According to ATTOM Data Solutions’ newly released September and Q3 2020 U.S. Foreclosure Market Report, foreclosure filings are down 12 percent from Q2 2020 and down 81 percent from Q3 2019, to the lowest level since ATTOM began tracking quarterly filings in Q1 2008. The reports shows there were a total of 27,016 U.S. properties with foreclosure filings in the third quarter of 2020.

ATTOM’s most recent foreclosure market analysis also reported there were a total of 9,707 U.S. properties with foreclosure filings in September 2020. That monthly figure is down 2 percent from the August 2020 and down 80 percent from September 2019.

The September and Q3 2020 report stated that lenders started the foreclosure process on 15,129 U.S. properties in the third quarter of 2020. That number is down 15 percent from Q2 2020 and down 81 percent from Q3 2019, marking the 21st consecutive quarter with a year-over-year decrease in foreclosure starts.

The report noted that states posting some of the greatest year-over-year decreases in foreclosure starts in Q3 2020, included Pennsylvania (down 95 percent); Wisconsin (down 93 percent); Washington (down 93 percent); Maryland (down 91 percent); and Colorado (down 90 percent).

According to the report, among the 220 metro areas analyzed, those that posted a year-over-year decrease in foreclosure starts in Q3 2020, included Washington, D.C. (down 91 percent); Philadelphia, Pennsylvania (down 90 percent); Cleveland, Ohio (down 89 percent); Denver, Colorado (down 89 percent); and Baltimore, Maryland (down 88 percent).

The report also noted that among markets with at least 1 million people, those with year-over-year decreases of at least 80 percent in foreclosure starts in Q3 2020, included Columbus, Ohio; Detroit, Michigan; Chicago, Illinois; Providence, Rhode Island; and Charlotte, North Carolina.

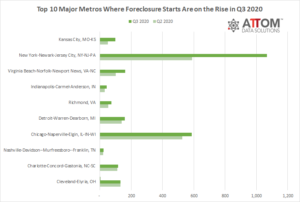

While these major metros are among those posting some of the largest annual declines in foreclosure starts in Q3 2020, some of those markets are also starting to see an increase in starts, or holding steady, compared to the previous quarter.

Among those metros with 1 million people or more, the top 10 posting quarterly increases in foreclosure starts or holding steady in Q3 2020 include: Kansas City, MO-KS (up 94 percent); New York-Newark-Jersey City, NY-NJ-PA (81 percent); Virginia Beach-Norfolk-Newport News, VA-NC (up 59 percent); Indianapolis-Carmel-Anderson, IN (up 42 percent); Richmond, VA (up 37 percent); Detroit-Warren-Dearborn, MI (up 15 percent); Chicago-Naperville-Elgin, IL-IN-WI (up 11 percent); Nashville-Davidson–Murfreesboro–Franklin, TN (up 5 percent); Charlotte-Concord-Gastonia, NC-SC (up 4 percent); and Cleveland-Elyria, OH (no change).

ATTOM’s September and Q3 2020 foreclosure market analysis also reported that lenders repossessed 6,076 U.S. properties through foreclosure (REO) in Q3 2020. That number is down 22 percent from Q2 2020 and down 82 percent from Q3 2019, to the lowest level since ATTOM began tracking.

This latest foreclosure market analysis noted there were 5,000 U.S. properties that started the foreclosure process in September 2020. That number is down 11 percent from August 2020 and down 80 percent from September 2019. The analysis also noted that lenders completed the foreclosure process on 2,013 U.S. properties in September 2020. That number is down 1 percent from August 2020 and down 83 percent from September 2019.

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.