In this Placer Bytes, we dive into two department brands and look at Ross after its expansion announcement.

Department Trends Ahead of Critical Holiday Season

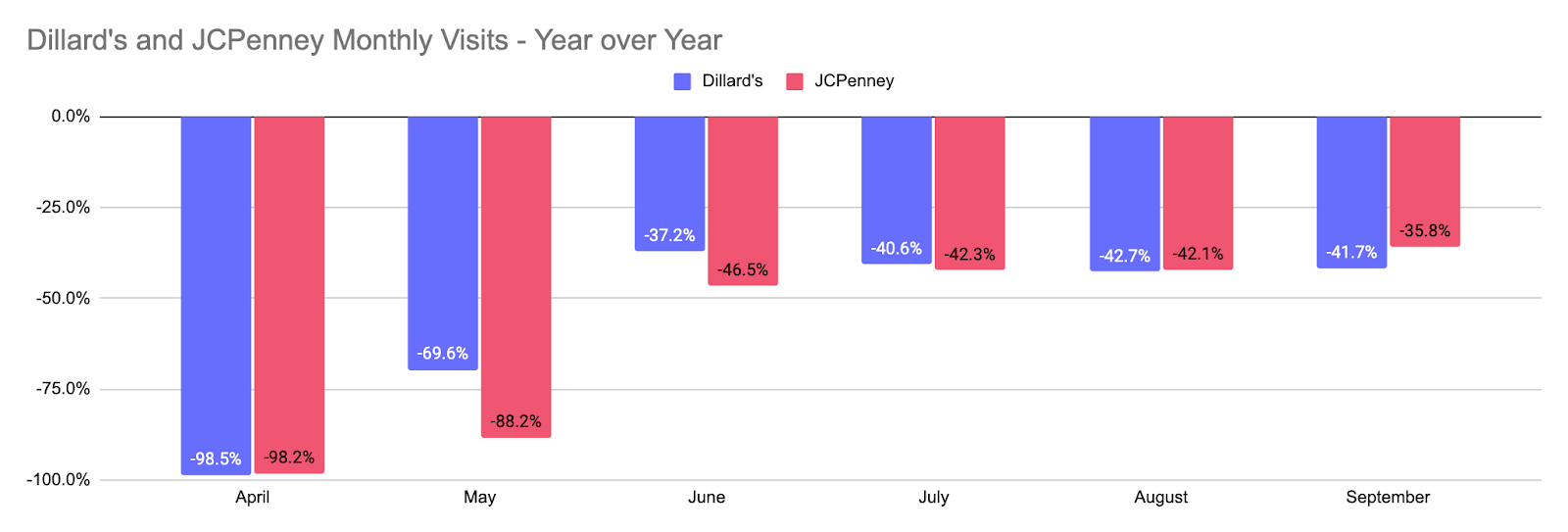

September produced a much-needed break from the stagnant traffic levels JCPenney had seen since the recovery kicked off in earnest for the brand in June. Visits were down 35.8% year over year, buoyed by Labor Day weekend, a welcome improvement over the three months prior when visits were down an average of 43.6%. Dillard’s, on the other hand, did not see a similar trend with visits taking a step back in recent months after reaching rates that were down just 37.2% in June. Instead August and September saw visit rates down 42.7% and 41.7% respectively.

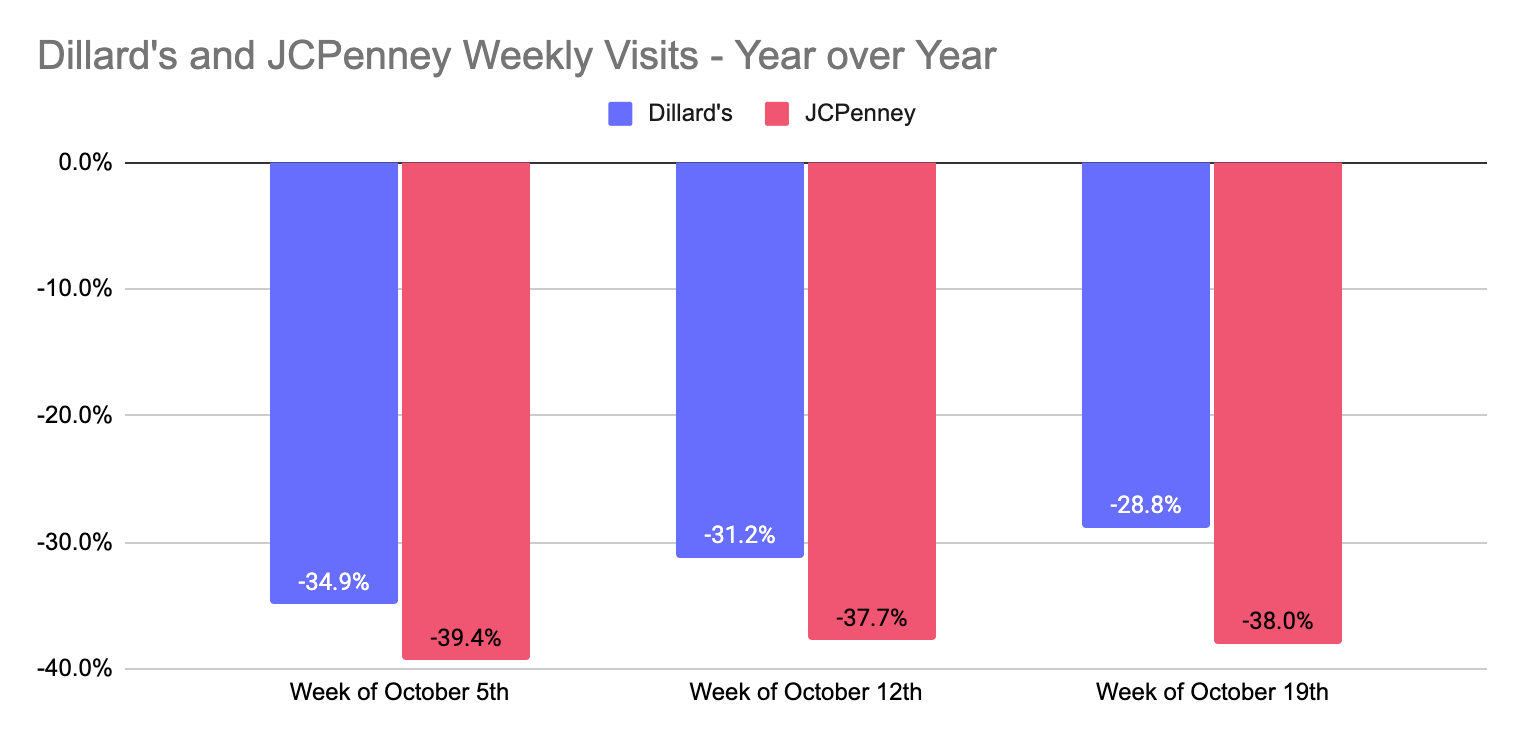

Yet, a significant turnaround does appear to be underway for the department brand. For the weeks beginning October 5th, 12th and 19th Dillard’s saw weekly visits down an average of 31.6% year over year. During this same period, JCPenney saw visits down an average of 38.4%, a step back from a Labor Day driven September, but still, progress on the summer months. And these positive results come at a critical time ahead of the holiday season.

Ross

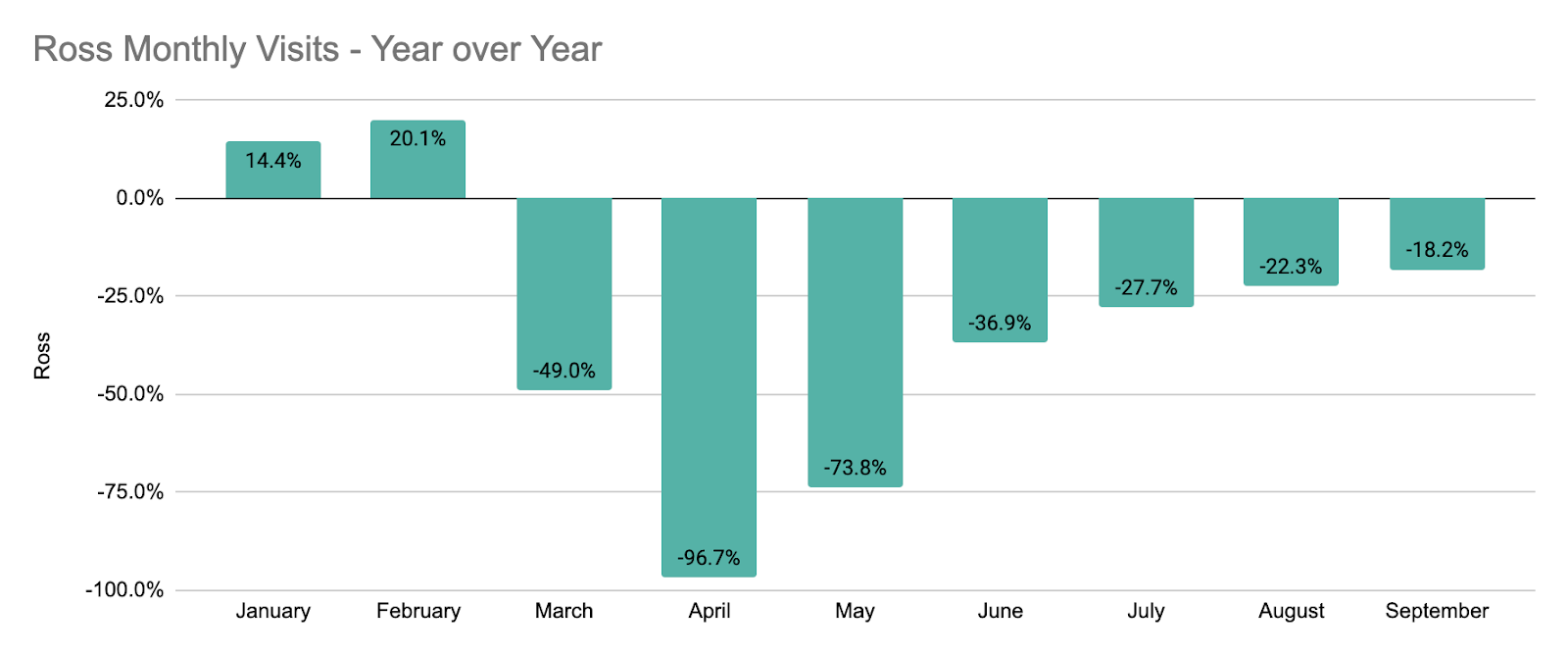

Ross Stores recently announced it would be expanding by over 3 dozen locations across the country. And this decision appears to make a tremendous amount of sense, even in the current retail environment. Visits to Ross locations have been steadily rising since traffic bottomed out in April as a result of COVID. Since that point, every month has seen steady traffic growth, with August and September seeing the visit gap decline to just 22.3% and 18.2% respectively.

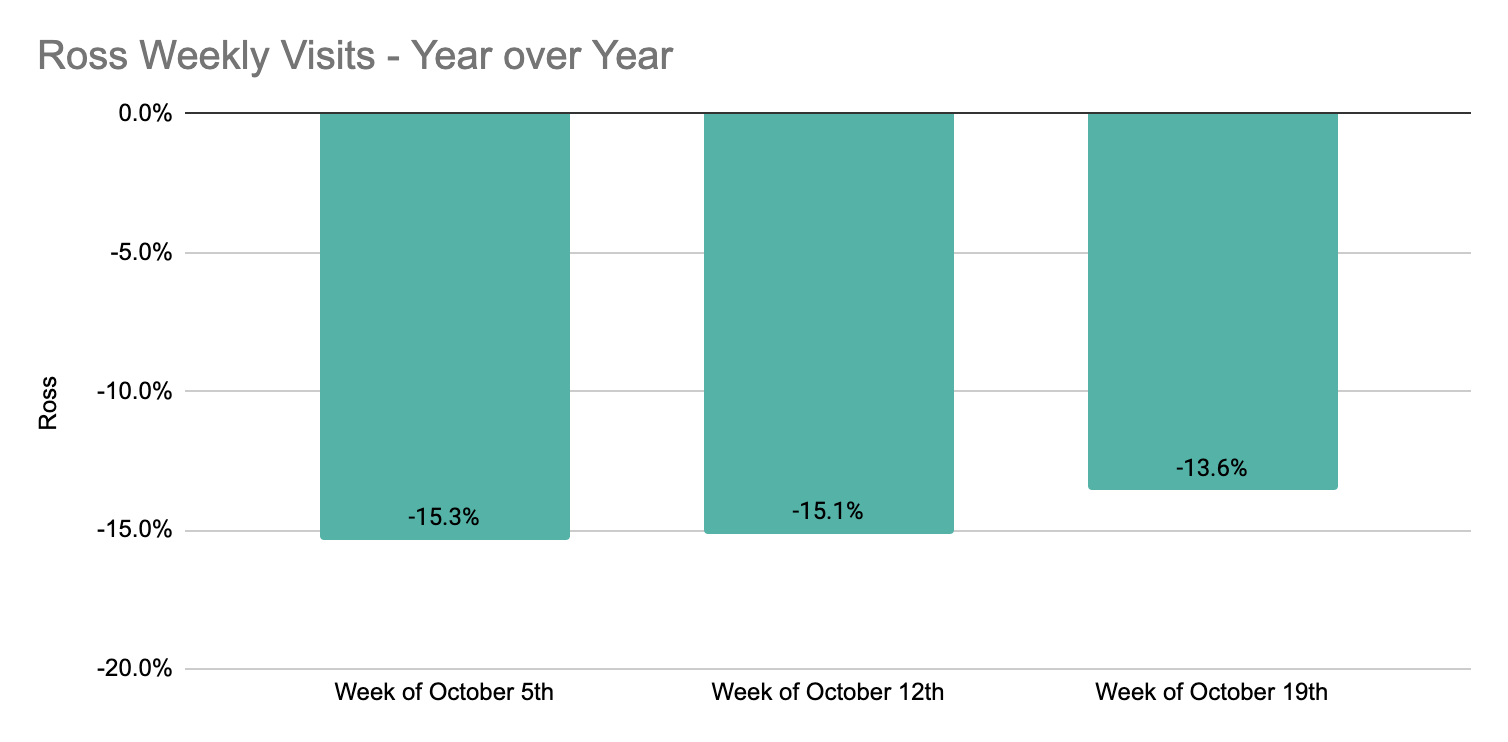

And critically, the pace does not appear to be slowing down. Ross visits were down an average of just 14.7% the weeks beginning October 5th, 12th, and 19th. This success, especially in a time of major difficulties in the wider apparel sector further deepens the faith that many off-price retailers have put in offline locations.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.