The United States recently hit a grim milestone, with more than 500,000 lives lost to the COVID-19 pandemic. As that number continues to climb, the federal government is stepping up its vaccination push, increasing the number of vaccines it distributes to states. Last week, the government said states were on track to receive 14.5 million doses. This marks a substantial increase from 13.5 million vaccines received the previous week, and 8.6 million in President Biden’s first week in office.

For their part, the Biden administration has made efforts to streamline a vaccine rollout that has been slow and marred by complications. Critical steps like forging partnerships with pharmacies and opening federally-run vaccination sites have had measurable impact in speeding up the process. As of now, 15% of Americans have received at least an initial dose of the two-shot-regimen, with more than 7.5% fully vaccinated.

Last week, vaccine manufacturers Pfizer and Moderna told Congress to expect a major increase in delivery of vaccine doses over the next month. So far, the two companies have provided the U.S. government with nearly 75 million doses, and they predict that number will hit 220 million by the end of March. Pfizer and Moderna also testified that they’re on track to deliver a combined 600 million doses by the end of July, enough to ensure 300 million people receive both doses of the two shot vaccine.

Last week also brought major progress for the Johnson & Johnson vaccine, as the US Food and Drug Administration authorized the company’s single-dose vaccine on Saturday. Prior to this approval, Johnson & Johnson testified that it had four million doses of its Covid-19 vaccine ready to ship immediately once emergency use authorization was issued. The company also stated that it is on track to provide enough of the single-shot vaccine to cover 100 million Americans in the first half of 2021.

British drug manufacturer AstraZeneca also has a vaccine in use in other parts of the world (British regulators authorized it for use nearly two months ago), but it has yet to gain approval in the United States. The FDA has signaled it will not approve AstraZeneca’s vaccine without additional U.S. clinical trial data, which could come in the following months. AstraZeneca has indicated that it has vaccines in the pipeline that could add to the U.S. supply once that approval is achieved.

Given the significant ramp up in vaccine distribution, we decided to revisit the jobs data for several of the key vaccine manufacturers working on COVID. In late November, we took a look at job listings and share prices for Pfizer, Moderna and AstraZeneca as the three manufacturers edged closer to FDA approval. We were curious to see how overall job numbers, as well as specific occupations, have changed now that production has increased and development is largely focused on modifications that might help combat new COVID variants.

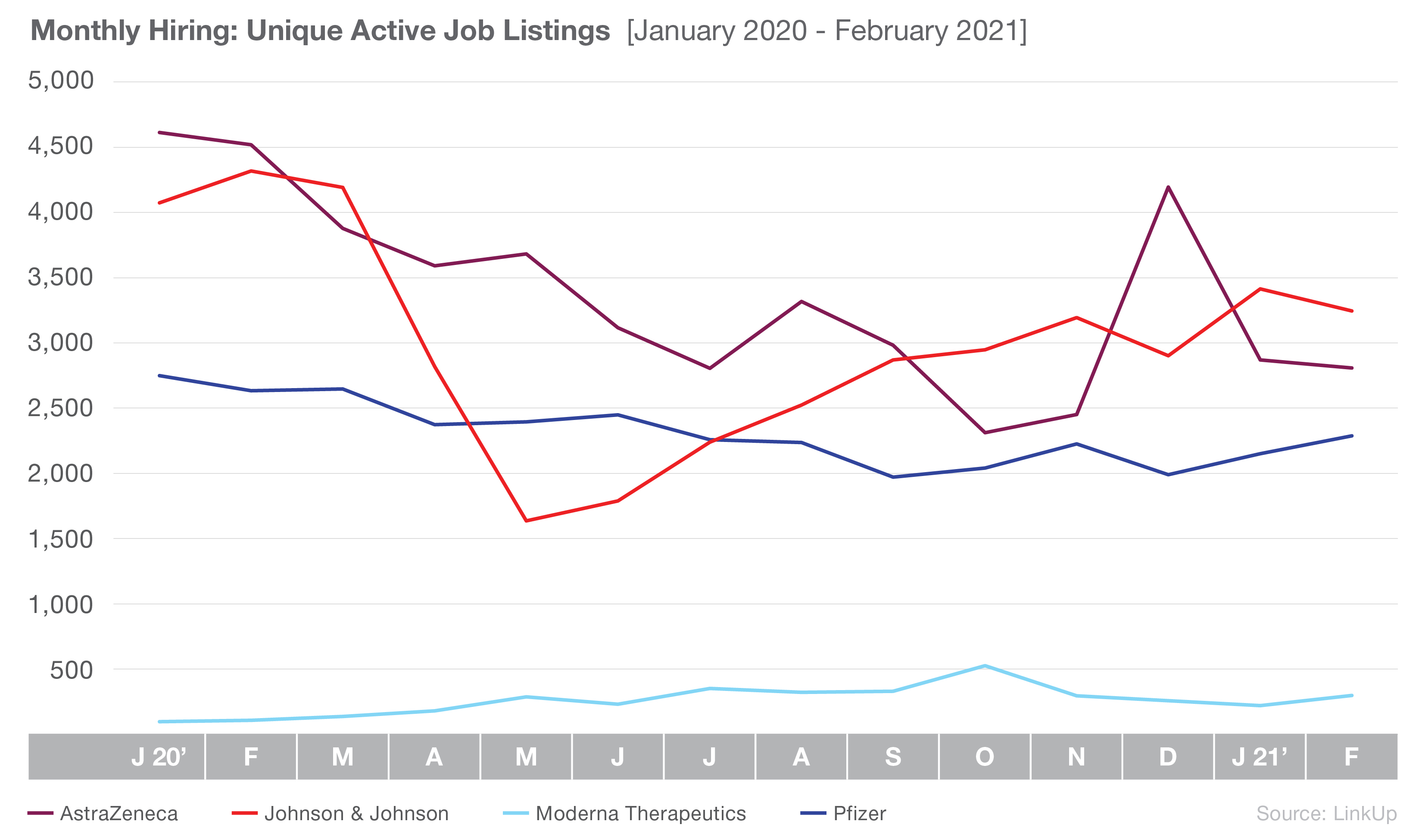

Overall, job listings at all four companies have declined, down 25% since January 2020. Though they have the most active listings of the four manufacturers, Johnson & Johnson is down 20% from January 2020; however, it is notable that the company has jumped 98% since it bottomed out in May 2020. Active job listings for AstraZeneca have also seen a gradual decline, with the exception of a jump in hiring in December 2020. Overall, the company is down 39% since January 2020.

Pfizer and Moderna have both seen relatively steady numbers throughout 2020 and early 2021, though Moderna consistently maintains a significantly lower number of listings. Moderna, up 209% since January 2020, is the only company of the four that never saw an initial drop from the pandemic. Pfizer has experienced a more gradual decline in listings since Jan 2020, down 17% overall, though it has recovered some jobs since December 2020.

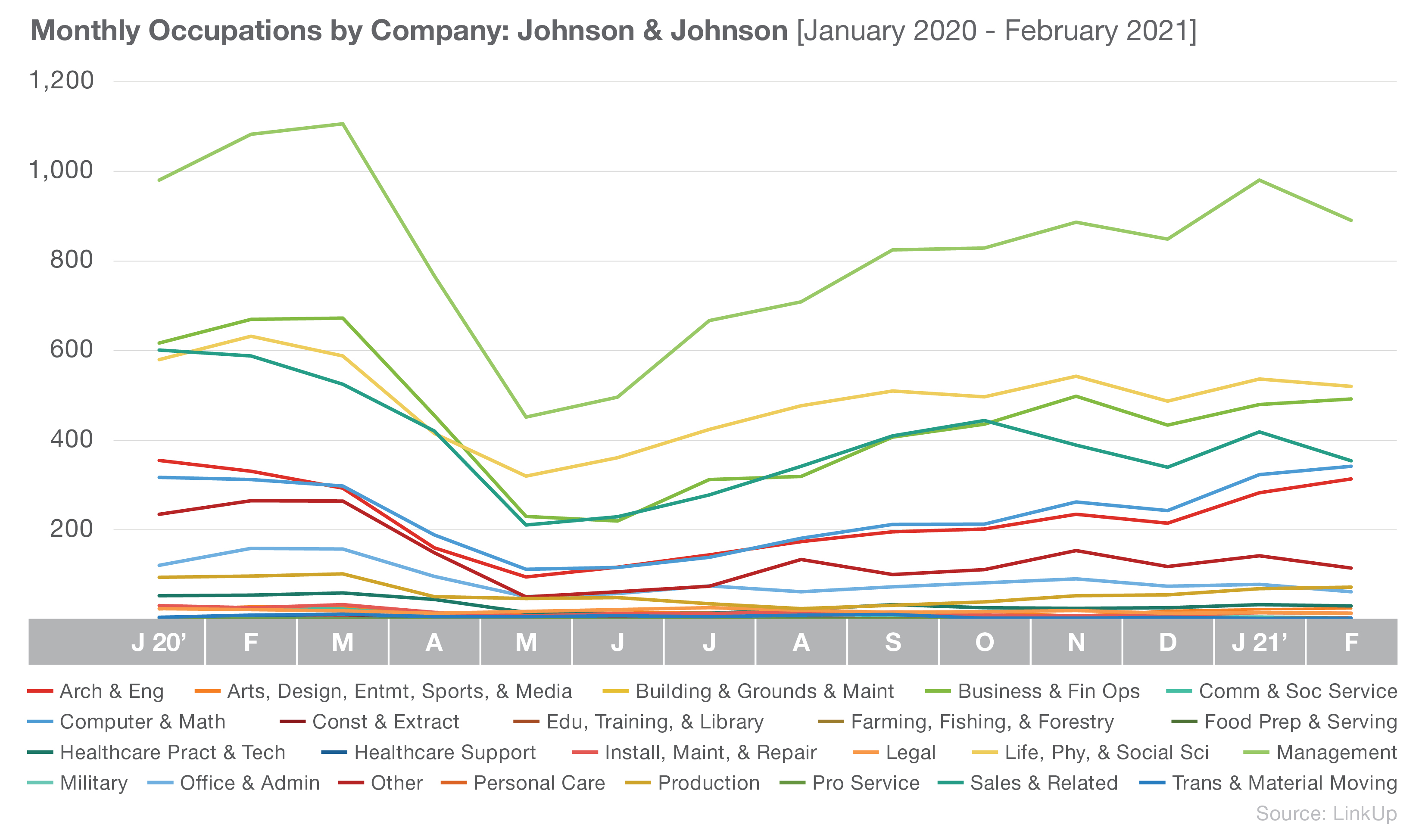

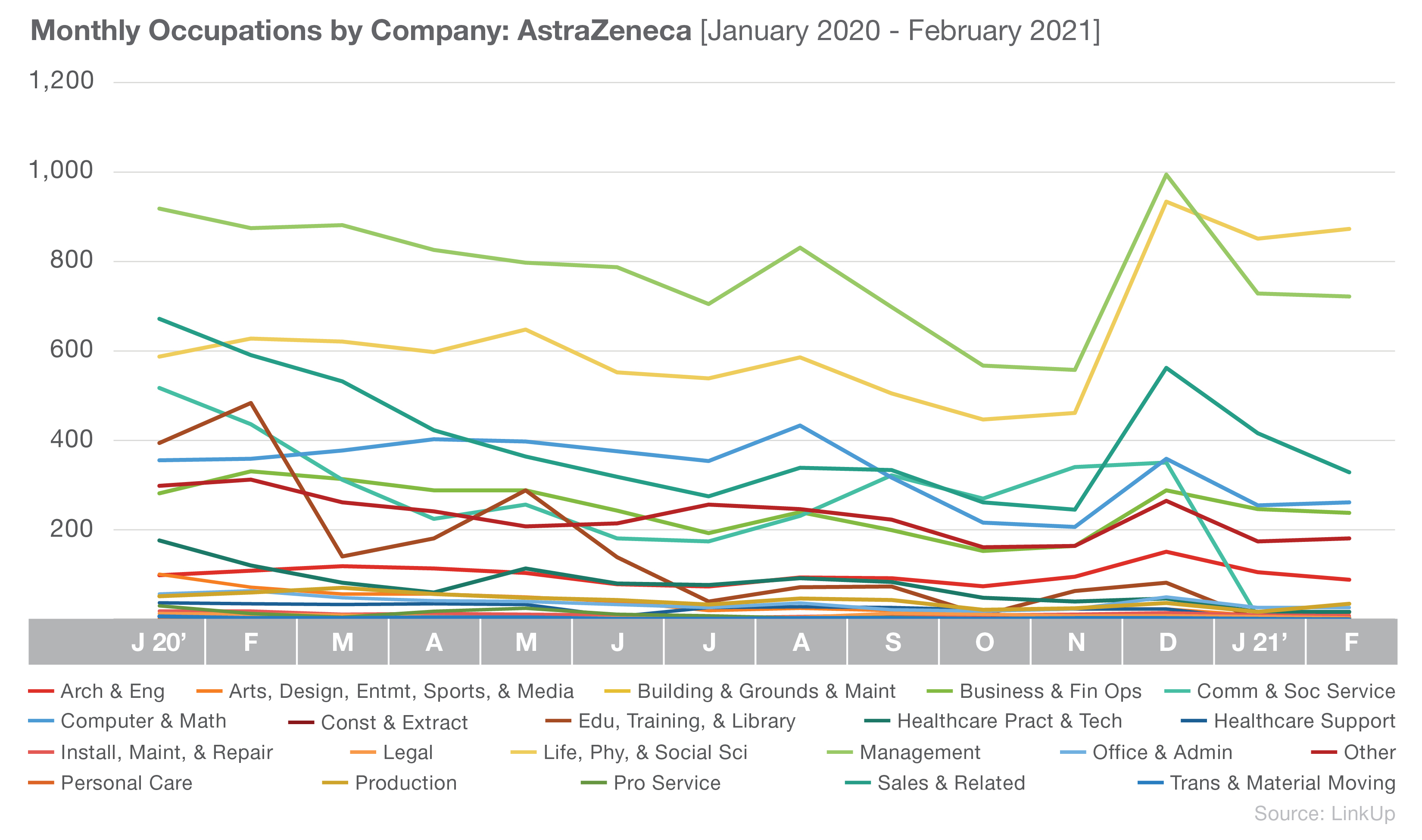

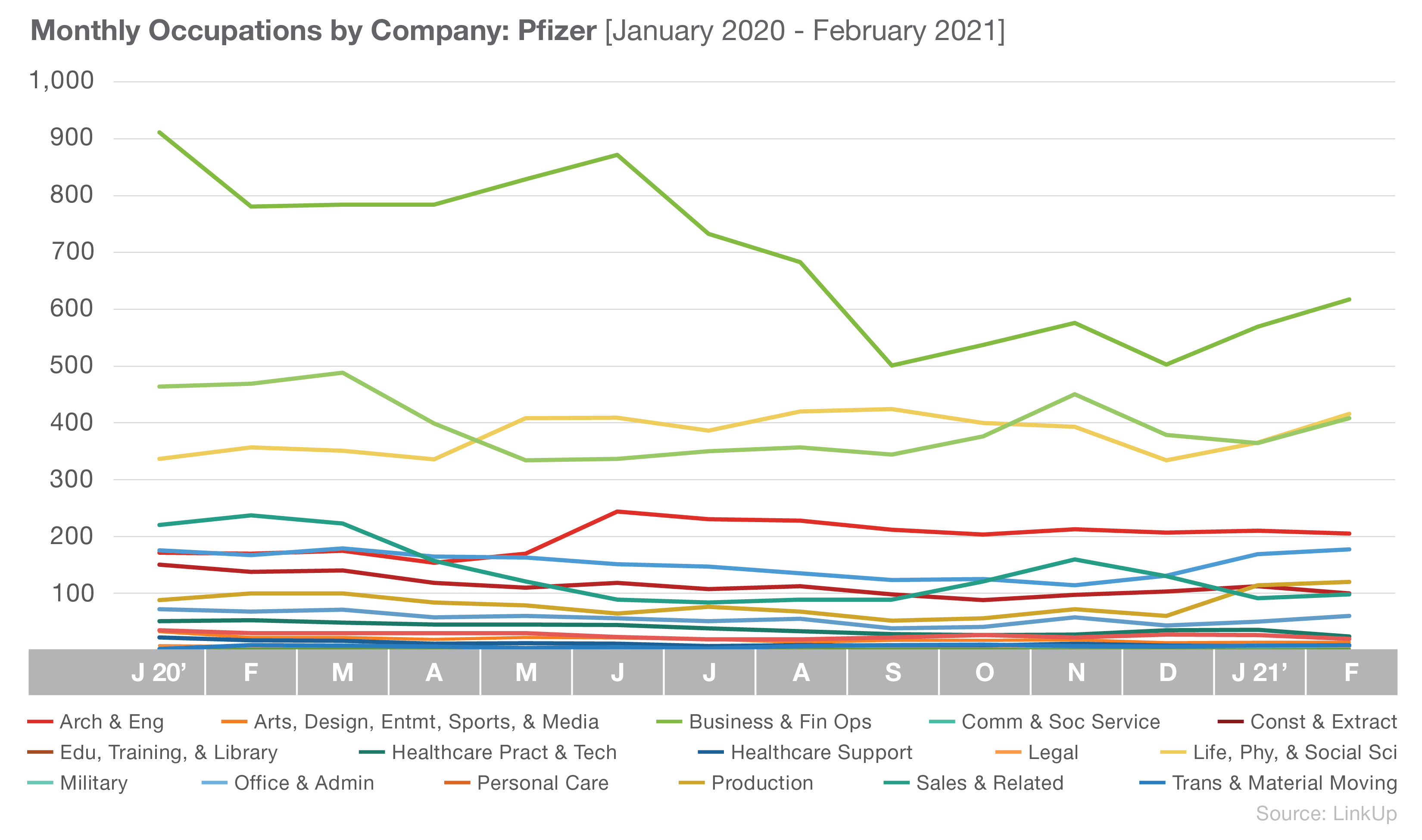

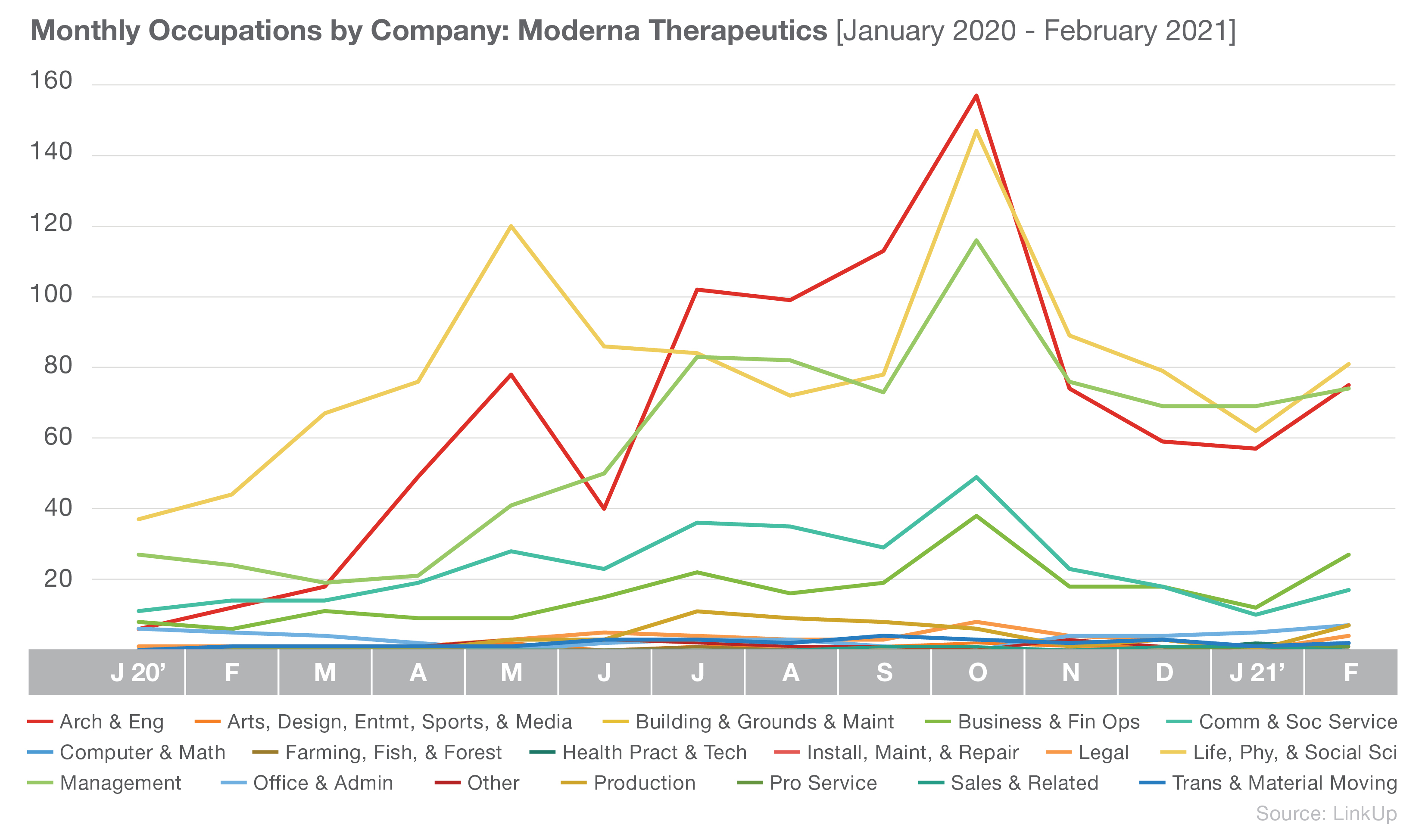

Drilling down to job listings by occupation, we observe some similarities between the four companies.

Currently, the top 3 occupations at Johnson & Johnson are Management; Life, Physical, and Social Science; and Business and Financial Operations.

AstraZeneca also has Life, Physical, and Social Science and Management occupations in two of their top three spots, though they differ from Johnson & Johnson with a greater focus on Sales and Related occupations.

Pfizer’s hiring focus appears to mirror Johnson & Johnson’s, with Business and Financial Operations; Life, Physical, and Social Science; and Management as their current top three occupations.

Moderna, with their lower number of listings overall, differs slightly with a focus on Computer and Mathematical occupations. Though we see Management occupations, as well Business and Financial Operations, in their top three as well.

With Johnson & Johnson’s recent emergency approval, AstaZeneca’s continued efforts toward validation in the U.S., as well as Pfizer and Moderna’s massive uptick in production, we anticipate labor demand for the four vaccine makers will continue to shift and change. The push to address emerging COVID variants adds an interesting dimension as well. We will continue to monitor jobs for the four vaccine makers as they enhance their efforts to put the pandemic behind us.

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.