Why settle for a deal when you can hold out for a steal? That is the attitude of investors hoping to cash in on distressed asset sales in the aftermath of the Covid-19 downturn. The reality, however, is that many of the highest quality assets will not be available on the cheap.

The US RCA CPPI National All-Property Index rose just 1.4% year-over-year in September, but this minimal movement raises a question from a number of investors: “Why haven’t prices dropped at double-digit rates across the board?” The challenge here is that perceptions and reality can differ.

In talking with these investors, a number of high-profile deals are cited as examples of price declines. For instance, an investor sold the Embassy Suites hotel in Manhattan for an $80 million loss after holding the asset for just 20 months. The thing is though, Manhattan and such high-profile deals are not the entirety of the U.S. commercial real estate market.

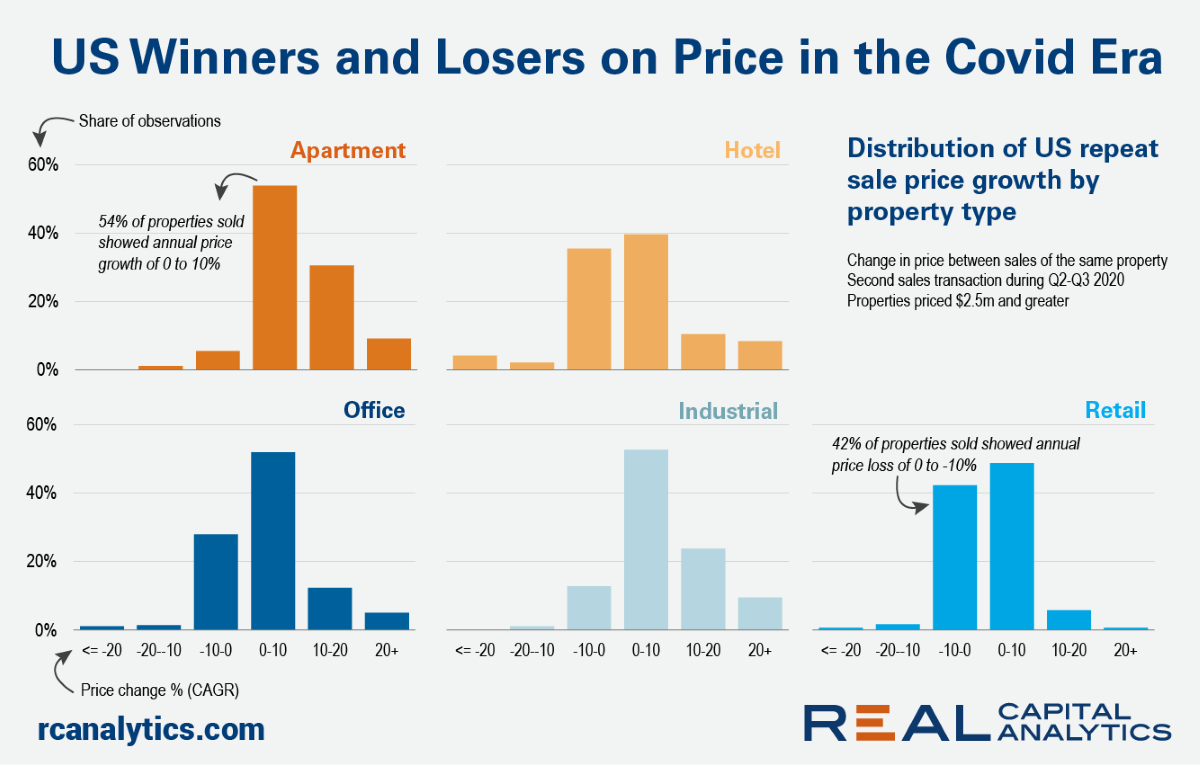

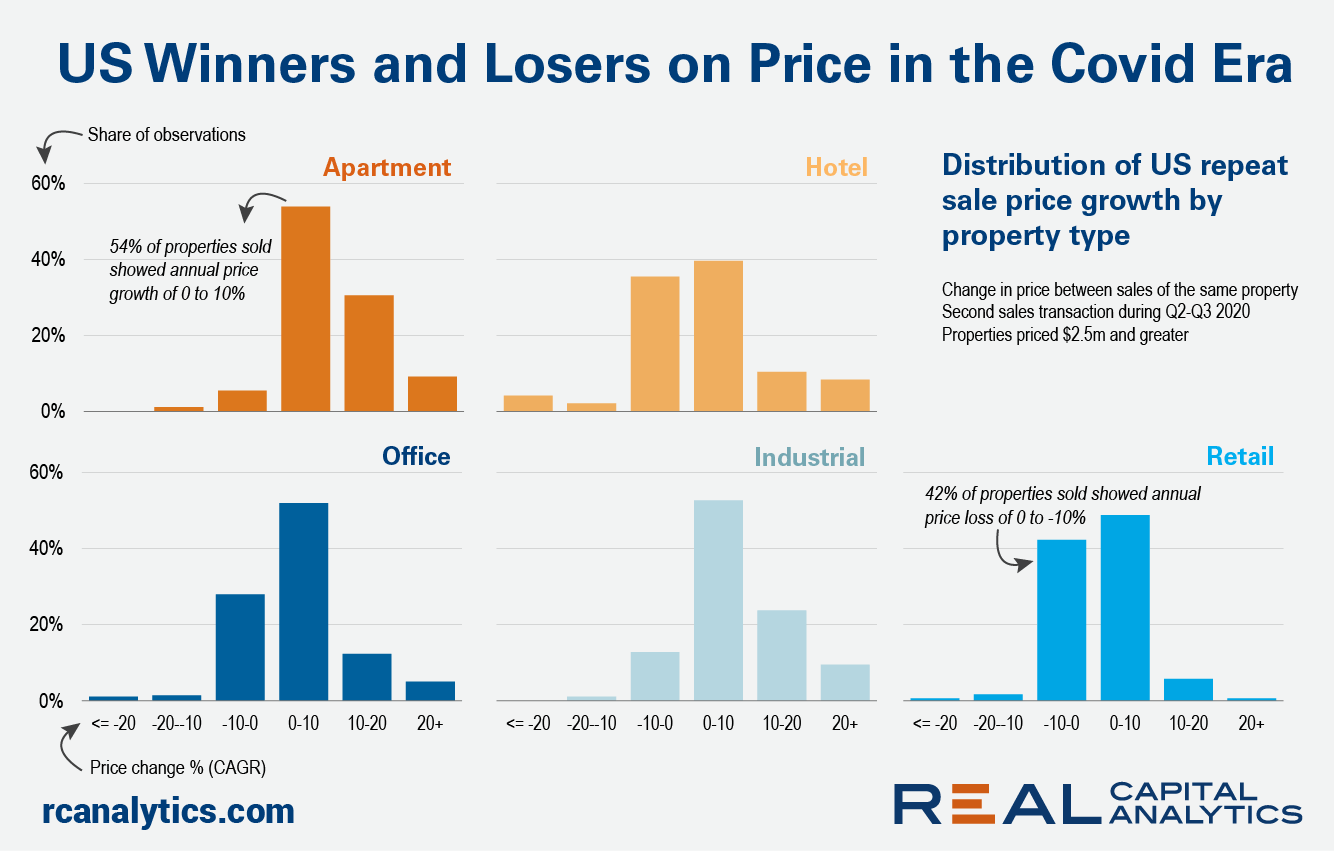

Looking at the distribution of price changes for deals completed in Q2 and Q3 2020 allows us to gauge some of the impact that the Covid-19 pandemic has had on the market. Presumably, any deal closed in this period involved both buyers and sellers incorporating their views on what happens next with the pandemic into their pricing. Looking here at the distribution of price gains across property sectors, it is clear that many sellers in this Covid era have been winners.

The charts look at the compound average growth rate in prices between sale points for all the matched pairs involved in the construction of the RCA CPPI. Looking at the extremes, in the retail sector, 45% of all observations experienced losses while only 6% of apartment observations experienced losses. Another way to look at these figures is that most investors who have sold in this Covid era have so far experienced a gain over the life of their investments.

The economic disruptions from Covid-19 have not translated through to distressed asset sales in many cases as current owners are not forced to sell as they were in the middle of the Global Financial Crisis. Those forced sales were driven by a lack of refinancing debt for even cash-flowing properties. That downturn was literally a financial crisis with a seizing of the mechanisms of global finance. The current downturn is all a function of a hopefully temporary disruption to property income.

The writing is on the wall for some property sectors because of these income challenges. A surge in troubled loans in the hotel and retail sectors in the Covid period will likely lead to a surge in distressed asset sales for these sectors. There are some troubled loans for the office sector but for the most part, property income challenges have yet to hit the market. The longer social distancing continues, the more challenges the office sector will face.

There are going to be properties available at prices severely discounted relative to the previous sales. It is questionable however if these deals will be steals. For many of these properties, the income challenges of the pandemic era will not be a temporary blip.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.