There is no question that spend in the Grocery sector has been elevated as a result of the pandemic – the real questions are by how much, and how that will change in 2021. Fable Data tracks real-time consumer spending, allowing us to provide valuable insights into the Grocery sector.

Seasonal fluctuations accentuated by COVID in Q4

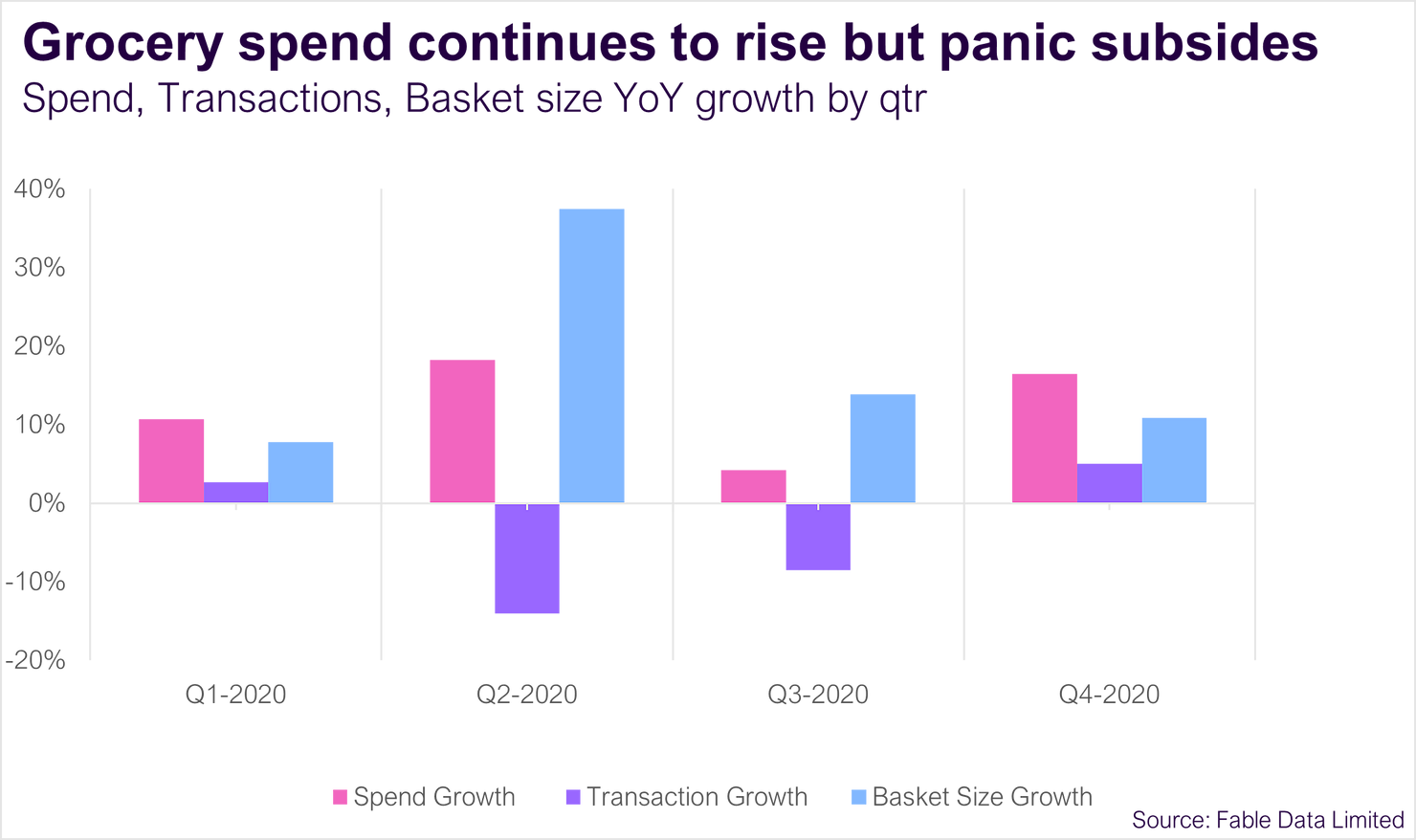

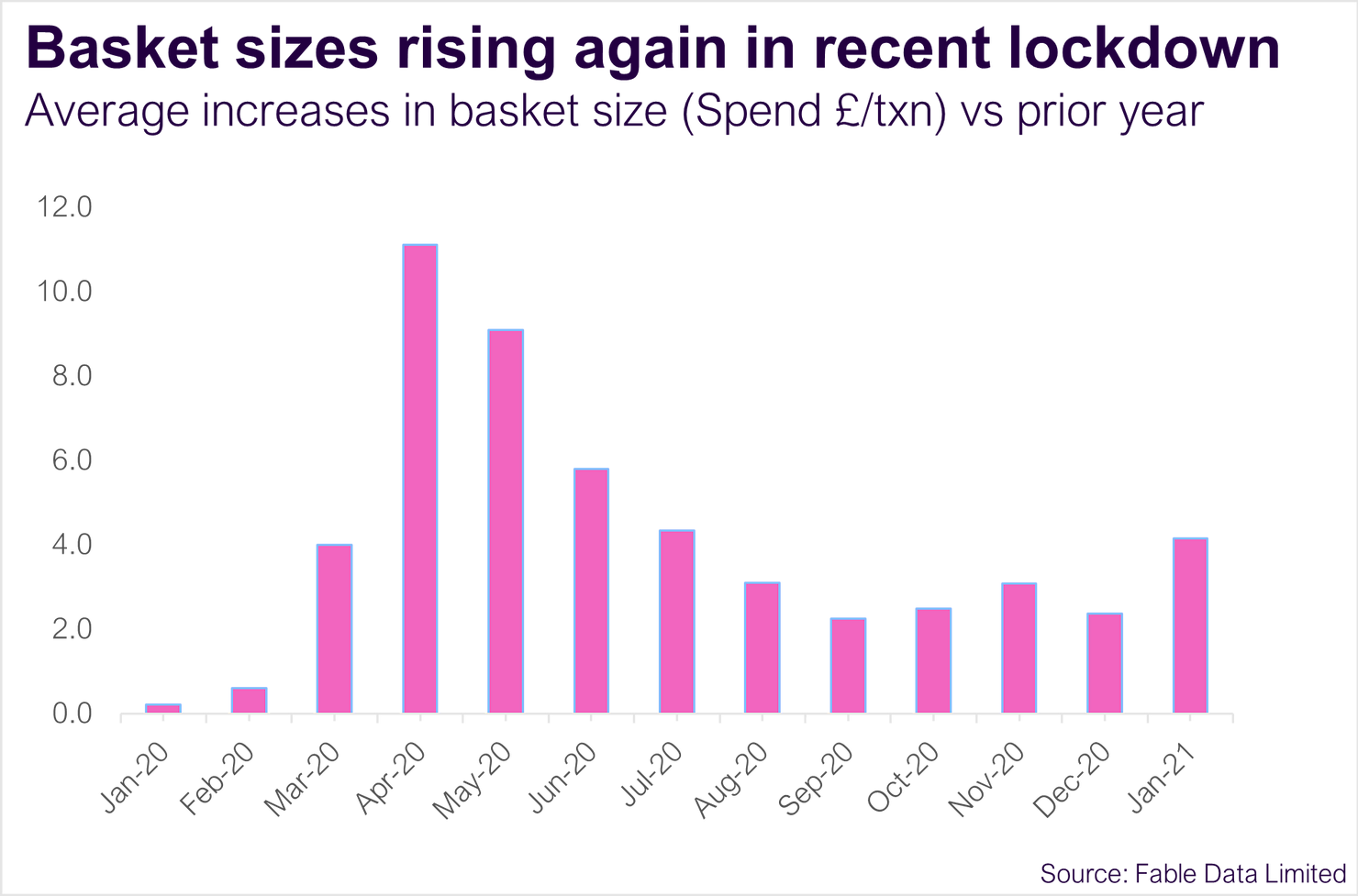

In 2020, Grocery spend was up c. +12% YoY. The highest growth for this sector was seen in Q2, with spend up c.+18% YoY, as lockdown restrictions were put in place. Q2 2020 was characterised by increased basket sizes at +38% YoY, as consumers made fewer trips to the store but raced to combat declining stock volumes, fuelled by spreading feelings of uncertainty and ‘panic buying’. Through Q3 and Q4 panic subsided as basket size growth was more moderate at +14% and +11% YoY respectively. Q4 spend, which typically hallmarks a peak spend period for Grocers, was another strong quarter of growth (up +16% YoY). During this period, transaction numbers were above 2019 levels by c.+5% YoY, following declines in Q2 and Q3.

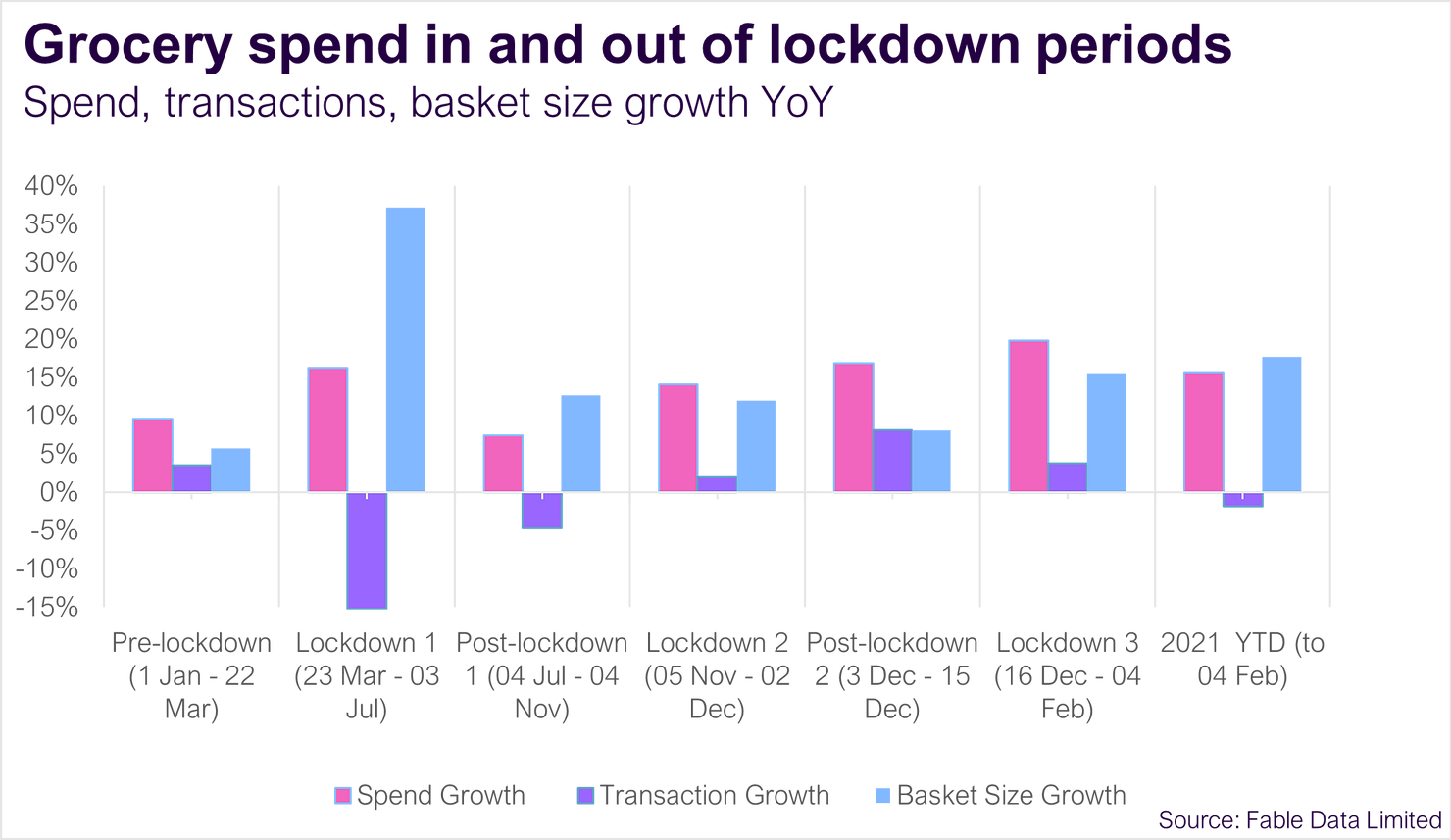

Grocery spend on pace to surpass 2020 spending levels

To learn more about the data behind this article and what Fable Data has to offer, visit https://www.fabledata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.