Based on transactions in January 2021, DoorDash leads in convenience store deliveries with 60% market share, ahead of goPuff (23%), Uber Eats (9%) and Instacart (4%).

Key Takeaways

2020 was a year of consolidation and convergence among top players in the on-demand delivery service market, and 2021 begins with even further expansion of these brands into new markets. Alongside increased consumer adoption of online grocery and food delivery sales we previously reported, the convenience store market is also poised for disruption amid Amazon’s plans to launch 3,000 cashierless Go Stores, grocers Whole Foods and Kroger testing convenience-style store formats, and popular convenience chains like Sheetz stating intentions to compete with both grocery stores and quick service restaurants.

The convenience store market size is expected to increase 5.5% in 2021, reaching an estimated $33 billion in revenue. As home delivery has become the norm following the COVID-19 pandemic, convenience store delivery is now also a growing sector alongside the on-demand food and grocery delivery markets. On April 1st, DoorDash started delivering from over 1,800 convenience stores nationwide, and 7-Eleven launched partnerships with both DoorDash and Postmates in late April. To understand which on-demand delivery services are growing the fastest within the convenience store industry, Edison Trends analyzed over 28,000 transactions in the U.S. from the top delivery apps.

_Convenience Stores Included in Analyses

_The convenience chains included in these analyses include: 7-Eleven, All In One Convenience Store, AMPM, Bartell Drugs, BP, Casey’s, Chevron, Circle K, CVS (front-of-store merchandise only/no pharmacy sales), DashMart, DJ’s Convenience Store, Duane Reade, Eddie’s Convenience Store, Exxon, GetGo, Hasty Market, Holiday Stationstore, Huck’s, Kinney Drugs, Kum & Go, Kwik Chek, Kwik Trip, Market on Demand, Maverik, Mini Mart Convenience Store, Minit Mart, Neighborhood, Convenience Store, QuickChek, QuikTrip, RaceTrac, Rite Aid, Royal Farms, Scotchman, Sheetz, Shell, Snack & Go, Speedway, The Convenience Store, United Pacific, Walgreens (front-of-store merchandise only/no pharmacy sales), and Wawa.

How did overall online spend change across food delivery, grocery, and convenience store sectors in the last year?

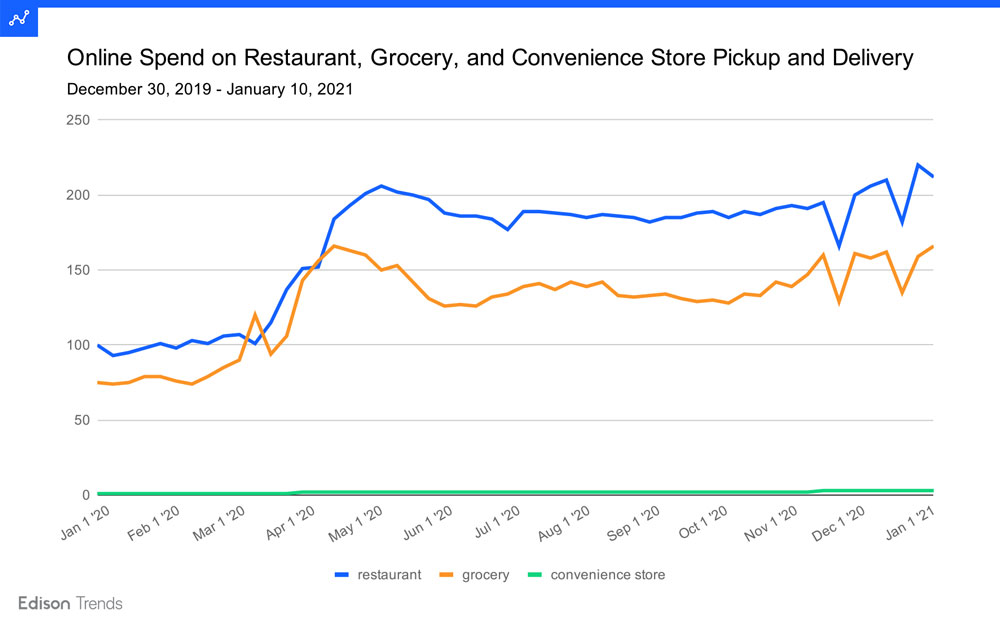

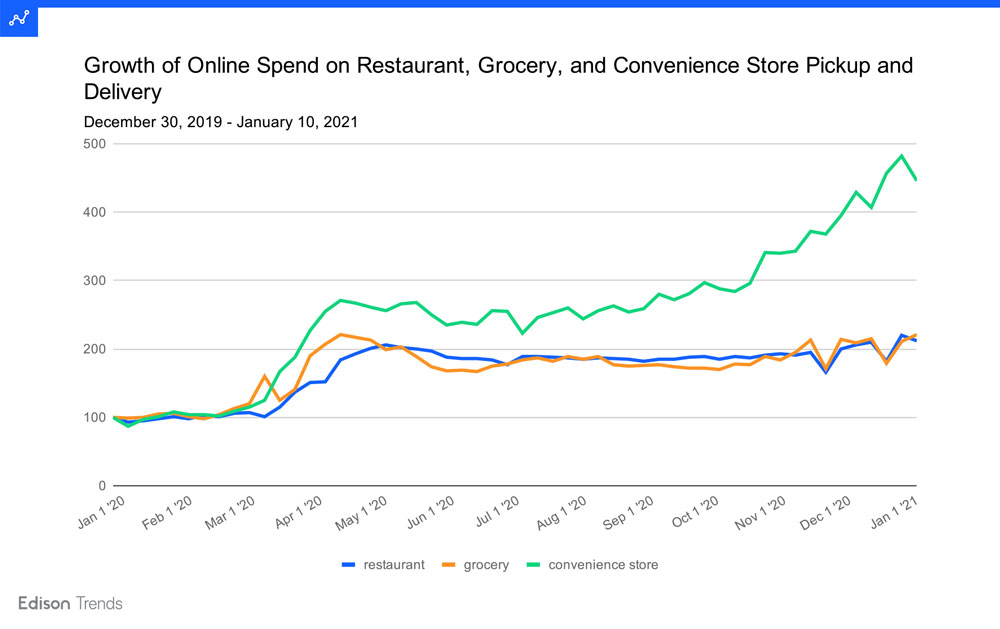

Figure 1a and 1b: Charts show estimated online spend compared and estimated growth of online spend compared across restaurant, grocery, and convenience store pickup and delivery transactions from December 30, 2019 - January 10, 2021, according to Edison Trends. This analysis is based on over 7,700,000 transactions. “Restaurant” includes 18 third-party services, 40 ordering platforms, and 75 restaurant websites. “Grocery” includes 36 grocery stores and ordering services, as well as Walmart, Sam’s Club, and Target. It does not include pickup orders direct from Target, but does include Shipt. “Convenience store” includes orders from 41 convenience and pharmacy stores through 18 third-party services and Instacart, as well as direct from goPuff, Casey’s, and 7-Eleven.

While overall online consumer spend on convenience stores is only a small percent of the volume that overall spend on restaurant and grocery respectively bring in, all three markets have showcased healthy growth over the course of the last year. Between the first week and the last week of 2020, convenience store online spending grew 4.46x, or a 346% increase, grocery grew 2.21x, or a 121% increase, and restaurant grew 2.12x, or a 112% increase.

Comparing how overall restaurant delivery sales and overall grocery delivery sales performed in 2019 vs. 2020 shows that customers spent 27% more on online restaurant purchases than they did on online grocery purchases in the four-week period starting December 30, 2019 vs. 33% more on restaurants than groceries in the four-week period starting December 14, 2020.

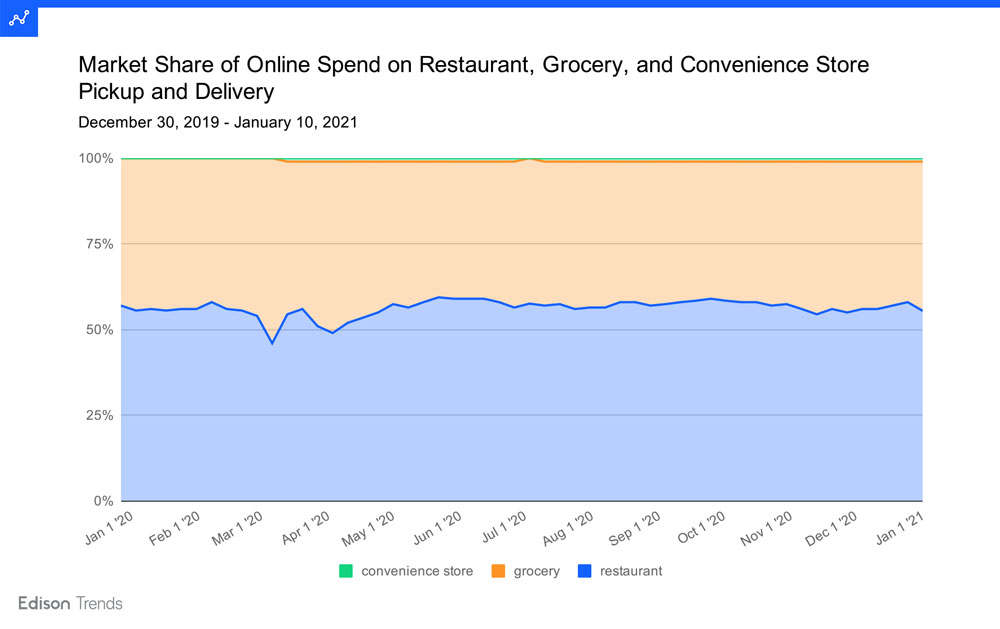

Figure 1c: Chart shows estimated market share of online spend on restaurant, grocery, and convenience store pickup and delivery transactions from December 30, 2019 - January 10, 2021, according to Edison Trends. This analysis is based on over 7,700,000 transactions. “Restaurant” includes 18 third-party services, 40 ordering platforms, and 75 restaurant websites. “Grocery” includes 36 grocery stores and ordering services, as well as Walmart, Sam’s Club, and Target. It does not include pickup orders direct from Target, but does include Shipt. “Convenience store” includes orders from 41 convenience and pharmacy stores through 18 third-party services and Instacart, as well as direct from goPuff, Casey’s, and 7-Eleven.

Looking at the money customers spent this year on online convenience store, grocery, and restaurant orders, restaurant orders took the majority. Restaurant share was 57% the first week of the year, and 56% as of the week of January 4th. Grocery started at 43%, and was at 44% the week of the 4th. Convenience store online sales, meanwhile, grew to 1% share by the end of the year.

Which on-demand delivery platform has the highest market share of Convenience Store transactions across the USA?

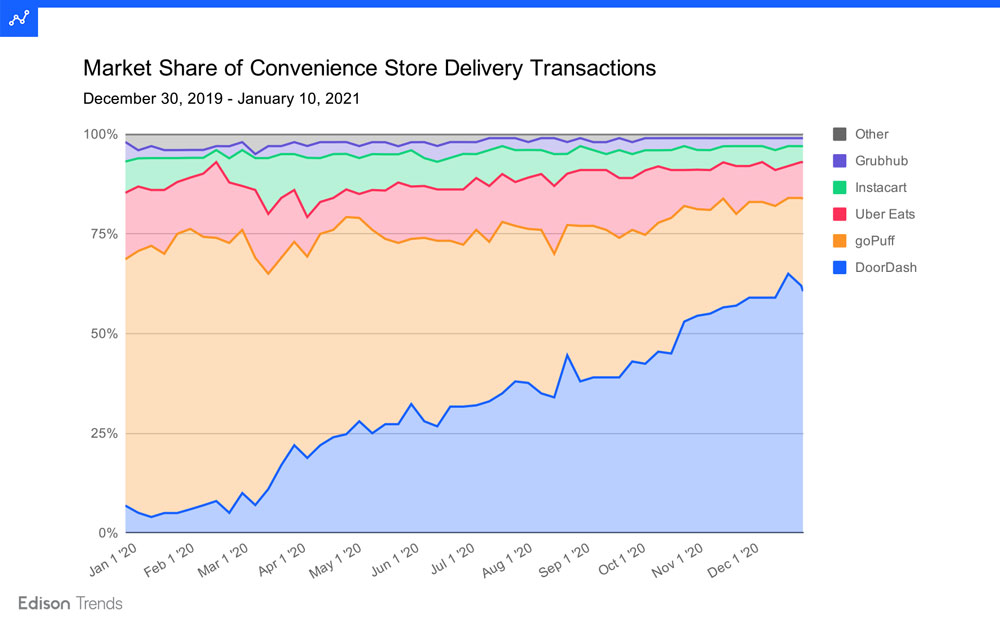

Figure 2a: Chart shows estimated market share of convenience store delivery transactions from December 30, 2019 - January 10, 2021 for Grubhub, Instacart, Uber Eats, goPuff, and DoorDash, according to Edison Trends. This analysis is based on over 45,000 transactions. DoorDash includes Caviar. Uber Eats includes Postmates. Grubhub includes Seamless, Eat24, Yelp, and Tapingo. “Other” includes NeighborFavor, Bite Squad, Delivery.com, Delivery Dudes, Ritual, and Fooda. Note: Due to rounding, numbers may not add to 100.

When it comes to convenience store transactions, DoorDash took the lead in market share for good in September 2020. Their growth had been rapid; in the first week of the year, they held 7% share, behind goPuff’s 63%. By the week of September 7, DoorDash’s share had climbed to 39% — a 32 percentage point increase.

As of the week of January 4, 2021, DoorDash’s share of convenience store transactions stood at 60%. Next-nearest competitor goPuff had 23%. Uber Eats had 9%, Instacart 4%, and Grubhub 2%.

Which on-demand delivery platform has the most market share of total consumer spend on convenience stores across the USA?

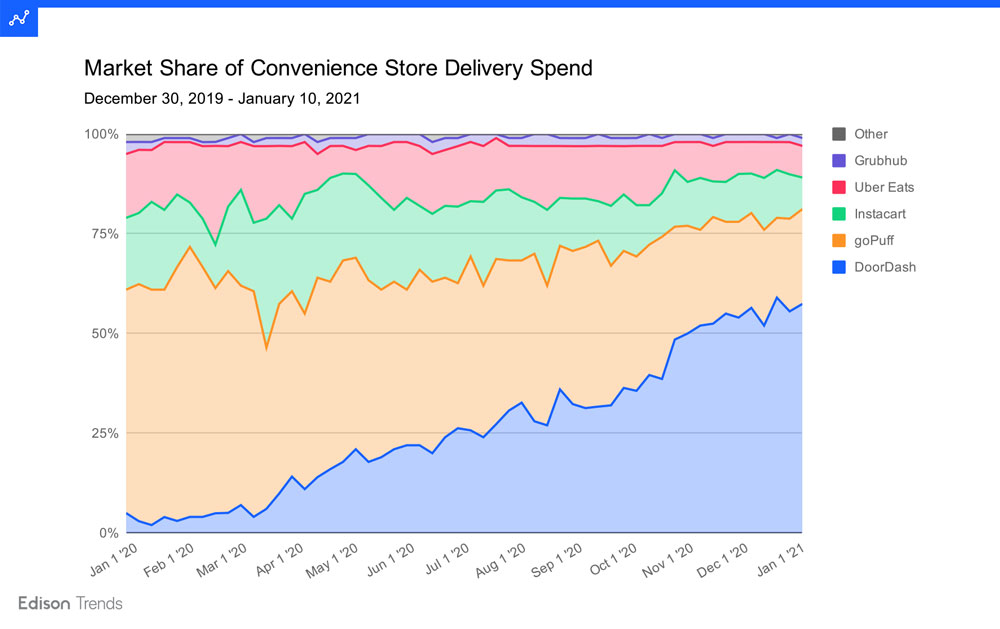

Figure 2b: Chart shows estimated market share of convenience store delivery spend from December 30, 2019 - January 10, 2021 for Grubhub, Instacart, Uber Eats, goPuff, and DoorDash, according to Edison Trends. This analysis is based on over 45,000 transactions. DoorDash includes Caviar. Uber Eats includes Postmates. Grubhub includes Seamless, Eat24, Yelp, and Tapingo. “Other” includes NeighborFavor, Bite Squad, Delivery.com, Delivery Dudes, Ritual, and Fooda. Note: Due to rounding, numbers may not add to 100.

Looking at market share of spend on convenience store transactions, DoorDash took the lead during the week of September 28, 2020. At the start of the year, their share had been 5%; by the week of September 28, it was 36% — a 31 percentage point gain.

As of the week of January 4, 2021, DoorDash’s share of spend on convenience store sales stood at 58%. goPuff had 24%, Instacart and Uber Eats each had 8%, and Grubhub had 2%.

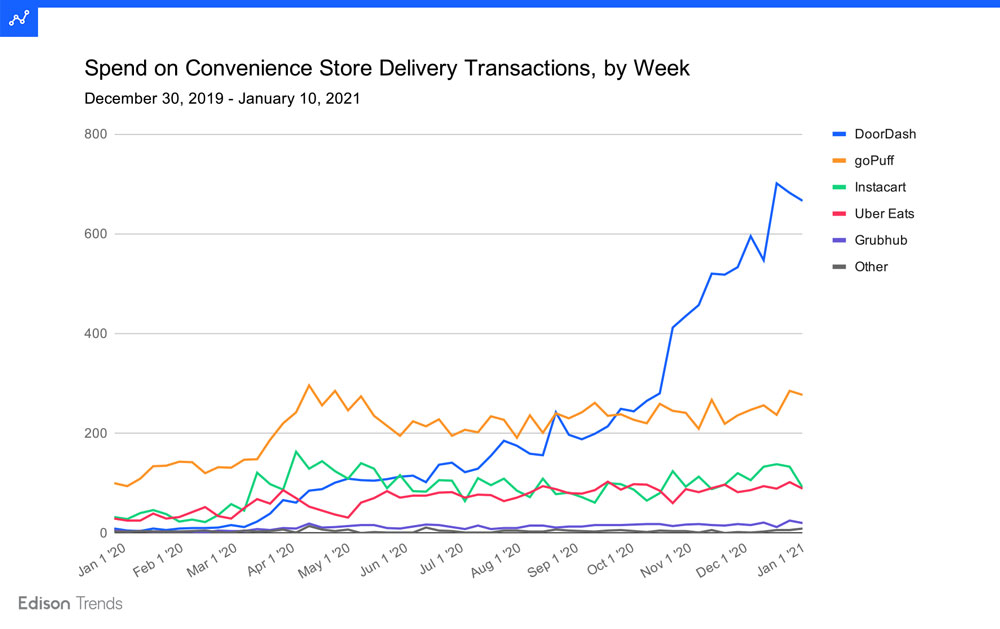

Figure 2c: Chart shows estimated spend on convenience store transactions by week from December 30, 2019 - January 10, 2021, for DoorDash, goPuff, Instacart, Uber Eats, and Grubhub, according to Edison Trends. Note: the highest weekly spend was set to 100, and all other values scaled accordingly. This analysis is based on over 45,000 transactions. DoorDash includes Caviar. Uber Eats includes Postmates. Grubhub includes Seamless, Eat24, Yelp, and Tapingo. “Other” includes NeighborFavor, Bite Squad, Delivery.com, Delivery Dudes, Ritual, and Fooda.

DoorDash has led in spending on convenience store delivery since late September. Their peak for the year occurred in the week of December 21, when customers spent 28% more on convenience store orders than they had the previous week.

Looking at quarter-over-quarter growth, DoorDash customers increased their convenience store spending by 162% from Q3 2020 to Q4. Grubhub grew in convenience store spending by 40%, Instacart 21%, goPuff 10%, and Uber Eats 7%.

To learn more about the data behind this article and what Edison Trends has to offer, visit https://trends.edison.tech/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.