The COVID pandemic had a clear and demonstrable impact on the retail industry. But the biggest, and perhaps, most important challenge is discerning which of these trends are here to stay and which are short term phenomena limited to the realities and context of the pandemic itself.

We took a look at several key trends that defined retail in 2020 with a look at which ones will have staying power into 2021.

Long Term Trends

Long term trends are those that began before the pandemic, and while their pace may have been affected by COVID, there is little to suggest that the overall trajectory will be changed. In short, they were already happening and they will likely continue after the pandemic.

Reimagining the Shopping Center

When we think of some of the most affected retail sectors, few have felt the pandemic’s impact more than indoor malls. Looking at sixteen top-performing indoor malls around the country saw visits from the first 11 months of the year down 49.3% year over year. And these were high performing malls whose average year-over-year change from 2018 to 2019 was essentially flat with just a 0.4% decline.

The difference is even more significant when we consider just how strong 2020 had started off for this category, as the same malls saw visits in January and February that were up 7.2% year over year. And while overall visit numbers will likely rebound to the growth experienced at the start of the year. The overall experience is heading for a significant change. Key mall tenants, from department stores to beauty brands like Sephora are testing what outdoor locations could mean. But at the same time, product brands like Nike and DTC companies like Warby Parker are finding a growing value in the opportunities generated by malls.

So, what should we expect? Beyond seeing a return to the norm with visits, expect malls and shopping centers to continue seeing a significant shift in their tenant mix. From co-working spaces and fitness chains in malls to department stores and classic indoor retailers in strip centers, the cross overs that were already being seen in 2019 will likely pick up pace even more in 2021.

What’s best with this particular trend is that it will likely drive more success for more centers and malls. The differentiation created by such a change will enable a greater degree of diversity for customers limiting direct competition between centers and creating more complementary regional mixes.

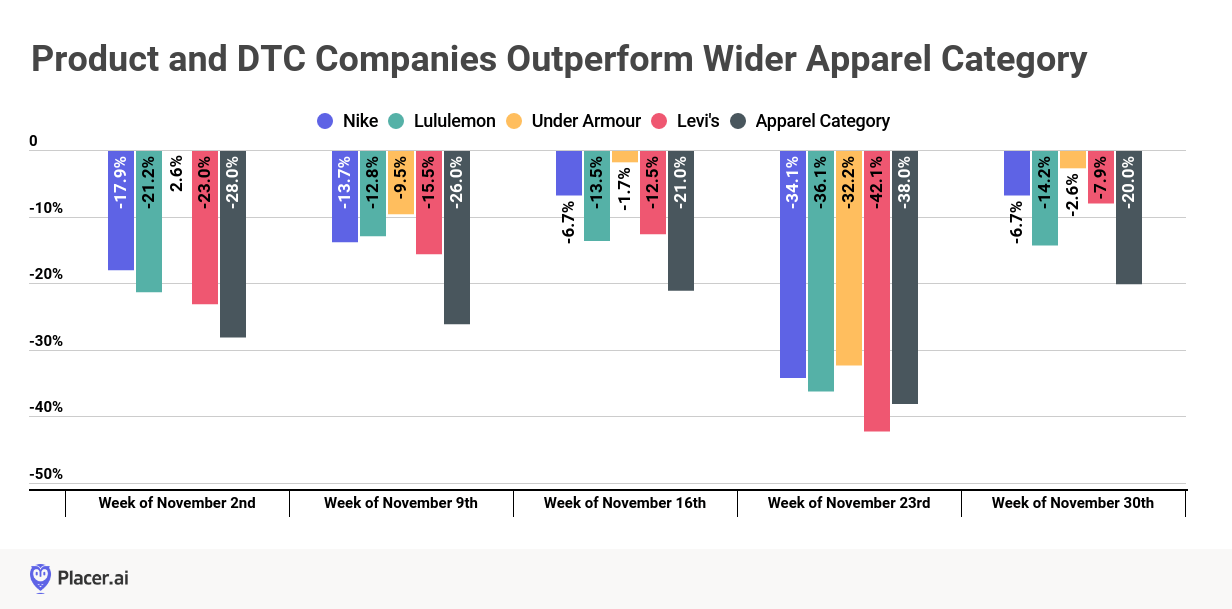

The Rise of DTC and Product Companies Offline

A key piece of the aforementioned trend is the continued rise of a significant type of offline retail player, the product or DTC brand. What they have in common is a sharper sense of self and more focused means of approaching the customer. Yet, for many, their strength in brand and proven digital acuity did not translate as effectively to offline as their approach ranged a spectrum between a sole devotion to wholesale channels and/or no offline presence at all.

Yet, that is changing fast. Nike, Levi’s, Lululemon, Allbirds, Everlane and many others are all expanding their offline reach in owned stores. Why? Because it allows them to pursue the potential of offline retail with a multi-pronged approach. Owned stores allow these companies to drive sales while doubling and tripling down on unique brand experiences, while simultaneously creating a more diverse distribution network reducing costs for delivery and returns. And these locations also provide huge marketing value as well especially when sites sit in major malls, shopping centers or high streets.

And this success alongside a confluence of other factors is likely to bring more similar players to the table. Whether it be Under Armour’s 2020 rebound, the struggle of department stores, a key channel for product brands, or the sense that mall and shopping center owners are willing to try newer types of agreements, it is clear that this trend is only going to pick up pace.

Caused by the Pandemic, Long Term Impact

The second class of trends found their starting point in the pandemic, but will likely last far beyond. In this case, the unique attributes of COVID-era behavior drove a change that may have clued many people into a better way of living.

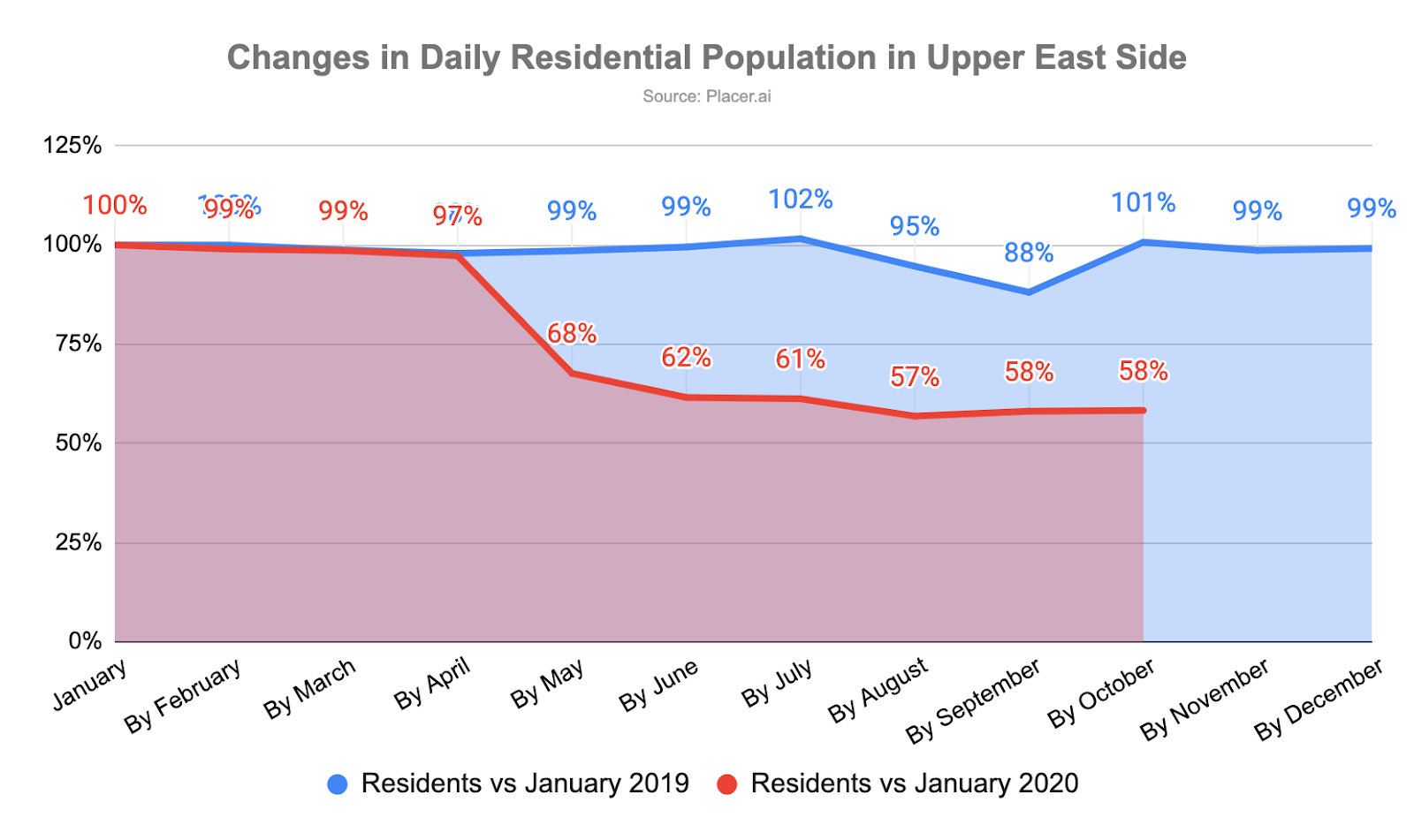

Suburban Revival

One of the defining trends of COVID’s aftermath will likely be the rise of the suburbs. Suburbs will never have the ‘cool’ factor that cities provide, but a combination of factors seem to be combining to create a real draw out of the urban sprawl. Firstly, the rules of work have changed with working from home moving from a fringe benefit to a daily necessity for many professionals. Secondly, with the exodus from major cities experienced across the country, more people have gotten a taste for added space. The Upper East Side of New York City, for example, has seen just 58% of its residents from the start of 2020 stick it out by October. Especially considering the ‘value’ that this space has compared to city living it is hard to imagine a scenario where all things return to ‘normal’.

This shift is obviously enormously consequential for office and residential real estate, but for retail as well. It means that a type of city resident that brands could previously reach in that urban environment has now moved elsewhere. This could lead to two different scenarios. In the first, brands that had previously reached this audience in the city will look into testing suburban formats in order to follow this target market as they move elsewhere. The second is that vacuums will be created that other brands can fill who already have a strong suburban orientation or presence.

The greatest likelihood is that it will be some combination of both, with certain retailers and restaurants looking to test different formats while others benefit from a new market that comes ‘available’.

Economic Uncertainty Drives Retail

While COVID may disappear, its effects in some areas will have a far longer reach. One perfect example is the economic consequences it created from job loss to underperformance to the struggles of small businesses. This trend of economic uncertainty, whose kick-off may have been the pandemic, will likely have effects that linger for years to come.

Even when COVID is a thing of the past, the ramifications of unemployment increases and shutdowns will be felt. And this means that brands oriented to this trend will likely succeed in 2021. So, who fits that description? Traditional grocers, a segment that performed well throughout COVID, will likely see their strength sustain as consumers forgo restaurant visits for home-cooked meals. Similarly, QSR brands like McDonald’s or Chick-fil-A who can provide high-value meals for that needed night out will also see strength. But even home improvement giants like Home Depot, Lowe’s and At Home could benefit. Much of their 2020 surge centered around our increasing time spent in the house, but it was also supported by economic uncertainty. Many individuals made the choice to upgrade their homes, whether via contractor or on their own, as opposed to looking to upgrade to a new home entirely. And this is a huge segment that ranges from the Tractor Supply’s of the world to Bed Bath & Beyond and HomeGoods.

Here Today, Gone Next Year

Few sentiments unify people as much as an overarching worldwide desire to see the days of COVID behind us. But with this return will come the end of several trends that defined retail in 2020. So which trends are likely to disappear?

Mission-Driven Shopping and Basket Size Spikes

Chief among the ‘doomed’ trends is the shift we saw to mission-driven shopping. Throughout the pandemic, visitors showed a proclivity for accomplishing as much as possible with a single visit. This gave a huge advantage to big box brands like Target, Walmart and Dollar General allowing them to not just drive visits during the pandemic, but to see major increases in basket size as well. In the case of Walmart, this actually offset declines in visits.

While these brands will likely be just as strong in 2021 as they were in 2020, it will likely not be the same factors that drive success. With a reduction of concern over COVID will likely come a return to the willingness to have multiple stops on a shopping trip. As a result visits will likely increase as visit duration averages drop to accommodate this return to ‘normalcy’. And although the retailers will likely still see strength in this renewed balance, CPG companies must have their finger on this particular pulse.

Many product brands have seen strength shift to different types of retail as a result of the pandemic, but that could quickly revert back. This will place a powerful demand on these brands to have an ongoing understanding of consumer visit patterns in order to best maximize their distribution and category management efforts.

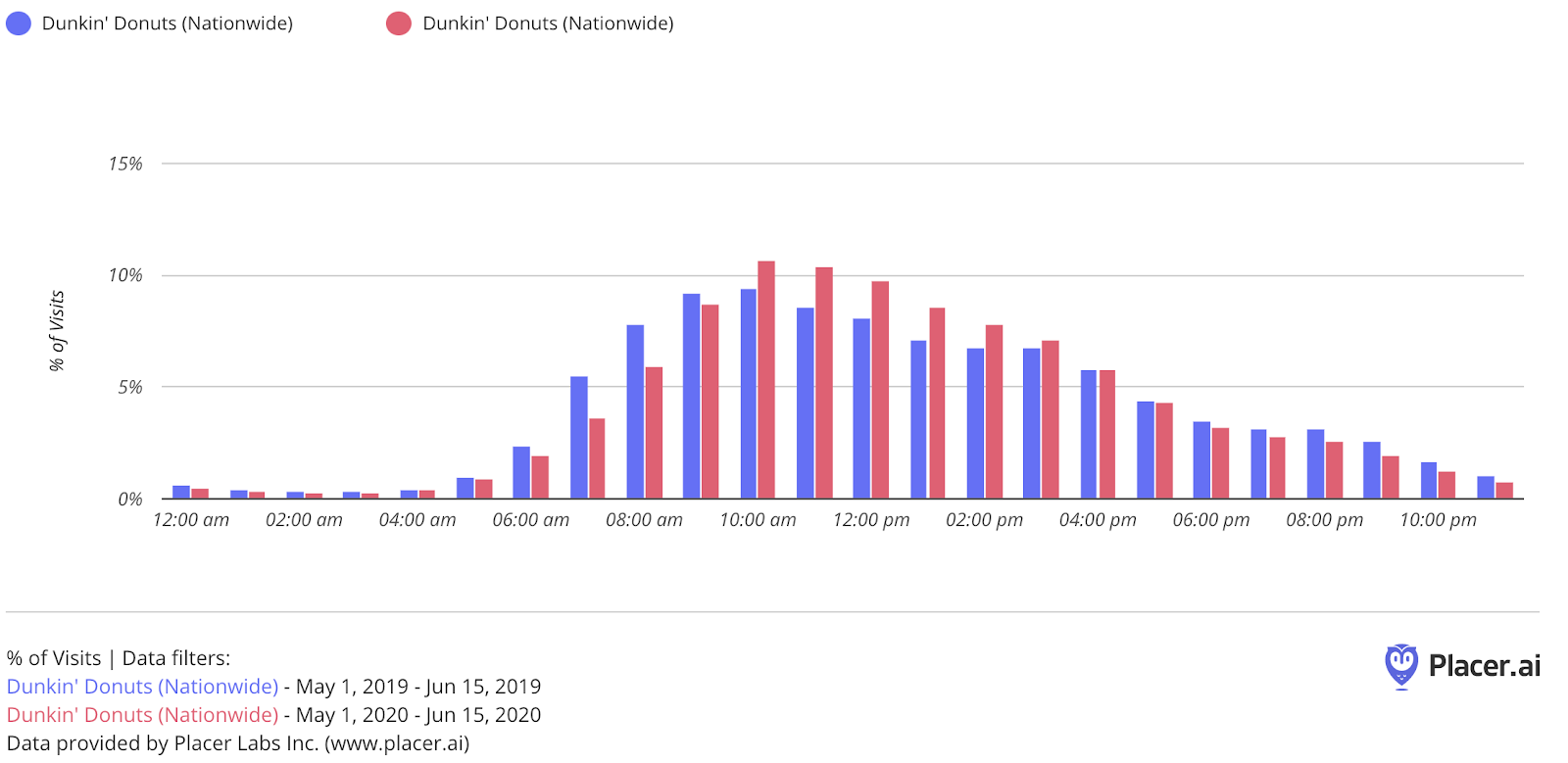

Breakfast Returns?

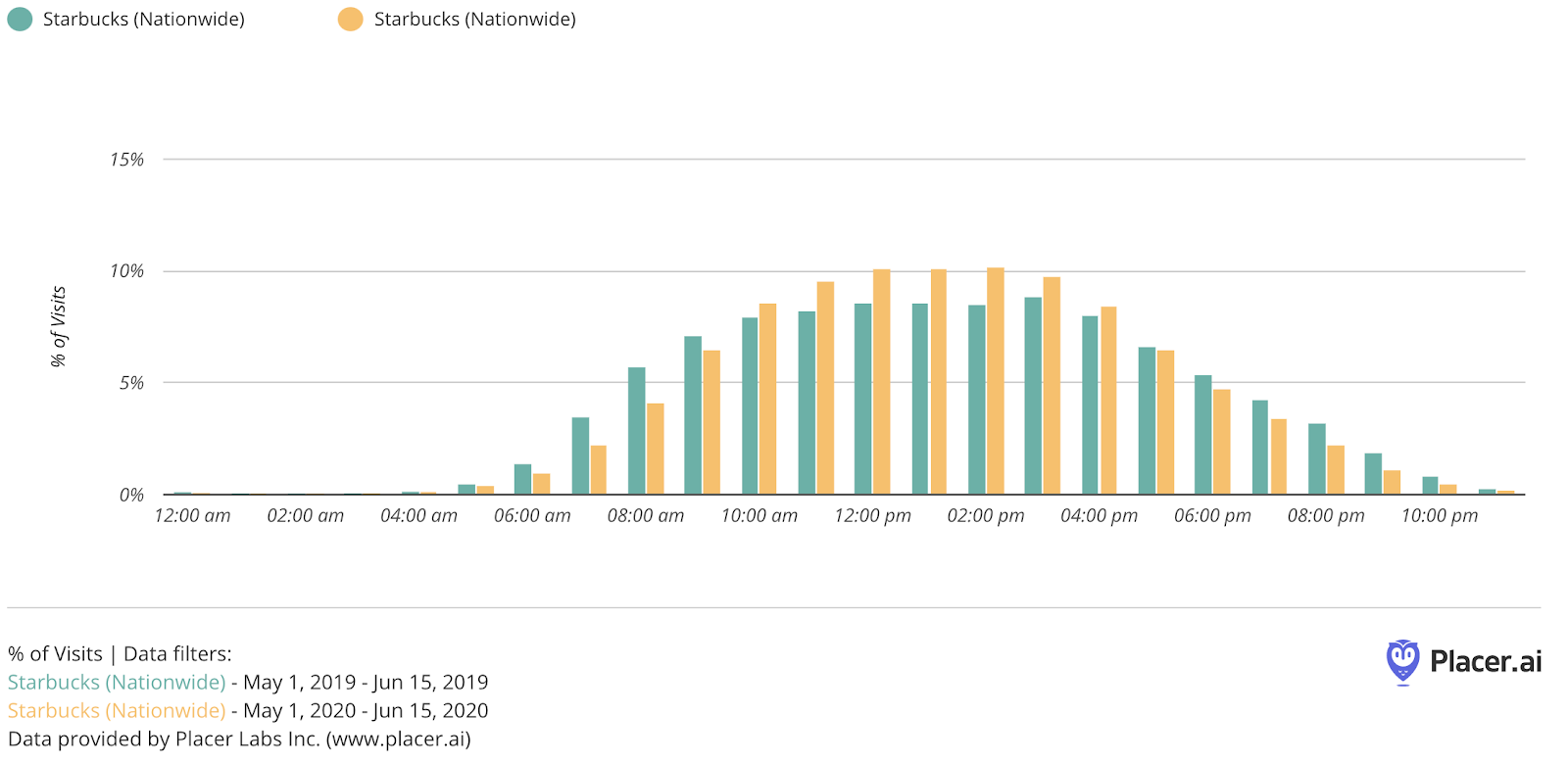

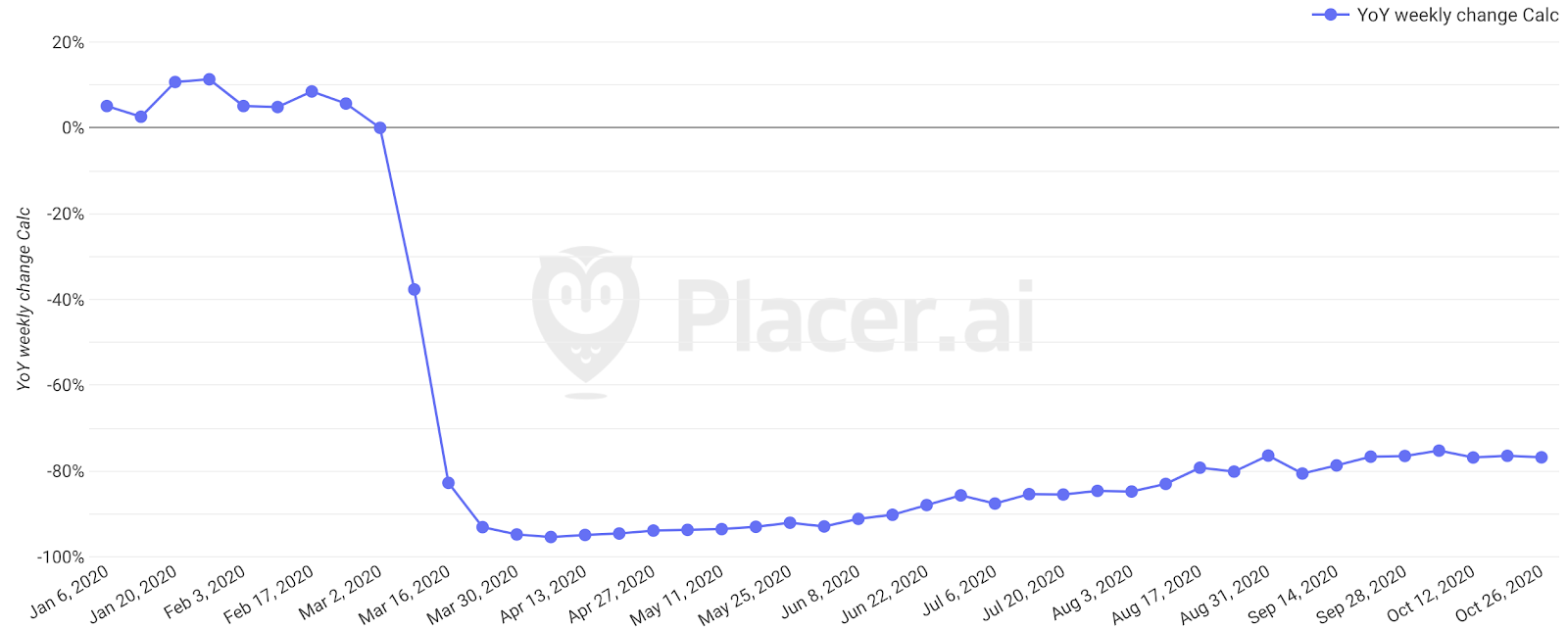

One of the less discussed victims of the pandemic has been the breakfast run to QSR brands like McDonald’s, Starbucks or Panera. The shift away from schools and normal commute routines meant that this particular time segment suffered at the expense of increases during lunch and dinner time.

With the greater return of commutes, work and school routines there should be an equivalent return of breakfast traffic, giving these QSR brands a boost. This is a further reason to believe that many QSR brands could see an exceptionally strong 2021 as the sector seems to be perfectly aligned with all key trends. On the one hand, they gain back morning visits while they remain aligned with economic uncertainty and will still benefit from their strength in takeaway and drive-thru.

With the greater return of commutes, work and school routines there should be an equivalent return of breakfast traffic, giving these QSR brands a boost. This is a further reason to believe that many QSR brands could see an exceptionally strong 2021 as the sector seems to be perfectly aligned with all key trends. On the one hand, they gain back morning visits while they remain aligned with economic uncertainty and will still benefit from their strength in takeaway and drive-thru.

Unknowns

Not all trends are created equally. While some seem destined to sustain and others seem guaranteed to disappear, there is another group defined by a big question mark. These trends were driven by the pandemic, have some staying power, but could easily revert back as well.

Full Work from Home?

Work from home quickly became a big part of the routine for many professionals, whether they liked it or not. And while the office is clearly not a thing of the past, the interaction with it may change substantially. Will most workplaces return full time to the office or will there be a greater balance between some days from home and some from a central workspace?

This shift will not only impact residential patterns, but retail ones as well. For example, if remote work becomes a greater piece of the puzzle do we see more companies offer ‘co-working’ opportunities giving a boost to brands like Industrious and WeWork within suburban malls and shopping centers? Could brands that combine coffee, lunch and WiFi, like Starbucks or Panera, see a boost from work-from-home patrons who need a few hours outside of the homestead on a more regular basis? These unknowns could have major implications on the several sectors and bear close monitoring.

Daytime Grocery?

Grocery brands didn’t just see visit growth, but a fundamental shift in shopping behavior. More visitors showed their preference for the morning trip than in the past and it came alongside a jump in visit duration. Will this shift sustain?

Likely, but only with a smaller net impact. Professionals who are able to gain more flexibility on work from home could very likely continue to choose their ideal shopping time leading to longer visits and larger basket sizes in this specific space. Yet, the full flexibility currently on offer will likely be curbed by at least some return to office/home work balances.

Now What?

The trends discussed may seem logical and therefore obvious, but the reality is that they are anything but. Understanding these shifts, whether we correctly predicted their continuation or failed to recognize their true staying power will have very significant effects on shopping behaviors across a variety of retail sectors. And these effects will go beyond the retailers and shopping center owners, driving major consequences for CPG companies as well. Staying ahead of these trends, and others like it, could be the key to maximizing success in 2021.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.