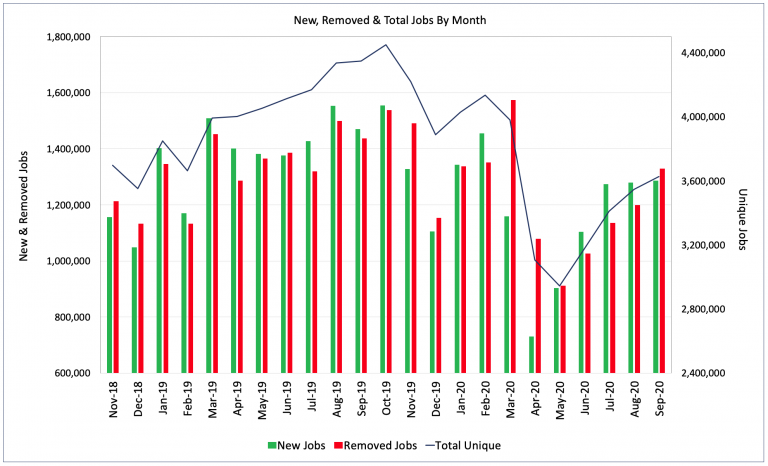

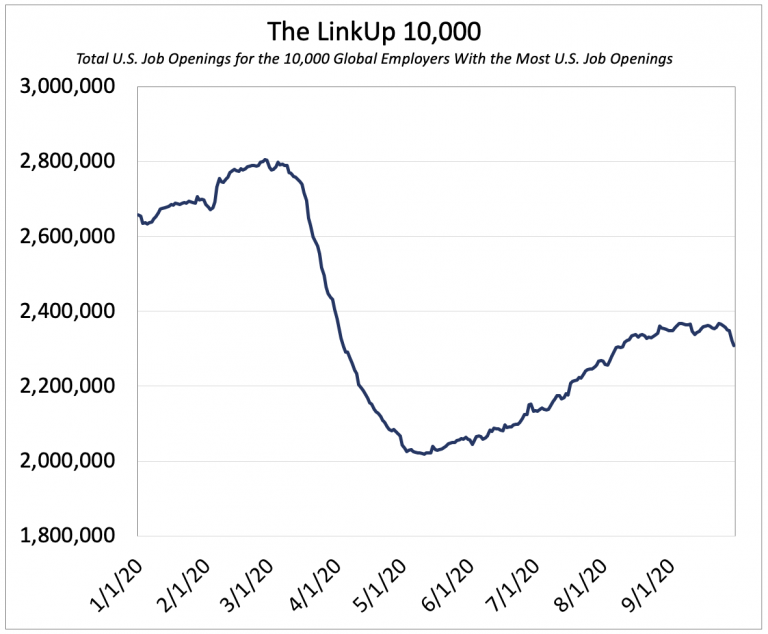

While U.S. job openings on company websites globally rose 2% in September, continuing the steady recovery in U.S. labor demand that began in May, the rate of increase was the slowest in the past 4 months.

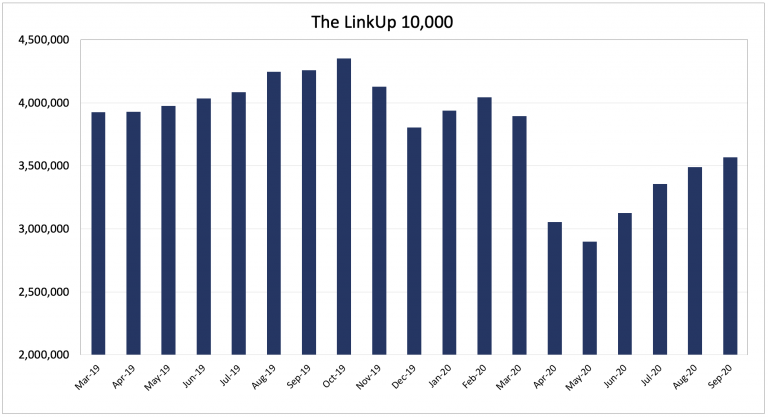

The LinkUp 10,000, a metric that measures the job openings for the 10,000 global employers with the most job openings in the U.S. for the month, rose an identical 2% in September, and again, the rate of increase was the slowest in the past 4 months.

The LinkUp 10,000, a metric that measures the job openings for the 10,000 global employers with the most job openings in the U.S. for the month, rose an identical 2% in September, and again, the rate of increase was the slowest in the past 4 months.

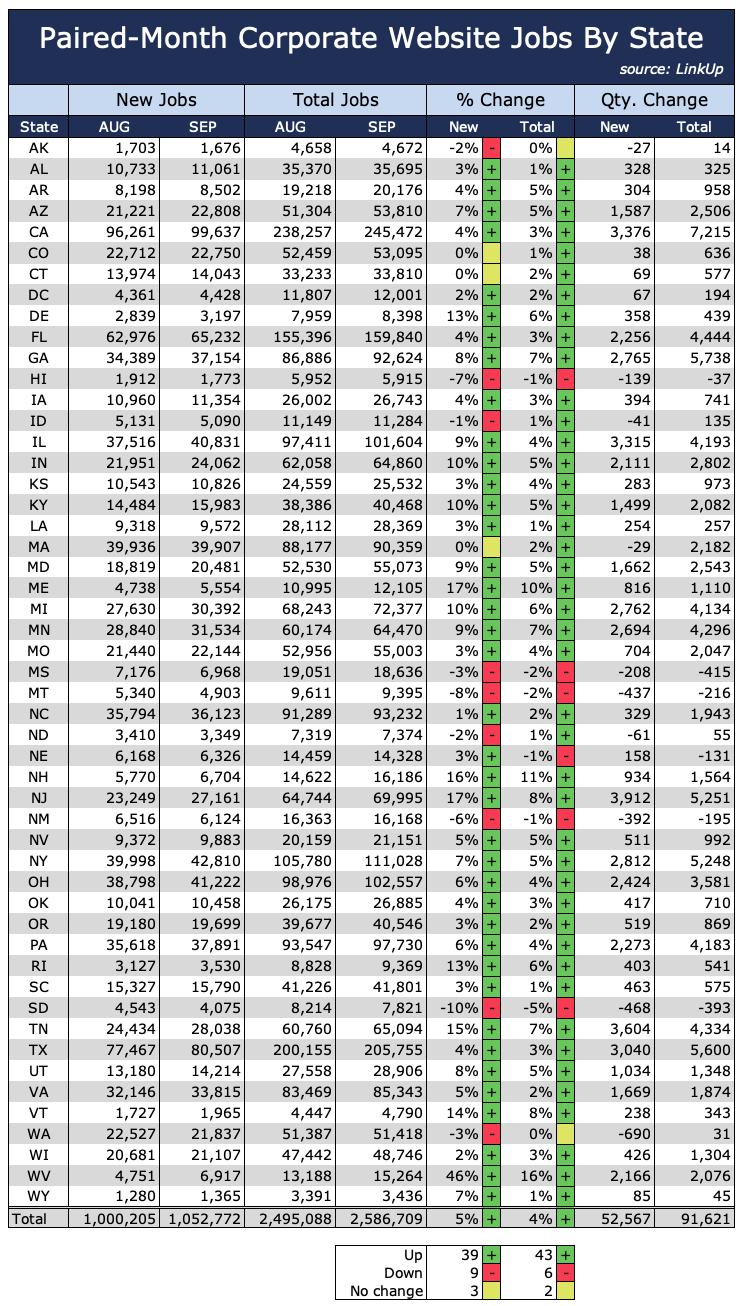

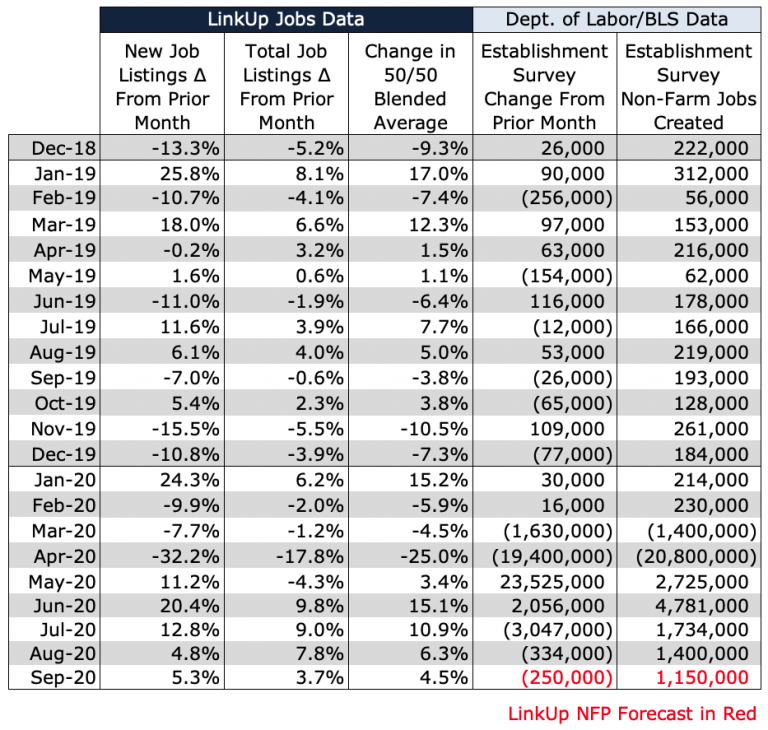

Looking at our paired-month data which measures the change in new and total job openings for the set of companies that were hiring in both August and September, new and total jobs rose 5% and 4% respectively.

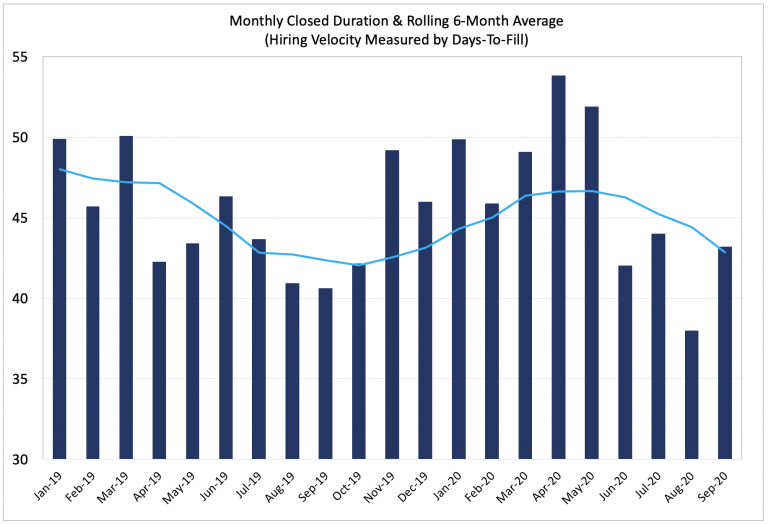

In September, hiring velocity slowed down quite a bit as average days-to-fill rose from 38 to 43 days.

In looking at The LinkUp 10,000 Daily, it’s easy to see how that decrease in hiring velocity has essentially put the brakes on the recovery in the labor market over the past 2 months and, in fact, thrown it into reverse in late September.

To gain a better understanding of exactly what’s been happening under the hood of the labor market since August, it’s worth looking at a handful of specific metrics we track across 3 distinct time periods since March:

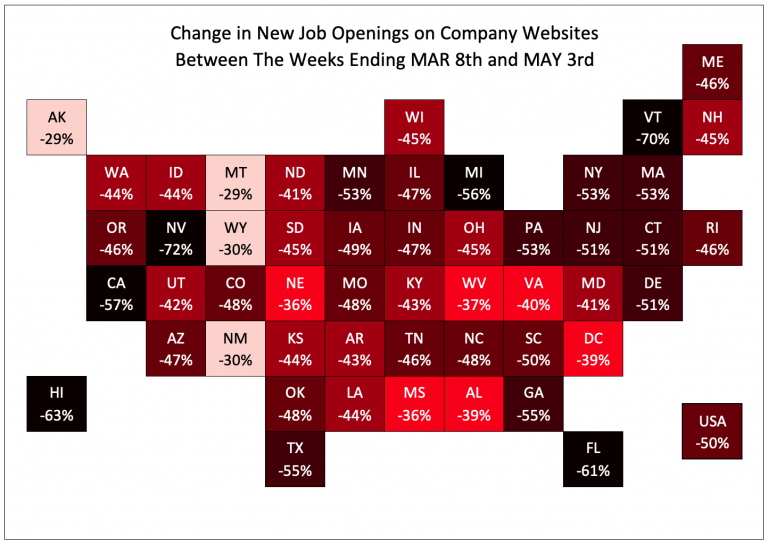

Between March and the beginning of May, new job openings dropped 50% across the U.S. with massive declines in every single state.

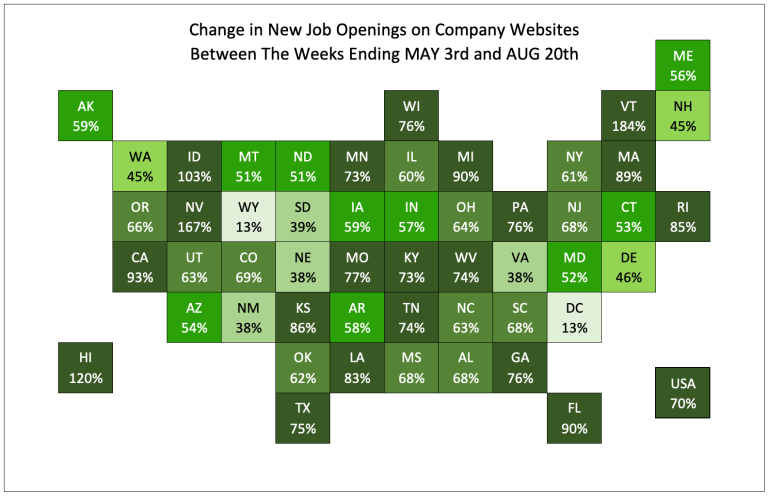

As states began to open up again, new job openings rose 70% between May and August, with significant gains across the entire country.

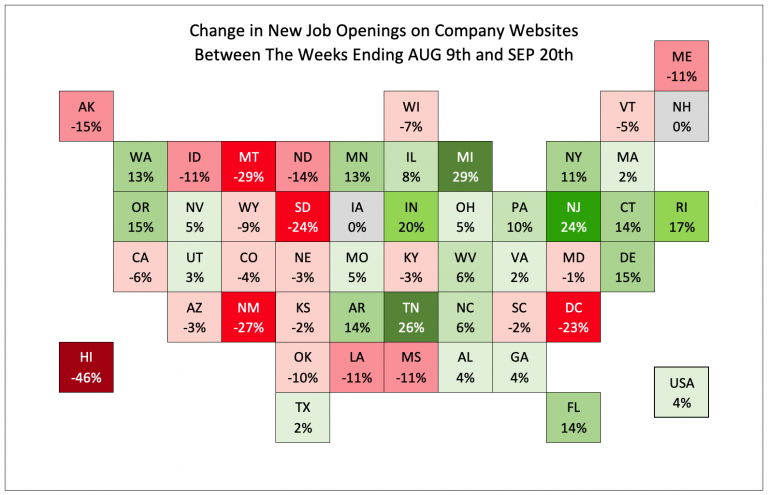

Since August 9th, new job openings have risen a paltry 4% nationally, with a high degree of variance across the country.

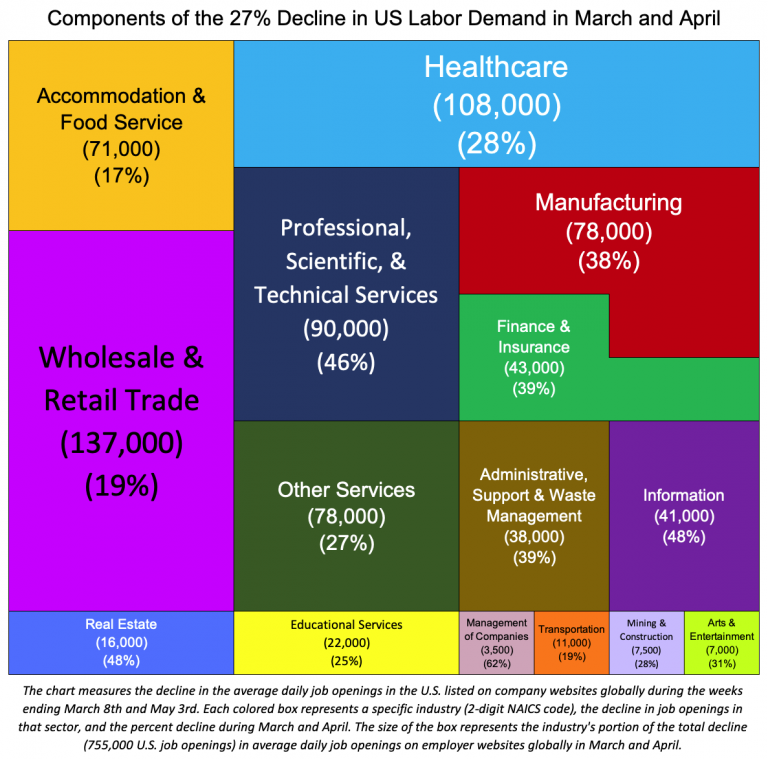

Average daily job openings dropped by 755,000 jobs between the weeks ending March 8th and May 3rd, a decline of 27%.

Average daily job openings dropped by 755,000 jobs between the weeks ending March 8th and May 3rd, a decline of 27%.

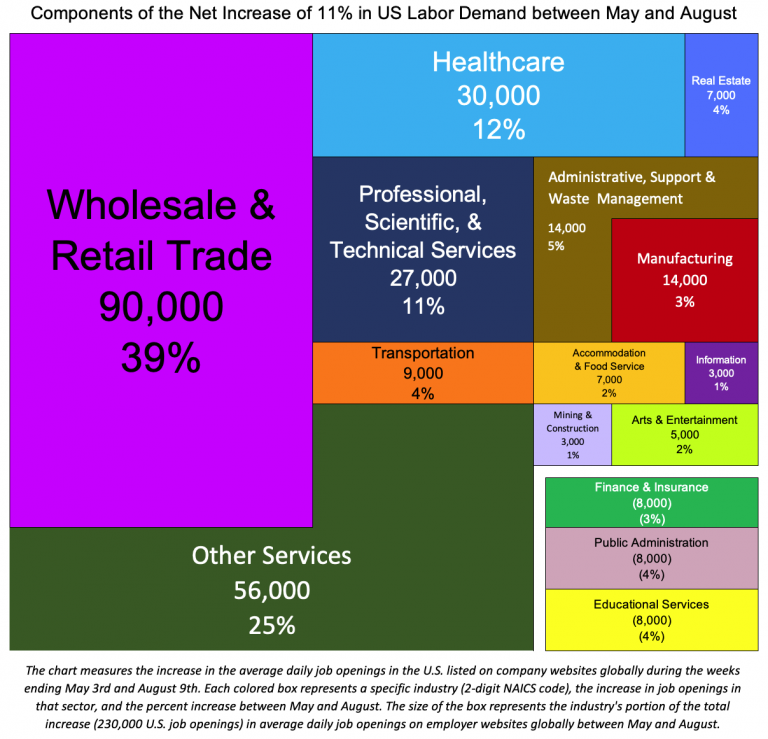

Between May and August, as the economy began to recover, average daily job openings increased by 11% with a net gain of 230,000 job openings. During that period, only 3 industries (Finance, Public Administration, and Education) showed a decline in average daily job openings.

Between May and August, as the economy began to recover, average daily job openings increased by 11% with a net gain of 230,000 job openings. During that period, only 3 industries (Finance, Public Administration, and Education) showed a decline in average daily job openings.

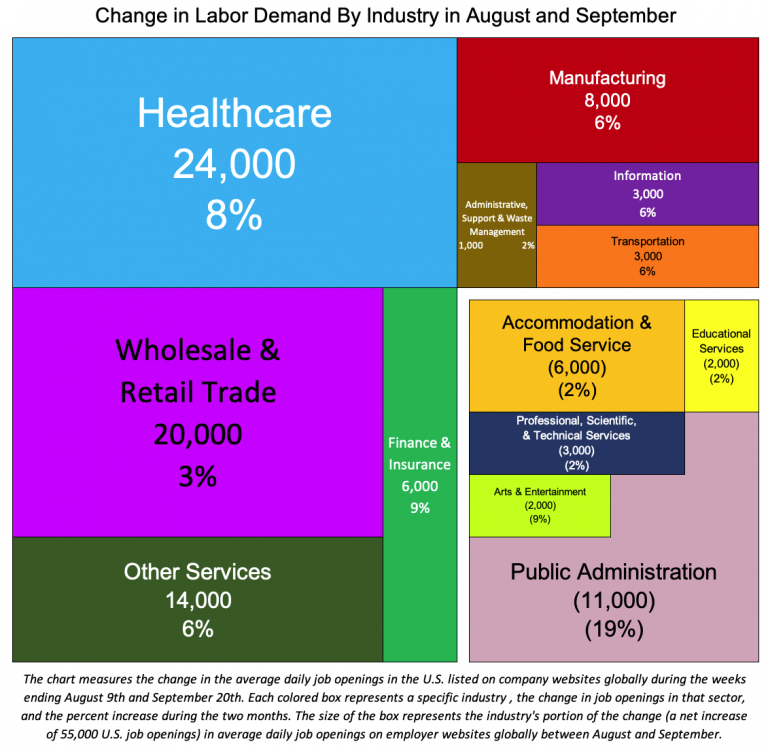

Since August, average daily job openings have only increased by 55,000 job openings, an increase of just 2%.

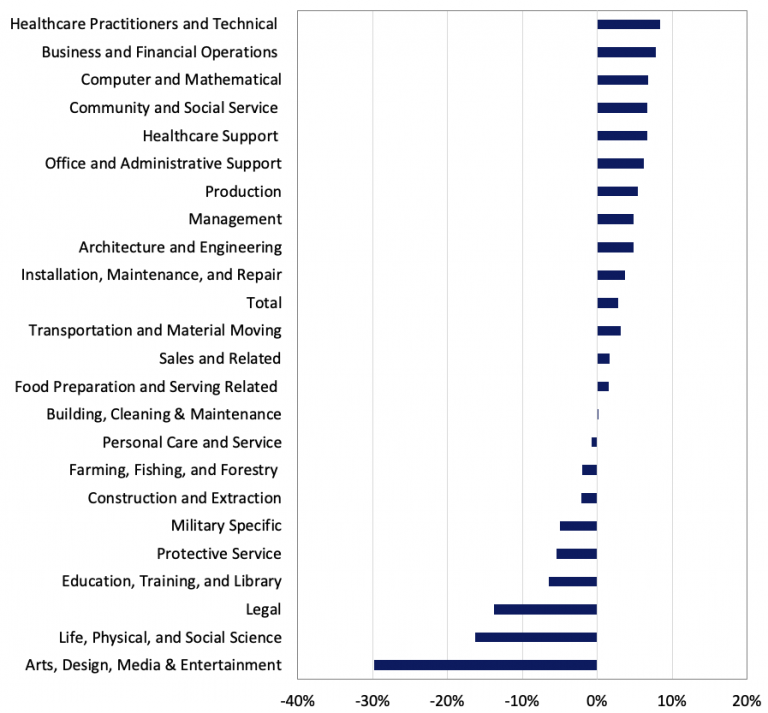

And over the past 2 months, nearly as many occupations (9) have seen a decline in labor demand as have those that have seen an increase (14).

So while we expect a better-than-consensus net gain of 1,150,000 jobs in September, that increase will be the smallest monthly gain in the past 4 months.

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.