According to ATTOM Data Solutions’ new Q1 2021 Vacant Property and Zombie Foreclosure Report, there are just over 1.4 million U.S. residential properties sitting vacant in Q1 2021, representing only 1.5 percent of all homes. The report noted the number of pre-foreclosure homes sitting empty or “zombie foreclosures” is just 6,677. That figure is down 12.3 percent from 7,612 in Q4 2020 and 23.1 percent from 8,678 in Q1 2020.

ATTOM’s latest vacant properties analysis reported that the portion of pre-foreclosure properties that have been abandoned into zombie status remained at 3.8 percent in Q1 2021, in comparison to Q4 2020. This quarterly report analyzes publicly recorded real estate data collected by ATTOM — including foreclosure status, equity, and owner-occupancy status — matched against monthly updated vacancy data.

The Q1 2021 vacant property and zombie foreclosure report also noted that among states with at least 100 properties in pre-foreclosure in Q1 2021, the biggest decreases from Q4 2020 in zombie properties included: Kentucky (down 52 percent), Mississippi (down 51 percent), Louisiana (down 48 percent), Connecticut (down 47 percent) and California (down 44 percent).

Also, according to ATTOM’s new vacant properties analysis, the states with the biggest increases from Q4 2020 in zombie properties, among those with at least 100 properties in pre-foreclosure in Q1 2021, included: Arkansas (up 63 percent), Texas (up 62 percent), Minnesota (up 32 percent), Massachusetts (up 24 percent) and Missouri (up 20 percent).

In terms of vacancy rates in Q1 2021, the analysis reported the rate for all residential properties in the U.S. declined to 1.46 percent from 1.56 percent in Q4 2020 and 1.53 percent in Q1 2020. States with the biggest decreases are Kentucky (down from 1.8 percent of all homes in the fourth quarter of 2021 to 1.2 percent now vacant), Rhode Island (down from 1.8 percent to 1.3 percent); Indiana (down from 2.5 percent to 2.3 percent), Kansas (down from 2.7 percent to 2.5 percent) and Mississippi (down from 2.7 percent to 2.5 percent).

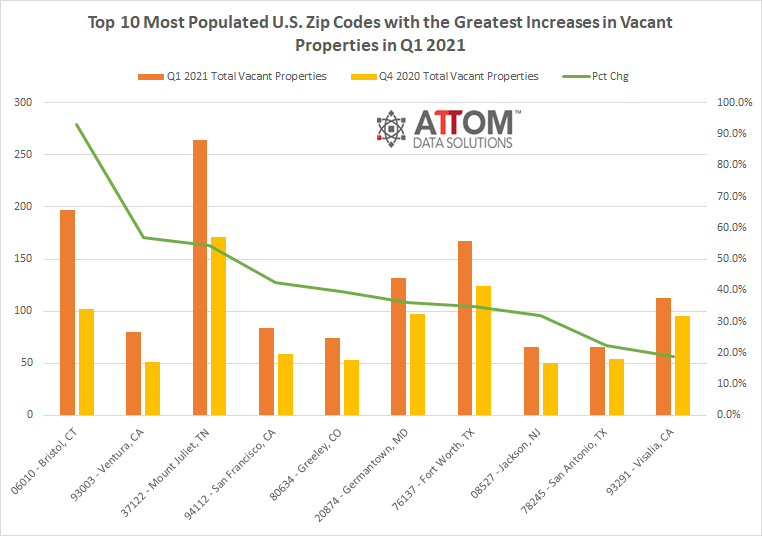

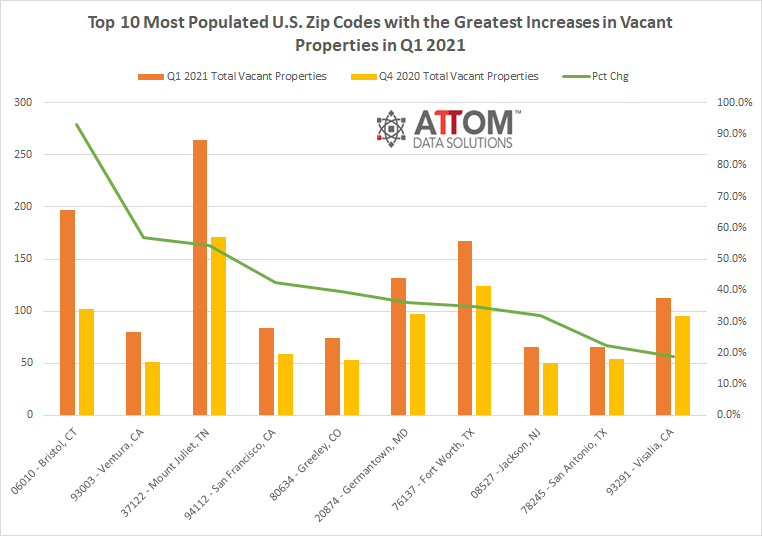

In this post, we take a deep dive into the data behind our Q1 2021 vacant property and zombie foreclosure report to reveal the top 10 zip codes with the greatest increases in the number of vacant properties from Q1 2021 to Q4 2020.

Among those more populated zip codes with populations of 50,000 or more and 50 or more vacant properties in Q1 2021, those with greatest increases in the number of vacant properties from Q4 2020 include: 06010 in Bristol, CT (up 93.1 percent); 93003 in Ventura, CA (up 56.9 percent); 37122 in Mount Juliet, TN (up 54.4 percent); 94112 in San Francisco, CA (up 42.4 percent); 80634 – Greeley, CO (up 39.6 percent); 20874 in Germantown, MD (up 36.1 percent); 76137 in Fort Worth, TX (up 34.7 percent); 08527 in Jackson, NJ (up 32.0 percent); 78245 in San Antonio, TX (up 22.2 percent); and 93291 in Visalia, CA (up 18.9 percent).

ATTOM’s Q1 2021 vacant properties analysis also reported that zombie-foreclosure rates increased from Q4 2020 to Q1 2021 in 29 states. Among those states with at least 100 properties in the foreclosure process during Q1 2021, those with the largest increases include: Kansas (rate up from 16.3 percent to 20.7 percent of all properties in the foreclosure process), Arkansas (up from 3.1 percent to 6.6 percent), Minnesota (up from 4.7 percent to 7.1 percent), Maine (up from 8.6 percent to 10.8 percent) and Hawaii (up from 4.7 percent to 6.4 percent).

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.