The top global investors acquired more commercial real estate in 2020 despite the challenges of the pandemic. There are clear signals in what they bought, however, that these investors are reacting to the uncertainty presented by the Covid-19 turmoil. Net purchases by property sector indicate that concerns about the office sector surfaced in 2020.

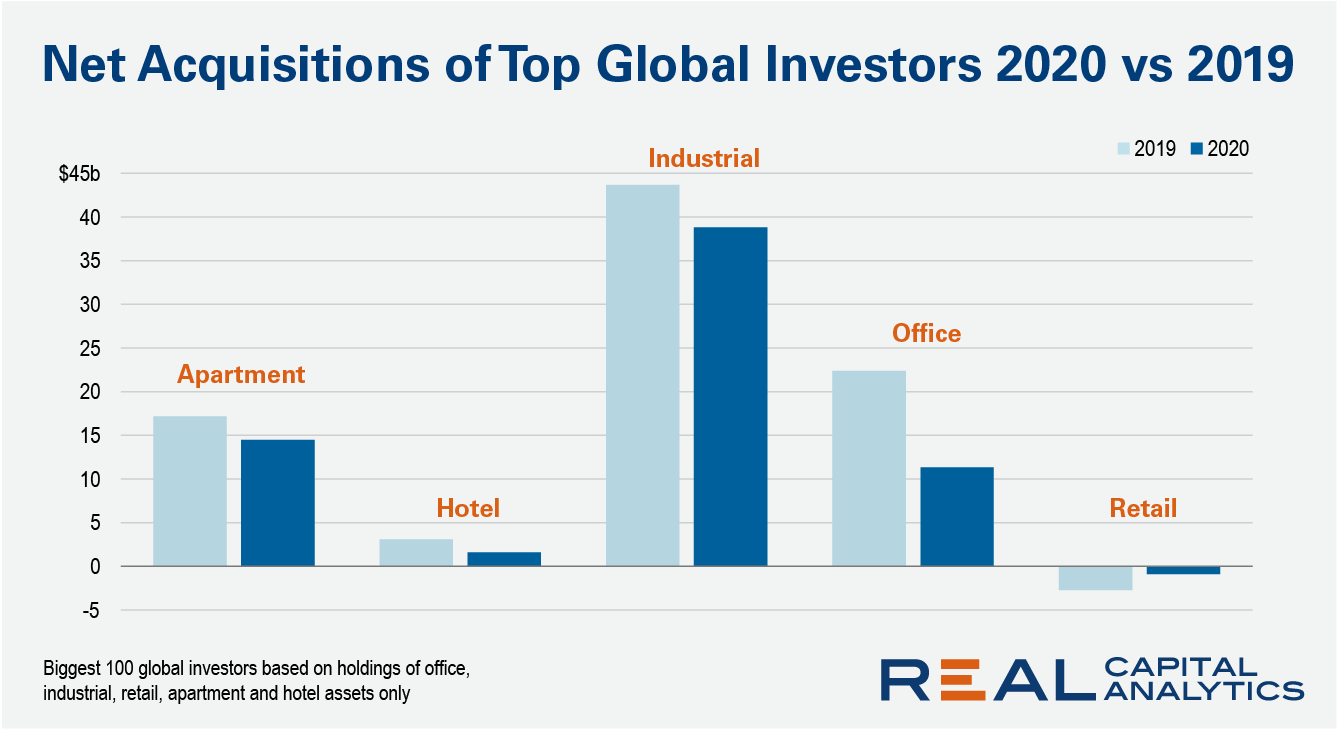

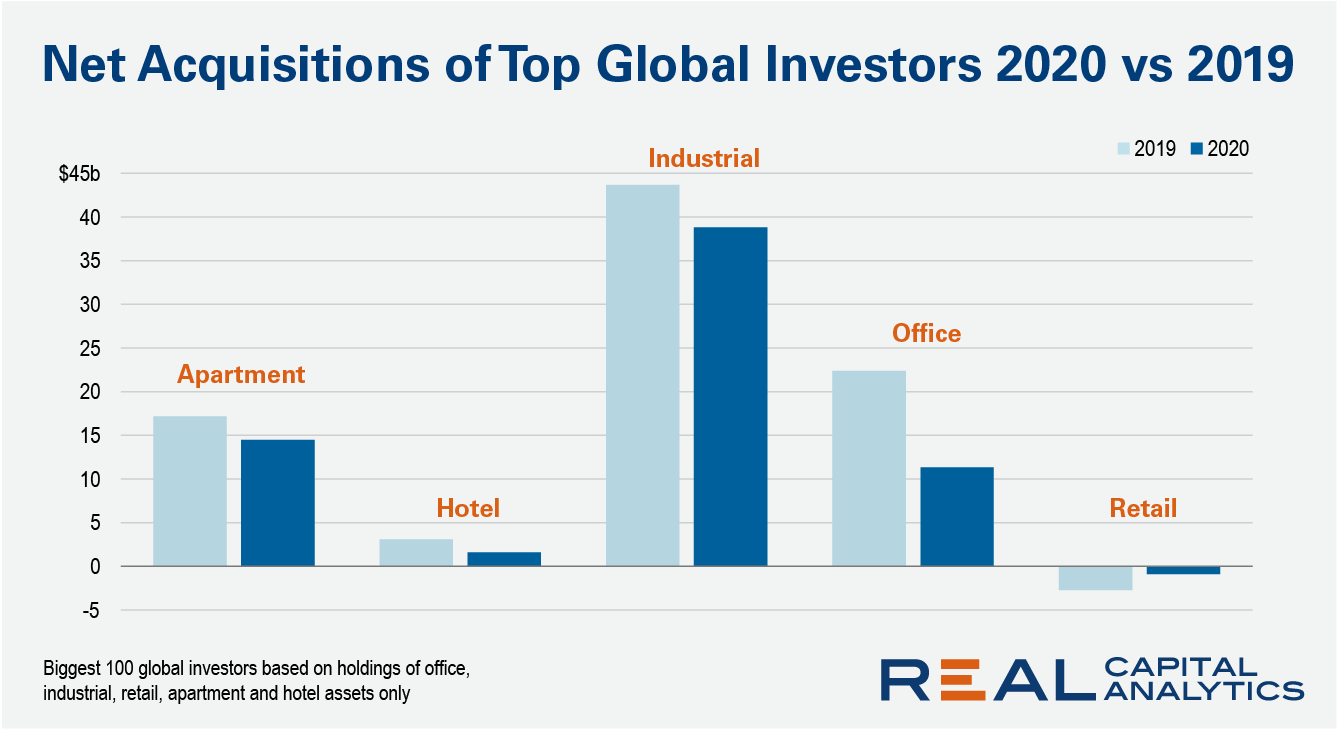

As a group, the top 100 global investors — based on the office, industrial, retail, apartment and hotel assets they own — purchased less in total for 2020 than in 2019, but they sold less as well. On a net basis, these investors collectively added $65.4 billion of commercial real estate assets to their portfolios last year. This figure was 22% down from the $83.7 billion level of 2019.

Examining the behavior of this group can help to identify broader trends. Investors who hold the most assets, after all, will see more potential deals and thus have more insight into pricing and capital flows. While as a group these investors added around one-fifth less commercial real estate to their portfolios in 2020, for some sectors the change in net additions was more pronounced.

The industrial sector was in the lead for 2020, both in absolute dollar terms and in a relative sense, with a mere 11% drop off in the pace of net investment relative to 2019. The apartment sector posted only a 16% decline in the pace of net investment. With these top investors adding $14.5 billion more in apartment assets to their portfolios than they sold for the year however, interest in this sector surpassed that for the office sector in 2020. These players added only $11.3 billion more office assets to their portfolios than they sold for the year, a 49% pace of decline from 2019.

The biggest investors worldwide are not necessarily the most active buyers and sellers. Some investors have large holdings and focus more on steady, prudent management of income rather than dealmaking. Still, by looking at these changes in their appetite for deals, it is clear that these investors are rotating away from offices.

Dealmaking fell in 2020 both because of the uncertainty around the future path of the pandemic as well as the physical challenges of bringing together buyers and sellers and completing paperwork. If the physical impediments to dealmaking were the same across all property sectors, then differences in deal activity should represent the degree of uncertainty for the future. The fact that net acquisitions fell more for offices than in other property sectors is a signal that the top global investors are more concerned about the future performance and current pricing of offices.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.