Earnest Research First Choice Retailer Methodology

The Earnest First Choice Retailer Rankings are based on the credit and debit card spend of millions of de-identified U.S. consumers. Earnest identifies each shopper’s First Choice Retailer by comparing their spend across 1,164 retailers between Thanksgiving and Cyber Monday. For example, if Shopper A spent $70 at Amazon, $50 at Walmart, and $30 at Target, their First Choice Retailer would be Amazon. Below, Amazon’s number one ranking means more customers spent the largest percentage of their retail wallet at Amazon during the holiday shopping period between Black Friday and Cyber Monday in 2020 than at any other merchant.

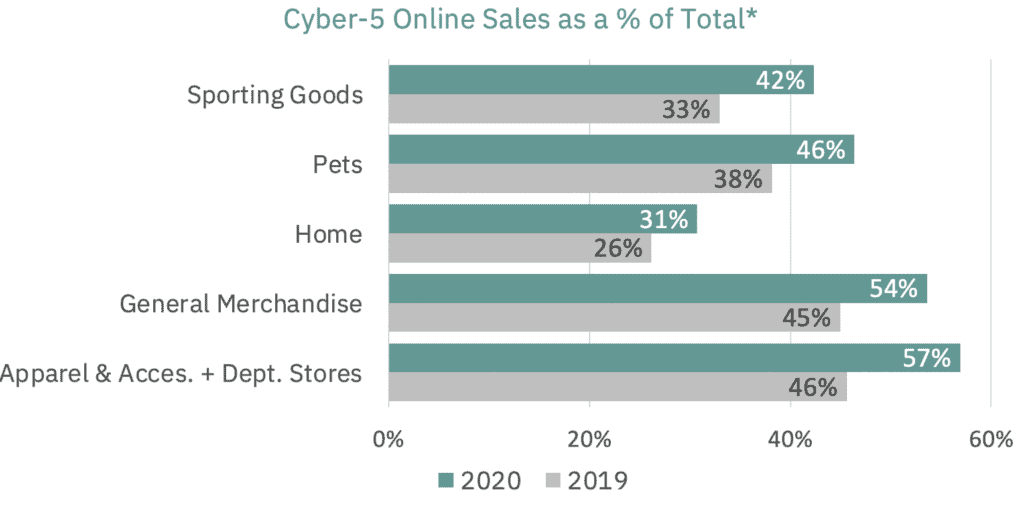

Shift to Online Across All Categories

Black Friday is traditionally associated with shoppers flocking to brick and mortar stores for blockbuster deals. However, this year online sales as a percentage of total purchases* surged, suggesting shoppers mostly stayed home. Notably, 57% of Apparel & Accessories and Department Store sales occurred online during the Thanksgiving shopping period ended the following Wednesday, up from 46% in 2019. Home transactions, including Home Improvement and Home Furnishings subcategories, remained the least likely purchases to be made online during the period.

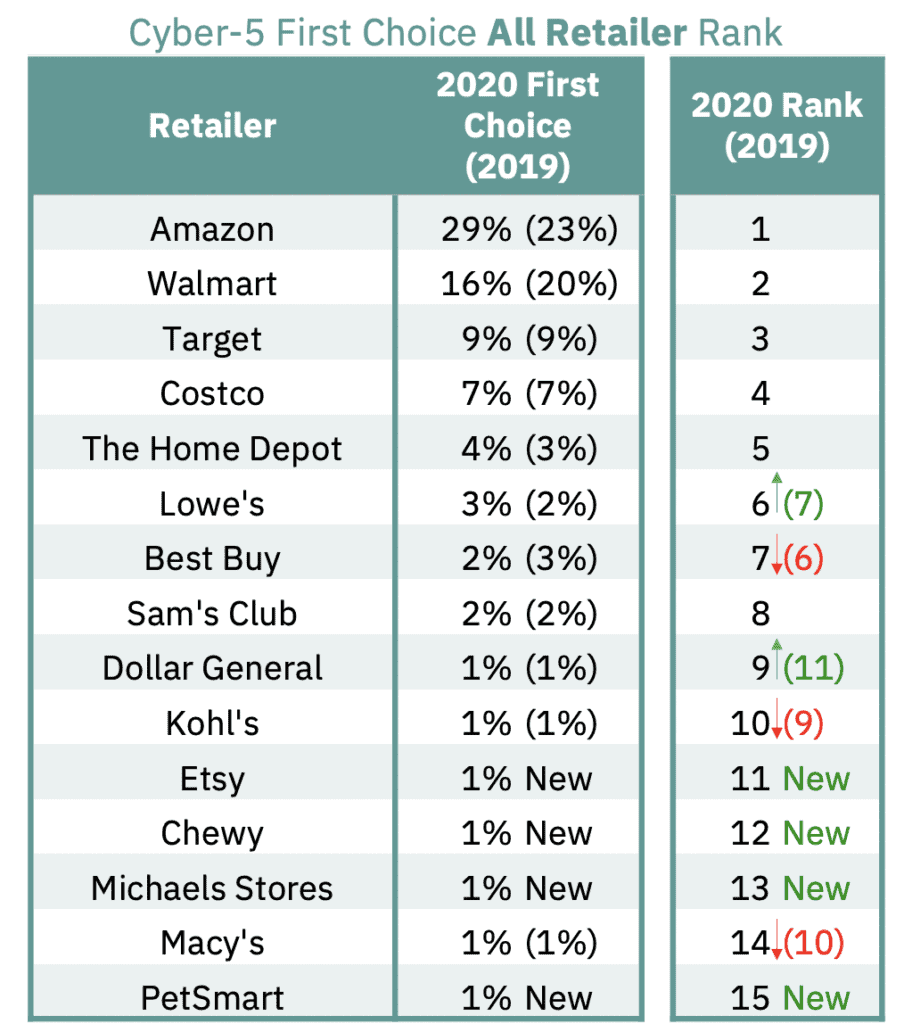

Amazon Consolidated its Position as US Consumers’ First Choice

Last year, Earnest reported that for the first time, Amazon topped Walmart as the First Choice Retailer among US consumers during the Thanksgiving to Cyber Monday shopping period. Amazon retained its position in consumer wallets, while Target, Costco, and Home Depot maintained their top-five First Choice Retailer rankings. Amazon also consolidated its position as the first choice for 29% of US consumers, up from 23% in 2019. Walmart remained the first choice for 16% of consumers.

Two online-only retailers, Etsy and Chewy, are new to the top-15 First Choice Retailer rankings in 2020, as are Michaels Stores, and Petsmart, replacing Old Navy, BJ’s Wholesale, Dick’s Sporting Goods, and T.J. Maxx. Also notable, Macy’s* dropped four places while Dollar General rose two.

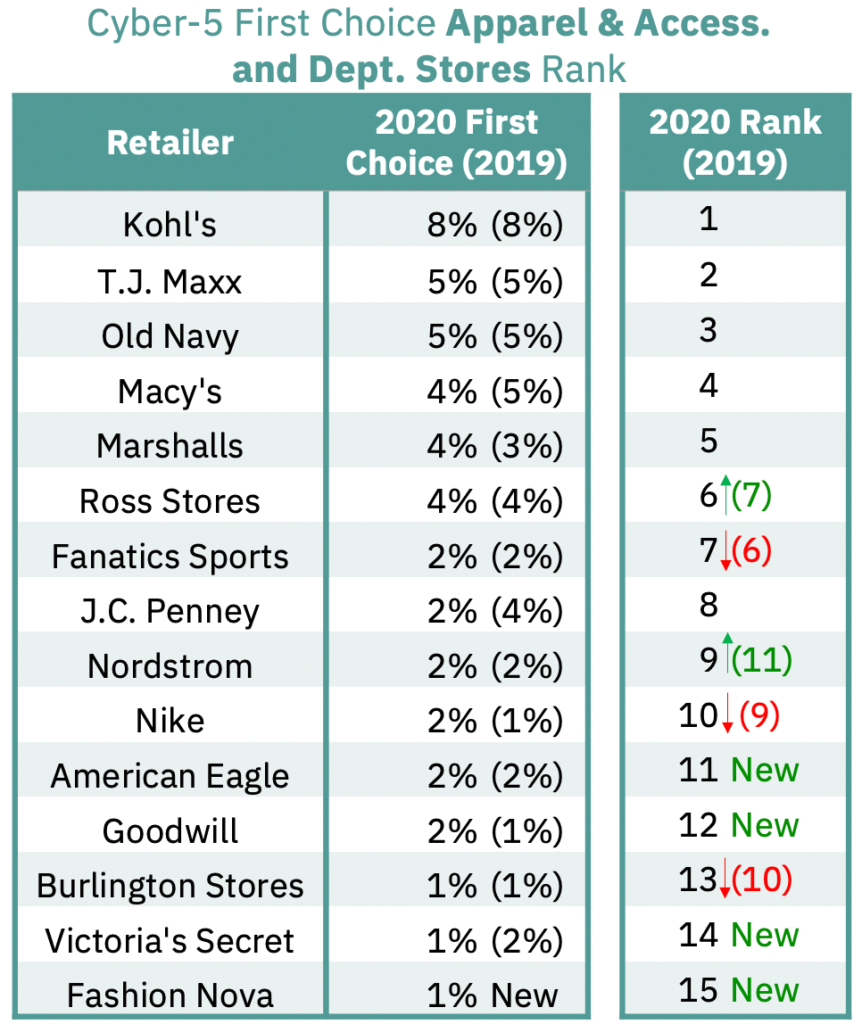

Apparel & Accessories and Department Stores: Kohl’s Stays on Top

Despite significant movement in the Apparel & Accessories and Department Stores rankings, Kohl’s retained its number 1 spot. T.J. Maxx displaced Old Navy for the number 2 spot. Mid-Tier and High-End Department Stores mostly fell from their previous year’s rankings (Macy’s, J.C. Penney, Nordstrom), while Off-Price mostly rose or retained their ranking. Online retailer Fashion Nova is new to the top-15 Apparel & Accessories and Department Stores list for 2020.

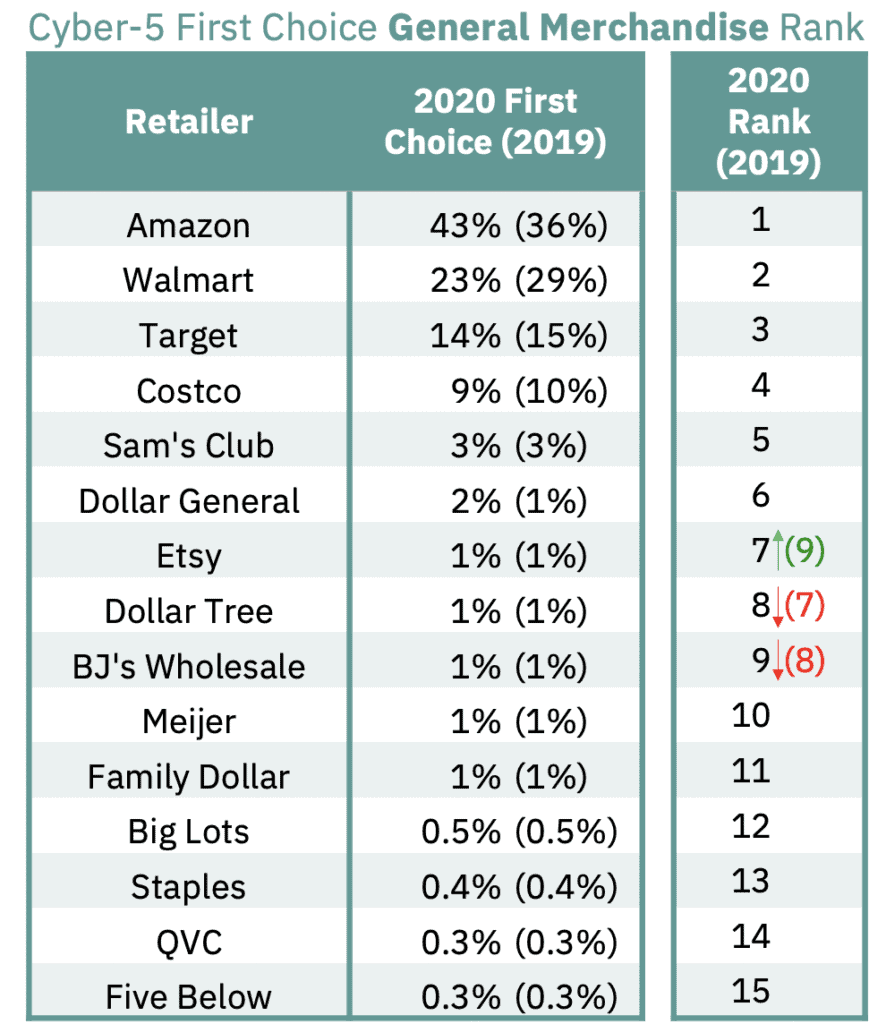

General Merchandise: Etsy Moves up the Rankings

Online marketplace Etsy moved up two rankings to number 7, displacing Dollar Tree and BJ’s Wholesale. Despite remaining largely unchanged, the General Merchandise rankings also showed consolidation of spend at Amazon, with all other top-15 retailers either maintaining or losing share.

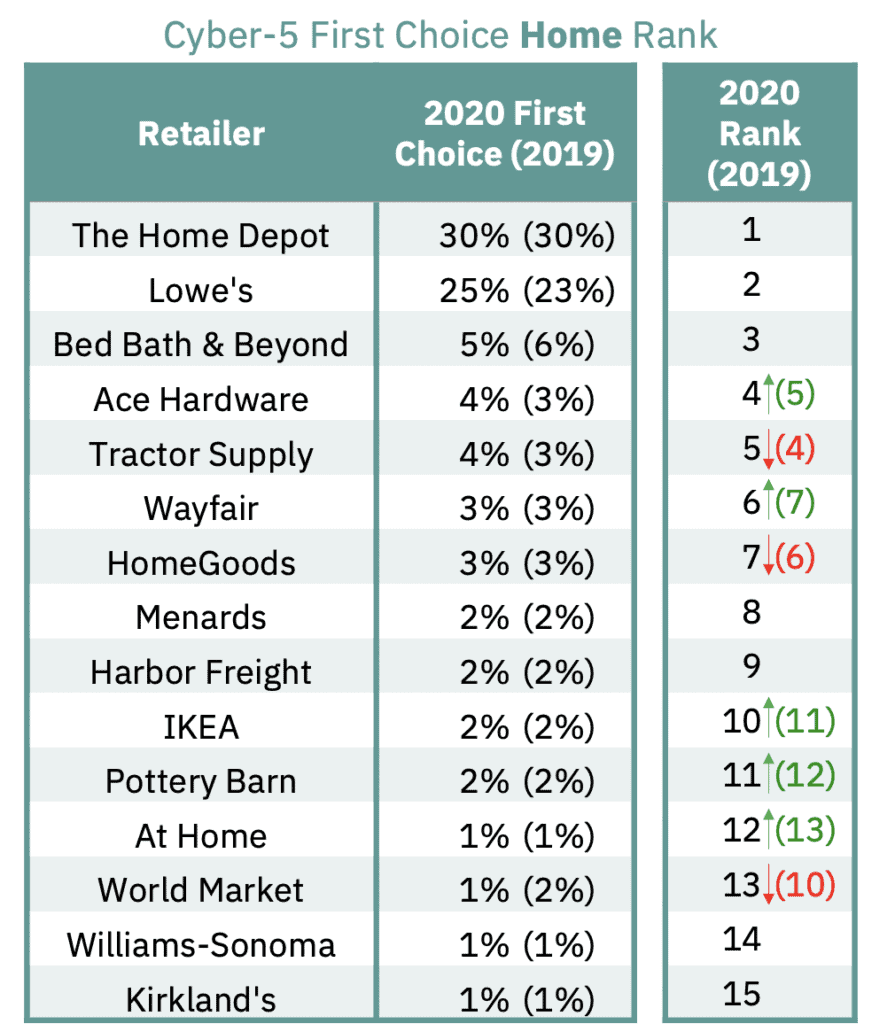

Home: Home Depot Holds Ranking, Lowe’s Grows First Choice

Home Depot remained the number one Home retailer among US consumers by staying at 30% of customers’ first choice. However, Lowe’s gained 3%, rising to 25% of customers’ first choice. This marks one of the rare instances of a category leader not strengthening its position as a first choice among customers this holiday season. Also noteworthy in the rankings was World Market losing three spots as other Home Furnishings names gained.

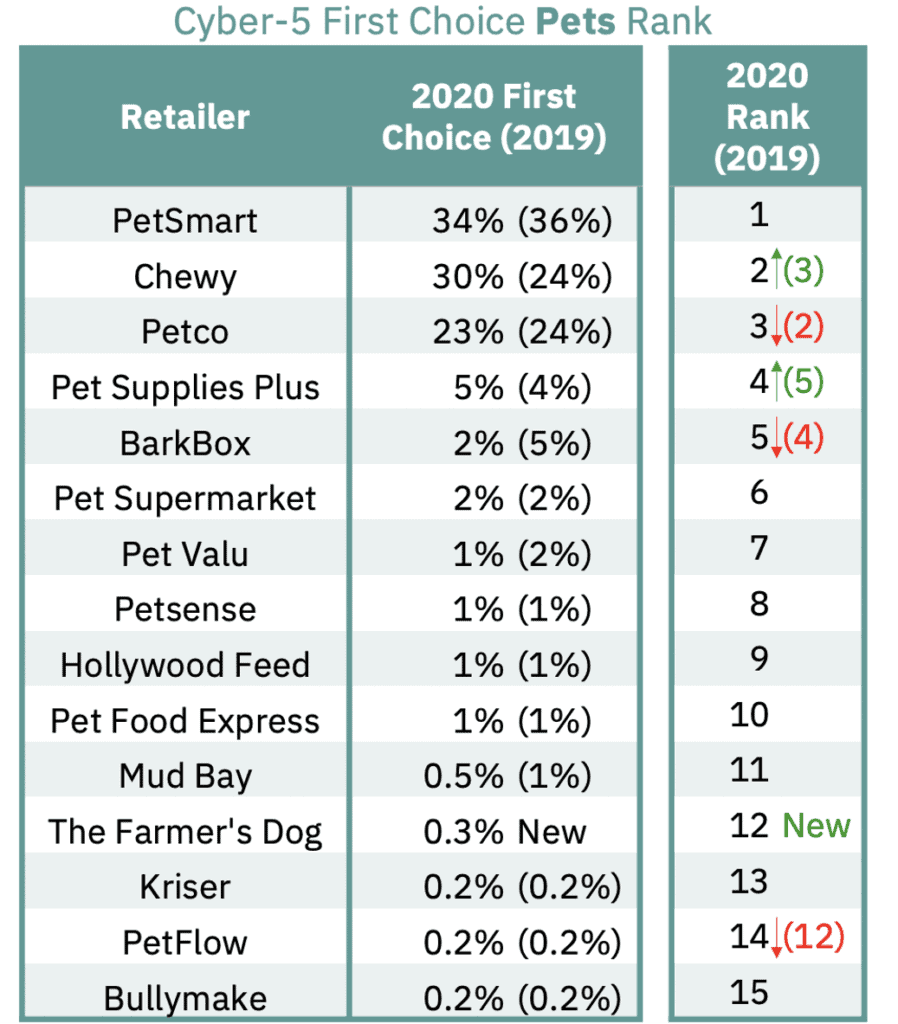

Pets: Chewy moves into Number Two Spot

PetSmart has led the Pets rankings for three consecutive years and remains on top. However, PetSmart’s online brand Chewy displaced Petco for number two, gaining 6 points of Pets category share to 30%. Online pet supply retailer The Farmer’s Dog is new to the list.

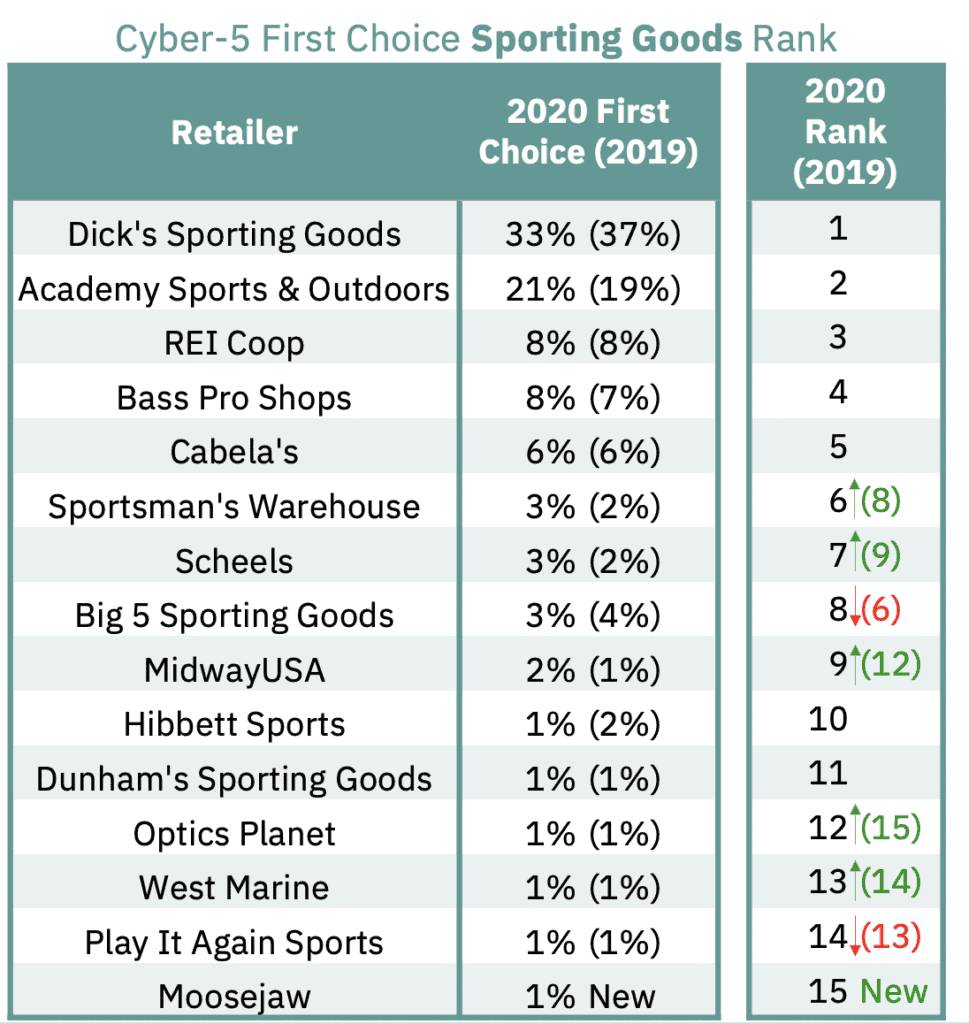

Sporting Goods: Dick’s Remains First, Hunting Retailers Gain

Dick’s Sporting Goods, Academy Sports, and REI rounded out the top three Sporting Goods retailers, unchanged from 2019. However, lower down the list, hunting and shooting focused retailers Sportsman’s Warehouse, MidwayUSA, and Optics Planet all gained. Modell’s, number seven from 2019, was removed due to its planned liquidation. Online outdoor retailer Moosejaw is new to the list.

Notes

All Retail: Active & Athleisure, Apparel Subscriptions, Children’s Apparel, Fast Fashion, Footwear, General Apparel, Intimate & Swimwear, Jewelry & Watches, Luggage & Bags, Luxury Apparel, Outdoor, Plus Size, Professional & Dress Attire, Specialty Apparel, Teen Apparel, High-End Department Stores, Mid-Tier Department Stores, Off-Price Department Stores, Audio Equipment, Computers & Tablets, General Electronics, Photo Equipment, Specialty Electronics, Big Box Retailers, Discount & Dollar Stores, Office Supplies, Online Marketplaces, Warehouse Clubs, Arts & Crafts, Music, Toys, Farm & Ranch, Garden & Outdoor, Home Furnishings, Home Improvement, Household Goods, Pet Supplies, Hunting & Fishing, Sports Gear.

Apparel & Access. and Dept Stores: Active & Athleisure, Apparel Subscriptions, Children’s Apparel, Fast Fashion, Footwear, General Apparel, Intimate & Swimwear, Jewelry & Watches, Luggage & Bags, Luxury Apparel, Outdoor, Plus Size, Professional & Dress Attire, Specialty Apparel, Teen Apparel, High-End Department Stores, Mid-Tier Department Stores, Off-Price Department Stores.

General Merchandise: Big Box Retailers, Discount & Dollar Stores, Office Supplies, Online Marketplaces, Warehouse Clubs.

Home: Farm & Ranch, Garden & Outdoor, Home Furnishings, Home Improvement, Household Goods.

Pets: Pet Supplies.

Sporting Goods: Hunting & Fishing, Sports Gear.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.