European luxury brands pride themselves on their heritage. In the US, newer names have built brands on innovation like narrow ties and a jetsetter lifestyle. But how do the sales for these companies compare in their home markets versus abroad? In today’s Insight Flash, we look at luxury spending trends in the US versus the UK, peeling back the onion to get to industry, subindustry, and brand-level trends. Our US dataset has historically been highly predictive of European luxury brand reported metrics for the local region, and our new UK dataset is similarly successful in tracking sales trends for US luxury brands abroad.

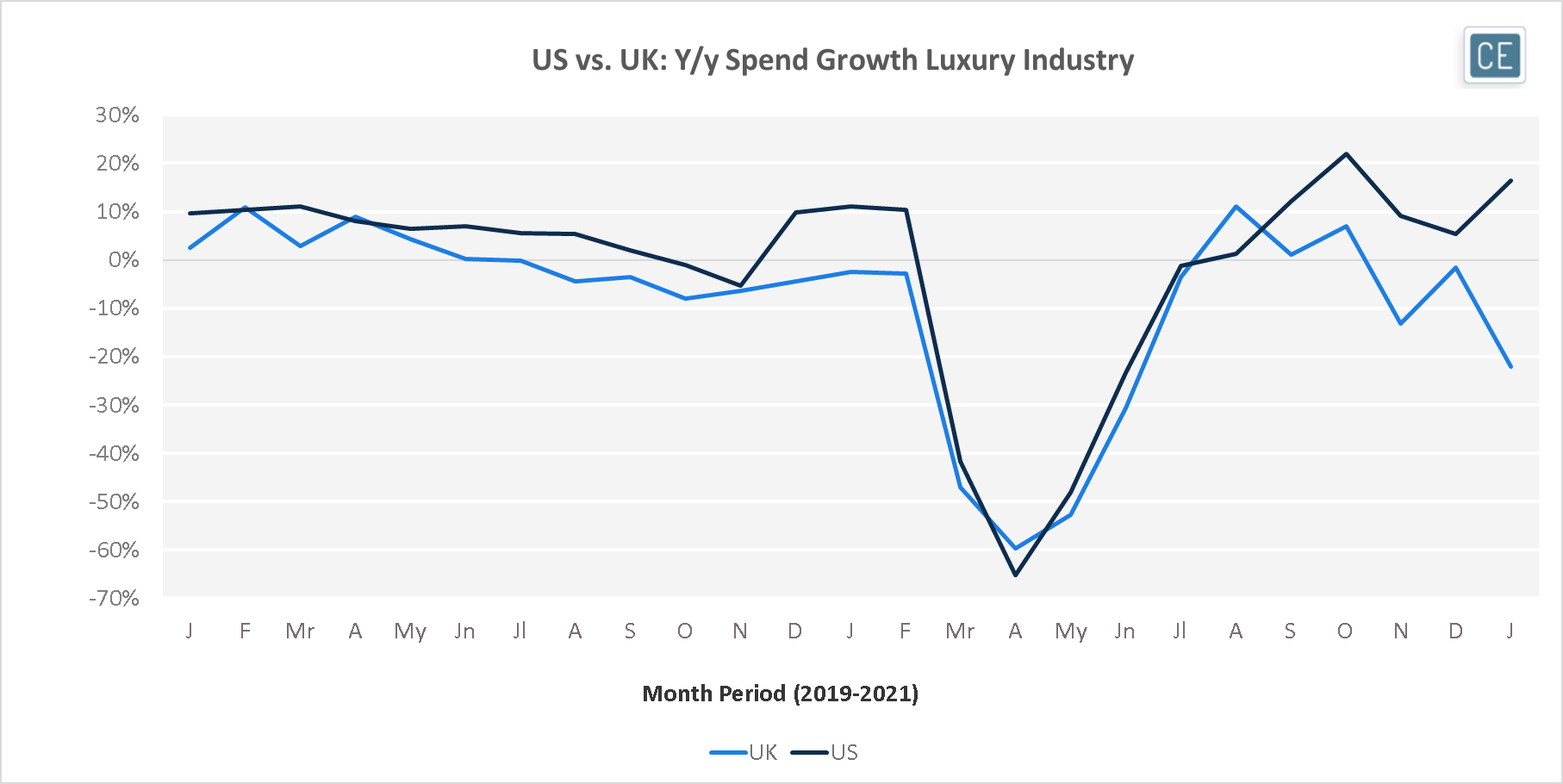

Throughout 2019, US Luxury spend growth outpaced UK Luxury spend growth. Spend in the US grew in the mid-single digits to low double-digits almost every month of 2019, while spend growth in the UK turned negative in the back half of the year. With the onset of the COVID-19 pandemic in March 2020, however, luxury growth and declines in the two countries began to look remarkably similar through September, though US growth began to surge beginning in October while growth in the UK fell for the same period.

US vs. UK Luxury Industry

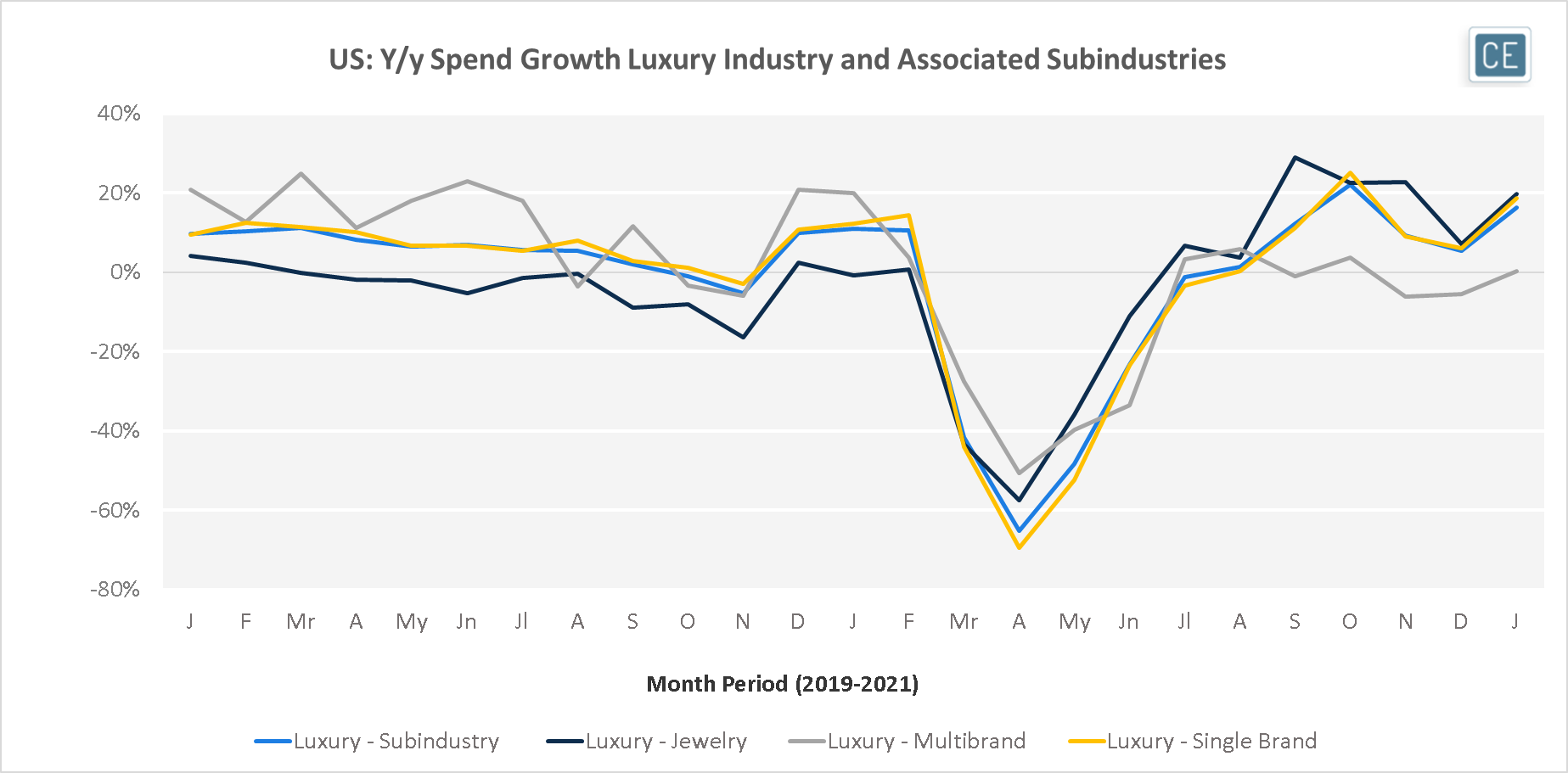

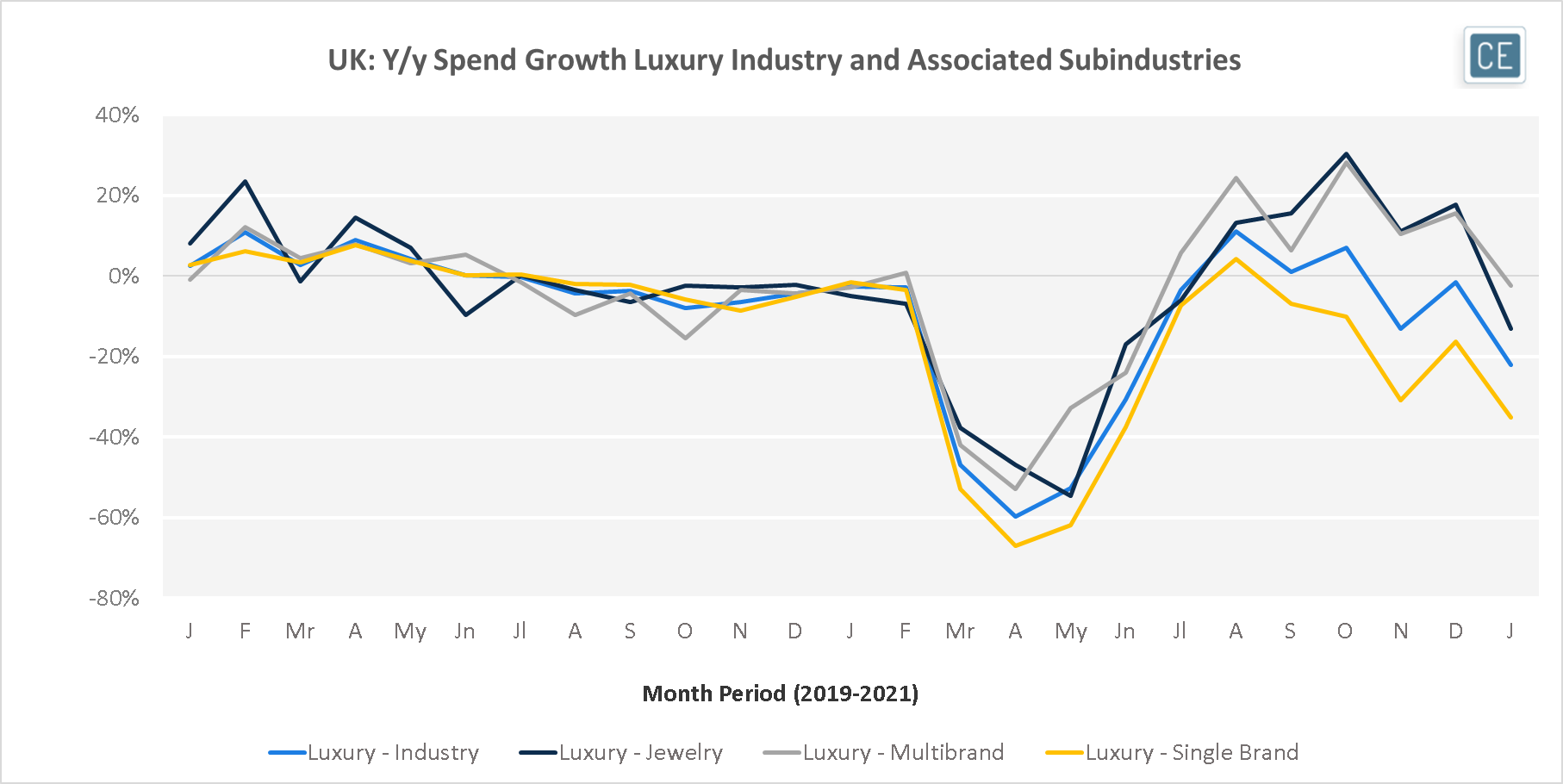

In the US, Multibrand Luxury like Net-A-Porter and Farfetch led industry growth pre-pandemic, though since May a combination of factors (possibly including stimulus checks) have propelled Jewelry retailer growth from the worst-performing to the best-performing subindustry. In the UK, trends reversed as Jewelry retailers had consistently been the strongest Luxury subindustry throughout 2019 until the second half of 2020, when Multibrand Luxury started to give it a run for its money. The pre-pandemic interest in Multibrand Luxury in the US is consistent with a customer profile of wanting to be exposed to the latest emerging brands and evaluate new pieces on a standalone basis versus having loyalty to a particular brand. But recent divergences may be signaling a changing of the guard in the UK.

US vs. UK Luxury Subindustries

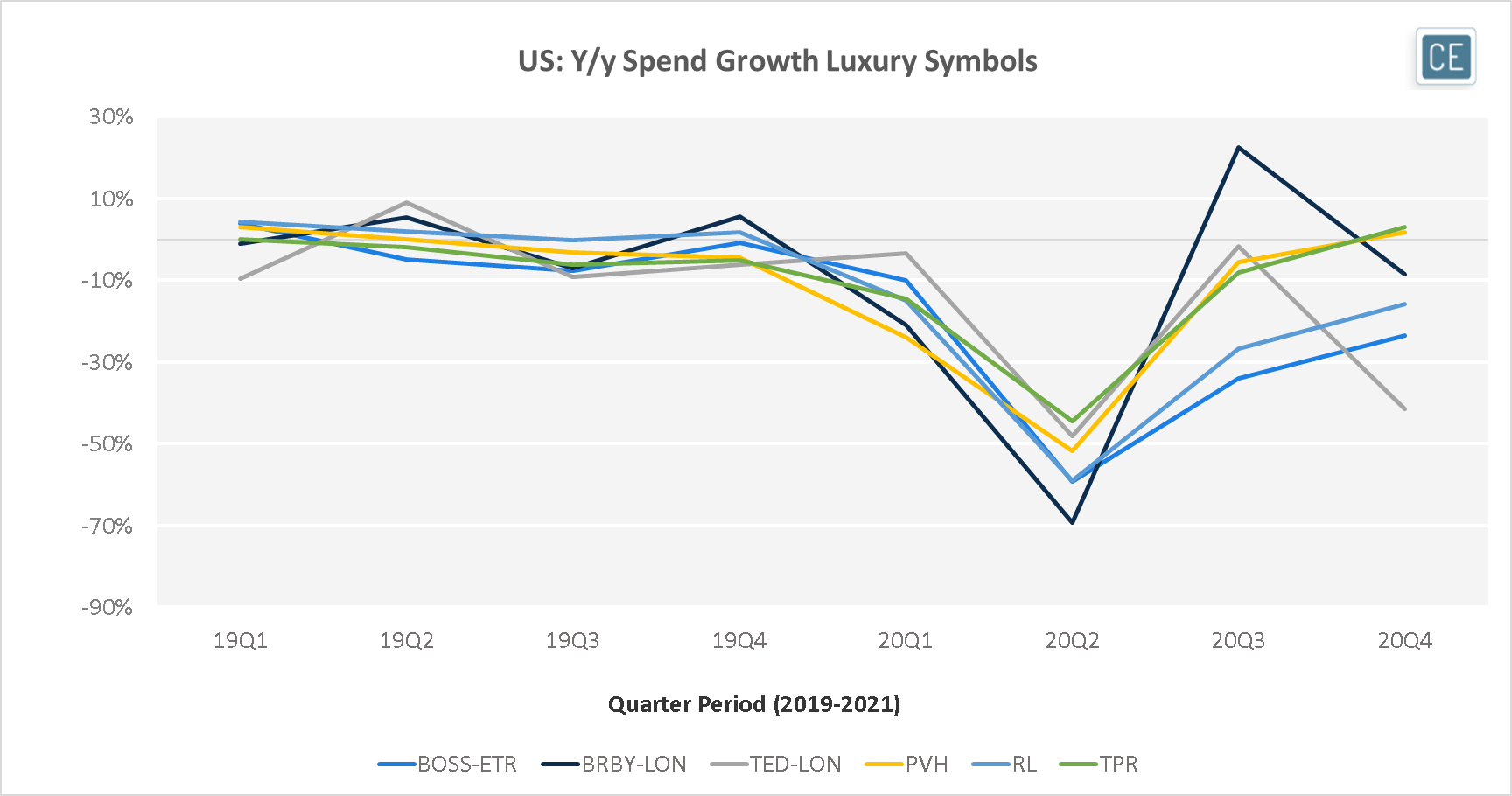

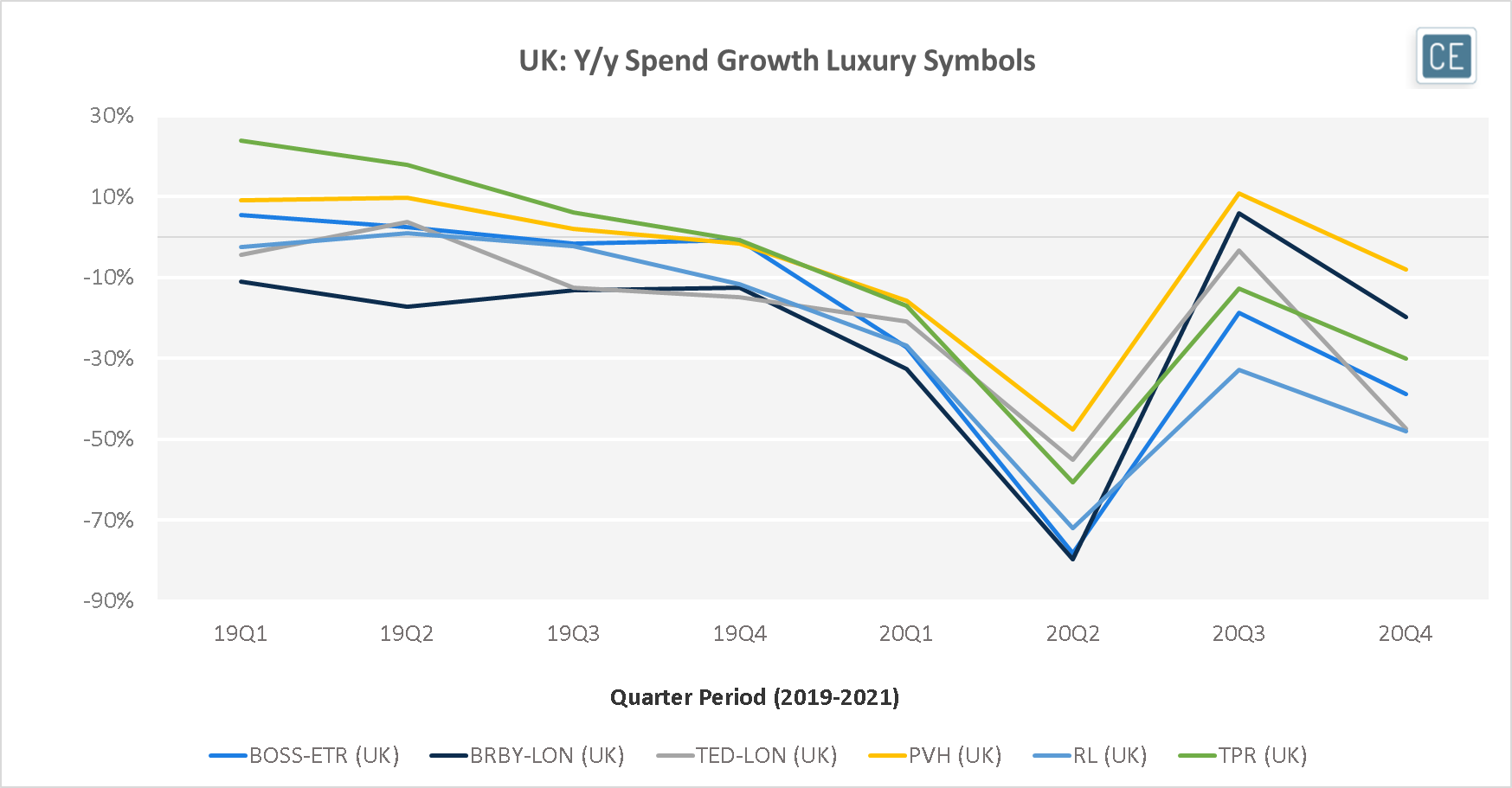

Among a selection of three US and three European luxury companies, RL and PVH sales (across their brands) were generally the strongest consistent spend growth names in the US in 2019. 2020 has seen TED-LON among the top spots, however. BRBY-LON has seen seasonal spend growth outpace peers. In the UK, TPR and PVH were growing the fastest in 2019, though TED-LON also appeared among the top luxury names there as well in 2020.

US vs. UK Company Trends

Note: Calendar Quarters

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.