Welcome to the year 2020, a year where months behind lockdown saw border closures and reopening’s take place at the speed of lightning. Once the Northern Hemisphere summer arrived, people still desired to travel despite all the hurdles: quarantines, masks, negative Covid19 tests, and other political whims. Yet long-haul was deemed out of the question. So instead, campervanning became cool again, #staycation was the trending hashtag and crossing the closest border became a priority.

The Reality of Travel

International travel arrivals average globally at -93% in October with the worst affected region being the APAC down by 97%. No surprises there once you realise the complexity of international travel in the Age of the Corona.

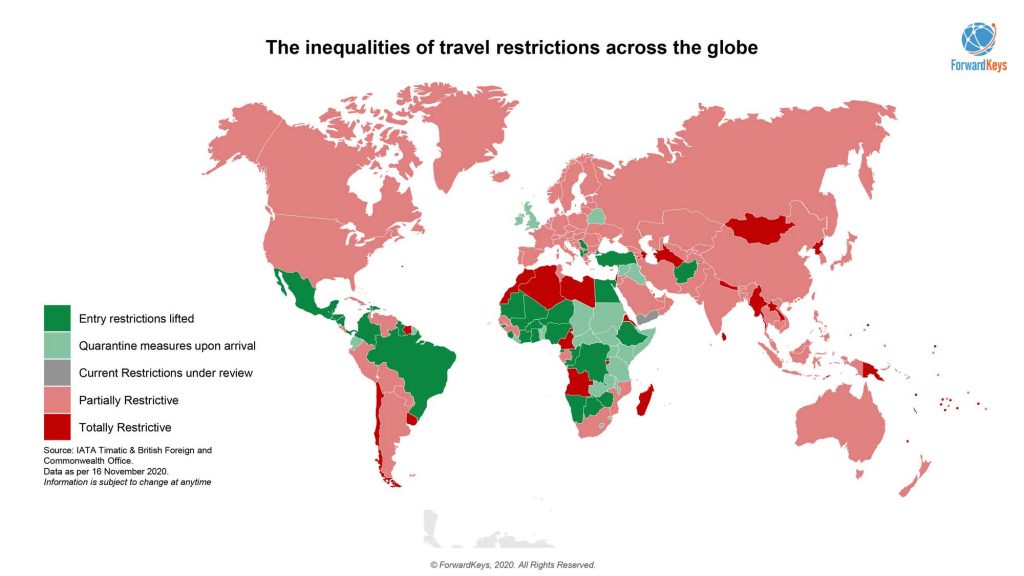

The graph above reveals just how complicated it is to get from A to B with some destinations re-opening their borders as is the case in South America, while others brace themselves or enter the 2nd wave of Covid-19 as is the case in Europe. Couple all this with the stress of connecting flights that may get cancelled mid-route or the introduction of a new travel rule – well, going on an adventure climbing Machu Pichu seems like a piece of cake in comparison!

The Rise of Domestic & Regional travel

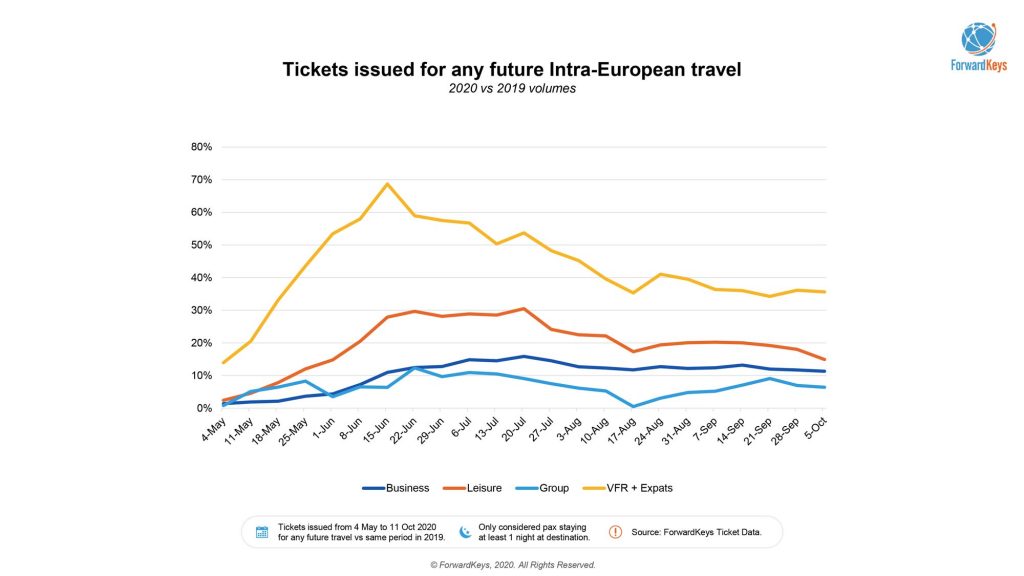

Since July 1, the analysts at ForwardKeys have observed the continual upward trend for intra-regional travel. The first instance took place during the European summer once countries such as Portugal, Spain and Greece re-opened their borders. Airlines hopped on the bandwagon and discounted fares from Ireland, Germany, and the Netherlands to further entice travellers to the warmer shores of the Mediterranean. Palma de Mallorca, Lisbon, and Heraklion all welcomed their European neighbours.

“In the graph below, not only can you see the weekly tickets issued for Intra-European travel compared to 2019 but our data can also show you which type of traveller is on the move: Visiting Friends & Family and Leisure,” says Olivier Ponti, VP of Insights at ForwardKeys.

The next regions to follow suit were Asia, Central and Latin America. Upon the October 15 announcement that a flight corridor was to be approved between Singapore and Hong Kong, flight searches for travel from Singapore to Hong Kong, which had been flat since the beginning of the COVID-19 crisis, soared to 50% of 2019 levels, while tickets issued jumped by 30%.

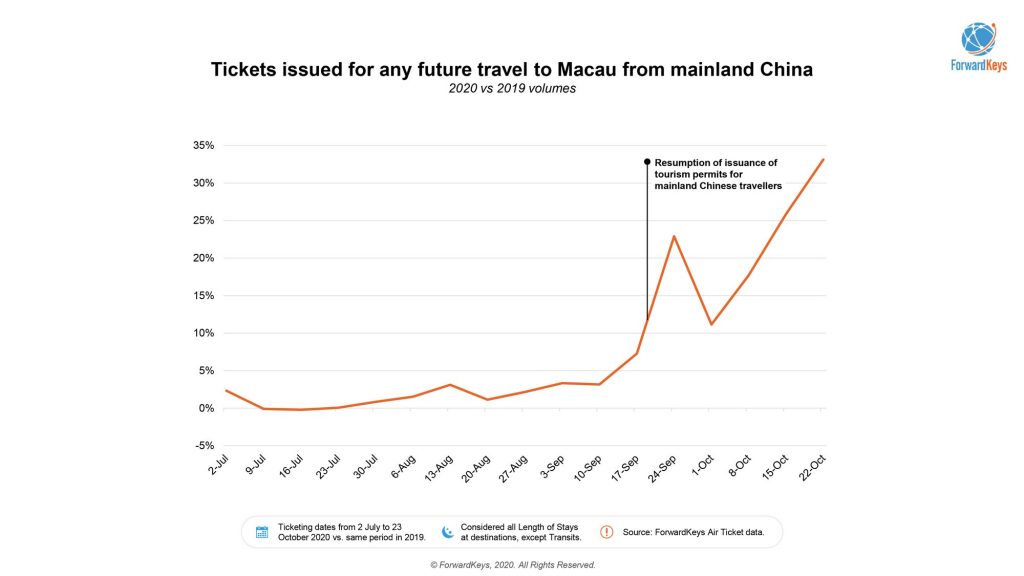

The one to watch is China to Macau. “The Macau government launched a USD 50 million spending stimulus scheme in September. Consumption vouchers have been distributed via the social media platform WeChat to boost mainland Chinese tourists; ticketing data shows a stable recovery in October for future travel. In the third week of October, issued tickets for mainland Chinese travel to Macau reached 67% of 2019 levels, with most being for travel in late October to mid-November,” says Ponti.

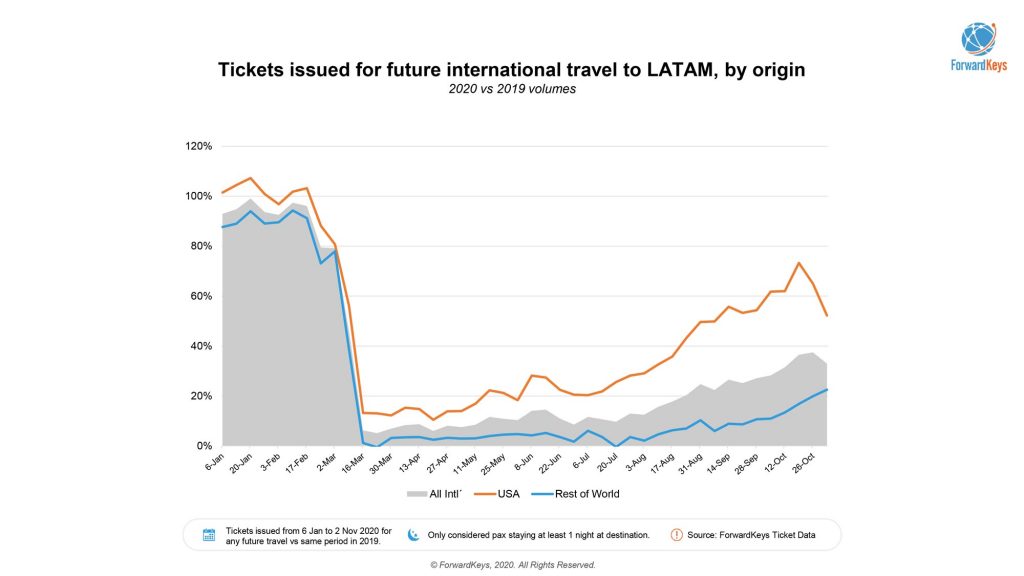

Meanwhile, Latin America and the Mayan Riviera have also seen some clear tale signs that the USA is one of their greatest source markets, miles ahead of the LATAM average. US travellers have been the main drivers behind reactivation and it will be interesting to see how this develops over time.

Mexico and Puerto Rico have been on a positive streak regarding visitors since September and in October in the top 10 most resilient cities it was led by Los Cabos (-34% YOY), Puerto Vallarta (-43% YOY) and San Juan (-52% YOY). Cancun was ranked number 7. All cities have been long time holiday favourites for US citizens with regular flights across America.

Brazil is also making a splash in the domestic travel segment since its Covid19 cases went back to zero and is another destination to watch.

“We are closely monitoring South America as the region is showing clears signs of reactivation following the reopening of several countries, including Chile, “adds Ponti excitedly.

The trend for domestic and regional travel is a reassuring one as it confirms that consumer demand for travel exists and has not perished due to the chaos the Covid19 pandemic unleashed on the world.

For travel and tourism to restart baby steps are required – first getting domestic travel off the ground, then getting regional flight agreements up in the air to finally, connecting the long-haul destinations more seamlessly and safely.

To learn more about the data behind this article and what ForwardKeys has to offer, visit http://forwardkeys.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.