Source: https://www.advan.us/blog.php

What a year it’s been! Few people will be sad to see it go and certainly here at Advan we are excited for what 2021 may bring.

To cap off the year, we’ve listed below what we think are 5 of the most interesting mobility trends in a year full of unexpected twists and turns. We look forward to more next year!

Wishing you a restful holiday season!

Advan’s Top 5 Mobility Trends of 2020

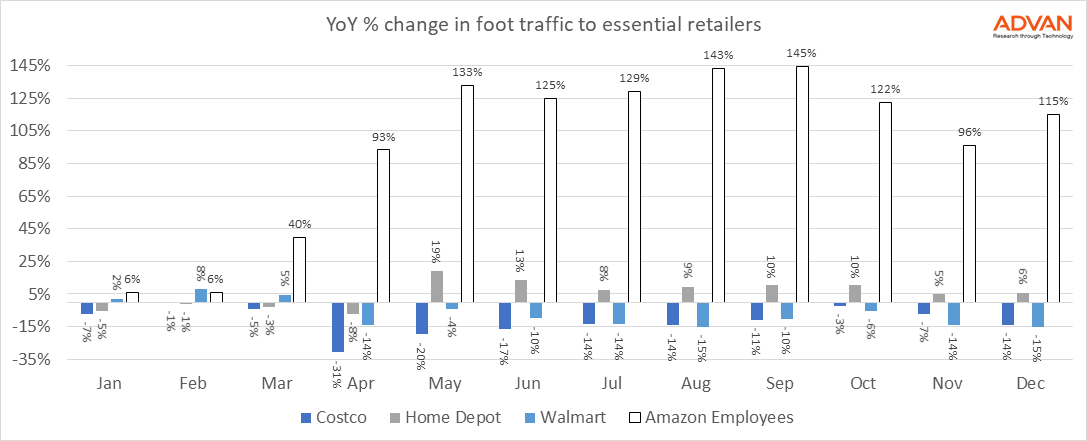

1. We learned the real definition of ‘essential’ retail: Costco, Walmart, Home

Depot and…Amazon!

From the very start of the pandemic as we all stocked up on canned goods and toilet paper, and much of the country went into lock-down, foot traffic data clearly showed that big box retailers would be early winners. Despite restricting the number of customers in stores - and the now familiar image of 6ft-spaced line-ups outside - visitor numbers to Walmart and Costco barely fell year-over-year. At its lowest, Costco foot traffic was down 31%. More surprising perhaps was the performance of home improvement retailers like Home Depot which, from May onwards, saw an increase in foot traffic compared to last year. But the clear winner was Amazon. As more shopping moved online, the number of employees at Amazon warehouses went through the roof - as did the company’s revenues, which were up 37% in the third quarter of 2020.

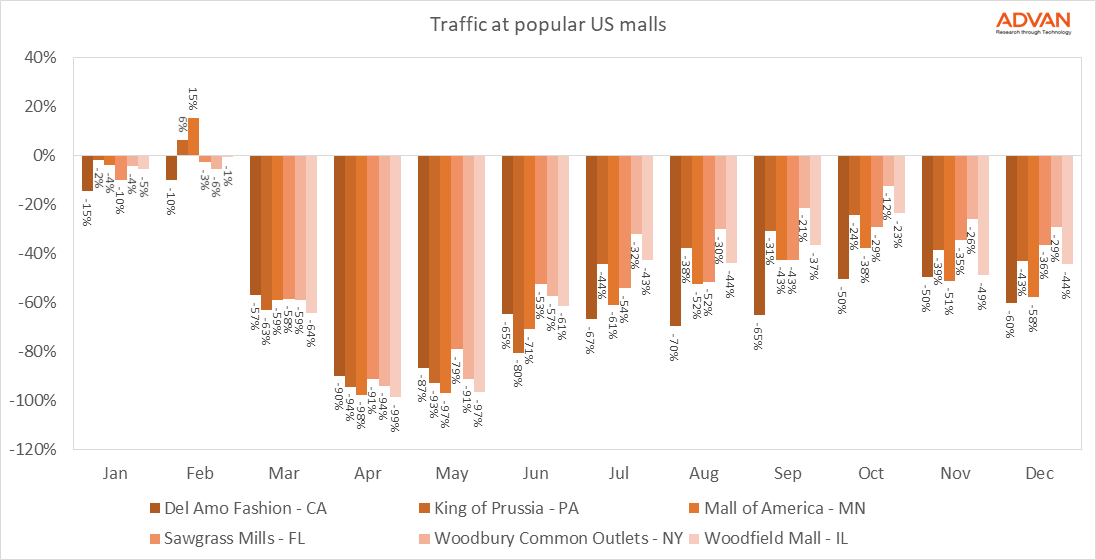

2. Despite what seemed like certain death, malls look set to fight another day

Even before the pandemic, stories were emerging about a bifurcation in the fate of malls. It was becoming apparent that top rated malls were gaining ground, with lower rated malls increasingly struggling to attract customers. During the early height of the pandemic, in April and May, no malls were spared. Traffic was uniformly down almost 100% at all locations. Yet, over the past several months, despite fluctuations in COVID case numbers and vast differences in regulation across states, we have seen a steady return of visitors to many popular malls in the US. In the Fall we saw foot traffic recovering substantially. In particular outdoor malls, such as Woodbury Common in New York, saw foot traffic rebound to just 12% below last year during October. So, while they are not out of the woods yet - traffic was down an average of 45% in December for the 6 malls we looked at - this represents a substantially more optimistic outlook than many hoped for 6 months ago.

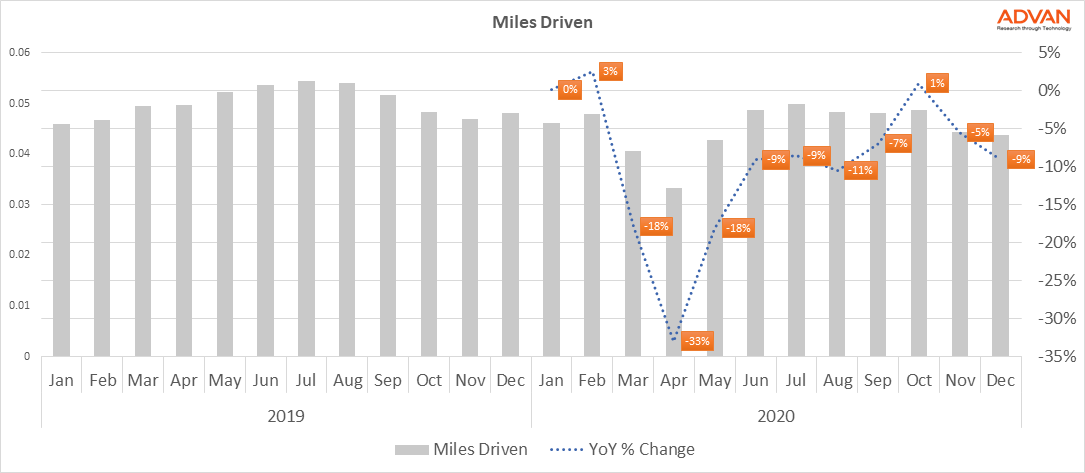

3. Even during the height of lockdown the number of miles driven by Americans hardly fell.

The Advan Miles Driven index is one of our favorite measures of human mobility. It has over 0.95 correlation with the Highways Administration estimate of miles driven. It’s used widely by macro traders as well as fundamental investors as an input for predicting demand for oil and gasoline prices. With an estimated 93% of US households owning a car, there should perhaps be little surprise at our dependency on motorized vehicles to get around. During the nadir in April, when most of the country was locked down, the average number of miles driven in the US was down 33% year-over-year. But this soon bounced back as restrictions imposed by lock-down were cancelled out by a reluctance to use public transportation. In December, miles driven were down just 9% compared to last year.

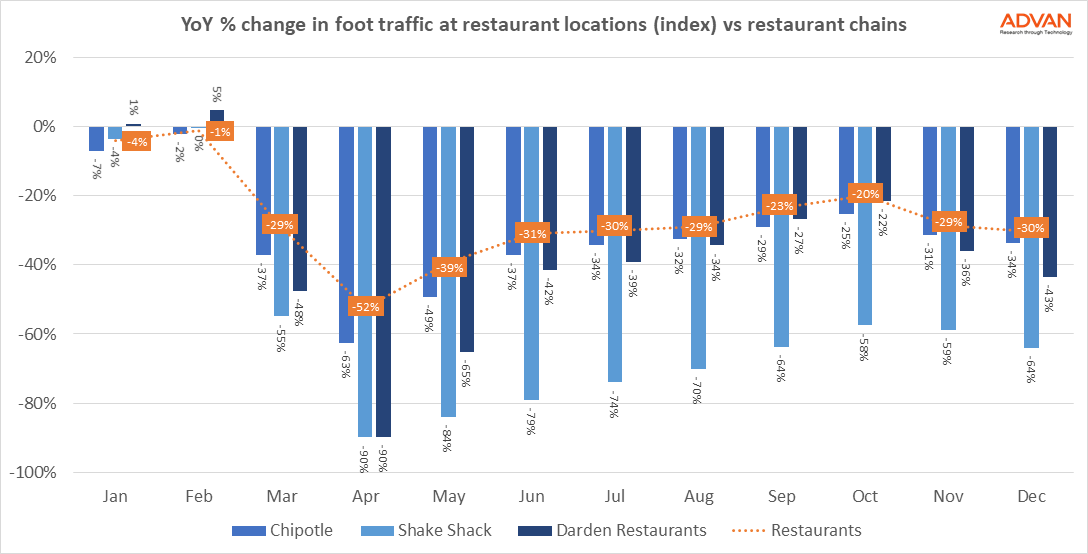

The restaurant sector was among the hardest hit but those that pivoted quickly showed greater resilience.

Many of us, when asked what we’ve missed most during the pandemic, will list having dinner or drinks out with friends among the things we most look forward to doing again. The restaurant sector has suffered more than most during the past several months. Fine dining has no doubt been the worst affected, with indoor dining all but halted or severely restricted. Yet among quick-service restaurants (QSR), those that were quick to pivot have seen some gratifying results. By making the most of patio space in the summer months, improving their online offerings, and developing easy and efficient curbside collection, chains such as Darden’s and Chipotle have managed to regain substantial foot traffic. Traffic at Chipotle was only down 34% in December, compared to 90% in April and 81% in May. Darden’s was down just 27% in September and 22% in October. Many of the changes made by the chains will hopefully carry them forward with renewed momentum as we head into the new year.

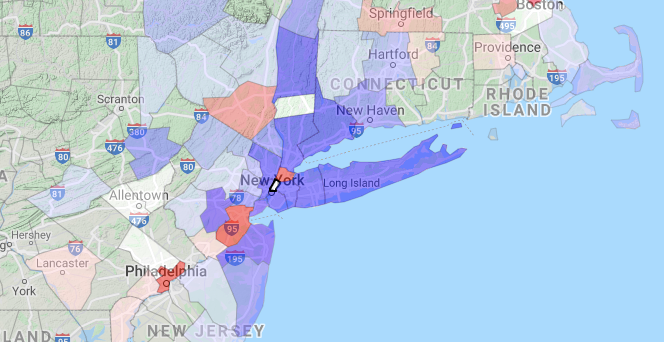

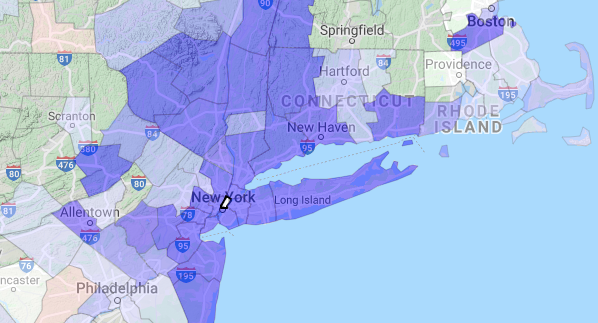

5. COVID resulted in significant migration out of New York City

Jan - Jul 2019

Jan - Jul 2020

In November we launched a new platform that enables easy and fast tracking of migration around the US. REPerspectives shows us how residential patterns are changing over time.

As one of the cities hit hardest by the virus, New York has seen a significant reversal in its typical migration trends. In the first 6 months of 2019, New York City (specifically Manhattan) saw a net outflow of just 2,860 people (essentially flat). During the same period of 2020 the net outflow was 56,280 with many Manhattanites who were now working from home and had the option to relocate, electing to leave the city. Time will tell whether this is a permanent trend or whether the Big Apple will prove to be the magnet it has always been.

As New Yorkers, we are optimistic that the allure of the Big Apple will return once the virus has been tamed. And that its restaurants, bars, stores and offices will be thronging with tourists and residents once again!

Wishing you happy holidays and a healthy and joyful new year!

To learn more about the data behind this article and what Advan has to offer, visit https://advanresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.