Brazil, like many nations, has lifted COVID-19-related entry restrictions for travelers and provided an additional flow of demand for reopening hotels. However, reopening measures are determined on a state level. How has this affected Brazil’s recovery?

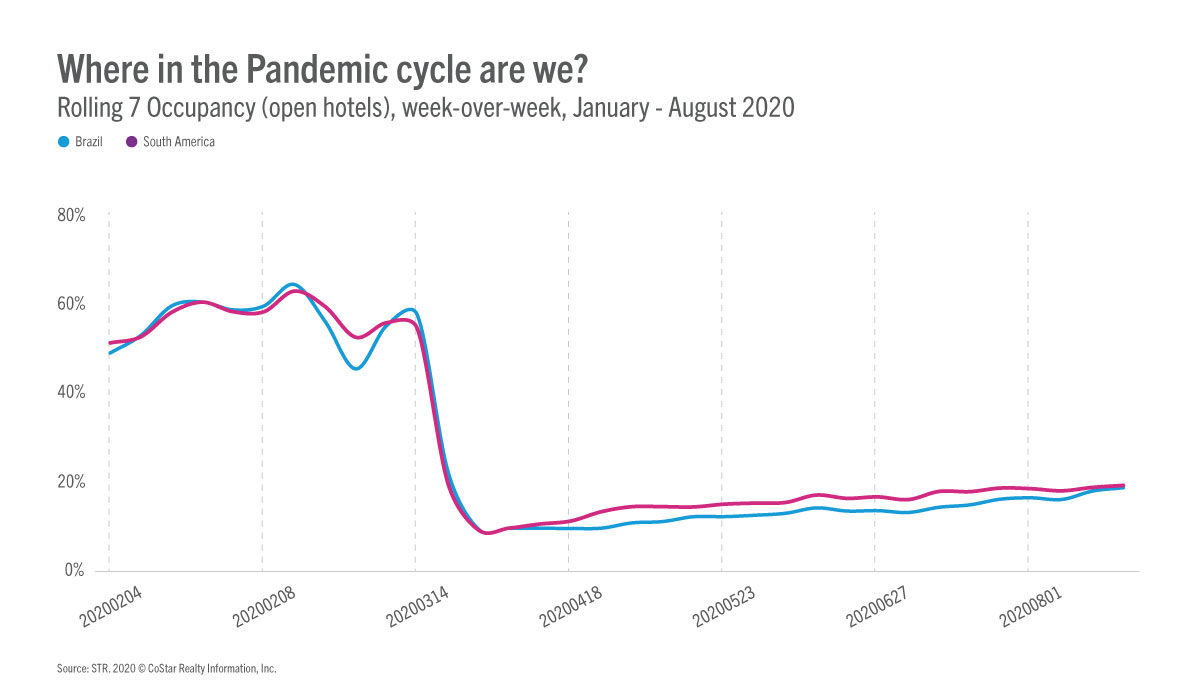

Brazil and South America synced up

For context, South America and Brazil reported their lowest pandemic occupancy levels for the week ending 28 March at 9.5% and 9.7%, respectively. Five months later during the week ending 22 August, South America and Brazil saw their highest occupancy level since the outbreak at 19.6% and 19.1%, respectively.

Regardless, performance remains at historic lows.

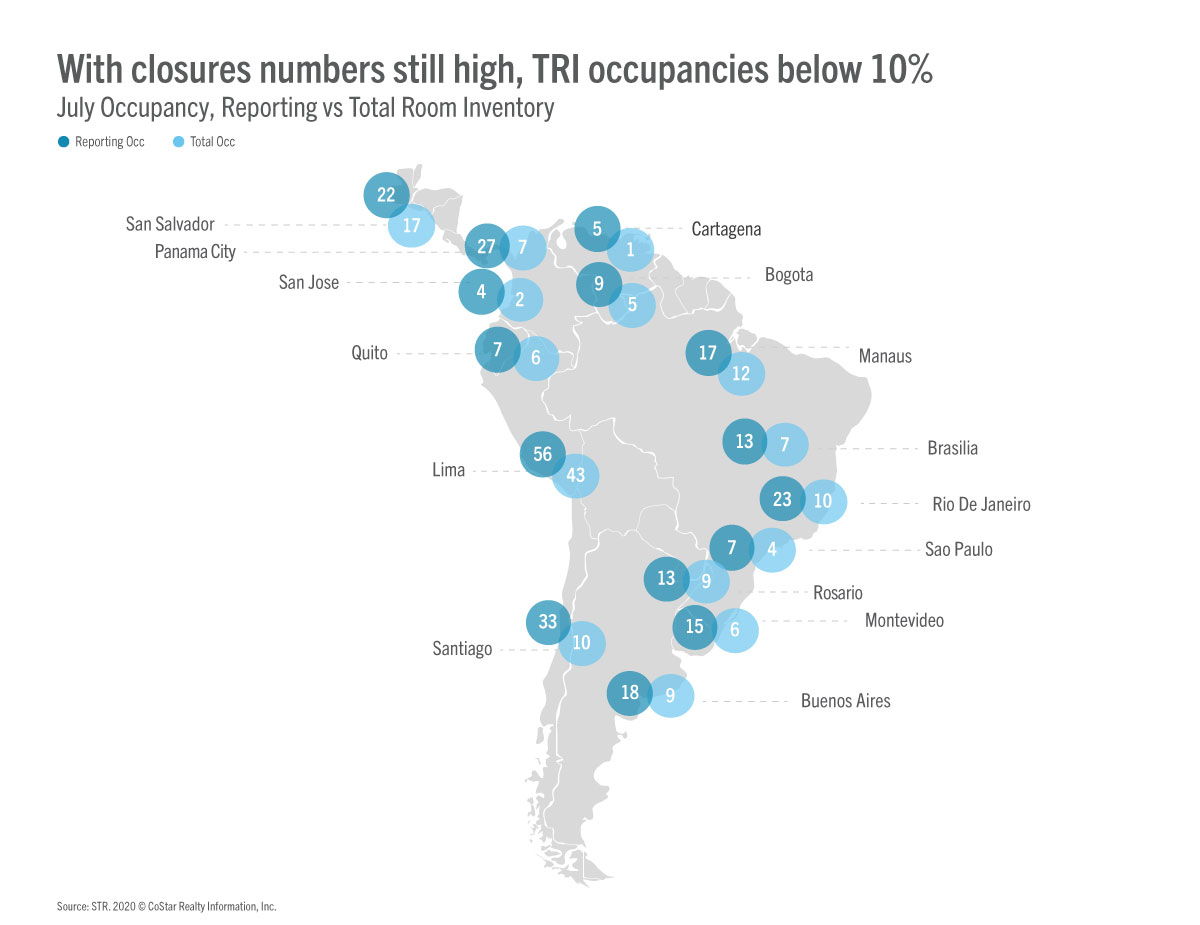

Key cities remain low

Rio de Janeiro, among key Brazilian cities, posted 23% occupancy for open hotels followed by Brasilia (13%). Sao Paulo posted an occupancy level of just 7% in July.

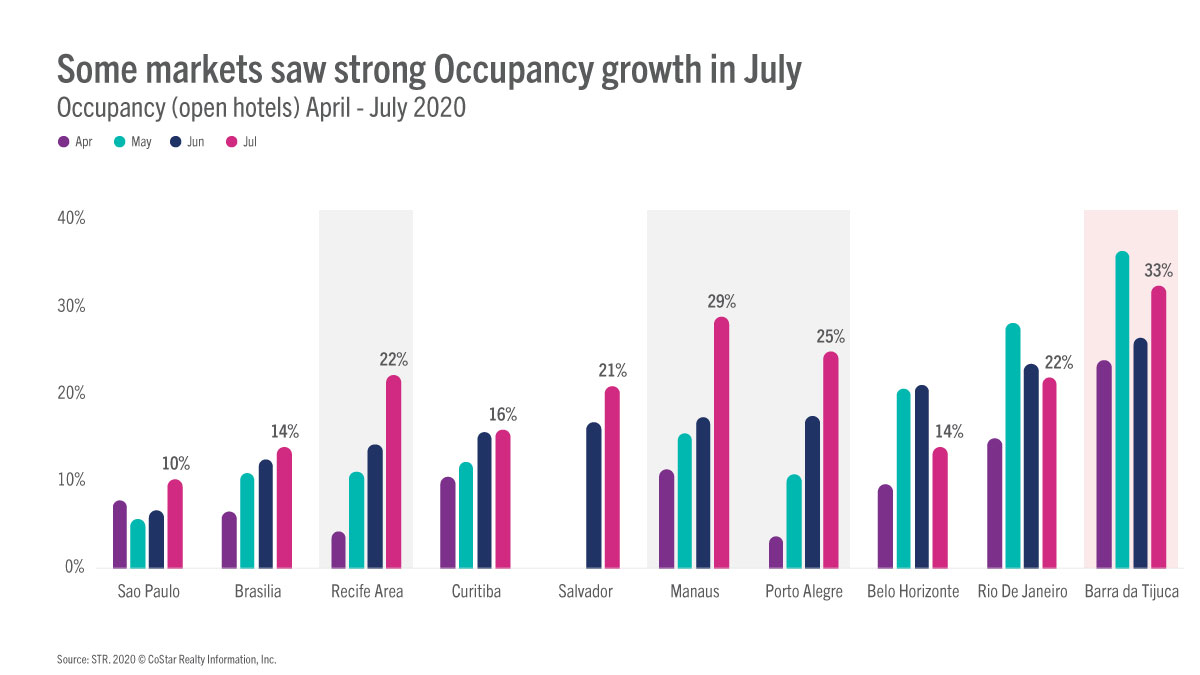

Leisure markets lead the recovery

Leisure markets in Brazil have seen steady occupancy increases due to rising domestic demand. In July, Barra de Tijuca posted a 33.3% occupancy level, followed closely by Manaus (29%), Porto Alegre (25%) and Recife Area (22%).

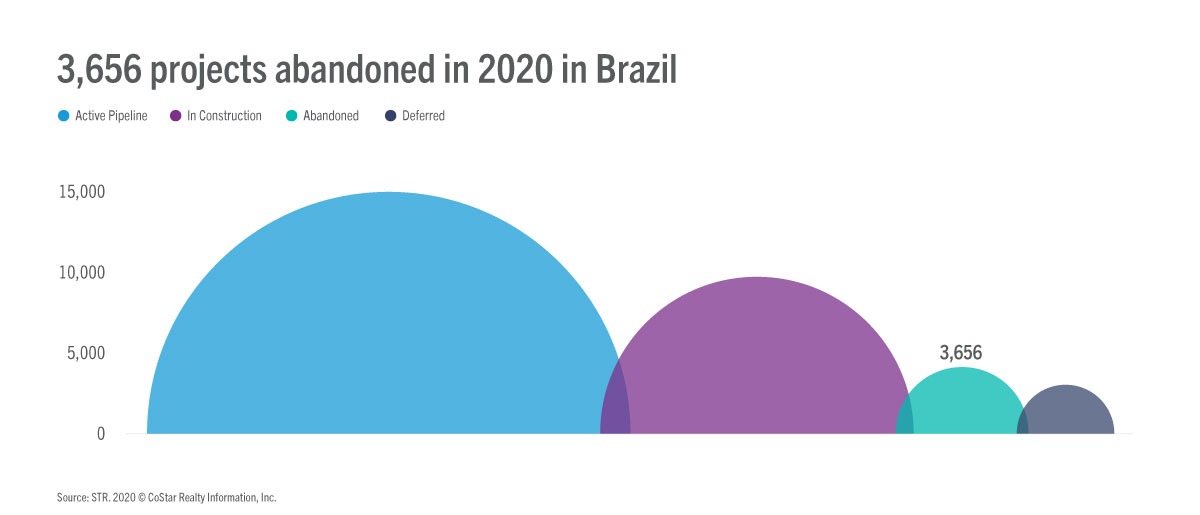

Has future development been affected?

Brazil still shows a considerable amount of pipeline projects; however, many have been shelved since the beginning of the year because of the pandemic. Although the market has 14,962 projects in the various phases of the pipeline, 3,656 projects have been abandoned this year.

At the time of writing, 8,109 projects are in construction. However, with uncertainty remaining around the pandemic, and many projects still in the planning phase, we could see a decrease in activity down the road.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.