The Covid-19 pandemic has struck Spain particularly hard. Cases and total deaths from the first wave of the outbreak were among the highest in the world and a secondary surge is underway.

The extent of the Spanish government’s lockdown and the resultant economic fallout has had a marked effect on the country’s commercial real estate market. Deal volume through the end of August fell 54% versus the same point in 2019 and the deal count dropped by 37%.

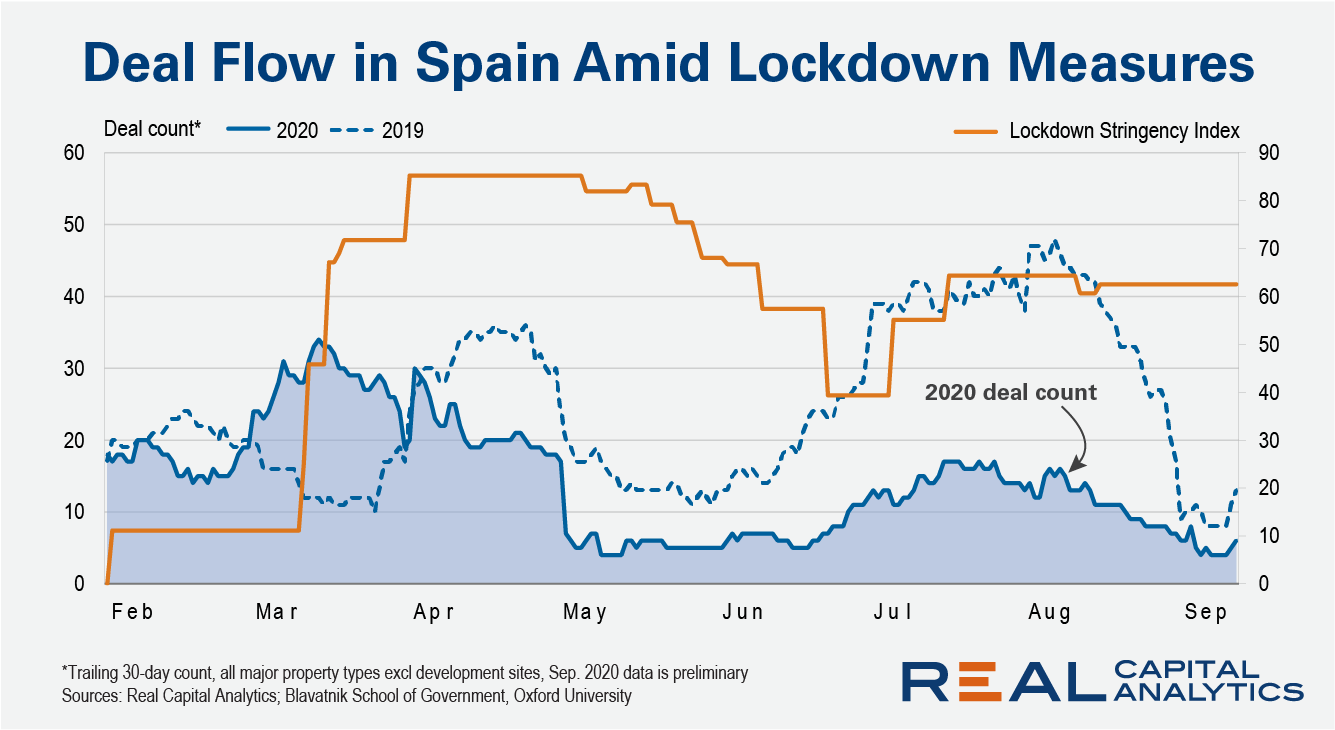

Comparing data from Oxford University’s Blavatnik School of Government and Real Capital Analytics shows the lag between the government’s Covid-fighting restrictions and the low in commercial real estate investment activity.

The Spanish government introduced the first set of restrictions to halt the spread of the virus on March 10 and these increased to reach a peak lockdown on March 30, according to the Blavatnik School of Government’s Lockdown Stringency Index. In comparison, property deal count, as measured by a trailing 30-day total, peaked in mid-March and started a downwards path until reaching a low on May 7.

As such, it took 58 days from the first major lockdown measures and 38 days from the moment of peak lockdown to the trough in property transactions. This emphasizes just how quickly the market reacted to onset of the crisis. The FTSE EPRA Nareit Spain Index took 38 days to go from peak in February to trough in March and this shows the direct market was on a similar timescale to the public market, in terms of deal flow at least.

More recently, Spain was forced into a new round of lockdown measures as the government tries to limit a second outbreak. The data suggests the property market has responded again and deal flows fell to a new low at the start of September, 54 days later. However, there is an important caveat: the summer period is typically slow for investment and the comparable data from 2019 shows that trend clearly.

Deals are still happening though, and Tristan Capital’s recent acquisition of two offices in Barcelona from Spanish player Immobiliaria Colonial shows international players remain active in the market. But with Spanish coronavirus cases elevated and the introduction of a local lockdown in Madrid, it is likely overall deal flow in Europe’s sixth largest market will remain subdued.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.