With Australia Day recently celebrated on January 26, the travel analytics experts at ForwardKeys decided to zoom into the latest air ticket data to see what is on the horizon for the sunny Land Down Under and the outlook reveals unique city opportunities.

Domestic Travel in YoY Reflection

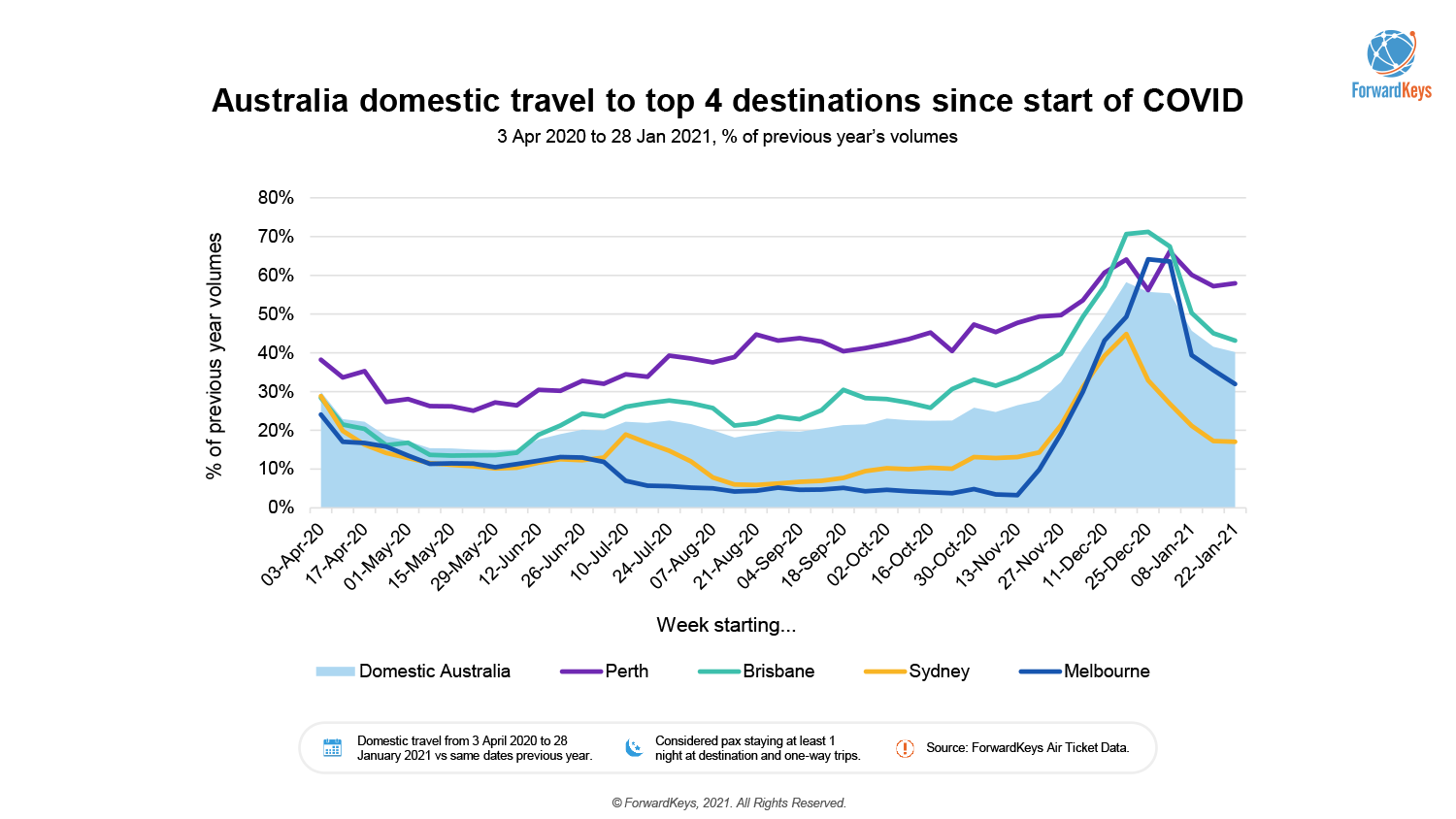

When examining the air tickets issued since the commencement of the Coronavirus in April 2020, domestic travel across Australia’s four main cities, revealed new destination gems in the mineral-rich parts of Australia: Queensland and Western Australia.

“The top destination (and trip origin) which has attracted the most travellers since the start of the pandemic has been Perth (-58.6% YoY as a destination), followed by Brisbane (-71.5%). Sydney (-85.7%) and Melbourne (-88.7%) came in 3rd and 4th – both below the domestic average of -74.4%,” says Antoine Vialle, Market Analyst at ForwardKeys.

“Although most cities are seeing huge declines in travel, some niche destinations have been resisting the impact of COVID. For example, Coondewanna and Barimunya, both mining towns in Western Australia, saw year-on-year increases of 7.7% and 16.8% respectively since the start of COVID,” adds Vialle.

So, is it the business market driving this demand for W.A, you wonder? Vialle says: “Looking at Perth, leisure is doing much better than business. Currently, we can see business travel decreased by 71.5% since the start of COVID, while leisure has been down only 55.9%. Leisure travel across Australia is sitting at -73.2%, so clearly Perth is moving in the right direction in terms of attracting holiday-makers.”

The Future Outlook for Domestic Tourism in Australia

With international travel to and from Australia currently on pause, while its national frontiers are closed for business, all eyes are on the domestic and inter-regional travel opportunities.

“Looking forward at Easter travel (week 29 March – 4 April 2021 vs 5 -12 April 2020), using our air ticket data we can see those forward bookings are only down -33% as of 28 January. The top trip origin is Melbourne (+7%), which is even seeing more tickets issued compared to Easter 2020, and the top destination is Brisbane (-27.7%). Even Hobart is seeing a 14.3% YoY growth. Dare I say it, but we may see some positive YoY growth over Easter this year in Australia,” reveals Vialle excitedly.

These results have been noticed by Tourism Australia and as such, they just re-launched their “Holiday Here This Year” marketing campaign on January 31. “With the industry suffering the double impacts of the bushfires and the subsequent global COVID-19 pandemic, now more than ever, our tourism operators need support.”

“After a challenging 2020 and disruptions to many summer holiday plans, Australians are still desiring a break, just over half of all Australians are still considering/planning interstate travel.”

Trans-Tasman Flight Path – A reality?

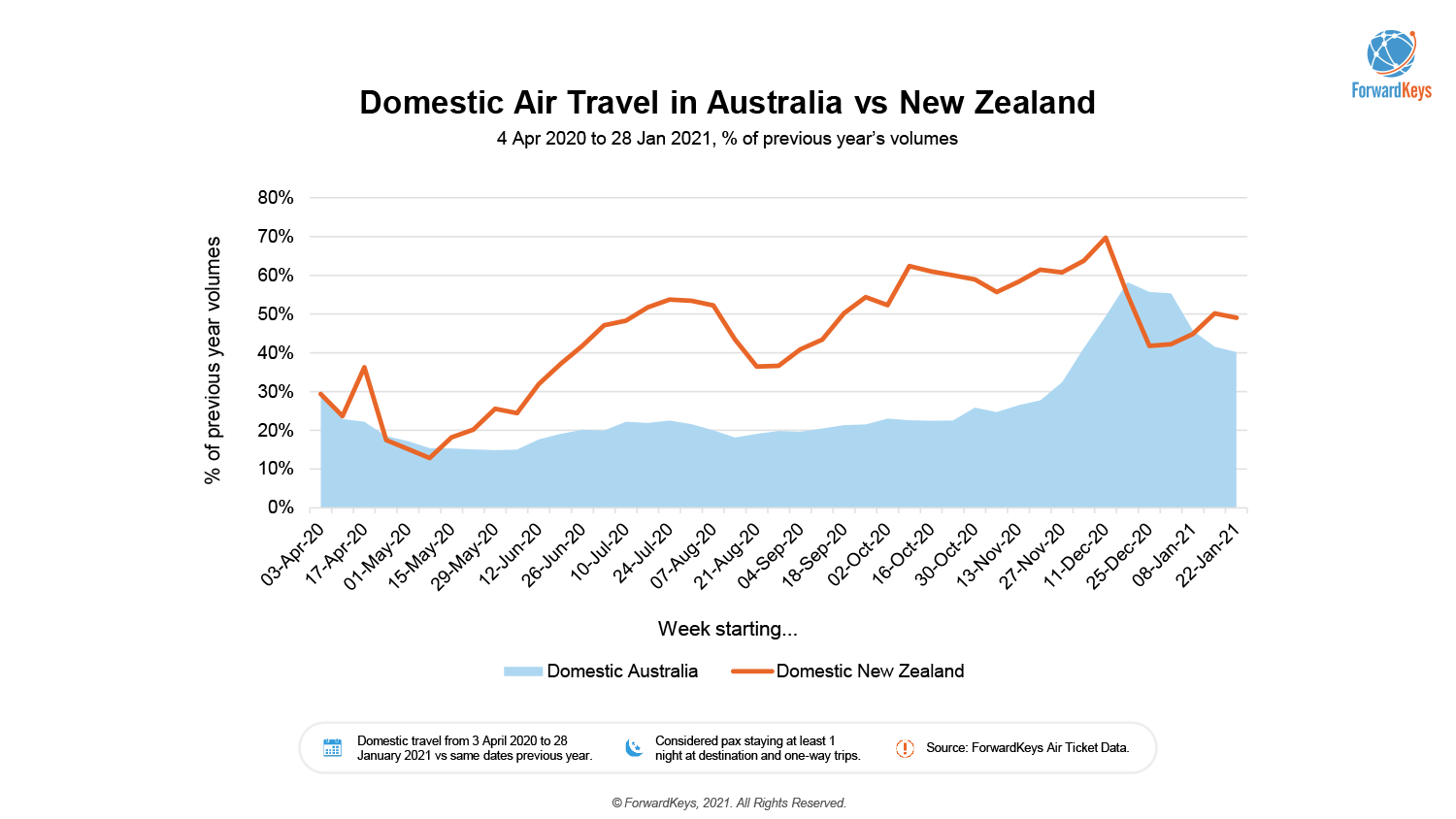

The desire to retain some form of international travel even if it is across the ditch to New Zealand and its Pacific Island cousins is still high on the agenda. NZ and Australia both have shared a similar stance on border protection and controlling the cases of Covid19 to have one of the lowest figures in the world.

“We took a look at domestic travel in Australia versus New Zealand to check the sense of interest in travel. Since the start of COVID, NZ travel has been down by 55.9% vs Australia at -74.4%,” says Vialle.

“However, Australia outpaced New Zealand over the festive season (18 Dec 2020 to 7 Jan 2021). Australia saw domestic travel make up 57% of the previous year’s volumes, while it was 47% for New Zealand,” adds Vialle.

APAC Director, Jameson Wong, comments that so much depends on the deployment of the Covid-19 vaccine. “This year’s vaccine deployment and efficacy are pivotal in setting the scene for how travel will commence. We also know for a fact now that the pace at which the vaccine is deployed will differ across the various countries and communities here in the Asia Pacific region. So, whilst we are turning a chapter in this pandemic, pre-Covid-19 levels of international travel are unlikely to return anytime soon.”

“Countries will have to rely on domestic/inter-state travel in the meantime and assess accordingly when it is safe to open up progressively to reciprocating countries,” Wong adds.

Never has the role of domestic and inter-regional travel been as important to the travel and tourism industry and for travellers hungry to travel and explore.

To learn more about the data behind this article and what ForwardKeys has to offer, visit http://forwardkeys.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.