Source: https://www.advan.us/blog.php

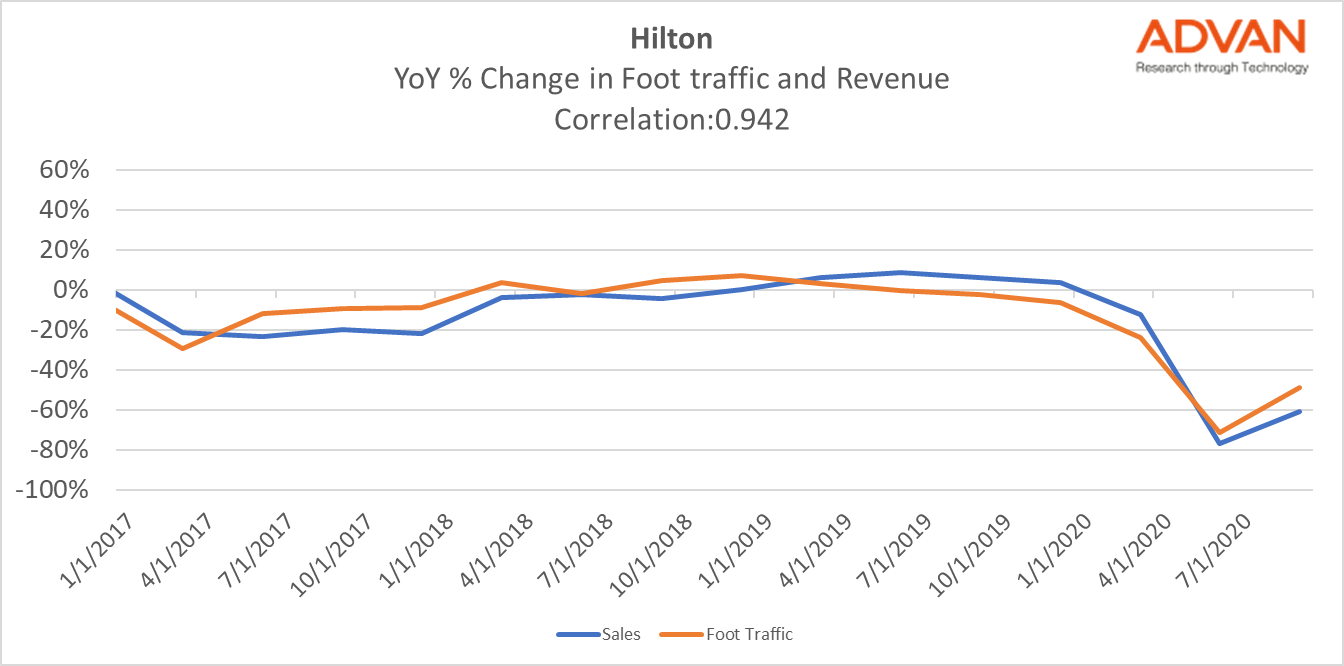

After months of travel restrictions and lockdown, there is some hope on the horizon for hotel chains such Hilton. Foot traffic is a very accurate measure of performance for hotels, as well as for cash-heavy businesses such as casinos.

For such type of companies tracking performance by transaction data is tricky, due to the fact that the booking date is different than the visit day and hotels have to book the revenue when the patrons visit the hotel, not when they book it (by GAAP standards). Rooms are typically booked in advance but can also be cancelled up to 48 hours in advance. Also, the common use of third party travel sites for booking rooms makes it difficult to allocate transactions to the correct hotel accurately

Mobility data based on visitors to a hotel provides very high confidence that a transaction has taken place and revenue will be captured.

Taking Hilton Group as an example, on a year-over-year basis foot traffic and revenue have consistently proven to have a correlation of almost 0.95. During the second quarter of this year both revenues and foot traffic for Hilton were down almost 80% compared to Q2 of 2019.

In Q3 both recovered steadily and were only 60% down year-on-year, offering hope that as mobility returns, revenues will do so as well.

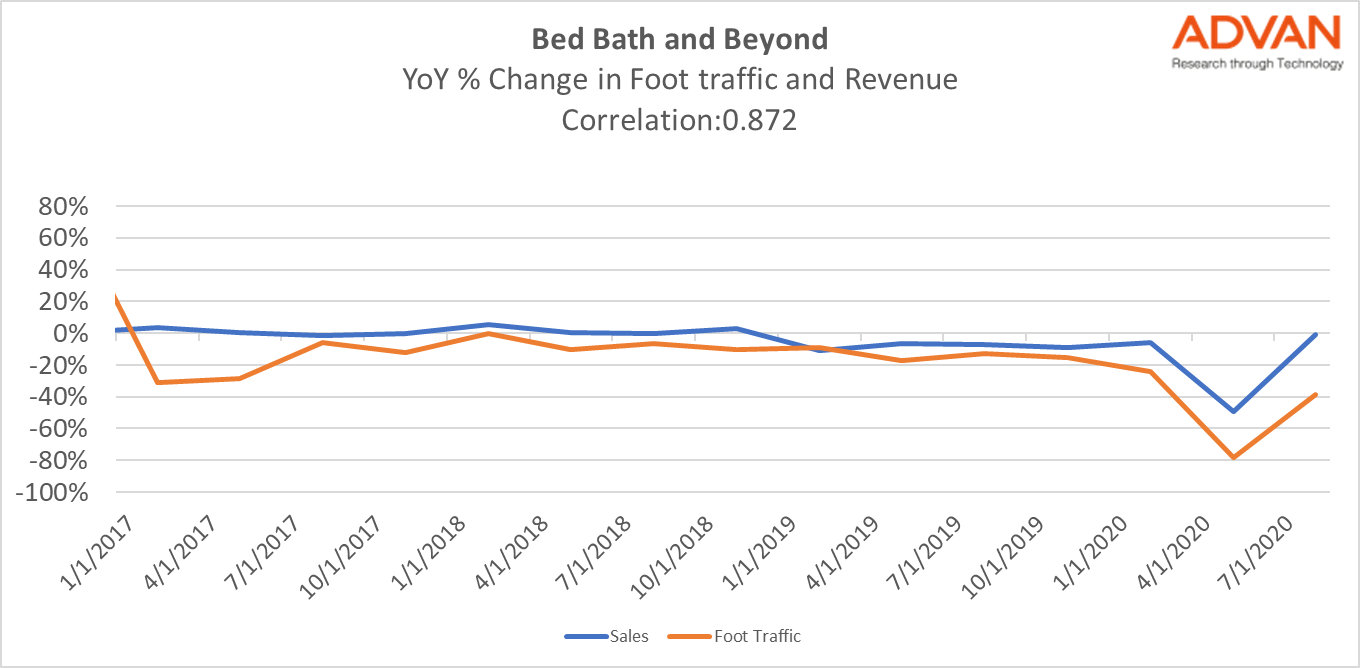

Another business that has shown a very close relationship between foot traffic and revenues is Bed, Bath & Beyond (BBBY). Year-over-year correlation between revenues and traffic to stores is almost 0.87. This suggests that customers to Bed, Bath & Beyond have a strong intention to buy when they visit a store.

Like many retailers, foot traffic at BBBY dropped to 80% below the previous year during the first phase of lockdowns in Q2. In the third quarter it rebounded to just 40% down year over year. Revenues were flat compared to the previous year, as the retailer also ramped up its online offering and curbside pick-up.

To learn more about the data behind this article and what Advan has to offer, visit https://advanresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.