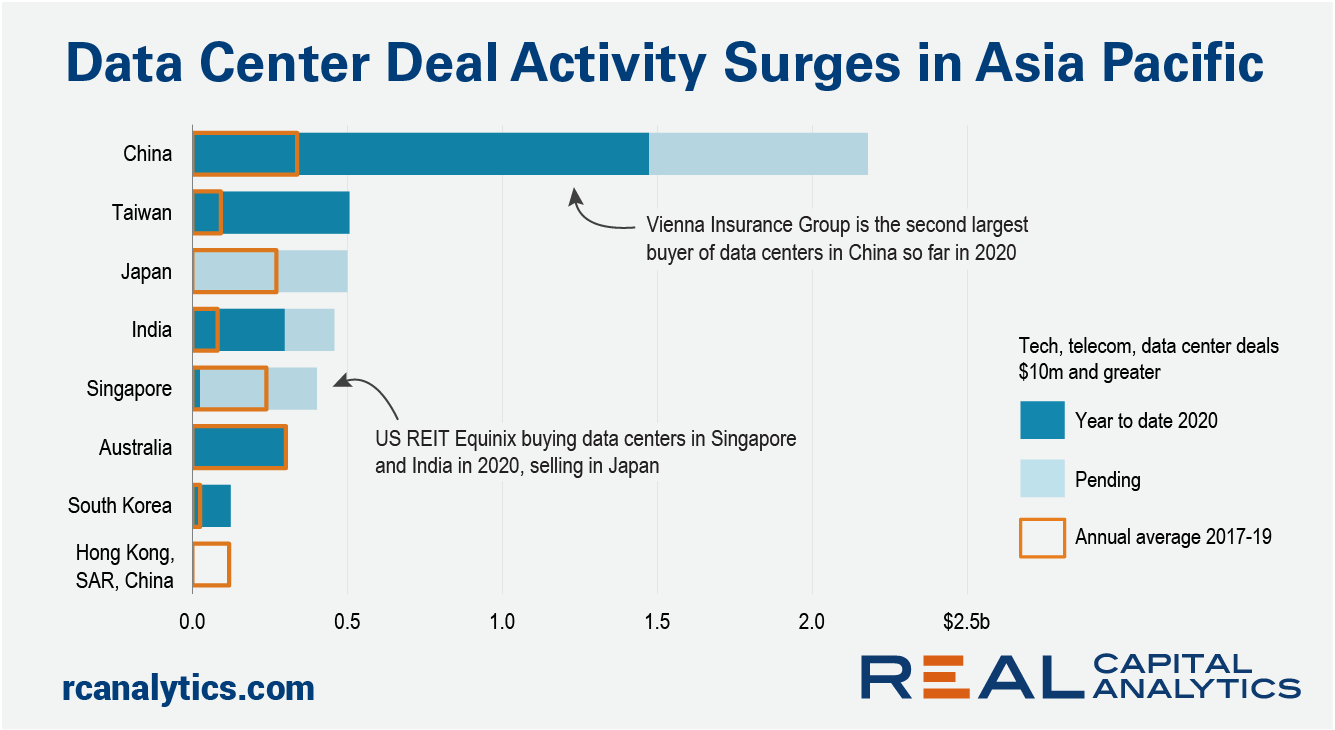

Real Capital Analytics has recorded more than $1.7 billion of technology, telecom and data center deals in the pipeline across China, Singapore, Japan and India. That’s on top of the $2.8 billion of high-spec building sales that have already taken place across the region so far in 2020. If all the mooted deals are finalized, the level would eclipse the combined deal total of the prior three years.

In the past, the high barriers to entry in the form of specialized knowledge required to develop and manage these properties has limited the pool of players directly invested in the sector. Additionally, a large proportion of investment-grade assets, such as hyperscale data centers, are still being developed.

The pending $560 million Beijing sale is a disposal by one of CITIC Capital’s private equity funds to operator GDS Holdings. Other major players have been busy setting up billion-dollar partnerships with seasoned developers and operators, while some, such as GIC, Gaw Capital and Keppel Capital, have entered into forward sales to increase their exposure to hyperscale facilities under construction.

In Hong Kong, while no deals have closed in 2020 so far, there was the $700 million purchase of a development site earmarked for a future data center by telecommunications giant China Mobile. (Development site sales not shown in the chart.)

Tech, telecom and data center deals accounted for less than 1% of aggregate Asia Pacific transaction volume in 2019 and by the midyear mark of 2020 this share had already climbed to 2%. With transaction activity in the region bruised by the pandemic, the flurry of data center deals is proving a bright spot.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.