Source: https://secondmeasure.com/datapoints/third-party-delivery-bolster-restaurant-industry-sales/

The COVID-19 pandemic has increased the popularity of third party delivery services, which have seen a surge in full-service restaurant partnerships as many restaurants turn to third-party delivery services to stay afloat. However, our consumer transaction data reveals that third party delivery services generate significantly more sales through quick-service restaurants than full-service restaurants, though they constitute a larger portion of total sales at full-service restaurants.

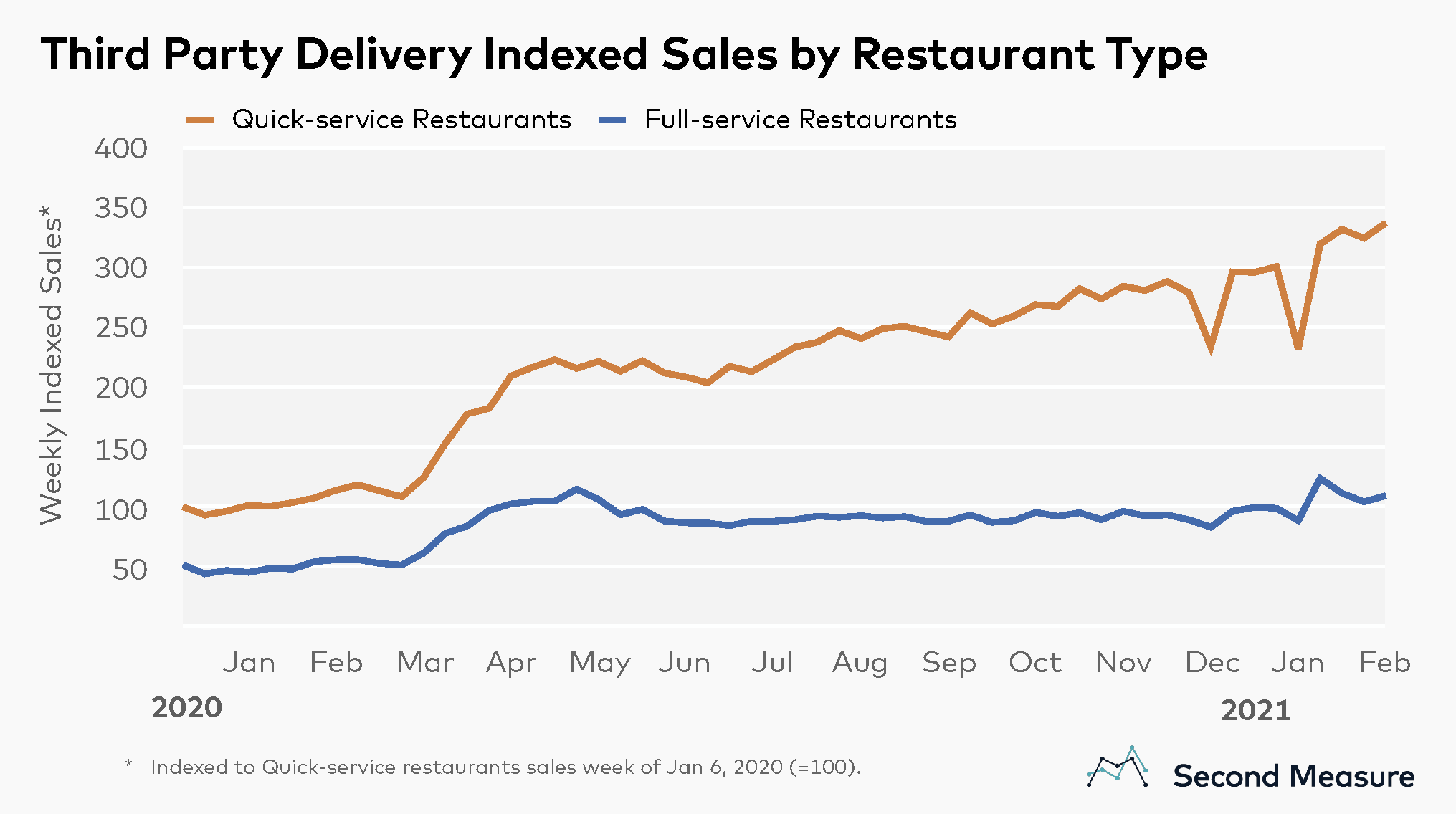

Quick-service restaurants (QSRs) are defined in our analysis as restaurants without table service, where food is cooked to order in a short period of time, while full-service restaurants are sit-down eateries where food is served directly to customers’ tables. Third party delivery sales volumes at both quick-service and full-service restaurants spiked the weeks of March 16 through May 4, the initial weeks of the pandemic. Sales have since leveled off for full-service restaurants, while maintaining steady growth for quick-service restaurants.

Where the volume of third party delivery sales at QSRs had been on average twice that of full-service restaurants when shelter-in-place orders first went into effect, it has grown to more than three times that of full service restaurants as of the first week of 2021. However, it is worth noting that quick service restaurant sales through third party delivery dipped over the holidays, while full service restaurants saw a modest bump around New Year’s.

Third party delivery makes up a larger portion of full-service restaurant sales

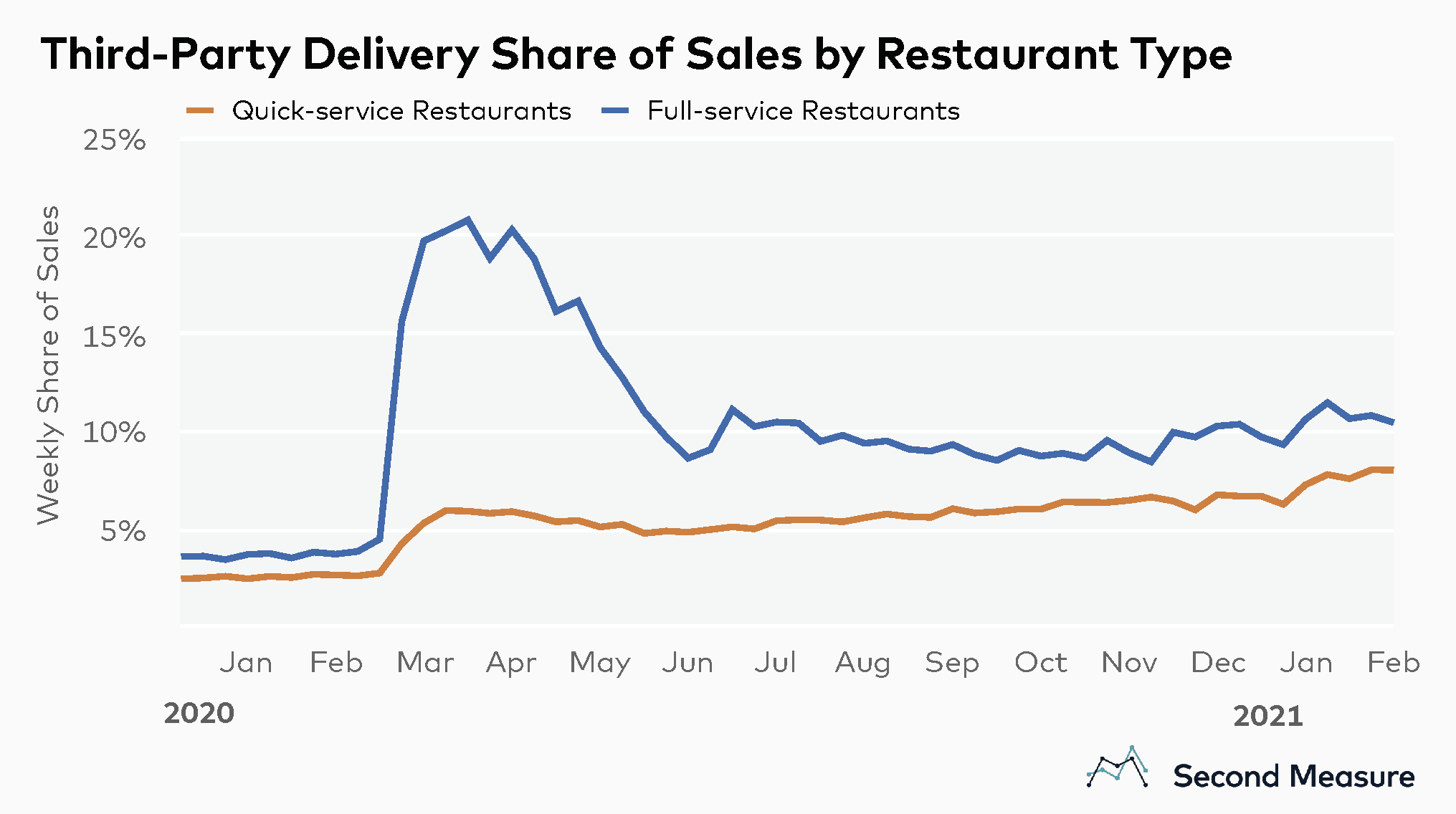

Third party delivery services constitute a larger share of sales at full-service restaurants than at quick-service restaurants. For full-service restaurants, third party share of sales skyrocketed from less than 5 percent the first week of March 2020 to nearly 20 percent by the last week of that same month, around the time that most states introduced stay-at-home orders.

Sales from third party delivery services have continued contributing a significant proportion of full-service restaurant sales in subsequent months, although the percentage decreased at the start of summer once stay-at-home orders began lifting in most states. Between March and June 2020, third party delivery share of sales constituted an average of 14 percent at full-service restaurants. As states started re-opening, full-service restaurants’ third party share of sales fell to an average of 9 percent from July through the rest of 2020.

Meanwhile, third party delivery share of sales at QSRs doubled from 3 percent in the first week of March to 6 percent in the final week of March. Share of sales has since been sustained at an average of 6 percent at quick-service restaurants, which may be due in part to more robust direct delivery services available at quick-service restaurants.

QSRs bouncing back faster than full-service restaurants

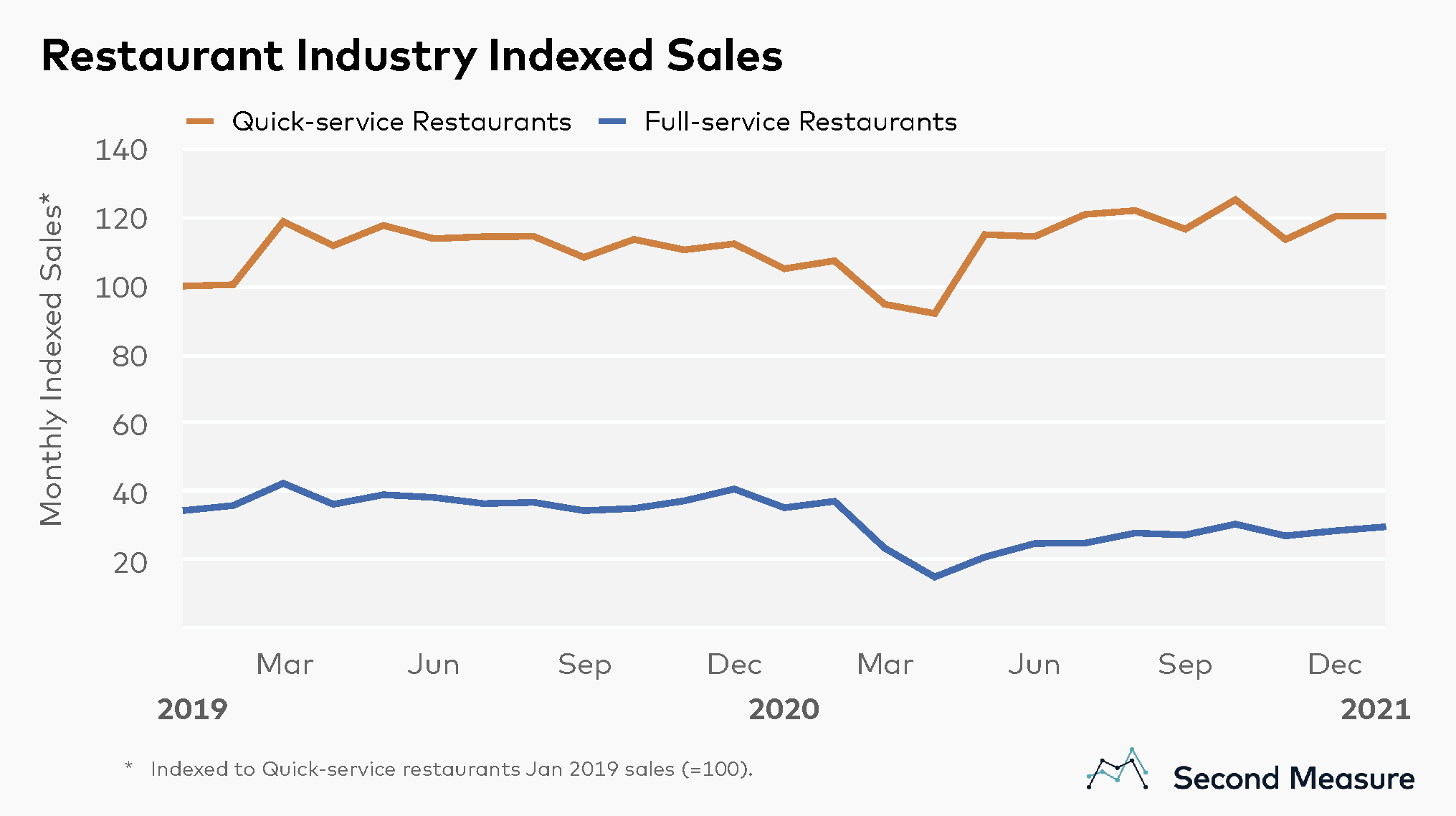

Third party delivery services could be propelling the quick-service restaurant industry’s steady recovery. QSRs have seen a recovery since the initial dip in sales at the start of the pandemic, while the full-service restaurant industry has not fully bounced back yet.

For quick-service restaurants, average monthly indexed sales from June through the rest of 2020 grew by 6 percent compared to the same period in 2019. In contrast, average monthly indexed sales at full-service restaurants over the same periods fell by 26 percent year-over-year.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.